Alberta

Alberta remains largest net contributor to Ottawa’s coffers despite damaging federal policies

From the Fraser Institute

By Tegan Hill and Spencer Gudewill

According to a recent poll by the Angus Reid Institute, nearly half of Albertans believe they get a “raw deal”—that is, they give more than they get—being part of Canada. It’s easy to see why Albertans are frustrated. Despite the province’s crucial role in the federation, the federal government continues to inflict restrictive and damaging policies on the Albertan economy.

The Trudeau government’s list of policies includes Bill C-69 (which imposes complex, uncertain and onerous review requirements on major energy projects), Bill C-48, (which bans large oil tankers off British Columbia’s northern coast and limits access to Asian markets), the oil and gas emission cap, the “clean fuel standard,” numerous “net-zero” targets that disproportionately impact Alberta, and so on. Not surprisingly, the same poll found that 65 per cent of Albertans believe federal government policies have hurt their province’s economy.

What’s less clear is why the federal government wants to thwart Alberta’s economic engine, considering how much the province contributes to the federation financially. In our current system of federalism, Ottawa collects various taxes then redistributes money to Canadians in other provinces for federal programs including equalization, the Canada Pension Plan (CPP) and employment insurance.

According to a new study published by the Fraser Institute, from 2007 to 2022 (the latest period of available data), Albertans contributed $244.6 billion more in taxes and other payments to the federal government than they received in federal spending—more than five times as much as British Columbians or Ontarians. The other seven provinces received more federal dollars than they contributed to federal revenues. In other words, Alberta is by far the largest net contributor to Ottawa’s coffers.

Alberta’s large net contribution reflects its comparatively young population (fewer retirees), higher rates of employment, higher average incomes and relatively strong economy. Alberta has a history of punching above its weight economically. For perspective, from 1981 to 2022, the province had the highest annual average economic growth rate in Canada. And despite dips in growth due to the 2014 oil-price collapse and COVID, in 2022 Alberta accounted for 17.9 per cent of Canada’s total economic growth despite being home to just 11.6 per cent of the country’s population.

It’s a similar story for business investment per private-sector worker (in 2022, Alberta’s level more than doubled the non-Alberta average among provinces) and private-sector job growth with Alberta contributing nearly one in every five private-sector jobs created in Canada in 2022.

Alberta’s prosperity, which helps fuel federation, may help explain why in 2022 56,245 more Canadian residents moved to Alberta than left it—a much higher net inflow than in any other province. For decades, Alberta has provided economic opportunities for Canadians from other provinces willing to relocate.

Finally, without Alberta’s large net contribution to the federal government’s bottom line, Ottawa would have significantly larger budget deficits. In 2022, for instance, without Alberta the Trudeau government’s $25.7 billion budget deficit would have ballooned to $39.9 billion. The larger the deficit (all else equal) the greater the debt accumulation, which Canadians must ultimately finance through their taxes.

When Alberta’s economy is strong and prosperous, it benefits all of Canada. And due to Alberta’s economic success, Albertans continue to contribute relatively more to the federation than Canadians in other provinces. That’s something the federal government should encourage, not discourage.

Authors:

Alberta

Equalization program disincentivizes provinces from improving their economies

From the Fraser Institute

By Tegan Hill and Joel Emes

As the Alberta Next Panel continues discussions on how to assert the province’s role in the federation, equalization remains a key issue. Among separatists in the province, a striking 88 per cent support ending equalization despite it being a constitutional requirement. But all Canadians should demand equalization reform. The program conceptually and practically creates real disincentives for economic growth, which is key to improving living standards.

First, a bit of background.

The goal of equalization is to ensure that each province can deliver reasonably comparable public services at reasonably comparable tax rates. To determine which provinces receive equalization payments, the equalization formula applies a hypothetical national average tax rate to different sources of revenue (e.g. personal income and business income) to calculate how much revenue a province could generate. In theory, provinces that would raise less revenue than the national average (on a per-person basis) receive equalization, while province’s that would raise more than the national average do not. Ottawa collects taxes from Canadians across the country then redistributes money to these “have not” provinces through equalization.

