Automotive

‘A Lot Of Government Coercion’: Study Slams ‘Forced Transition’ To EVs Consumers Don’t Seem To Want

From the Daily Caller News Foundation

By Owen Klinsky

The push for electric vehicle (EV) adoption is largely premised on misleading claims, and could bring enormous costs for U.S. consumers and the economy, a new meta-study shared exclusively with the Daily Caller News Foundation found.

Federal regulators and multinational corporations have attempted to push EVs on the American public in recent years, with the Biden-Harris administration introducing strict tailpipe emissions standards, and major automakers implementing lofty electric production targets. However, widespread EV adoption may not be as feasible as lawmakers and auto executives once claimed, with a new meta-analysis from the Institute for Energy Research (IER) noting EVs can have a variety of drawbacks for consumers when compared to their gas-powered counterparts, including elevated upfront costs, lower resale values, limited driving range and a lack of charging infrastructure.

“We argue the EV transition is going to take a lot of government coercion to make happen,” Kenny Stein, vice president of policy at IER and the study’s lead author, told the DCNF. “It is a very difficult process, and it is not a very desirable process to force.”

When Government Chooses Your Car Study; Institute for Energy Research (IER)

Much of the reason a U.S. EV transition will not occur without government force, according to the study, is cost. The price of an average EV in the first quarter of 2024 was $53,048, compared to just $35,722 for conventional vehicles, according to car shopping guide Edmunds, meaning many EVs continue to be less affordable than their gas-powered counterparts even with the U.S. Treasury Department’s $7,500 tax credit.

The IER study also cites elevated depreciation as a constraint on EV adoption, noting that the average five-year depreciation for an electric car is $43,515 compared to $27,883 for a gas-powered vehicle, according to vehicle valuation company Kelley Blue Book. The rapid depreciation is largely driven by battery replacement costs, which range from $7,000 to as much as $30,000.

In addition to sheer cost, the study found “range anxiety” — the concern among drivers that they will run out of charge before reaching their destination or a charging station — is a major source of consumer reluctance to purchase EVs. While “range anxiety” can be reduced by increasing mileage, expanding an EV’s range requires a larger battery, which in turn drives up vehicle cost and creates a difficult tradeoff for consumers.

A lack of charging infrastructure also contributes to range concerns, and has proven difficult to fix despite ample government funding, the study found. For example, the bipartisan infrastructure bill of 2021 allotted $7.5 billion to subsidize thousands of new EV charging stations, but only seven stations in four states had been built as of April.

The combination of range issues and high costs has helped drive a slackening in EV demand, with EV sales growing 50% in the first half of 2023 and 31% in the first half of 2024, less than the 71% increase in the first half of 2022. Moreover, a June poll from The Associated Press-NORC Center for Public Affairs Research and the University of Chicago’s Energy Policy Institute found 46% of respondents were “unlikely” or “very unlikely” to purchase an EV, while just 21% were “very” or “extremely” likely to make the change.

If thousands of new charging stations are built and demand rises due to the alleviation of range concerns, the transition would create a variety of new infrastructural challenges, namely that it would reduce the reliability of an already constrained U.S. power grid.

“Up until two years ago or so, electricity demand in the United States was flat so nobody worried about running out of electricity. But with the data center boom and AI [artificial intelligence], there’s been a sudden spike in demand for electricity, and demand is expected to continue growing,” Stein told the DCNF. “Now you’re suddenly talking about not having enough electricity to supply everyday use at the same time we are trying to force pre-existing transportation systems to run on electricity. When you combine that EVs are more expensive and less flexible with the possibility we may be running out of electricity to keep homes cool and to operate industrial facilities, the logic of pursuing [the EV transition] gets even worse.”

Electricity demand has grown by 1.3% annually for the past three years — more than double the average growth rate from 2010 to 2019, according to the Federal Reserve Bank of Kansas City. The surge has been driven largely by a boom in artificial intelligence and data centers, with commercial electricity accounting for 60% of growth in total U.S. power demand between 2021 and 2023.

