Business

With our economy becalmed, Good Ship Canada needs a new captain

From the MacDonald Laurier Institute

Output has been stagnant for five years now. Canada is ‘as idle as a painted ship upon a painted ocean’

One of my favourite poems is Samuel Coleridge’s “The Rime of the Ancient Mariner.” It describes a ship driven by storms towards the South Pole. An albatross saves the ship and crew but the Ancient Mariner kills it, an act of cruelty for which he is later punished, including by having to repeat the story to strangers for the rest of his life.

It is the verse “Day after day, day after day,/ We stuck, nor breath nor motion;/ As idle as a painted ship/ Upon a painted ocean” that became one of my favourites. It comes back to me periodically when life seems stalled.

Which is the case with Canada these days. Our economy is at a standstill. Interest rates are up and inflation, though trending down, remains stubbornly high. Real GDP growth these past four quarters (August 2022 to August 2023) was a feeble 0.9 per cent. Any growth we do have is from a policy-driven population expansion of close to three per cent. But per capita GDP actually fell 2.1 per cent over that period, which means Canadians are poorer today than they were a year ago.

And it’s not just this year. Canada has been a “painted ship on a painted ocean” for some time. From January 2018 to June of this year, our GDP per capita was flat, according to OECD data released this week. Add in July and August and Canada’s per capita real GDP has declined slightly — from $52,300 in January 2018 to $51,900 in August (in 2012 dollars).

With the pandemic and surging inflation after 2020, you might think other countries’ economies are also becalmed. But they aren’t. U.S. per capita real GDP is up 2.4 per cent over the past year and up 9.3 per cent since January 2018, from US$61,500 to US$67,200 (again in 2012 dollars). At today’s exchange rate, Canada’s per capita GDP is now just 56 per cent of America’s — ouch!

Nor is it just the U.S. we’re slipping behind. Compared to our own slight decline in real per capita GDP since 2018, the OECD average is up 5.6 per cent, though there’s considerable variation across countries. For example, resource-rich Australia’s real per capita GDP was up only 4.8 per cent — which was still better than here — but superstar Ireland’s was up fully 31.0 per cent.

Let’s face it: Sir Wilfrid Laurier’s famous 1904 prediction that “For the next 100 years, Canada shall be the star towards which all men who love progress and freedom shall come” seems hollow these days. It is not that we don’t have the potential to shine; it’s that we so often fail to. We do still attract immigrants, but they often leave — as much as 20 per cent of a cohort over 25 years according to the Conference Board. And if salaries here keep falling behind those in the U.S., will we still be able to attract the best and brightest?

Canada has always been a trading nation but exports as a share of GDP have been relatively flat this past decade. The oil and gas sector has been our most important source of export earnings, surpassing even motor vehicles and parts, but since 2015 the Trudeau government has actively discouraged its growth.

We have had our share of innovations over the years but R&D spending has slipped back to the same share of GDP as it was in 1998. It seems the only way for Canada to develop new things is to subsidize them to the hilt with multi-billion grants like the ones given this past year to three different battery manufacturers.

Our health-care system is a shambles, with long waiting lines and not enough doctors and health professionals. One index ranks Canada’s health system as only 32nd best among 166 countries (with Singapore, Japan, South Korea, Taiwan and Israel ranking highest). We know what the problems are, but we seemingly don’t have the will to fix them.

Our tax system is a mess, with high rates and far too many ineffective incentives. Canada now has one of the highest top personal income tax rates in the world but applies it at much lower incomes than elsewhere, beginning at only twice the average wage. One important driver of U.S. growth was the Tax Cuts and Jobs Act of 2017, which bolstered investment by 20 per cent, as shown in important research released last month.

We are a free rider in defence and security spending, at only 1.29 per cent of GDP, well below the minimum two per cent needed to fulfil our NATO obligations. Our financial contribution to modernize NORAD is lacking despite the growing importance of the Arctic to Russia and China. We have contributed little in the way of advanced weaponry or tanks to our allies in Eastern Europe or the Middle East. Europe is desperate for natural gas but instead of buying it from us it is having to import it from Qatar.

