Alberta

Pot Meet Kettle – Group points out hypocrisy in opposition to Smith’s Alberta Sovereignty Act

News release from Free Alberta Strategy

Earlier this week, the UCP leadership candidates running to be Premier participated in their final debate before voting gets underway.

Once again, our Free Alberta Strategy and our Alberta Sovereignty Act were featured heavily, but this time something else caught our eye too.

Throughout the campaign, some of the harshest critics of the Alberta Sovereignty Act have been candidates Travis Toews and Rebecca Schulz, who say that it’s “nuts” for Alberta to do anything that might be unconstitutional, and that such actions would create economic “chaos.”

But, as was revealed during the debate, apparently both candidates actually have no problem doing unconstitutional things…

Travis Toews has, right in his campaign platform, a plan to impose tariffs on goods and services from parts of Canada “deemed hostile to Alberta”.

That’s a clearly unconstitutional proposal, that would certainly cause economic “chaos”, and yet Toews seems perfectly fine with that when it’s *his* idea.

Schulz, meanwhile, is proposing to use the “turn off the taps” legislation to punish other Provinces.

Again, this is clearly unconstitutional, and certain to cause economic “chaos”, and yet Schulz is fine with that as long as it’s *her* idea.

Both of these policies would be a direct violation of section 121 of the Constitution, which states:

“All Articles of the Growth, Produce, or Manufacture of any one of the Provinces shall, from and after the Union, be admitted free into each of the other Provinces.”

This means that arbitrarily setting tariffs on goods from hostile regions, whether justified or not, is clearly a contravention of the constitution.

Now, this isn’t to say that neither Toews nor Schulz are wrong to make these suggestions – it’s vital for Alberta to stand up for itself, and these policies may well help us do so!

But isn’t it interesting that they’re in favour of unconstitutional “chaos-creating” ideas, as long as they’re the ones proposing them?

It’s almost as if it’s more about politics than about implementing the best policies to protect Alberta’s interests.

The Sovereignty Act is a tool to be used to keep the federal government in its lane.

It forms just one piece of our detailed, well-thought-through Free Alberta Strategy, which all works together to help promote Alberta’s interests.

It isn’t a solitary line in a campaign platform, or a talking point to be used at a debate.

It’s a full, 48-page, detailed report that proposes a series of initiatives the Alberta government could implement today, without needing any permission from Ottawa, to make Alberta a sovereign jurisdiction within Canada.

If you want to learn more, and help us advance Alberta’s interests, you can do so by:

- Reading the full, detailed Free Alberta Strategy here.

- Signing, and getting your family and friends to sign, our petition.

- Helping us promote and advance the cause by making a donation.

Thanks for your support, as we continue to develop and promote details solutions to the challenges facing Alberta.

Regards,

The Free Alberta Strategy Team

Alberta

Premier Smith: Canadians support agreement between Alberta and Ottawa and the major economic opportunities it could unlock for the benefit of all

From Energy Now

By Premier Danielle Smith

Get the Latest Canadian Focused Energy News Delivered to You! It’s FREE: Quick Sign-Up Here

If Canada wants to lead global energy security efforts, build out sovereign AI infrastructure, increase funding to social programs and national defence and expand trade to new markets, we must unleash the full potential of our vast natural resources and embrace our role as a global energy superpower.

The Alberta-Ottawa Energy agreement is the first step in accomplishing all of these critical objectives.

Recent polling shows that a majority of Canadians are supportive of this agreement and the major economic opportunities it could unlock for the benefit of all Canadians.

As a nation we must embrace two important realities: First, global demand for oil is increasing and second, Canada needs to generate more revenue to address its fiscal challenges.

Nations around the world — including Korea, Japan, India, Taiwan and China in Asia as well as various European nations — continue to ask for Canadian energy. We are perfectly positioned to meet those needs and lead global energy security efforts.

Our heavy oil is not only abundant, it’s responsibly developed, geopolitically stable and backed by decades of proven supply.

If we want to pay down our debt, increase funding to social programs and meet our NATO defence spending commitments, then we need to generate more revenue. And the best way to do so is to leverage our vast natural resources.

At today’s prices, Alberta’s proven oil and gas reserves represent trillions in value.

It’s not just a number; it’s a generational opportunity for Alberta and Canada to secure prosperity and invest in the future of our communities. But to unlock the full potential of this resource, we need the infrastructure to match our ambition.