On the supply side, the Biden-Harris Environmental Protection Agency (EPA) has pushed to reshape the power grid by effectively requiring America’s existing coal plants will have to use carbon capture and storage (CCS) technology to control 90% of their carbon emissions by 2032 if they want to stay running past 2039, and certain new natural gas plants will have to cut their emissions by 90% by 2032. The EPA rule “leaves coal-heavy regions, like the one covered by the Midcontinent Independent System Operator, vulnerable to reliability problems in the near future,” Isaac Orr, a policy fellow for the Center of the American Experiment who specializes in grid analysis, previously told the DCNF.

Grid reliability is already wavering, with hundreds of millions of Americans at risk of experiencing power shortages this winter if weather conditions are harsh, according to power grid watchdog the North American Electric Reliability Corporation (NERC).

The IER study also identifies a set of “myths fueling electric vehicle policy,” including that EVs are necessarily better for the environment.

“One of the biggest sources of emissions from vehicles is tire wear, because tires are made primarily from oil, and as your tires roll along the ground, they degrade and release particulates into the air,” Stein told the DCNF. “Electric vehicles are much heavier than gas-powered cars due to their batteries, which requires them to have heavier tires that wear faster, so EVs actually have much higher particulate emissions than comparable internal combustion engine vehicles.”

A 2020 study from environmental engineering consultancy Emissions Analytics found particulate wear emissions were 1,000 times worse than exhaust emissions, with later research conducted by the consulting firm finding a Tesla Model Y produced 26% more tire emissions than a comparable hybrid vehicle.

Additionally, the IER study notes EVs require six times the mineral inputs of conventional cars, which in turn calls for emissions-intensive mining processes that produce toxic waste.

“For average Americans, the tradeoff calculation obviously is not working,” the study’s authors wrote. “This is not due to misinformation; indeed… there is plenty of pro-EV misinformation. It is simply that…there are negative tradeoffs to EVs. In designing policy, these negative factors must be considered rather than simply ignored.”

Automotive

Canadians rejecting Liberal’s EV mandates because consumers are rational

From Resource Works

Bad policy, not misinformation, is to blame for the decline in EV sales

It was a clever move for federal minister Gregor Robertson to stand in Victoria and blame the oil and auto industries for spreading “misinformation” about electric vehicles.

If people don’t follow a government order, then someone else must have lied to them.

But the truth is simpler, and more uncomfortable for Ottawa and Victoria: Canadians are against aggressive EV mandates because the policies behind them are not based on reality.

Politicians have been pushing electric vehicles (EVs) as a cornerstone of the fight against climate change for years, promising a cleaner future through ambitious mandates and generous rebates.

All of this effort looked good on paper: passing laws, handing out thousands (millions, billions) in subsidies, paving the way for Canada’s transition to an electric future.

But, in real life, it’s just not working out this way.

Why? Because instead of crafting long-term rules based on the realities of infrastructure, cost, and consumer choice, Ottawa rushed ahead with policies that ignored market signals.

They assumed subsidies would keep EV sales flowing indefinitely, only to be shocked when sales plummeted once the rebates dried up.

Canadians are responding rationally to high prices, unreliable charging networks, and impractical mandates.

Not long ago, Ottawa set ambitious, unattainable targets: 20 percent zero-emission vehicle sales by 2026, 60 percent by 2030, and 100 percent by 2035.

British Columbia went further, aiming for 26 percent by 2026, 90 percent by 2030, and 100 percent by 2035.

In theory, it looked achievable. In practice, it’s been a wake-up call.

The numbers tell the story. Statistics Canada reported that EVs accounted for 18.29 percent of new vehicle sales in December 2024. Just four months later, when Ottawa’s iZEV program ran out of funds and provincial rebates ended, that figure crashed to 7.53 percent.

In British Columbia, once a leader in EV adoption, the market share dropped from nearly 25 percent in mid-2024 to 15 percent a year later.

Quebec, long the most EV-friendly province, saw a similar decline when its $7,000 subsidy was slashed nearly in half.

Why? Canadians have been very clear.

Cost is the biggest barrier, according to polls like this one from Ipsos in 2025. But this isn’t the only issue.

Ipsos found 56 percent of British Columbians oppose EV mandates, with even higher resistance among older households and those outside Metro Vancouver. People resent being told they must buy expensive cars they can’t easily charge or fully trust in harsh winters.

