Business

With our economy becalmed, Good Ship Canada needs a new captain

From the MacDonald Laurier Institute

Output has been stagnant for five years now. Canada is ‘as idle as a painted ship upon a painted ocean’

One of my favourite poems is Samuel Coleridge’s “The Rime of the Ancient Mariner.” It describes a ship driven by storms towards the South Pole. An albatross saves the ship and crew but the Ancient Mariner kills it, an act of cruelty for which he is later punished, including by having to repeat the story to strangers for the rest of his life.

It is the verse “Day after day, day after day,/ We stuck, nor breath nor motion;/ As idle as a painted ship/ Upon a painted ocean” that became one of my favourites. It comes back to me periodically when life seems stalled.

Which is the case with Canada these days. Our economy is at a standstill. Interest rates are up and inflation, though trending down, remains stubbornly high. Real GDP growth these past four quarters (August 2022 to August 2023) was a feeble 0.9 per cent. Any growth we do have is from a policy-driven population expansion of close to three per cent. But per capita GDP actually fell 2.1 per cent over that period, which means Canadians are poorer today than they were a year ago.

And it’s not just this year. Canada has been a “painted ship on a painted ocean” for some time. From January 2018 to June of this year, our GDP per capita was flat, according to OECD data released this week. Add in July and August and Canada’s per capita real GDP has declined slightly — from $52,300 in January 2018 to $51,900 in August (in 2012 dollars).

With the pandemic and surging inflation after 2020, you might think other countries’ economies are also becalmed. But they aren’t. U.S. per capita real GDP is up 2.4 per cent over the past year and up 9.3 per cent since January 2018, from US$61,500 to US$67,200 (again in 2012 dollars). At today’s exchange rate, Canada’s per capita GDP is now just 56 per cent of America’s — ouch!

Nor is it just the U.S. we’re slipping behind. Compared to our own slight decline in real per capita GDP since 2018, the OECD average is up 5.6 per cent, though there’s considerable variation across countries. For example, resource-rich Australia’s real per capita GDP was up only 4.8 per cent — which was still better than here — but superstar Ireland’s was up fully 31.0 per cent.

Let’s face it: Sir Wilfrid Laurier’s famous 1904 prediction that “For the next 100 years, Canada shall be the star towards which all men who love progress and freedom shall come” seems hollow these days. It is not that we don’t have the potential to shine; it’s that we so often fail to. We do still attract immigrants, but they often leave — as much as 20 per cent of a cohort over 25 years according to the Conference Board. And if salaries here keep falling behind those in the U.S., will we still be able to attract the best and brightest?

Canada has always been a trading nation but exports as a share of GDP have been relatively flat this past decade. The oil and gas sector has been our most important source of export earnings, surpassing even motor vehicles and parts, but since 2015 the Trudeau government has actively discouraged its growth.

We have had our share of innovations over the years but R&D spending has slipped back to the same share of GDP as it was in 1998. It seems the only way for Canada to develop new things is to subsidize them to the hilt with multi-billion grants like the ones given this past year to three different battery manufacturers.

Our health-care system is a shambles, with long waiting lines and not enough doctors and health professionals. One index ranks Canada’s health system as only 32nd best among 166 countries (with Singapore, Japan, South Korea, Taiwan and Israel ranking highest). We know what the problems are, but we seemingly don’t have the will to fix them.

Our tax system is a mess, with high rates and far too many ineffective incentives. Canada now has one of the highest top personal income tax rates in the world but applies it at much lower incomes than elsewhere, beginning at only twice the average wage. One important driver of U.S. growth was the Tax Cuts and Jobs Act of 2017, which bolstered investment by 20 per cent, as shown in important research released last month.

We are a free rider in defence and security spending, at only 1.29 per cent of GDP, well below the minimum two per cent needed to fulfil our NATO obligations. Our financial contribution to modernize NORAD is lacking despite the growing importance of the Arctic to Russia and China. We have contributed little in the way of advanced weaponry or tanks to our allies in Eastern Europe or the Middle East. Europe is desperate for natural gas but instead of buying it from us it is having to import it from Qatar.

While regional tensions have always been a major part of Canadian history, we seem to have lost all sight of nation-building. National infrastructure projects are absent. Provincial trade barriers undermine internal growth but are hard to remove. Alberta, angry with a federal government intent on shackling its energy industry, is ready to pull out of the national social security system. Quebec is drastically hiking tuition fees on students from the rest of Canada who attend its anglophone universities.

To fulfill its remarkable potential, this country cannot remain a painted ship upon a painted ocean. Someone needs to move the ship forward.

