Alberta

A Matter of Fact: Environment Minister Steven Guilbeault’s future view of Canada’s oil and gas sector is unrealistic

Canadian Minister of the Environment and Climate Change, Steven Guilbeault, speaks at the China pavilion during the United Nations Conference of the Parties (COP15) in Montreal, Quebec, on December 14, 2022. Getty Images photo

From the Canadian Energy Centre Ltd.

Canada could play a key role in lowering global emissions by unlocking our LNG industry and helping Asian countries replace coal

Federal Environment and Climate Change Minister Steven Guilbeault is continuing to plot a painful course toward a short-sighted phase out of Canada’s world class oil and gas sector based on an unrealistic view of world’s future energy mix.

In an interview with Euractiv, Guilbeault said he supports the phase out of unabated fossil fuels, those without the technology to minimize emissions, by 2050 to align with the International Energy Agency’s Net Zero Scenario, a path that is largely out of touch with the current global reality.

Based on that increasingly unlikely scenario, the minister said he anticipates Canada’s oil and gas sector will follow suit with a 50% to 75% reduction in the production of oil and gas by 2050, which would be devastating for our economy, hurt our economic allies, and make little to no progress towards reducing global emissions.

Here are the facts.

Fact: The IEA’s Net Zero Scenario is largely aspirational, not practical

Guilbeault’s vision of a massive global reduction of fossil fuel usage is growing even less likely amid a lingering energy crisis prompted by several years of declining investment in oil and gas followed by Russia’s invasion of Ukraine.

The fact is, this year the world will use more oil and more coal than any time in human history.

According to the IEA’s latest short-term outlook, global oil use will hit a record high of 102 million barrels per day this year and is expected to grow to 106 million barrels per day by 2028. Last week, OPEC forecasted that by 2045, global oil demand will reach 110 million barrels per day.

Meanwhile, demand for natural gas, particularly liquefied natural gas (LNG) is soaring.

By 2040, global LNG demand – driven primarily by growing Asian economies – is expected to reach 700 million tonnes, a more than 75 per cent increase from 2022. Demand for LNG is expected to outpace supply by the middle of this decade.

Relying on the IEA’s Net Zero scenario, Guilbeault said he believes oil use will decline to between 25-30 million barrels per day, a 75 per cent reduction. Rapid deployment of renewables, he said, would fill that void despite some significant hurdles that could hinder a sweeping transition.

The bottom line is pretty clear. In the IEA’s most likely scenario, oil and gas will still account for 47 per cent of the global energy mix in 2050, a reduction of 5 per cent from 2021. While the share of renewables will more than double, it is still expected only to account for 29 per cent of the world’s energy mix in 2050.

Fact: A rapid phase out of oil and gas would hurt Canada and its allies

Canada’s oil and gas sector is a critical part of our economy, supporting hundreds of thousands of jobs from coast-to-coast, including thousands of jobsin manufacturing, environmental, and financial services tied to the industry, especially in Ontario and Quebec.

A recent analysis by commodity data firm S&P Global focused specifically on the oil sands suggests that efforts to meet federal emissions targets for 2030 would likely force the industry to slash production by up to 1.3 million barrels per day.

According to the analysis, that could result in the elimination of between 5,400 and 9,500 jobs. With just over 54,000 oil and gas extraction jobs in Canada, that would mean the elimination of as much as 17% of the workforce.

In addition to jobs, the industry is also an economic bulwark, generating $168 billion in GDP in 2021, about 7.2 per cent of Canada’s economic activity. Oil and gas also accounted for nearly a third of Canada’s exports in 2021, injecting $140 billon into the economy.

Amid the ongoing global energy crisis, some of Canada’s international allies have turned to Canada to be a potential key supplier as they look for stable and responsible suppliers to replace Russian oil and gas.

The leaders of Germany and Japan made direct appeals to Canada to supply more LNG to help meet their energy needs.

Yamanouchi Kanji, Japan’s ambassador to Canada, made it clear that some of our Asian allies see Canada as a key player in the world’s future energy, particularly when it comes to LNG.

“The world is waiting for Canada,” he said earlier this year. “Canada can and should play a very important role to support the energy situation not only in Japan and South Korea, but the world.”

Fact: Reducing global emissions starts with Canadian natural gas

If Canada is truly serious about tackling global greenhouse gas emissions, we could make a much bigger impact by supplying energy-hungry Asian countries with some of the cleanest LNG on the planet to replace coal.

Climate change is a global issue, not a local one.

Despite being one of the world’s largest energy producers, Canada is still only responsible for about 1.6 per cent of total global emissions.

Developing Asian counties, particularly China, have turned to coal to help power their growing economies. A switch to natural gas to generate power reduces emissions by 50 per cent on average, according to the IEA. Canadian natural gas shipped as LNG could perform even better, reducing emissions from coal by about 65 per cent, according to Energy for a Secure Future.