Subsidies made high sticker prices tolerable for middle-class families, but when the rebates vanished while mandates and fines remained, buyers walked away.

Barry Penner of the Energy Futures Institute put it bluntly: governments “put the cart before the horse,” demanding widespread adoption before ensuring affordability or infrastructure.

The financial penalties for automakers are steep. Missing federal targets by 10 percent could mean hundreds of millions in fines.

In British Columbia, dealers face $20,000 penalties for every gas-powered car sold over the mandated ratio. Those who can’t comply often buy credits—frequently from Tesla, a California-based company that benefits while Canadian businesses foot the bill. These rules aren’t just hitting “Big Oil”; they’re straining local dealers and sending money abroad.

Infrastructure is another glaring issue. Ottawa estimates Canada has 33,700 chargers today but needs 679,000 by 2040—an average of 40,000 new chargers annually for 15 years, a pace experts call unrealistic.

In British Columbia, Penner notes the province has just 5,000 chargers now and needs 40,000 more by 2030. Meeting the 2035 mandate would also require electricity equivalent to two additional Site C dams, even as B.C. relies on 20 to 25 percent of its power from external sources, often fossil fuels.

Canadians aren’t against cleaner technology—they’re against being forced into choices that don’t fit their lives. The frustration stems from policies that feel disconnected from the realities of cost, convenience, and infrastructure. More blame or moralizing won’t fix this.

Penner has urged governments to “take our foot off the gas and realign our policies with reality.”

That could mean reinstating rebates if mandates persist, investing heavily in charging networks, or setting broader emissions targets that give consumers real choices instead of rigid quotas.

The EV dream will keep stalling unless that happens. It’s not because Canadians don’t know what’s going on; it’s because governments made decisions based on wishful thinking.

Agriculture

Canola or cars? Canada can’t save both

This article supplied by Troy Media.

By Doug Firby

By Doug Firby

Canada is risking its most successful export to prop up an EV pipe dream

Picture a Canadian industry that contributes $43 billion to the economy and employs about 200,000 people.

There aren’t many of those in this country. Any industry of that size should be considered indispensable.

And yet, while there is (understandable) national hand-wringing over the future of Canada’s auto industry—especially in light of U.S. President Donald

Trump’s renewed tariff rampage—another industry, arguably more economically important, is being dangerously overlooked.

That industry is canola.

A summer drive through Manitoba, Saskatchewan or Alberta makes the scale hard to miss. Yellow fields stretch to every horizon. Canola production has exploded over the past decade and has become the very lifeblood of the Prairies.

Without it, large parts of those provinces would be economically barren and far more sparsely populated. We’re not talking about niche agriculture here—we’re talking about a foundational industry that keeps the lights on across three provinces.

Canada is the world’s largest exporter of canola, a crop used to produce cooking oil, animal feed and biofuels. Its export-driven success makes it a cornerstone of the Prairie economy.

Now consider this: Canada’s auto manufacturing industry contributes about $19 billion annually to GDP and employs around 125,000 people directly in assembly and parts manufacturing. Include distribution and aftermarket services, and you get a bigger figure, but the core numbers still pale in comparison to canola.

So, here’s the uncomfortable question: If you had to sacrifice one, which would it be?

It’s a Hobson’s choice. Nobody wants to lose either. But Canada has been pushed into a position where something has to give.

The Trudeau government—and before that, the Biden administration—imposed 100 per cent tariffs on made-in-China electric vehicles (EVs). The logic was straightforward: protect the billions being pumped into Canada’s auto sector and turn the country into a hub for EV innovation and production.

It was a defensive move: one meant to slow China’s dominance in the global EV market and give domestic manufacturers room to grow. Without it, cheap, wellbuilt Chinese EVs would undercut Canadian and North American models before they ever left the factory floor.

But China doesn’t take these things lightly. In retaliation, it slapped a 76 per cent tariff on Canadian canola. Prairie farmers, many of whom are already grappling with rising costs and unpredictable weather, are now wondering if their main market is disappearing overnight.

China has long been Canada’s largest canola customer, though the relationship has had flare-ups, including temporary bans in past years tied to diplomatic disputes.

