Banks

What 100 million “unbanked” Nigerians can teach Canadians about Central Bank Digital Currency

From the Frontier Centre for Public Policy

By Gieb Lisikh

Despite credit cards, e-transfers and online banking having already made money go pretty much digital, the Bank of Canada is busily working on a much bigger transformation. Canada is one of about 100 countries that – in uncanny synchronicity – several years ago joined the race toward retail central bank digital currency (CBDC).

Touted as the digital equivalent of cash, CBDC risks eroding the established banking system and, among many other problems, is likely to be vulnerable to hackers’ attacks which, should a foreign government use this as a tactic in “hybrid” warfare, might prove capable of destabilizing a target country’s economy.

Considering such acute risks, it would be reasonable to expect that the explosion of worldwide interest in CBDC is justified by its special qualities that address obvious pressing needs of the citizenry. The purported consumer and other needs for CBDC, however, seem to be entirely fabricated, while the qualities that actually differentiate CBDC from the money we use now are hushed and obscured by virtue-signalling.

CBDC’s main advertised feature is equivalency to cash. It is everywhere marketed as a means to advance “financial inclusion” – a convenient way for the “unbanked” to access financial services – both a stand-in and replacement for cash, which it is claimed is about to disappear from use.

The Bank of Canada admits, however, that CBDC cannot actually replace cash or make an “unbanked” person “banked”. That’s because CBDC does nothing to address the two key reasons people still use cash: the need for privacy and independence from technology. CBDC does the opposite. First, CBDC has a built-in lack of privacy as it’s designed to always leave a digital trail. Second, it requires the use of an internet-connected device – meaning it is not only technology-dependent but interruptible.

While some research suggests only 2 percent of Canadians still rely heavily on cash, a Bank of Canada survey found that 46 percent of us would find the elimination of cash anywhere from inconvenient to disastrous. What might happen if governments forcibly removed cash from circulation? We don’t need to guess, for we have a large-scale case-study available.

In Nigeria, about half of adults had no bank account when in October 2021 the government introduced eNaira, the world’s first serious CBDC implementation. Making 100 million “unbanked” Nigerians happy was no doubt intended not only as a national but as a global endorsement for CBDC. Yet it did the opposite, eventually rocking the country to its core.

A piddly 0.8 percent of already “banked” Nigerians downloaded eNaira wallets in the first year after the launch, of whom most did not engage in any transactions. Not dissuaded by such overwhelming indifference, the government doubled-down with an all-out attack on cash, demonetizing banknotes and forcing Nigerians to exchange their cash holdings for eNaira. The nation’s 100 million poorest people were left with paper money they could not use to buy food or other necessities. This triggered violent riots as desperate hungry people took to the streets, demanding reinstatement of cash. The situation persisted for more than three months until cash was re-enabled. Today Nigeria’s government is trying to boost eNaira use through artificial cash shortages.

The International Monetary Fund’s (IMF) consultants heavily pushed the “financial inclusion” narrative in Nigeria, fully endorsing it as “a key policy objective that central banks, especially those in emerging and low-income countries, are considering for retail [CBDC].” Yet bizarrely, the same IMF document notes: “The impact of CBDC for improving financial inclusion is currently speculative, where further evidence and experience are needed to fully understand benefits and limitations.”

How can the main reason for a large financial overhaul that will be life-altering for hundreds of millions of people and carries many risks be…speculative? As if dodging this question, the Bank of Canada turns the conversation on its head: instead of looking for a justifiable use case that warrants “wide adoption, acceptance and use of CBDC”, it goes into talk of “overcoming the barriers”. The Bank seems to have made its commitment to building CBDC capacity before finding a genuine need. And that leaves us with the only sensible conclusion: that the advertised justifications are just an awkward façade, hiding the real and not-so-welcome reasons.

The two major features making CBDC different from traditional money are that CBDC is centrally traceable and programmable. This makes CBDC almost infinitely dangerous. It will be only one step from monitoring your every financial move to telling you how and when to spend your money. CBDC will enable “special purposes” like spending caps or blocks, transfer limits, consumption controls, penalty taxes, forced loans, nudge economics, geo fencing and more. These things are already happening in China and, according to Russian officials, may soon begin there as well.

Those utterly undemocratic purposes should outrage any Westerner, but they fit China’s social credit system like a glove. They could be further enhanced by other privacy-intrusive measures like digital ID, surveillance and elimination of cash or alternative monetary systems such as cryptocurrency.

Canadians have expressed no desire, understanding or even, for the most part, awareness of the publicly-funded CBDC development and the reasons behind it. As in Nigeria, the nation’s central bank does not listen but simply insists on and proceeds with this affair, claiming it’s to benefit Canadians but failing or not even trying to articulate how.

The original, full-length version of this article was recently published in C2C Journal.

Gleb Lisikh is a researcher and IT management professional, and a father of three children. He lives in Vaughan, Ontario and grew up in various parts of the Soviet Union.

Banks

Debanking Is Real, And It’s Coming For You

From the Frontier Centre for Public Policy

Marco Navarro-Genie warns that debanking is turning into Ottawa’s weapon of choice to silence dissent, and only the provinces can step in to protect Canadians.