While regional tensions have always been a major part of Canadian history, we seem to have lost all sight of nation-building. National infrastructure projects are absent. Provincial trade barriers undermine internal growth but are hard to remove. Alberta, angry with a federal government intent on shackling its energy industry, is ready to pull out of the national social security system. Quebec is drastically hiking tuition fees on students from the rest of Canada who attend its anglophone universities.

To fulfill its remarkable potential, this country cannot remain a painted ship upon a painted ocean. Someone needs to move the ship forward.

Business

RFK Jr. planning new restrictions on drug advertising: report

Quick Hit:

The Trump administration is reportedly weighing new restrictions on pharmaceutical ads—an effort long backed by Health Secretary Robert F. Kennedy Jr. Proposals include stricter disclosure rules and ending tax breaks.

Key Details:

-

Two key proposals under review: requiring longer side-effect disclosures in TV ads and removing pharma’s tax deduction for ad spending.

-

In 2024, drug companies spent $10.8 billion on direct-to-consumer ads, with AbbVie and Pfizer among the top spenders.

-

RFK Jr. and HHS officials say the goal is to restore “rigorous oversight” over drug promotions, though no final decision has been made.

Diving Deeper:

According to a Bloomberg report, the Trump administration is advancing plans to rein in direct-to-consumer pharmaceutical advertising—a practice legal only in the U.S. and New Zealand. Rather than banning the ads outright, which could lead to lawsuits, officials are eyeing legal and financial hurdles to limit their spread. These include mandating extended disclosures of side effects and ending tax deductions for ad spending—two measures that could severely limit ad volume, especially on TV.

Health and Human Services Secretary Robert F. Kennedy Jr., who has long called for tougher restrictions on drug marketing, is closely aligned with the effort. “We are exploring ways to restore more rigorous oversight and improve the quality of information presented to American consumers,” said HHS spokesman Andrew Nixon in a written statement. Kennedy himself told Sen. Josh Hawley in May that an announcement on tax policy changes could come “within the next few weeks.”

The ad market at stake is enormous. Drugmakers spent $10.8 billion last year promoting treatments directly to consumers, per data from MediaRadar. AbbVie led the pack, shelling out $2 billion—largely to market its anti-inflammatory drugs Skyrizi and Rinvoq, which alone earned the company over $5 billion in Q1 of 2025.

AbbVie’s chief commercial officer Jeff Stewart admitted during a May conference that new restrictions could force the company to “pivot,” possibly by shifting marketing toward disease awareness campaigns or digital platforms.

Pharma’s deep roots in broadcast advertising—making up 59% of its ad spend in 2024—suggest the impact could be dramatic. That shift would mark a reversal of policy changes made in 1997, when the FDA relaxed requirements for side-effect disclosures, opening the floodgates for modern TV drug commercials.

Supporters of stricter oversight argue that U.S. drug consumption is inflated because of these ads, while critics warn of economic consequences. Jim Potter of the Coalition for Healthcare Communication noted that reinstating tougher ad rules could make broadcast placements “impractical.” Harvard professor Meredith Rosenthal agreed, adding that while ads sometimes encourage patients to seek care, they can also push costly brand-name drugs over generics.

Beyond disclosure rules, the administration is considering changes to the tax code—specifically eliminating the industry’s ability to write off advertising as a business expense. This idea was floated during talks over Trump’s original tax reform but was ultimately dropped from the final bill.

Business

Canada’s critical minerals are key to negotiating with Trump

From Resource Works

The United States wants to break its reliance on China for minerals, giving Canada a distinct advantage.

Trade issues were top of mind when United States President Donald Trump landed in Kananaskis, Alberta, for the G7 Summit. As he was met by Prime Minister Mark Carney, Canada’s vast supply of critical minerals loomed large over a potential trade deal between North America’s two largest countries.

Although Trump’s appearance at the G7 Summit was cut short by the outbreak of open hostilities between Iran and Israel, the occasion still marked a turning point in commercial and economic relations between Canada and the U.S. Whether they worsen or improve remains to be seen, but given Trump’s strategy of breaking American dependence on China for critical minerals, Canada is in a favourable position.