This year, Ontario, Quebec, Manitoba and all of Atlantic Canada will receive a share of the $26.2 billion in equalization spending. Alberta, British Columbia and Saskatchewan—calculated to have a higher-than-average ability to raise revenue—will not receive payments.

Of course, equalization has long been a contentious issue for contributing provinces including Alberta. But the program also causes problems for recipient or “have not” provinces that may fall into a welfare trap. Again, according to the principle of equalization, as a province’s economic fortunes improve and its ability to raise revenues increases, its equalization payments should decline or even end.

Consequently, the program may disincentivize provinces from improving their economies. Take, for example, natural resource development. In addition to applying a hypothetical national average tax rate to different sources of provincial revenue, the equalization formula measures actual real-world natural resource revenues. That means that what any provincial government receives in natural resource revenue (e.g. oil and hydro royalties) directly affects whether or not it will receive equalization—and how much it will receive.

According to a 2020 study, if a province receiving equalization chose to increase its natural resource revenues by 10 per cent, up to 97 per cent of that new revenue could be offset by reductions in equalization.

This has real implications. In 2018, for instance, the Quebec government banned shale gas fracking and tightened rules for oil and gas drilling, despite the existence of up to 36 trillion cubic feet of recoverable natural gas in the Saint Lawrence Valley, with an estimated worth of between $68 billion and $186 billion. Then in 2022, the Quebec government banned new oil and gas development. While many factors likely played into this decision, equalization “claw-backs” create a disincentive for resource development in recipient provinces. At the same time, provinces that generally develop their resources—including Alberta—are effectively punished and do not receive equalization.

The current formula also encourages recipient provinces to raise tax rates. Recall, the formula calculates how much money each province could hypothetically generate if they all applied a national average tax structure. Raising personal or business tax rates would raise the national average used in the formula, that “have not” provinces are topped up to, which can lead to a higher equalization payment. At the same time, higher tax rates can cause a decline in a province’s tax base (i.e. the amount of income subject to taxes) as some taxpayers work or invest less within that jurisdiction, or engage in more tax planning to reduce their tax bills. A lower tax base reduces the amount of revenue that provincial governments can raise, which can again lead to higher equalization payments. This incentive problem is economically damaging for provinces as high tax rates reduce incentives for work, savings, investment and entrepreneurship.

It’s conceivable that a province may be no better off with equalization because of the program’s negative economic incentives. Put simply, equalization creates problems for provinces across the country—even recipient provinces—and it’s time Canadians demand reform.

Alberta

Provincial pension plan could boost retirement savings for Albertans

From the Fraser Institute

By Tegan Hill and Joel Emes

In 2026, Albertans may vote on whether or not to leave the Canada Pension Plan (CPP) for a provincial pension plan. While they should weigh the cost and benefits, one thing is clear—Albertans could boost their retirement savings under a provincial pension plan.

Compared to the rest of Canada, Alberta has relatively high rates of employment, higher average incomes and a younger population. Subsequently, Albertans collectively contribute more to the CPP than retirees in the province receive in total CPP payments.

Indeed, from 1981 to 2022 (the latest year of available data), Alberta workers paid 14.4 per cent (annually, on average) of total CPP contributions (typically from their paycheques) while retirees in the province received 10.0 per cent of the payments. That’s a net contribution of $53.6 billion from Albertans over the period.

Alberta’s demographic and income advantages also mean that if the province left the CPP, Albertans could pay lower contribution rates while still receiving the same retirement benefits under a provincial pension plan (in fact, the CPP Act requires that to leave CPP, a province must provide a comparable plan with comparable benefits). This would mean Albertans keep more of their money, which they can use to boost their private retirement savings (e.g. RRSPs or TFSAs).

