Business

Trudeau hiking taxes again in 2024

From the Canadian Taxpayers Federation

Author: Franco Terrazzano

Brace for impact, taxpayers.

Prime Minister Justin Trudeau will be reaching deeper into your pockets in the new year with payroll tax hikes, a carbon tax hike and alcohol tax hikes.

Canadians will be paying higher payroll taxes because of the mandatory rising Canada Pension Plan and Employment Insurance contributions.

If you make $73,200 or more, you’ll be paying an extra $347 in payroll taxes in 2024, for a total tax bill of $5,104.

Your employer will also be forced to fork over $5,524 in the new year.

The federal government is imposing a new tax, which it calls “CPP2.” The original CPP taxes your income at six per cent up to $68,500. The new CPP2 expands that threshold and taxes additional income at four per cent up to $73,200.

Trudeau likes to claim he’s “working to make life more affordable.” But he’s also hiking a tax that directly makes life more expensive: the carbon tax.

The carbon tax increases the price of gasoline, diesel and home heating fuels, which is a big deal in our vast, cold country. The carbon tax also makes groceries more expensive, as it increases costs for the farmers who grow our food and the truckers who deliver it.

The carbon tax will cost the average family up to $911 in 2024 even after the rebates, according to the Parliamentary Budget Officer.

The feds are also scheming up a digital services tax. This new tax targets social media platforms, companies operating digital marketplaces, and businesses earning revenue from online advertising, such as Amazon, Google, Facebook, Uber and Airbnb.

Consumers should expect to pay higher prices because of the tax. When faced with the three per cent DST in France, Amazon increased its commission charge to French vendors by the same amount.

You could be forgiven if all these tax hikes drive you to drink.

But when you pick up that case of Blue, a bottle of pinot or a mickey of rum, Trudeau will be taking an extra 4.7 per cent from you through his alcohol tax hikes.

Next year’s federal alcohol tax hike is expected to cost taxpayers almost $100 million.

Taxes in Canada already account for about half of the price of beer, 65 per cent of the price of wine and more than three quarters of the price of spirits.

While Trudeau hikes taxes, many other countries are providing relief.

The Canadian Taxpayers Federation identified 51 national governments that provided tax relief during the pandemic or to ease the burdens of inflation. Those governments include more than half of the G7 and G20 countries and two-thirds of the countries in the Organization for Economic Co-operation and Development.

Provincial governments – of all political stripes – are also providing relief.

Manitoba’s NDP government is suspending its fuel tax in the new year. Gas tax relief from Ontario’s Progressive Conservatives will save a family with a minivan and pick-up truck about $185 through June 2024. And the Liberals in Newfoundland and Labrador cut their gas tax by eight cents per litre.

The Alberta government promised to cut personal income taxes and passed legislation requiring a vote before a government can increase income or business taxes. Manitoba’s income tax cuts could save an individual taxpayer more than $2,000. Quebec lowered its income tax rate on the first two brackets. New Brunswick implemented significant income tax relief in 2023. And Prince Edward Island’s income tax cut will save middle-class taxpayers up to $200.

The fastest, simplest and easiest way for Trudeau to make all areas of life more affordable is to ditch his high-tax policies and allow Canadians to keep more of our money.

Business

When politicians gamble, taxpayers lose

From the Canadian Taxpayers Federation

Author: Jay Goldberg

Trudeau and Ford bragged about how a $5 billion giveaway to Honda is going to generate 1,000 jobs. In case you’re thinking of doing the math, that’s $5 million per job.

Politicians are rolling the dice on the electric vehicle industry with your money.

If they bet wrong, and there’s a good chance they have, hardworking Canadians will be left holding the bag.

Prime Minister Justin Trudeau and Premier Doug Ford announced a $5-billion agreement with Honda, giving another Fortune 500 automaker a huge wad of taxpayer cash.