There is one nation-building project that stands above all others in its ability to deliver economic benefits to Canada — a new bitumen pipeline to Asian markets.

The energy agreement signed on Nov. 27 includes a clear path to the construction of a one-million-plus barrel-per-day bitumen pipeline, with Indigenous co-ownership, that can ensure our province and country are no longer dependent on just one customer to buy our most valuable resource.

Indigenous co-ownership also provide millions in revenue to communities along the route of the project to the northwest coast, contributing toward long-lasting prosperity for their people.

The agreement also recognizes that we can increase oil and gas production while reducing our emissions.

The removal of the oil and gas emissions cap will allow our energy producers to grow and thrive again and the suspension of the federal net-zero power regulations in Alberta will open to doors to major AI data-centre investment.

It also means that Alberta will be a world leader in the development and implementation of emissions-reduction infrastructure — particularly in carbon capture utilization and storage.

The agreement will see Alberta work together with our federal partners and the Pathways companies to commence and complete the world’s largest carbon capture, utilization and storage infrastructure project.

This would make Alberta heavy oil the lowest intensity barrel on the market and displace millions of barrels of heavier-emitting fuels around the globe.

We’re sending a clear message to investors across the world: Alberta and Canada are leaders, not just in oil and gas, but in the innovation and technologies that are cutting per barrel emissions even as we ramp up production.

Where we are going — and where we intend to go with more frequency — is east, west, north and south, across oceans and around the globe. We have the energy other countries need, and will continue to need, for decades to come.

However, this agreement is just the first step in this journey. There is much hard work ahead of us. Trust must be built and earned in this partnership as we move through the next steps of this process.

But it’s very encouraging that Prime Minister Mark Carney has made it clear he is willing to work with Alberta’s government to accomplish our shared goal of making Canada an energy superpower.

That is something we have not seen from a Canadian prime minister in more than a decade.

Together, in good faith, Alberta and Ottawa have taken the first step towards making Canada a global energy superpower for benefit of all Canadians.

Danielle Smith is the Premier of Alberta

Alberta

A Memorandum of Understanding that no Canadian can understand

From the Fraser Institute

The federal and Alberta governments recently released their much-anticipated Memorandum of Understanding (MOU) outlining what it will take to build a pipeline from Alberta, through British Columbia, to tidewater to get more of our oil to markets beyond the United States.

This was great news, according to most in the media: “Ottawa-Alberta deal clears hurdles for West Coast pipeline,” was the top headline on the Globe and Mail’s website, “Carney inks new energy deal with Alberta, paving way to new pipeline” according to the National Post.

And the reaction from the political class? Well, former federal environment minister Steven Guilbeault resigned from Prime Minister Carney’s cabinet, perhaps positively indicating that this agreement might actually produce a new pipeline. Jason Kenney, a former Alberta premier and Harper government cabinet minister, congratulated Prime Minister Carney and Premier Smith on an “historic agreement.” Even Alberta NDP Leader Naheed Nenshi called the MOU “a positive step for our energy future.”

Finally, as Prime Minister Carney promised, Canada might build critical infrastructure “at a speed and scale not seen in generations.”

Given this seemingly great news, I eagerly read the six-page Memorandum of Understanding. Then I read it again and again. Each time, my enthusiasm and understanding diminished rapidly. By the fourth reading, the only objective conclusion I could reach was not that a pipeline would finally be built, but rather that only governments could write an MOU that no Canadian could understand.

The MOU is utterly incoherent. Go ahead, read it for yourself online. It’s only six pages. Here are a few examples.

The agreement states that, “Canada and Alberta agree that the approval, commencement and continued construction of the bitumen pipeline is a prerequisite to the Pathways project.” Then on the next line, “Canada and Alberta agree that the Pathways Project is also a prerequisite to the approval, commencement and continued construction of the bitumen pipeline.”

Two things, of course, cannot logically be prerequisites for each other.

But worry not, under the MOU, Alberta and Ottawa will appoint an “Implementation Committee” to deliver “outcomes” (this is from a federal government that just created the “Major Project Office” to get major projects approved and constructed) including “Determining the means by which Alberta can submit its pipeline application to the Major Projects Office on or before July 1, 2026.”

