Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

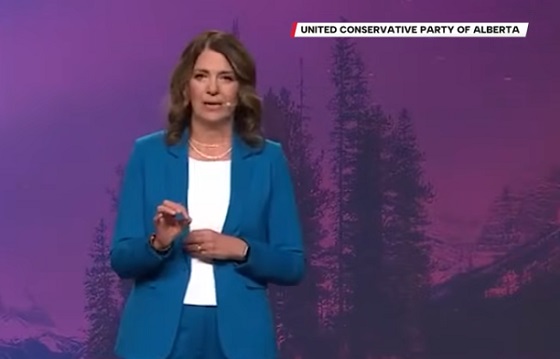

Keynote address of Premier Danielle Smith at 2025 UCP AGM

Alberta

Net Zero goal is a fundamental flaw in the Ottawa-Alberta MOU

From the Fraser Institute

By Jason Clemens and Elmira Aliakbari

The challenge of GHG emissions in 2050 is not in the industrial world but rather in the developing world, where there is still significant basic energy consumption using timber and biomass.

The new Memorandum of Understanding (MOU) between the federal and Alberta governments lays the groundwork for substantial energy projects and infrastructure development over the next two-and-a-half decades. It is by all accounts a step forward, though, there’s debate about how large and meaningful that step actually is. There is, however, a fundamental flaw in the foundation of the agreement: it’s commitment to net zero in Canada by 2050.

The first point of agreement in the MOU on the first page of text states: “Canada and Alberta remain committed to achieving net zero greenhouse gas emissions by 2050.” In practice, it’s incredibly difficult to offset emissions with tree planting or other projects that reduce “net” emissions, so the effect of committing to “net zero” by 2050 means that both governments agree that Canada should produce very close to zero actual greenhouse gas (GHG) emissions. Consider the massive changes in energy production, home heating, transportation and agriculture that would be needed to achieve this goal.

So, what’s wrong with Canada’s net zero 2050 and the larger United Nations’ global goal for the same?

Let’s first understand the global context of GHG reductions based on a recent study by internationally-recognized scholar Vaclav Smil. Two key insights from the study. First, despite trillions being spent plus international agreements and regulatory measures starting back in 1997 with the original Kyoto agreement, global fossil fuel consumption between then and 2023 increased by 55 per cent.

Second, fossil fuels as a share of total global energy declined from 86 per cent in 1997 to 82 per cent in 2022, again, despite trillions of dollars in spending plus regulatory requirements to force a transition away from fossil fuels to zero emission energies. The idea that globally we can achieve zero emissions over the next two-and-a-half decades is pure fantasy. Even if there is an historic technological breakthrough, it will take decades to actually transition to a new energy source(s).

Let’s now understand the Canada-specific context. A recent study examined all the measures introduced over the last decade as part of the national plan to reduce emissions to achieve net zero by 2050. The study concluded that significant economic costs would be imposed on Canadians by these measures: inflation-adjusted GDP would be 7 per cent lower, income per worker would be more than $8,000 lower and approximately 250,000 jobs would be lost. Moreover, these costs would not get Canada to net zero. The study concluded that only 70 per cent of the net zero emissions goal would be achieved despite these significant costs, which means even greater costs would be imposed on Canadians to fully achieve net zero.

It’s important to return to a global picture to fully understand why net zero makes no sense for Canada within a worldwide context. Using projections from the International Energy Agency (IEA) in its latest World Energy Outlook, the current expectation is that in 2050, advanced countries including Canada and the other G7 countries will represent less than 25 per cent of global emissions. The developing world, which includes China, India, the entirety of Africa and much of South America, is estimated to represent at least 70 per cent of global emissions in 2050.

Simply put, the challenge of GHG emissions in 2050 is not in the industrial world but rather in the developing world, where there is still significant basic energy consumption using timber and biomass. A globally-coordinated effort, which is really what the U.N. should be doing rather than fantasizing about net zero, would see industrial countries like Canada that are capable of increasing their energy production exporting more to these developing countries so that high-emitting energy sources are replaced by lower-emitting energy sources. This would actually reduce global GHGs while simultaneously stimulating economic growth.

Consider a recent study that calculated the implications of doubling natural gas production in Canada and exporting it to China to replace coal-fired power. The conclusion was that there would be a massive reduction in global GHGs equivalent to almost 90 per cent of Canada’s total annual emissions. In these types of substitution arrangements, the GHGs would increase in energy-producing countries like Canada but global GHGs would be reduced, which is the ultimate goal of not only the U.N. but also the Carney and Smith governments as per the MOU.

Finally, the agreement ignores a basic law of economics. The first lesson in the very first class of any economics program is that resources are limited. At any given point in time, we only have so much labour, raw materials, time, etc. In other words, when we choose to do one project, the real cost is foregoing the other projects that could have been undertaken. Economics is mostly about trying to understand how to maximize the use of limited resources.

The MOU requires massive, literally hundreds of billions of dollars to be used to create nuclear power, other zero-emitting power sources and transmission systems all in the name of being able to produce low or even zero-emitting oil and gas while also moving to towards net zero.

These resources cannot be used for other purposes and it’s impossible to imagine what alternative companies or industries would have been invested in. What we do know is that workers, entrepreneurs, businessowners and investors are not making these decisions. Rather, politicians and bureaucrats in Ottawa and Edmonton are making these decisions but they won’t pay any price if they’re wrong. Canadians pay the price. Just consider the financial fiasco unfolding now with Ottawa, Ontario and Quebec’s subsidies (i.e. corporate welfare) for electric vehicle batteries.

Understanding the fundamentally flawed commitment to Canadian net zero rather than understanding a larger global context of GHG emissions lays at the heart of the recent MOU and unfortunately for Canadians will continue to guide flawed and expensive policies. Until we get the net zero policies right, we’re going to continue to spend enormous resources on projects with limited returns, costing all Canadians.

-

National2 days ago

National2 days agoAlleged Liberal vote-buying scandal lays bare election vulnerabilities Canada refuses to fix

-

Alberta23 hours ago

Alberta23 hours agoNet Zero goal is a fundamental flaw in the Ottawa-Alberta MOU

-

Addictions2 days ago

Addictions2 days agoThe Death We Manage, the Life We Forget

-

Food23 hours ago

Food23 hours agoCanada Still Serves Up Food Dyes The FDA Has Banned

-

Crime2 days ago

Crime2 days agoVancouver police seize fentanyl and grenade launcher in opioid-overdose crisis zone

-

Daily Caller2 days ago

Daily Caller2 days agoJohn Kerry Lurches Back Onto Global Stage For One Final Gasp

-

National1 day ago

National1 day agoEco-radical Canadian Cabinet minister resigns after oil deal approved

-

Addictions23 hours ago

Addictions23 hours agoManitoba Is Doubling Down On A Failed Drug Policy