Then Trudeau released a video on social media bragging about “betting big” on the electric vehicle industry in Canada. The “betting” part of Trudeau’s statement tells you everything you need to know about why this is a big mistake.

Governments should never “bet” with taxpayer money. That’s the reality of corporate welfare: when governments give taxpayer money to corporations with few strings attached, everyday Canadians are left hoping and praying that politicians put the chips on the right numbers.

And these are huge bets.

When Trudeau and Ford announced this latest giveaway to Honda, the amount of taxpayer cash promised to the electric vehicle sector reached $57 billion. That’s more than the federal government plans to spend on health care this year.

Governments should never gamble with taxpayer money and there are at least three key reasons why this Honda deal is a mistake.

First, governments haven’t even proven themselves capable of tracking how many jobs are created through their corporate welfare schemes.

Trudeau and Ford bragged about how a $5 billion giveaway to Honda is going to generate 1,000 jobs. In case you’re thinking of doing the math, that’s $5 million per job.

Five million dollars per job is already outrageous. But some recent reporting from the Globe and Mail shows why corporate welfare in general is a terrible idea.

The feds don’t even have a proper mechanism for verifying if jobs are actually created after handing corporations buckets of taxpayer cash. So, while 1,000 jobs are promised through the Honda deal, the government isn’t capable of confirming whether those measly 1,000 jobs will materialize.

Second, betting on the electric vehicle industry comes with risk.

Trudeau and Ford gave the Ford Motor Company nearly $600 million to retool a plant in Oakville to build electric cars instead of gasoline powered ones back in 2020. But just weeks ago, Ford announced plans to delay the conversion for another three years, citing slumping electric vehicle sales.

Look into Ford’s quarterly reports and the danger of betting on electric vehicles becomes clear as day: Ford’s EV branch lost $1.3 billion in the first quarter of 2024. Reports also show Ford lost $130,000 on every electric vehicle sold.

The decline of electric vehicle demand isn’t limited to Ford. In the United States, electric vehicle sales fell by 7.3 per cent between the last quarter of 2023 and the first quarter of 2024.

Even Tesla’s sales were down 13 per cent in the first quarter of this year compared to the first quarter of 2023.

A Bloomberg headline from early April read “Tesla’s sales miss by the most ever in brutal blow for EVs.”

There’s certainly a risk in betting on electric vehicles right now.

Third, there’s the question of opportunity cost. Imagine what else our governments could be doing with $57 billion?

For about the same amount of money, the federal government could suspend the federal sales tax for an entire year. The feds could also use $57 billion to double health-care spending or build 57 new hospitals.

The solution for creating jobs isn’t to hand a select few companies buckets of cash just to lure them to Canada. Politicians should be focusing on creating the right environment for any company, large or small, to grow without a government handout.

To do that, Canada must be more competitive with lower business taxes, less red tape and more affordable energy. That’s a real recipe for success that doesn’t involve gambling with taxpayer cash.

It’s time for our politicians to kick their corporate welfare addiction. Until they do, Canadians will be left paying the price.