What does “Determining the means” even mean?

What’s worse is that under the MOU, the application for this pipeline project must be “ready to submit to the Major Projects Office on or before July 1, 2026.” Then it could be another two years (or until 2028) before Ottawa approves the pipeline project. But the MOU states the Pathways Project is to be built in stages, starting in 2027. And that takes us back to the circular reasoning of the prerequisites noted above.

Other conditions needed to move forward include:

The private sector must construct and finance the pipeline. Serious question: which private-sector firm would take this risk? And does the Alberta government plan to indemnify the company against these risks?

Indigenous Peoples must co-own the pipeline project.

Alberta must collaborate with B.C. to ensure British Columbians get a cut or “share substantial economic and financial benefits of the proposed pipeline” in MOU speak.

None of this, of course, addresses the major issue in our country—that is, investors lack clarity on timelines and certainty about project approvals. The Carney government established the Major Project Office to fast-track project approvals and provide greater certainty. Of the 11 project “winners” the federal government has already picked, most either already had approvals or are already at an advanced stage in the process. And one of the most important nation-building projects—a pipeline to get our oil to tidewater—hasn’t even been referred to the Major Project Office.

What message does all this send to the investment community? Have we made it easier to get projects approved? No. Have we made things clearer? No. Business investment in Canada has fallen off a cliff and is down 25 per cent per worker since 2014. We’ve seen a massive outflow of capital from the country, more than $388 billion since 2014.

To change this, Canada needs clear rules and certain timelines for project approvals. Not an opaque Memorandum of Understanding.

-

Focal Points1 day ago

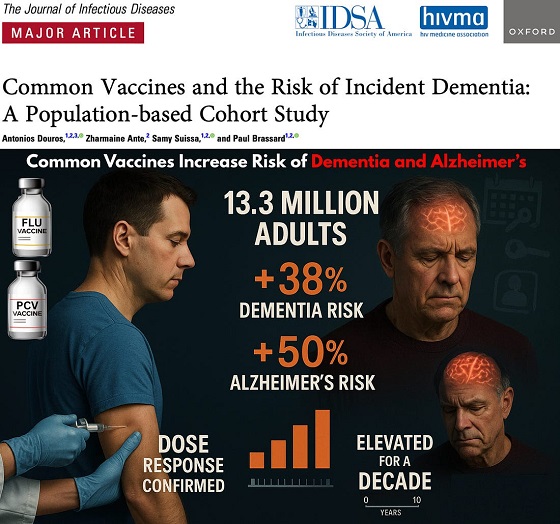

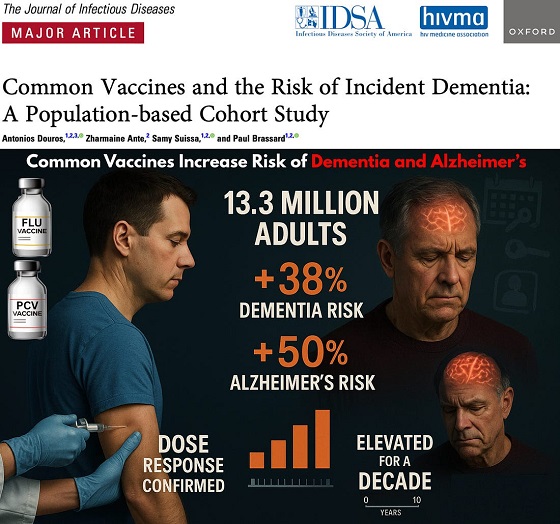

Focal Points1 day agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

Business2 days ago

Business2 days agoLoblaws Owes Canadians Up to $500 Million in “Secret” Bread Cash

-

Business22 hours ago

Business22 hours agoThe EU Insists Its X Fine Isn’t About Censorship. Here’s Why It Is.

-

Dan McTeague2 days ago

Dan McTeague2 days agoWill this deal actually build a pipeline in Canada?

-

Economy18 hours ago

Economy18 hours agoAffordable housing out of reach everywhere in Canada

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoUS Condemns EU Censorship Pressure, Defends X

-

Banks2 days ago

Banks2 days agoTo increase competition in Canadian banking, mandate and mindset of bank regulators must change

-

Business11 hours ago

Business11 hours agoThe Climate-Risk Industrial Complex and the Manufactured Insurance Crisis