Despite the president’s early exit, he and Prime Minister Carney signed an accord that pledged to strike a Canada-US trade deal within 30 days.

Canada’s minerals are a natural advantage during trade talks due to the rise in worldwide demand for them. Without the minerals that Canada can produce and export, it is impossible to power modern industries like defence, renewable energy, and electric vehicles (EV).

Nickel, gallium, germanium, cobalt, graphite, and tungsten can all be found in Canada, and the U.S. will need them to maintain its leadership in the fields of technology and economics.

The fallout from Trump’s tough talk on tariff policy and his musings about annexing Canada have only increased the importance of mineral security. The president’s plan extends beyond the economy and is vital for his strategy of protecting American geopolitical interests.

Currently, the U.S. remains dependent on China for rare earth minerals, and this is a major handicap due to their rivalry with Beijing. Canada has been named as a key partner and ally in addressing that strategic gap.

Canada currently holds 34 critical minerals, offering a crucial potential advantage to the U.S. and a strategic alternative to the near-monopoly currently held by the Chinese. The Ring of Fire, a vast region of northern Ontario, is a treasure trove of critical minerals and has long been discussed as a future powerhouse of Canadian mining.

Ontario’s provincial government is spearheading the region’s development and is moving fast with legislation intended to speed up and streamline that process. In Ottawa, there is agreement between the Liberal government and Conservative opposition that the Ring of Fire needs to be developed to bolster the Canadian economy and national trade strategies.

Whether Canada comes away from the negotiations with the US in a stronger or weaker place will depend on the federal government’s willingness to make hard choices. One of those will be ramping up development, which can just as easily excite local communities as it can upset them.

One of the great drags on the Canadian economy over the past decade has been the inability to finish projects in a timely manner, especially in the natural resource sector. There was no good reason for the Trans Mountain pipeline expansion to take over a decade to complete, and for new mines to still take nearly twice that amount of time to be completed.

Canada is already an energy powerhouse and can very easily turn itself into a superpower in that sector. With that should come the ambition to unlock our mineral potential to complement that. Whether it be energy, water, uranium, or minerals, Canada has everything it needs to become the democratic world’s supplier of choice in the modern economy.

Given that world trade is in flux and its future is uncertain, it is better for Canada to enter that future from a place of strength, not weakness. There is no other choice.

-

Alberta1 day ago

Alberta1 day agoAlberta health care blockbuster: Province eliminating AHS Health Zones in favour of local decision-making!

-

Alberta1 day ago

Alberta1 day agoCentral Alberta MP resigns to give Conservative leader Pierre Poilievre a chance to regain a seat in Parliament

-

Alberta20 hours ago

Alberta20 hours agoCalls for a new pipeline to the coast are only getting louder

-

Alberta1 day ago

Alberta1 day agoAlberta pro-life group says health officials admit many babies are left to die after failed abortions

-

conflict2 days ago

conflict2 days agoTrump: ‘We’ have control over Iranian airspace; know where Khomeini is hiding

-

Daily Caller1 day ago

Daily Caller1 day ago‘Not Held Hostage Anymore’: Economist Explains How America Benefits If Trump Gets Oil And Gas Expansion

-

Business2 days ago

Business2 days agoThe CBC is a government-funded giant no one watches

-

Alberta12 hours ago

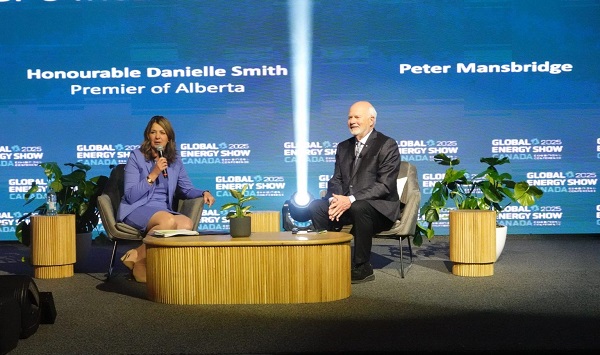

Alberta12 hours agoUnified message for Ottawa: Premier Danielle Smith and Premier Scott Moe call for change to federal policies