Business

WEF panelist suggests COVID response accustomed people to the idea of CBDCs

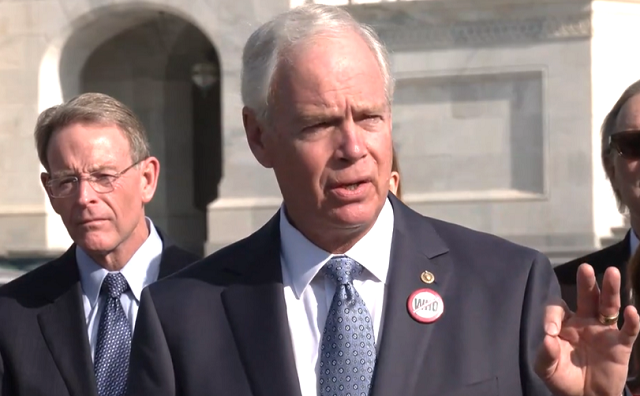

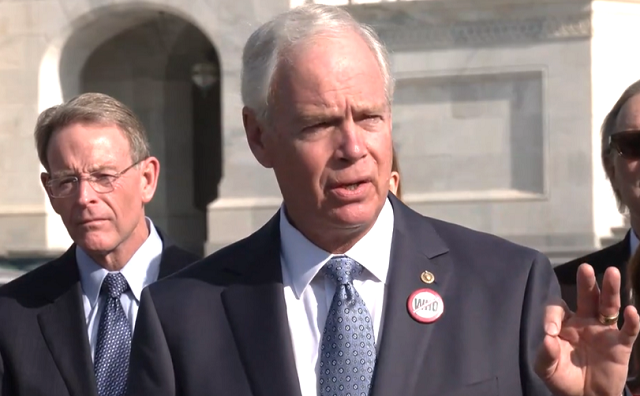

Central Bank of Bahrain governor Khalid Humaidan

From LifeSiteNews

When asked how he would convince people that CBDCs would be a trusted medium of exchange, Bahrain’s central bank governor said that COVID made the digital transformation ‘something of a requirement’ that had ‘very little resistance.’

Central bank digital currencies (CBDCs) will hopefully replace physical cash and become fully digital, a central banker tells the World Economic Forum (WEF).

Speaking at the WEF Special Meeting on Global Collaboration, Growth and Energy Development on Sunday, Central Bank of Bahrain governor Khalid Humaidan told the panel “Open Forum: The Digital Currencies’ Opportunity in the Middle East” that one of the goals of CBDC was to replace cash, at least in Bahrain, and to go “one hundred percent digital.”

Humaidan likened physical cash to being an antiquated “analogue” technology and that CBDC was the digital solution that would hopefully replace cash:

"We're probably going to stop calling it central bank digital currency [CBDC]. It's going to be a digital form of cash, and at some point in time hopefully we will be able to be 100% digital": Central Bank of Bahrain Governor Khalid Humaidan to the WEF https://t.co/Pspr0M1Uuq pic.twitter.com/N5aOkCpzh1

— Tim Hinchliffe (@TimHinchliffe) April 29, 2024

“I thank this panel and this opportunity. It forced me to refine my thoughts and opinions where I’m at a place comfortably now that I’m ready to verbalize what I think about CBDC,” said Humaidan.

If we think cash is the analogue and digital currency is the form of digital – CBDC is the digital form of cash – today, clearly we’re in a hybrid situation; we’re using both.

We know in the past when it comes to cash, central bankers were very much in control with all aspects of cash, and now we’re comfortable to the point where the private sector plays a big role in the printing of the cash, in the distribution of the cash, and with the private sector we use interest rates to manage the supply of cash.

The same thing is likely to happen with CBDC. Yes, the central bank will have a role, but at some point in time – the same way we don’t call it ‘central bank cash’ – we’re probably going to stop calling it central bank digital currency.

“It’s going to be a digital form of the cash, and at some point in time hopefully we will be able to be one hundred percent digital,” he added.

When asked how he would convince people that CBDC would be a trusted medium of exchange, Bahrain’s central bank governor said that people were already used to it and that COVID made the digital transformation “necessary” and “something of a requirement” that had “very little resistance.”

"There's less use of cash […] The transition to fully digital is not going to be a stretch […] People are used to it […] Its adoption rates increased because of COVID […] There is very little resistance": Central Bank of Bahrain Governor Khalid Humaidan to the WEF on CBDC pic.twitter.com/zB7nJAi48G

— Tim Hinchliffe (@TimHinchliffe) April 29, 2024

“Right now, many of our payments are digital. The truth is, I said that we’re in a hybrid model; there’s less and less use of cash,” said Humaidan.

I think from predominantly digital with a little physical, I think the transition to fully digital is not going to be a stretch.