According to one estimate, Albertans’ contribution rate could fall from 9.9 per cent (the current base CPP rate) to 5.85 per cent under a provincial pension plan. Under this scenario, a typical Albertan earning the median income ($50,000 in 2025) and contributing since age 18, would save $50,023 over their lifetime from paying a lower rate under provincial pension plan. Thanks to the power of compound interest, with a 7.1 per cent (average) nominal rate of return (based on a balanced portfolio of investments), those savings could grow to nearly $190,000 over the same worker’s lifetime.

Pair that amount with what you’d receive from the new provincial pension plan ($265,000) and you’d have $455,000 in retirement income (pre-tax)—nearly 72 per cent more than under the CPP alone.

To be clear, exactly how much you’d save depends on the specific contribution rate for the new provincial pension plan. We use 5.85 per cent in the above scenario, but estimates vary. But even if we assume a higher contribution rate, Albertan’s could still receive more in retirement with the provincial pension plan compared to the current CPP.

Consider the potential with a provincial pension contribution rate of 8.21 per cent. A typical Albertan, contributing since age 18, would generate $330,000 in pre-tax retirement income from the new provincial pension plan plus their private savings, which is nearly one quarter larger than they’d receive from the CPP alone (again, $265,000).

Albertans should consider the full costs and benefits of a provincial pension plan, but it’s clearly Albertans could benefit from higher retirement income due to increased private savings.

-

Crime2 days ago

Crime2 days agoArrest made in Charlie Kirk assassination

-

International2 days ago

International2 days agoBreaking: ‘Catch This Fascist’: Radicalized Utah Suspect Arrested in Charlie Kirk Assassination, Officials Say

-

Frontier Centre for Public Policy2 days ago

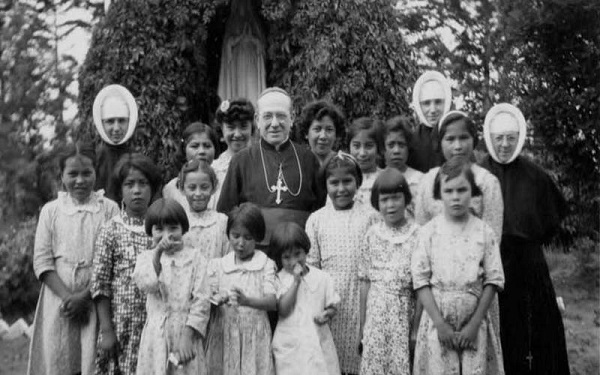

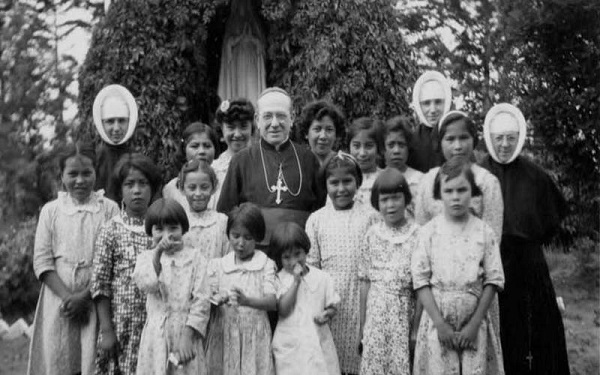

Frontier Centre for Public Policy2 days agoEvery Child Matters, Except When It Comes To Proof In Kamloops

-

Crime2 days ago

Crime2 days ago‘Radicalized’ shooter dead, two injured in wake of school shooting

-

Crime2 days ago

Crime2 days ago“Hey fascist! Catch!”: Authorities confirm writing on alleged Kirk killer’s bullet casings

-

J.D. Tuccille2 days ago

J.D. Tuccille2 days agoAfter Charlie Kirk’s Murder, Politicians Can Back Away From the Brink, or Make Matters Worse

-

International2 days ago

International2 days agoCharlie Kirk Shooting Suspect Revealed: Here’s What His Ammunition Said

-

Daily Caller1 day ago

Daily Caller1 day ago‘You Have No Idea What You Have Unleashed’: Erika Kirk Addresses Supporters For First Time Since Kirk’s Assassination