Fraser Institute

Powerful players count on corruption of ideal carbon tax

From the Fraser Institute

Prime Minister Trudeau recently whipped out the big guns of rhetoric and said the premiers of Alberta, Nova Scotia, New Brunswick, Newfoundland and Labrador, Ontario, Prince Edward Island and Saskatchewan are “misleading” Canadians and “not telling the truth” about the carbon tax. Also recently, a group of economists circulated a one-sided open letter extolling the virtues of carbon pricing.

Not to be left out, a few of us at the Fraser Institute recently debated whether the carbon tax should or could be reformed. Ross McKitrick and Elmira Aliakbari argued that while the existing carbon tax regime is badly marred by numerous greenhouse gas (GHG) regulations and mandates, is incompletely revenue-neutral, lacks uniformity across the economy and society, is set at an arbitrary price and so on, it remains repairable. “Of all the options,” they write, “it is widely acknowledged that a carbon tax allows the most flexibility and cost-effectiveness in the pursuit of society’s climate goals. The federal government has an opportunity to fix the shortcomings of its carbon tax plan and mitigate some of its associated economic costs.”

I argued, by contrast, that due to various incentives, Canada’s relevant decision-makers (politicians, regulators and big business) would all resist any reforms to the carbon tax that might bring it into the “ideal form” taught in schools of economics. To these groups, corruption of the “ideal carbon tax” is not a bug, it’s a feature.

Thus, governments face the constant allure of diverting tax revenues to favour one constituency over another. In the case of the carbon tax, Quebec is the big winner here. Atlantic Canada was also recently won by having its home heating oil exempted from carbon pricing (while out in the frosty plains, those using natural gas heating will feel the tax’s pinch).

Regulators, well, they live or die by the maintenance and growth of regulation. And when it comes to climate change, as McKitrick recently observed in a separate commentary, we’re not talking about only a few regulations. Canada has “clean fuel regulations, the oil-and-gas-sector emissions cap, the electricity sector coal phase-out, strict energy efficiency rules for new and existing buildings, new performance mandates for natural gas-fired generation plants, the regulatory blockade against liquified natural gas export facilities” and many more. All of these, he noted, are “boulders” blocking the implementation of an ideal carbon tax.

Finally, big business (such as Stellantis-LG, Volkswagen, Ford, Northvolt and others), which have been the recipients of subsidies for GHG-reducing activities, don’t want to see the driver of those subsidies (GHG regulations) repealed. And that’s only in the electric vehicle space. Governments also heavily subsidize wind and solar power businesses who get a 30 per cent investment tax credit though 2034. They also don’t want to see the underlying regulatory structures that justify the tax credit go away.

Clearly, all governments that tax GHG emissions divert some or all of the revenues raised into their general budgets, and none have removed regulations (or even reduced the rate of regulation) after implementing carbon-pricing. Yet many economists cling to the idea that carbon taxes are either fine as they are or can be reformed with modest tweaks. This is the great carbon-pricing will o’ the wisp, leading Canadian climate policy into a perilous swamp.

Author:

Fraser Institute

Long waits for health care hit Canadians in their pocketbooks

From the Fraser Institute

Canadians continue to endure long wait times for health care. And while waiting for care can obviously be detrimental to your health and wellbeing, it can also hurt your pocketbook.

In 2024, the latest year of available data, the median wait—from referral by a family doctor to treatment by a specialist—was 30 weeks (including 15 weeks waiting for treatment after seeing a specialist). And last year, an estimated 1.5 million Canadians were waiting for care.

It’s no wonder Canadians are frustrated with the current state of health care.

Again, long waits for care adversely impact patients in many different ways including physical pain, psychological distress and worsened treatment outcomes as lengthy waits can make the treatment of some problems more difficult. There’s also a less-talked about consequence—the impact of health-care waits on the ability of patients to participate in day-to-day life, work and earn a living.

According to a recent study published by the Fraser Institute, wait times for non-emergency surgery cost Canadian patients $5.2 billion in lost wages in 2024. That’s about $3,300 for each of the 1.5 million patients waiting for care. Crucially, this estimate only considers time at work. After also accounting for free time outside of work, the cost increases to $15.9 billion or more than $10,200 per person.

Of course, some advocates of the health-care status quo argue that long waits for care remain a necessary trade-off to ensure all Canadians receive universal health-care coverage. But the experience of many high-income countries with universal health care shows the opposite.

Despite Canada ranking among the highest spenders (4th of 31 countries) on health care (as a percentage of its economy) among other developed countries with universal health care, we consistently rank among the bottom for the number of doctors, hospital beds, MRIs and CT scanners. Canada also has one of the worst records on access to timely health care.

So what do these other countries do differently than Canada? In short, they embrace the private sector as a partner in providing universal care.

Australia, for instance, spends less on health care (again, as a percentage of its economy) than Canada, yet the percentage of patients in Australia (33.1 per cent) who report waiting more than two months for non-emergency surgery was much higher in Canada (58.3 per cent). Unlike in Canada, Australian patients can choose to receive non-emergency surgery in either a private or public hospital. In 2021/22, 58.6 per cent of non-emergency surgeries in Australia were performed in private hospitals.