Disagree with the establishment and you risk losing your bank account

What looked like a narrow, post-convoy overreach has morphed into something much broader—and far more disturbing. Debanking isn’t a policy misfire. It’s turning into a systemic method of silencing dissent—not just in Canada, but across the Western world.

Across Canada, the U.S. and the U.K., people are being cut off from basic financial services not because they’ve broken any laws, but because they hold views or support causes the establishment disfavors. When I contacted Eva Chipiuk after RBC quietly shut down her account, she confirmed what others had only whispered: this is happening to a lot of people.

This abusive form of financial blacklisting is deep, deliberate and dangerous. In the U.K., Nigel Farage, leader of Reform UK and no stranger to controversy, was debanked under the fig leaf of financial justification. Internal memos later revealed the real reason: he was deemed a reputational risk. Cue the backlash, and by 2025, the bank was forced into a settlement complete with an apology and compensation. But the message had already been sent.

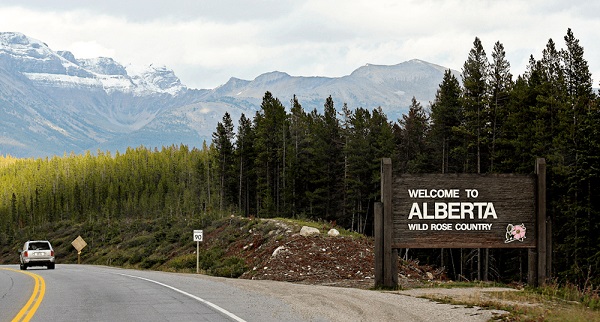

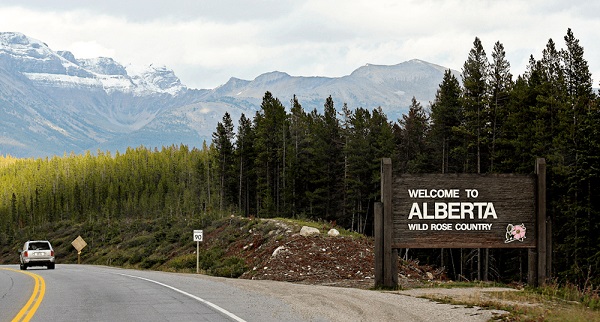

That message didn’t stay confined to Britain. And let’s not pretend it’s just private institutions playing favourites. Even in Alberta—where one might hope for a little more institutional backbone—Tamara Lich was denied an appointment to open an account at ATB Financial. That’s Alberta’s own Crown bank. If you think provincial ownership protects citizens from political interference, think again.

Fortunately, not every institution has lost its nerve. Bow Valley Credit Union, a smaller but principled operation, has taken a clear stance: it won’t debank Albertans over their political views or affiliations. In an era of bureaucratic cowardice, Bow Valley is acting like a credit union should: protective of its members and refreshingly unapologetic about it.

South of the border, things are shifting. On Aug. 7, 2025, U.S. President Donald Trump signed an executive order titled “Guaranteeing Fair Banking for All Americans.” The order prohibits financial institutions from denying service based on political affiliation, religion or other lawful activity. It also instructs U.S. regulators to scrap the squishy concept of “reputational risk”—the bureaucratic smoke screen used to justify debanking—and mandates a review of past decisions. Cases involving ideological bias must now be referred to the Department of Justice.

This isn’t just paperwork. It’s a blunt declaration: access to banking is a civil right. From now on, in the U.S., politically motivated debanking comes with consequences.

Of course, it’s not perfect. Critics were quick to notice that the order conveniently omits platforms like PayPal and other payment processors—companies that have been quietly normalizing debanking for over a decade. These are the folks who love vague “acceptable use” policies and ideological red lines that shift with the political winds. Their absence from the order raises more than a few eyebrows.

And the same goes for another set of financial gatekeepers hiding in plain sight. Credit card networks like Visa, American Express and Mastercard have become powerful, unaccountable referees, denying service to individuals and organizations labelled “controversial” for reasons that often boil down to politics.

If these players aren’t explicitly reined in, banks might play by the new rules while the rest of the financial ecosystem keeps enforcing ideological conformity by other means.

If access to money is a civil right, then that right must be protected across the entire payments system—not just at your local branch.

While the U.S. is attempting to shield its citizens from ideological discrimination, there is a noticeable silence in Canada. Not a word of concern from the government benches—or the opposition. The political class is united, apparently, in its indifference.

If Ottawa won’t act, provinces must. That makes things especially urgent for Alberta and Saskatchewan. These are the provinces where dissent from Ottawa’s policies is most common—and where citizens are most likely to face politically motivated financial retaliation.

But they’re not powerless. Both provinces boast robust credit union systems. Alberta even owns ATB Financial, a Crown bank originally created to protect Albertans from central Canadian interference. But ownership without political will is just branding.