Business

Ottawa should end war on plastics for sake of the environment

From the Fraser Institute

Here’s the shocker: Meng shows that for 15 out of the 16 uses, plastic products incur fewer GHG emissions than their alternatives…

For example, when you swap plastic grocery bags for paper, you get 80 per cent higher GHG emissions. Substituting plastic furniture for wood—50 per cent higher GHG emissions. Substitute plastic-based carpeting with wool—80 per cent higher GHG emissions.

It’s been known for years that efforts to ban plastic products—and encourage people to use alternatives such as paper, metal or glass—can backfire. By banning plastic waste and plastic products, governments lead consumers to switch to substitutes, but those substitutes, mainly bulkier and heavier paper-based products, mean more waste to manage.

Now a new study by Fanran Meng of the University of Sheffield drives the point home—plastic substitutes are not inherently better for the environment. Meng uses comprehensive life-cycle analysis to understand how plastic substitutes increase or decrease greenhouse gas (GHG) emissions by assessing the GHG emissions of 16 uses of plastics in five major plastic-using sectors: packaging, building and construction, automotive, textiles and consumer durables. These plastics, according to Meng, account for about 90 per cent of global plastic volume.

Here’s the shocker: Meng shows that for 15 out of the 16 uses, plastic products incur fewer GHG emissions than their alternatives. Read that again. When considering 90 per cent of global plastic use, alternatives to plastic lead to greater GHG emissions than the plastic products they displace. For example, when you swap plastic grocery bags for paper, you get 80 per cent higher GHG emissions. Substituting plastic furniture for wood—50 per cent higher GHG emissions. Substitute plastic-based carpeting with wool—80 per cent higher GHG emissions.

A few substitutions were GHG neutral, such as swapping plastic drinking cups and milk containers with paper alternatives. But overall, in the 13 uses where a plastic product has lower emissions than its non-plastic alternatives, the GHG emission impact is between 10 per cent and 90 per cent lower than the next-best alternatives.

Meng concludes that “Across most applications, simply switching from plastics to currently available non-plastic alternatives is not a viable solution for reducing GHG emissions. Therefore, care should be taken when formulating policies or interventions to reduce plastic demand that they result in the removal of the plastics from use rather than a switch to an alternative material” adding that “applying material substitution strategies to plastics never really makes sense.” Instead, Meng suggests that policies encouraging re-use of plastic products would more effectively reduce GHG emissions associated with plastics, which, globally, are responsible for 4.5 per cent of global emissions.

The Meng study should drive the last nail into the coffin of the war on plastics. This study shows that encouraging substitutes for plastic—a key element of the Trudeau government’s climate plan—will lead to higher GHG emissions than sticking with plastics, making it more difficult to achieve the government’s goal of making Canada a “net-zero” emitter of GHG by 2050.

Clearly, the Trudeau government should end its misguided campaign against plastic products, “single use” or otherwise. According to the evidence, plastic bans and substitution policies not only deprive Canadians of products they value (and in many cases, products that protect human health), they are bad for the environment and bad for the climate. The government should encourage Canadians to reuse their plastic products rather than replace them.

Author:

Business

ESG Puppeteers

From Heartland Daily News

By Paul Mueller

The Environmental, Social, and Governance (ESG) framework allows a small group of corporate executives, financiers, government officials, and other elites, the ESG “puppeteers,” to force everyone to serve their interests. The policies they want to impose on society — renewable energy mandates, DEI programs, restricting emissions, or costly regulatory and compliance disclosures — increase everyone’s cost of living. But the puppeteers do not worry about that since they stand to gain financially from the “climate transition.”

Consider Mark Carney. After a successful career on Wall Street, he was a governor at two different central banks. Now he serves as the UN Special Envoy on Climate Action and Finance for the United Nations, which means it is his job to persuade, cajole, or bully large financial institutions to sign onto the net-zero agenda.

But Carney also has a position at one of the biggest investment firms pushing the energy transition agenda: Brookfield Asset Management. He has little reason to be concerned about the unintended consequences of his climate agenda, such as higher energy and food prices. Nor will he feel the burden his agenda imposes on hundreds of millions of people around the world.

And he is certainly not the only one. Al Gore, John Kerry, Klaus Schwab, Larry Fink, and thousands of other leaders on ESG and climate activism will weather higher prices just fine. There would be little to object to if these folks merely invested their own resources, and the resources of voluntary investors, in their climate agenda projects. But instead, they use other people’s resources, usually without their knowledge or consent, to advance their personal goals.

Even worse, they regularly use government coercion to push their agenda, which — incidentally? — redounds to their economic benefit. Brookfield Asset Management, where Mark Carney runs his own $5 billion climate fund, invests in renewable energy and climate transition projects, the demand for which is largely driven by government mandates.

