Fraser Institute

Alberta sets pace on new housing construction—rest of Canada should catch up

From the Fraser Institute

By Tegan Hill and Austin Thompson

Albertans make outsized contributions to the rest of Canada in many areas including federal tax revenue (helping fund programs such as equalization), Canada Pension Plan contributions, and job creation. But Alberta also leads the way on another front—housing construction.

To understand Canada’s housing affordability crisis, simply consult the law of supply and demand. Too few homes are being built for Canada’s surging population, which has been fuelled by record-setting levels of immigration. In response, the Carney government has promised to double the rate of homebuilding in Canada by 2035.

But is that realistic?

To achieve that feat, homebuilding in Canada must increase by an annual average rate of 6.5 per cent over the next 10 years. But according to new housing data, construction on new homes in Canada increased by only 3.5 per cent in the first half of 2025 compared to the same period last year. The national figure was weighted down by sharp declines in Ontario (-24.8 per cent) and British Columbia (-8.2 per cent), reflecting steep drops in Toronto (-44.2 per cent) and Vancouver (-10.6 per cent).

Meanwhile in Alberta, in the first half of 2025, construction started on 27,902 new homes—an increase of 29.7 per cent over the same period last year—with sizeable gains in both Edmonton (28.6 per cent) and Calgary (31.6 per cent). In fact, if not for the increase in homebuilding in Alberta, national housing starts would have fallen by 2.2 per cent rather than increasing by 3.5 per cent.

Not surprisingly, In recent years Alberta has welcomed tens of thousands of residents from other provinces due in part to relatively affordable housing. And when Canadians move to Alberta, they ease pressure on the overheated housing markets they leave behind. While Alberta still has housing challenges—supply hasn’t kept pace with Alberta’s population boom—the province is trending in the right direction, something that can’t be said for many other parts of the country.

But Alberta can’t solve the national housing crisis on its own. Consider that 6,392 more housing starts were added in Alberta in the first half of this year compared to the same period last year. Meanwhile, Toronto alone saw housing starts drop by 9,954—more than wiping out Alberta’s gains.

Clearly, homebuilding in Alberta is a source of strength for the province and the country. But areas of the country struggling to build enough homes would do well to emulate Alberta’s success, which rests in part on comparatively low municipal fees on builders, faster approvals by city hall for new housing projects, and more relaxed rules regarding what can be built and where. For its part, Alberta and its municipalities should double down on these policies to maintain the province’s housing advantage.

Alberta is setting the pace on housing construction. It should keep building—and the rest of Canada should catch up.

Alberta

Federal policies continue to block oil pipelines

From the Fraser Institute

By Tegan Hill and Elmira Aliakbari

Prime Minister Carney’s recently released list of five projects—which the government deems to be in the national interest and will expedite—doesn’t include a new oil pipeline for western Canada in general or Alberta in particular. The reason given was that no private developer stepped forward to finance or build one. But the reason for that is not a mystery: Justin Trudeau’s damaging energy policies continue to drive away oil and gas investment even though his successor campaigned on a different, more pragmatic approach. It’s no wonder Albertans are frustrated.

Promising to make Canada the world’s leading “energy superpower,” the Carney government in the spring introduced Bill C-5, the “Building Canada Act,” to give the federal cabinet sweeping powers to circumvent existing laws and regulations for projects deemed to be in the “national interest.” In effect, cabinet and the prime minister are empowered to pick winners and losers based on vague criteria and priorities. But while specific projects will be expedited, so far nothing has been done to undo the damaging federal policies that have hamstrung Canada’s energy sector over the last decade.

Trudeau-era changes to the regulatory system for large infrastructure projects included: Bill C-69 (the federal “Impact Assessment Act”); the West Coast tanker ban (as spelled out in federal Bill C-48); and the federal cap imposed exclusively on oil and gas emissions. These have hindered energy investment and development and impeded prosperity, not only in energy-producing provinces, but across the country.