People are used to it, people have engaged in it and certain circumstances did help. Its adoption rates increased because of COVID.

“This is where contactless started to become something of a necessity, something of safety, something of a requirement, and because of that there is very little resistance; trust is already there,” he added.

"Is it [digital euro] going to be as private as cash? No. A digital currency will never be as anonymous and as protecting of privacy in many respects as cash, which is why cash will always be around": Christine Lagarde, BIS Innovation Summit, March 2023 #CBDC pic.twitter.com/BLMVOPax6a

— Tim Hinchliffe (@TimHinchliffe) April 11, 2023

Meanwhile, European Central Bank president Christine Lagarde has been going around the world telling people that the digital euro CBDC would not eliminate cash, and that cash would always be an option.

Speaking at the Bank for International Settlements (BIS) Innovation Summit in March 2023, Lagarde said that a digital currency will never be as anonymous as cash, and for that reason, cash will always be around.

“Is it [digital euro] going to be as private as cash? No,” she said.

A digital currency will never be as anonymous and as protecting of privacy in many respects as cash, which is why cash will always be around.

If people want to use cash in some countries or in some transactions, cash should be available.

“A digital currency is an alternative, is another means of payment and will not provide exactly the same level of privacy and anonymity as cash, but will be pretty close in terms of complete neutrality in relation to the data,” she added.

A WEF Agenda blog post from September, 2017, lists the “gradual obsolescence of paper currency” as being “characteristic of a well-designed CBDC.”

"You could have a potentially […] darker world where the government decides that [CBDC] can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort": Eswar Prasad, WEF #AMNC23 pic.twitter.com/KkWgaEWAR5

— Tim Hinchliffe (@TimHinchliffe) June 28, 2023

Last year at the WEF’s 14th Annual Meeting of the New Champions, aka “Summer Davos,” in Tianjing, China, Cornell University professor Eswar Prasad said that “we are at the cusp of physical currency essentially disappearing,” and that programmable CBDCs could take us to either a better or much darker place.

“If you think about the benefits of digital money, there are huge potential gains,” said Prasad, adding, “It’s not just about digital forms of digital currency; you can have programmability – units of central bank currency with expiry dates.

You could have […] a potentially better – or some people might say a darker world – where the government decides that units of central bank money can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort, and that is very powerful in terms of the use of a CBDC, and I think also extremely dangerous to central banks.

The WEF’s Special Meeting on Global Collaboration, Growth and Energy Development took place from April 27-29 in Riyadh, Saudi Arabia.

“Saudi Arabia’s absolute monarchy restricts almost all political rights and civil liberties,” according to D.C.-based NGO Freedom House.

In the kingdom, “No officials at the national level are elected,” and “the regime relies on pervasive surveillance, the criminalization of dissent, appeals to sectarianism and ethnicity, and public spending supported by oil revenues to maintain power.”

Reprinted with permission from The Sociable.

-

Alberta1 day ago

Alberta1 day agoGame changer: Trans Mountain pipeline expansion complete and starting to flow Canada’s oil to the world

-

Addictions1 day ago

Addictions1 day agoCanada’s ‘safer supply’ patients are receiving staggering amounts of narcotics

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoBook Burning Goes Digital

-

conflict22 hours ago

conflict22 hours agoImmigration Experts Warn Possible Biden Plan To Import Gazan Refugees Would Be ‘National Security Disaster’

-

illegal immigration17 hours ago

illegal immigration17 hours agoPanama Elects President Vowing Shutdown Of Key Routes To US Used By Over Half A Million Migrants

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoThe Predictable Wastes of Covid Relief

-

Bruce Dowbiggin23 hours ago

Bruce Dowbiggin23 hours agoDo It Once, Shame On You; Do It Twice, Shame On Me

-

Great Reset18 hours ago

Great Reset18 hours agoAll 49 GOP senators call on Biden admin to withdraw support for WHO pandemic treaty