With analysts expecting world LNG demand to double over the next two decades, Canada could make a real measurable impact on lowering global emissions by unlocking its LNG potential.

A recent study by Wood Mackenzie found that Canadian LNG exports could reduce net emissions in Asia by 188 million tonnes per year through 2050. Put another way, that would be the annual equivalent of removing the emissions of all vehicles on Canadian roads, or wiping out nearly three time’s B.C.’s total emissions.

Meanwhile, a coalition of six companies representing 95 per cent of Canada’s oil sand production have jointly committed to achieve net zero emissions by 2050. The Pathways Alliance is looking to harness emerging technology like carbon capture and storage as well as small modular nuclear reactors to reach that target.

The reality is that if Canada significantly curtails its oil and gas industry, other national producers, some of which lack Canada’s commitment to democratic ideals and the environment, will fill that void. This could see bad actors like Russia continue to maintain a strategic and economic advantage over Europe by maintaining European reliance on its energy.

Fact: Phasing out oil and gas would hurt Indigenous communities

Over the last decade, Indigenous communities have emerged as key players in Canada’s energy sector, allowing First Nations in many cases to create intergenerational opportunity for their people.

From pipelines to LNG terminals, dozens of Indigenous communities have entered into ownership agreements on major oil and gas projects.

In B.C., 16 First Nations will acquire a 10 per cent stake in the Coastal GasLink pipeline once it’s completed later this year. In Alberta, another 23 First Nation and and Métis communities are now approximately 12 per cent owners of seven operating Enbridge oil sands pipelines, the largest Indigenous energy transaction ever in North America.

And in northwest B.C., the Haisla Nation is 50 per cent owner of the proposed Cedar LNG project, which would be the first Indigenous-owned LNG terminal in the world.

“When Europeans, Asians and Americans think of Canada’s Indigenous peoples, they often think we oppose all energy development. We aren’t victims of development. Increasingly we are partners and even owners in major projects,” Haisla Nation Chief Councillor Crystal Smith said during an April press conference after leading a delegation of Indigenous leaders to meet key international diplomats.

Indigenous employment in Canada’s oil and gas sector has continued to grow, rising by more than 20 per cent since 2014 to reach an estimated 10,400 jobs in 2020.

Indigenous-owned businesses also benefit from the industry, with three major projects – the Trans Mountain Expansion, Coastal GasLink, and LNG Canada – spending some $9 billion with Indigenous- and locally-owned businesses.

Alberta

Danielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

From LifeSiteNews

The Alberta premier has denounced Skate Canada as ‘disgraceful’ for refusing to host events in the province because of a ban on ‘transgender’ men in women’s sports.

Alberta Premier Danielle Smith has demanded an apology after Skate Canada refused to continue holding events in Alberta.

In a December 16 post on X, Smith denounced Skate Canada’s recent decision to stop holding competitions in Alberta due to a provincial law keeping gender-confused men from competing in women’s sports.

“Women and girls have the right to play competitive sports in a safe and fair environment against other biological females,” Smith declared. “This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.”

Women and girls have the right to play competitive sports in a safe and fair environment against other biological females.

This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.

Skate Canada‘s refusal to hold events in… pic.twitter.com/n4vbkTx6B0

— Danielle Smith (@ABDanielleSmith) December 16, 2025

“Skate Canada‘s refusal to hold events in Alberta because we choose to protect women and girls in sport is disgraceful,” she declared.

“We expect they will apologize and adjust their policies once they realize they are not only compromising the fairness and safety of their athletes, but are also offside with the international community, including the International Olympic Committee, which is moving in the same direction as Alberta,” Smith continued.

Earlier this week, Skate Canada announced their decision in a statement to CBC News, saying, “Following a careful assessment of Alberta’s Fairness and Safety in Sport Act, Skate Canada has determined that we are unable to host events in the province while maintaining our national standards for safe and inclusive sport.”

Under Alberta’s Fairness and Safety in Sport Act, passed last December, biological men who claim to be women are prevented from competing in women’s sports.

Notably, Skate Canada’s statement failed to address safety and fairness concerns for women who are forced to compete against stronger, and sometimes violent, male competitors who claim to be women.

Under their 2023 policy, Skate Canada states “skaters in domestic events sanctioned by Skate Canada who identify as trans are able to participate in the gender category in which they identify.”

While Skate Canada maintains that gender-confused men should compete against women, the International Olympic Committee is reportedly moving to ban gender-confused men from women’s Olympic sports.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely that males have a considerable innate advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

Alberta

Alberta’s huge oil sands reserves dwarf U.S. shale

From the Canadian Energy Centre

By Will Gibson

Oil sands could maintain current production rates for more than 140 years

Investor interest in Canadian oil producers, primarily in the Alberta oil sands, has picked up, and not only because of expanded export capacity from the Trans Mountain pipeline.