The Energy East and Eastern Mainline pipelines from Alberta and Saskatchewan to the east coast would have expanded Canada’s access to European markets. But the Trudeau government rendered the projects (Energy East and the Eastern Mainline) economically unprofitable by introducing new regulatory hurdles that ultimately forced TransCanada to withdraw from the project.

A year after taking office, the Trudeau government simply cancelled the Northern Gateway pipeline, an already approved $7.9 billion project that would have transported crude oil from Alberta to the B.C. coast, thus expanding Canada’s access to Asian markets. As for Trans Mountain, the one pipeline project that did survive the Trudeau years, after the private investor was frightened off by regulatory hurdles and delays and the federal government took over, costs sky-rocketed to $34 billion—more than six times the original estimate.

With policies like these still in place, it’s no wonder investors aren’t lining up to put big money into Canadian oil and gas. Just how great the discouragement has been is indicated by the 56 per cent inflation-adjusted decline in overall investment in the oil and gas sector between 2014 and 2023 (from $84.0 billion to $37.2 billion).

That decline in investment has had and will continue to have big consequences for the western provinces, particularly Alberta, where energy is a key part of the economy. But it would be a mistake to think the costs are limited to Alberta. From 2007 to 2022, Albertans’ net contribution to federal finances (total federal taxes they paid minus federal money spent on or transferred to them) was $244.6 billion. A strong Alberta helps keep taxes lower and fund public services across Canada.

Canada urgently needs new oil pipelines to tidewater. The U.S. is currently the destination for 97 per cent of our oil exports. This heavy reliance on a single customer leaves us exposed to policy shifts in Washington, such as the recent threat of tariffs on Canadian energy. Expanding pipeline infrastructure both westward and eastward would help diversify our export market into Asia and Europe, as well as strengthen our energy security.

Prime Minister Carney’s short list of projects is another blow to western Canada, and especially Alberta. There’s an obvious reason no private developer has stepped forward to finance or build a new oil pipeline: the Trudeau government’s damaging energy policies. The federal government needs to undo these policies and allow the private sector to make Canada an energy superpower.

Business

Canada’s ‘supply management’ system makes milk twice as expensive and favours affluent dairy farms

From the Fraser Institute

By Fred McMahon

While the Canada-U.S. trade negotiations continue, with much speculation about potential deals, one thing is certain: Canada’s agricultural marketing boards remain a barrier to success.

A White House official said as much: “[Canada] has repeatedly demonstrated a lack of seriousness in trade discussions as it relates to removing trade barriers.” That’s a clear reference to agricultural marketing boards, our Iron Curtain trade barrier. International trade lawyer Lawrence L. Herman aptly described boards as “Canada’s Soviet-style supply management system.”

Agricultural marketing boards are as Canadian as maple syrup, but more so. Maple syrup is international. Supply management is uniquely Canadian. No other country has such a system. And for good reason. It’s odious policy, favouring an affluent few, burdening the poorest, and creating needless friction with allies and trading partners.

President Trump’s distaste for the boards is well known. But, it’s not just Donald. The European Union, the United Kingdom, the World Trade Organization (effectively all of Canada’s trading partners)—and, wait for it, the majority Canadian farmers—all oppose the boards.

Canada claims to support free trade, except when we don’t. Canada seals off a large portion of its agricultural market with the system, but gets irritable when another country closes part of its market—say for autos, aluminum or steel.

Marketing boards employ a variety of tools, including quotas and tariffs, and a large bureaucracy to block international and interprovincial trade and deprive Canadians of choice in dairy, eggs and poultry. Without competition, productivity stagnates and prices soar.

The cost of living in the United States is 8.4 per cent higher than in the Canada, rent 14.9 per cent higher. But, thanks to our marketing boards, milk is twice as expensive—C$3.07 a litre on average in Canada versus C$1.47 in the United States. The most recent estimate of the cost of the system revealed, using 2015 data, that the average Canadian household pays an extra $300 to $433 annually because of marketing boards, hitting hard poorer Canadians, who spend a higher portion of their income on food than affluent Canadians.