More than two-thirds of Canada’s exported canola goes to China. The latest tariff hike has already wiped out an estimated $1 billion in value. And there’s no clear end in sight.

Manitoba Premier Wab Kinew was blunt last week: Canada cannot afford to be in a trade war with both the United States and China. He suggested that, in the short term, Ottawa should direct EV tariff revenues to support canola producers. That may buy us some time. But the broader strategic question looms larger: With the U.S. under Trump becoming an increasingly unstable trade partner, and China punishing us for playing by American rules, where does Canada place its long-term bet?

It’s not an easy question to answer.

China is hardly an ideal partner. Its human rights record is abysmal, and its growing economic power often comes with strings attached. But we also can’t deny that it has already become the global manufacturing centre in many key sectors—including electric vehicles.

Then there’s the U.S. A longtime ally, yes, but under Trump, all bets are off. In January, he said of Canada, “We don’t need anything they have.” Not cars. Not oil. Not even niceties.

CUSMA—the Canada–United States–Mexico Agreement that replaced NAFTA—governs most of Canada’s trade with our two largest partners. If Trump reopens the deal—and with Trump, it’s usually safest to take him literally—the Canadian auto industry may not survive. Billions in subsidies and protective tariffs won’t matter if the largest market slams its door shut.

So, again: what should we protect?

New markets for canola are being pursued—in Europe, Japan and elsewhere. But they won’t match China’s scale anytime soon. Diversifying export markets takes years. Prairie farmers don’t have that kind of time.

Meanwhile, dreams of building a Canadian-made EV remain just that: dreams. The auto sector may eventually pivot and survive, but right now, it’s the one on life support. Canola is the industry that’s vibrant—unless we let it get crushed in a trade crossfire.

I lived in an auto town for over two decades. I know the stakes. I’ve seen what happens when plants close, when supply chains dry up, and when livelihoods vanish.

But we need to be realistic.

Canola is a winning industry. It feeds the economy, supports thousands of families and helps keep our rural communities alive. It doesn’t need endless

subsidies or federal cheerleading—it just needs stable access to markets.

That might mean giving ground on EV tariffs. That might mean swallowing some pride on the international stage. But Canada cannot afford to sacrifice a thriving sector to save one already on the brink.

If we’re going to make hard choices—and we will—let’s make the one that protects what still works.

Canada cannot lose canola.

Doug Firby is an award-winning editorial writer with over four decades of experience working for newspapers, magazines and online publications in Ontario and western Canada. Previously, he served as Editorial Page Editor at the Calgary Herald.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

espionage2 days ago

espionage2 days agoInside Xi’s Fifth Column: How Beijing Uses Gangsters to Wage Political Warfare in Taiwan — and the West

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoDecision expected soon in case that challenges Alberta’s “safe spaces” law

-

Education2 days ago

Education2 days agoOur kids are struggling to read. Phonics is the easy fix

-

International2 days ago

International2 days agoBrazil sentences former President Bolsonaro to 27 years behind bars

-

COVID-191 day ago

COVID-191 day agoWhy FDA Was Right To Say No To COVID-19 Vaccines For Healthy Kids

-

Business7 hours ago

Business7 hours agoCarney Admits Deficit Will Top $61.9 Billion, Unveils New Housing Bureaucracy

-

Energy1 day ago

Energy1 day agoTrump Admin Torpedoing Biden’s Oil And Gas Crackdown

-

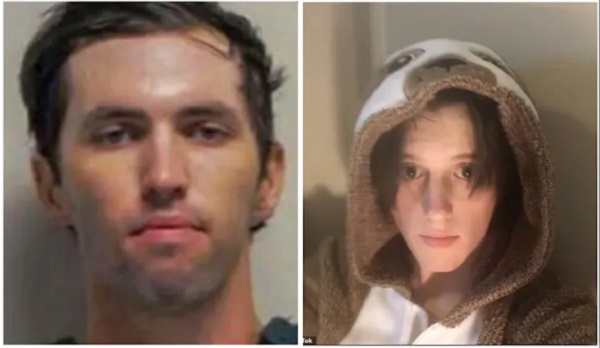

Crime1 day ago

Crime1 day agoTransgender Roomate of Alleged Charlie Kirk Assassin Cooperating with Investigation