Enverus Intelligence Research says the real draw — and a major factor behind oil sands equities outperforming U.S. peers by about 40 per cent since January 2024 — is the resource Trans Mountain helps unlock.

Alberta’s oil sands contain 167 billion barrels of reserves, nearly four times the volume in the United States.

Today’s oil sands operators hold more than twice the available high-quality resources compared to U.S. shale producers, Enverus reports.

“It’s a huge number — 167 billion barrels — when Alberta only produces about three million barrels a day right now,” said Mike Verney, executive vice-president at McDaniel & Associates, which earlier this year updated the province’s oil and gas reserves on behalf of the Alberta Energy Regulator.

Already fourth in the world, the assessment found Alberta’s oil reserves increased by seven billion barrels.

Verney said the rise in reserves despite record production is in part a result of improved processes and technology.

“Oil sands companies can produce for decades at the same economic threshold as they do today. That’s a great place to be,” said Michael Berger, a senior analyst with Enverus.

BMO Capital Markets estimates that Alberta’s oil sands reserves could maintain current production rates for more than 140 years.

The long-term picture looks different south of the border.

The U.S. Energy Information Administration projects that American production will peak before 2030 and enter a long period of decline.

Having a lasting stable source of supply is important as world oil demand is expected to remain strong for decades to come.

This is particularly true in Asia, the target market for oil exports off Canada’s West Coast.

The International Energy Agency (IEA) projects oil demand in the Asia-Pacific region will go from 35 million barrels per day in 2024 to 41 million barrels per day in 2050.

The growing appeal of Alberta oil in Asian markets shows up not only in expanded Trans Mountain shipments, but also in Canadian crude being “re-exported” from U.S. Gulf Coast terminals.

According to RBN Energy, Asian buyers – primarily in China – are now the main non-U.S. buyers from Trans Mountain, while India dominates purchases of re-exports from the U.S. Gulf Coast. .

BMO said the oil sands offers advantages both in steady supply and lower overall environmental impacts.

“Not only is the resulting stability ideally suited to backfill anticipated declines in world oil supply, but the long-term physical footprint may also be meaningfully lower given large-scale concentrated emissions, high water recycling rates and low well declines,” BMO analysts said.

-

Digital ID2 days ago

Digital ID2 days agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Energy2 days ago

Energy2 days agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Daily Caller20 hours ago

Daily Caller20 hours agoParis Climate Deal Now Decade-Old Disaster

-

Business10 hours ago

Business10 hours agoOttawa Pretends To Pivot But Keeps Spending Like Trudeau

-

armed forces1 day ago

armed forces1 day agoOttawa’s Newly Released Defence Plan Crosses a Dangerous Line

-

Energy9 hours ago

Energy9 hours agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

Censorship Industrial Complex7 hours ago

Censorship Industrial Complex7 hours agoHow Wikipedia Got Captured: Leftist Editors & Foreign Influence On Internet’s Biggest Source of Info

-

Bruce Dowbiggin2 days ago

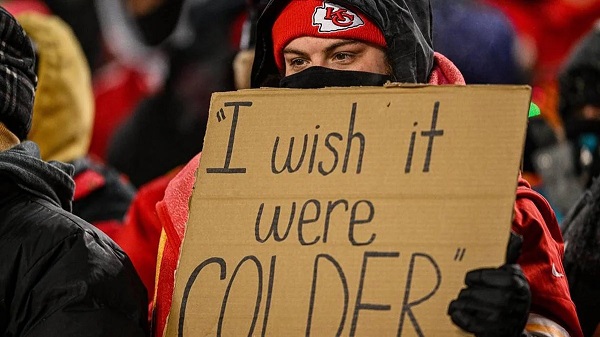

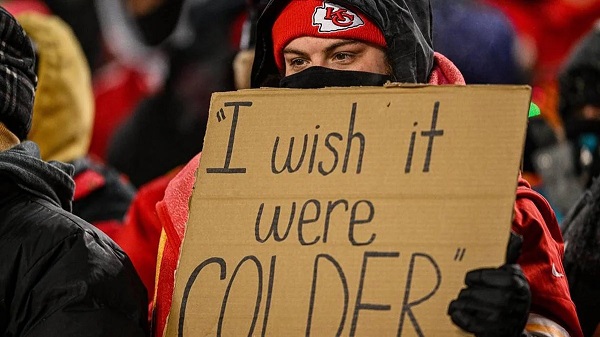

Bruce Dowbiggin2 days agoNFL Ice Bowls Turn Down The Thermostat on Climate Change Hysteria