Martha Hall Findlay, former Liberal MP and leadership contender, now director of the University of Calgary’s School of Public Policy, wrote with outrage, “The average Canadian dairy farm’s net worth is almost $4 million…. This archaic [supply-management] system forces a single mother on welfare to pay hundreds of dollars more per year than she needs to, just so we can continue to enrich a small number of cartel millionaires… members of the oft-vilified ‘one-percent’.”

Don’t expect meaningful negotiations. Canada’s Parliament, endorsed by the Senate, recently unanimously passed Bill C-202, which prohibits the foreign affairs minister from negotiating increased quotas or reduced tariffs for imports of supply-managed products.

The dairy industry, particularly in Quebec, is the big player. To protect this mighty lobby, Bloc Québécois Leader Yves-François Blanchet proposed C-202, backed by all parties, fearing a Quebec backlash if they stood up for Canadians, including for Quebecers who lack the privilege of owning one of province’s 4,200 multi-million-dollar dairy farms of Canada’s 9,400.

The Canadian Agri-Food Trade Alliance (CAFTA), Grain Growers of Canada (GGC), and other farm groups oppose C-202. Scott Hepworth, acting chair of GGC, said, “Parliament chose to prioritize one group of farmers over another. As a grain producer, I know firsthand how important international trade is to my family’s livelihood. Without reliable access to global markets, farmers like me are left behind.”

Canada has 65,000 grain farms and 53,000 pig and beef farms, compared to 14,700 supply-managed farms, less than one per cent of the total of 190,000 farms in Canada.

Marketing boards benefit a tiny minority of Canadian farmers while damaging the majority and increasing prices for all Canadians. One benefit of Donald Trump’s trade war against Canada has been the resolve on all levels of government to reduce home-grown obstacles to growth, including iron trade curtains between provinces.

The spineless response to C-202 reveals the weakness of that resolve and politician’s willingness to bend the knee to rich lobbies, toss other farmers under the bus, and carelessly pile on costs for Canadians, particularly low-income ones.

-

Business1 day ago

Business1 day agoWEF has a plan to overhaul the global financial system by monetizing nature

-

Alberta12 hours ago

Alberta12 hours agoAlberta teachers to vote on tentative agreement with province

-

Daily Caller1 day ago

Daily Caller1 day agoTrump’s Ultimatum To Europe On Russian Oil

-

Alberta1 day ago

Alberta1 day agoAlberta pro-lifers demand protections for infants born alive after failed abortions

-

Business2 days ago

Business2 days agoGoogle Admits Biden White House Pressured Content Removal, Promises to Restore Banned YouTube Accounts

-

Business1 day ago

Business1 day agoTaxpayers: Stop wasting money and scrap the gun ban

-

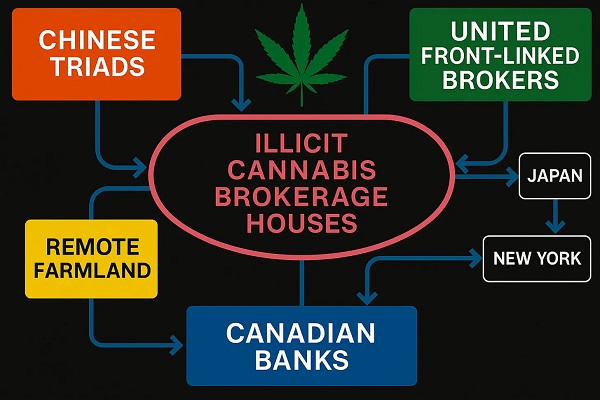

espionage2 days ago

espionage2 days agoCanada Under Siege: Sparking a National Dialogue on Security and Corruption

-

Business12 hours ago

Business12 hours agoCanada’s Future May Lie In Continental Integration