If Alberta and Saskatchewan are serious about defending civil liberties, they should act now. They can legislate protections that prohibit financial blacklisting based on political affiliation or lawful advocacy. They can require due process before any account is frozen. They can strip “reputational risk” from the rulebooks and make it clear to Ottawa: using banks to punish dissenters won’t fly here.

Because once governments—or corporations doing their bidding—can cut off your access to money for holding the wrong opinion, democracy isn’t just threatened.

It’s already broken.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Alberta

Your money isn’t as safe as you think

This article supplied by Troy Media.

The Emergencies Act proved how quickly bank accounts can be weaponized. Alberta must act now to protect its citizens.

When Eva Chipiuk (the Alberta lawyer who famously confronted former Prime Minister Justin Trudeau’s assertions at the Emergencies Act inquiry) found out her Royal Bank account was being shut down, it confirmed a chilling truth: those who challenge Ottawa are not safe from retribution.

Chipiuk committed no crime and was not charged with any offence. However, the Montreal-based Royal Bank refused to provide her services, citing an unspecified risk. The message is clear: if you challenge Ottawa, you may risk being treated as an economic non-person. This comes just months before Tamara Lich, an Alberta resident, is expected to be sentenced for standing up against COVID overreach.

The Alberta government cannot ignore these threats against its citizens. There is plenty Ottawa doesn’t like about Alberta and Albertans today. Given that, in a February 2022 Globe and Mail oped—written before he became prime minister—Mark Carney described civil protesters as “seditionists,” one doesn’t need much imagination to see how his government could treat Albertans who push for greater control over their future. The province must prepare now to shield its citizens from financial retaliation.

Albertans who think their money is safe if it’s parked at a credit union or ATB, instead of a chartered bank, are mistaken. It isn’t. Under the Criminal Code, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, and the Emergencies Act, Ottawa can force any “financial service provider”—including provincially regulated credit unions—to freeze accounts. For example, when Tamara Lich tried to open an account with ATB—Alberta’s Crown-owned financial institution—she was denied even an appointment.

Events such as these show that it doesn’t take a judge to determine you have run afoul of those laws—only a government that disagrees with you.

Alberta has the tools to defend its citizens, and it should use them. It should start by making ATB and its provincially regulated credit unions fortresses against politically motivated financial punishment. ATB, created in 1938 to shield farmers from the aggressive lending practices of Laurentian bankers, has a distinct status as an arm of the Alberta government.

That status can be leveraged today to keep Ottawa at bay by:

- Refocusing ATB on serving Albertans, not advancing trendy corporate agendas.

- Amending the ATB Financial Act to require judicial orders for any account freezes or closures, mandate public reporting of such actions, and enshrine political neutrality to ensure no Albertan is denied service for lawful political activity.

- Preparing to invoke the Sovereignty Act if Ottawa attempts another Emergencies Act-style move, instructing ATB and its credit unions to disregard unconstitutional federal orders unless validated by Alberta courts.

- Creating a Québec-style integrated financial regulator to oversee ATB and Alberta’s provincially regulated credit unions, insulating them from Ottawa’s reach.

- Exploring alternative payment systems to reduce reliance on Ottawa-controlled clearing mechanisms. Payments Canada—which Ottawa controls—could be used as a choke point against Alberta institutions. A provincial or private settlement system would blunt that weapon before it can be deployed.

Finally, Alberta should enact an Alberta Financial Rights Act guaranteeing that no one will be denied financial services and that no account can be frozen or closed without due process in open court.

Ottawa will not take this lying down. It can seek court injunctions, threaten ATB’s and our credit unions’ access to national payment systems, or pass legislation directly targeting provincial Crown corporations. Alberta must anticipate these moves now by drafting constitutional challenges, forging alliances with like-minded provinces, and building backup clearing systems.

When the federal government can freeze your account for giving $50 to the “wrong” cause, you are not a free citizen. You are a subject. The treatment of Tamara Lich and Eva Chipiuk’s debanking is a warning.

Alberta can either wait for the next wave of financial punishments to hit its citizens, or it can act decisively to make ATB and its provincially regulated credit unions fortresses that protect them. Premier Danielle Smith has a unique opportunity to put Alberta first again—and she should take it.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta2 days ago

Alberta2 days agoFact, fiction, and the pipeline that’s paying Canada’s rent

-

Business24 hours ago

Business24 hours agoCarney government plans to muddy the fiscal waters in upcoming budget

-

Business1 day ago

Business1 day agoTrump Warns Beijing Of ‘Countermeasures’ As China Tightens Grip On Critical Resources

-

International1 day ago

International1 day agoTrump gets an honourable mention: Nobel winner dedicates peace prize to Trump

-

International2 days ago

International2 days agoTrump-brokered Gaza peace agreement enters first phase

-

Alberta2 days ago

Alberta2 days agoAlberta Is Where Canadians Go When They Want To Build A Better Life

-

Crime1 day ago

Crime1 day agoCanada’s safety minister says he has not met with any members of damaged or destroyed churches

-

COVID-191 day ago

COVID-191 day agoTamara Lich says she has no ‘remorse,’ no reason to apologize for leading Freedom Convoy