For example, the National Conference of State Legislatures has long advocated “Renewable Portfolio Standards” that require state utilities to generate a certain percentage of electricity from renewable sources. The Clean Energy States Alliance tracks which states have committed to moving to 100 percent renewable energy, currently 23 states, the District of Columbia, and Puerto Rico. And then there are thousands of “State Incentives for Renewables and Efficiency.”

Behemoth hedge fund and asset manager BlackRock announced that it is acquiring a large infrastructure company, as a chance to participate in climate transition and benefit its clients financially. BlackRock leadership expects government-fueled demand for their projects, and billions of taxpayer dollars to fund the infrastructure necessary for the “climate transition.”

CEO Larry Fink has admitted, “We believe the expansion of both physical and digital infrastructure will continue to accelerate, as governments prioritize self-sufficiency and security through increased domestic industrial capacity, energy independence, and onshoring or near-shoring of critical sectors. Policymakers are only just beginning to implement once-in-a-generation financial incentives for new infrastructure technologies and projects.” [Emphasis added.]

Carney, Fink, and other climate financiers are not capitalists. They are corporatists who think the government should direct private industry. They want to work with government officials to benefit themselves and hamstring their competition. Capitalists engage in private voluntary association and exchange. They compete with other capitalists in the marketplace for consumer dollars. Success or failure falls squarely on their shoulders and the shoulders of their investors. They are subject to the desires of consumers and are rewarded for making their customers’ lives better.

Corporatists, on the other hand, are like puppeteers. Their donations influence government officials, and, in return, their funding comes out of coerced tax dollars, not voluntary exchange. Their success arises not from improving customers’ lives, but from manipulating the system. They put on a show of creating value rather than really creating value for people. In corporatism, the “public” goals of corporations matter more than the wellbeing of citizens.

But the corporatist ESG advocates are facing serious backlash too. The Texas Permanent School Fund withdrew $8.5 billion from Blackrock last week. They join almost a dozen state pensions that have withdrawn money from Blackrock management over the past few years. And last week Alabama passed legislation defunding public DEI programs. They follow in the footsteps of Florida, Texas, North Carolina, Utah, Tennessee, and others.

State attorneys general have been applying significant pressure on companies that signed on to the “net zero” pledges championed by Carney, Fink, and other ESG advocates. JPMorgan and State Street both withdrew from Climate Action 100+ in February. Major insurance companies started withdrawing from the Net-Zero Insurance Alliance in 2023.

Still, most Americans either don’t know much about ESG and its potential negative consequences on their lives or, worse, actually favour letting ESG distort the market. This must change. It’s time the ESG puppeteers found out that the “puppets” have ideas, goals, and plans of their own. Investors, taxpayers, and voters should not be manipulated and used to climate activists’ ends.

They must keep pulling back on the strings or, better yet, cut them altogether.

Paul Mueller is a Senior Research Fellow at the American Institute for Economic Research. He received his PhD in economics from George Mason University. Previously, Dr. Mueller taught at The King’s College in New York City.

Originally posted at the American Institute for Economic Research, reposted with permission.

-

espionage14 hours ago

espionage14 hours agoThe Scientists Who Came in From the Cold: Canada’s National Microbiology Laboratory Scandal, Part I

-

Economy1 day ago

Economy1 day agoCanadians experiencing second-longest and third steepest decline in living standards in last 40 years

-

National13 hours ago

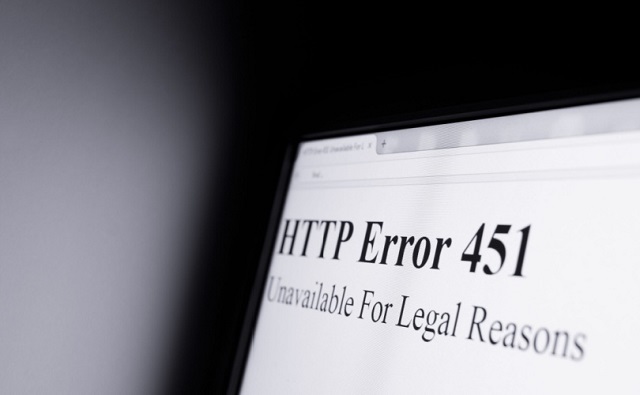

National13 hours agoTrudeau’s internet censorship Bill C-11 will not be implemented until late 2025

-

Great Reset1 day ago

Great Reset1 day agoBiden Administration Eager to Sign WHO Pandemic Treaty

-

Energy2 days ago

Energy2 days agoNew Report Reveals Just How Energy Rich America Really Is

-

Opinion2 days ago

Opinion2 days agoOrdinary working Canadians are not buying into transgender identity politics

-

Economy1 day ago

Economy1 day agoFeds spend $3 million to fly 182 politicians and bureaucrats to climate conference

-

Automotive2 days ago

Automotive2 days agoBiden’s Climate Agenda Is Running Headfirst Into A Wall Of His Own Making