But we don’t need to look abroad for evidence that the private sector can help reduce wait times by delivering publicly-funded care. From 2010 to 2014, the Saskatchewan government, among other policies, contracted out publicly-funded surgeries to private clinics and lowered the province’s median wait time from one of the longest in the country (26.5 weeks in 2010) to one of the shortest (14.2 weeks in 2014). The initiative also reduced the average cost of procedures by 26 per cent.

Canadians are waiting longer than ever for health care, and the economic costs of these waits have never been higher. Until policymakers have the courage to enact genuine reform, based in part on more successful universal health-care systems, this status quo will continue to cost Canadian patients.

Business

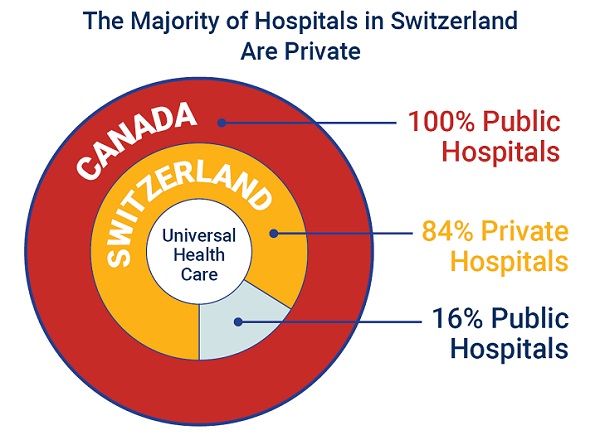

84% of Swiss hospitals and 60% of hospitalizations are in private facilities, and they face much lower wait times

From the Fraser Institute

If Canada reformed to emulate Switzerland’s approach to universal health care, including its much greater use of private sector involvement, the country would deliver far better results to patients and reduce wait times, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian policy think-tank.

“The bane of Canadian health care is lack of access to timely care, so it’s critical to look to countries like Switzerland with more successful universal health care,” said Yanick Labrie, senior fellow at the Fraser Institute and author of Integrating Private Health Care Into Canada’s Public System: What We Can Learn from Switzerland. The study highlights how Switzerland successfully integrates the private sector into their universal health-care system, which consistently outperforms Canada on most health-care metrics, including wait times.

For example, in 2022, the percentage of patients who waited less than two months for a specialist appointment was 85.3 per cent in Switzerland compared to just 48.3 per cent in Canada.

In Switzerland, 84.2 per cent of all hospitals are private (either for-profit or not-for profit) institutions, and the country’s private hospitals provide 60.2 per cent of all hospitalizations, 60.9 per cent of all births, and 67.1 per cent of all operating rooms.

Crucially, Swiss patients can obtain treatment at the hospital of their choice, whether located inside or outside their geographic location, and hospitals cannot discriminate against patients, based on the care required.

“Switzerland shows that a universal health-care system can reconcile efficiency and equity–all while being more accessible and responsive to patients’ needs and preferences,” Labrie said.

“Based on the success of the Swiss model, provinces can make these reforms now and help improve Canadian health care.”

Integrating Private Health Care into Canada’s Public System: What We Can Learn from Switzerland

- Access to timely care remains the Achilles’ heel of Canada’s health systems. To reduce wait times, some provinces have partnered with private clinics for publicly funded surgeries—a strategy that has proven effective, but continues to spark debate in Canada.

- This study explores how Switzerland successfully integrates private health care into a universal public system and considers what Canada can learn from this model.

- In Switzerland, universal coverage is delivered through a system of managed competition among 44 non-profit private insurers, while decentralized governance allows each of the 26 cantons to coordinate and oversee hospital services in ways that reflect local needs and priorities.

- Nearly two-thirds of Swiss hospitals are for-profit institutions; they provide roughly half of all hospitalizations, births, and hospital beds across the country.

- All hospitals are treated equally—regardless of legal status—and funded through the same activity-based model, implemented nationwide in 2012.

- The reform led to a significant increase in the number of cases treated without a corresponding rise in expenditures per case, suggesting improved efficiency, better use of resources, and expanded access to hospital care.

- The average length of hospital stay steadily decreased over time and now stands at 4.87 days in for-profit hospitals versus 5.53 days in public ones, indicating faster patient turnover and more streamlined care pathways.

- Hospital-acquired infection rates are significantly lower in private hospitals (2.7%) than in public hospitals (6.2%), a key indicator of care quality.

- Case-mix severity is as high or higher in private hospitals, countering the notion that they only take on simpler or less risky cases.

- Patient satisfaction is slightly higher in private hospitals (4.28/5) than in public ones (4.17/5), reflecting strong user experience across multiple dimensions.

- Canada could benefit from regulated competition between public and private providers and activity-based funding, without breaching the Canada Health Act.

-

conflict2 days ago

conflict2 days agoOne dead, over 60 injured after Iranian missiles pierce Iron Dome

-

Crime19 hours ago

Crime19 hours agoManhunt on for suspect in shooting deaths of Minnesota House speaker, husband

-

Business8 hours ago

Business8 hours agoCarney’s European pivot could quietly reshape Canada’s sovereignty

-

Alberta8 hours ago

Alberta8 hours agoAlberta’s grand bargain with Canada includes a new pipeline to Prince Rupert