Alberta

Police seize more than 66 kg of illicit drugs in interprovincial trafficking investigation

News release from the Edmonton Police Service

The Edmonton Police Service (EPS) has seized more than 66 kilograms of methamphetamine, cocaine, fentanyl and heroin in a large-scale drug investigation in central Edmonton.

In December 2023, members of the Edmonton Drug and Gang Enforcement Section (EDGE) initiated an inter-provincial drug trafficking investigation.

During the investigation, three male suspects were noted to be involved in various aspects of inter-provincial drug trafficking, including transporting drugs into and out of Alberta, as well as distributing them throughout Edmonton, including the inner-city community. A storage location for the drugs was located in a central Edmonton high rise apartment.

On May 9, 2024, police executed search warrants at three residences and four vehicles. As a result of the search warrants, EDGE members seized:

- 55.7 kg of methamphetamine, worth approximately $250,650

- 8.7 kg of cocaine, worth approximately $696,000

- 2.5 kg of fentanyl, worth approximately $300,000

- 83.5 grams of heroin, worth approximately $28,400

- 20 kg of buffing agent

- Five handguns, three of which were loaded at the time of seizure and two of which had defaced serial numbers. Two were also reported stolen in Saskatchewan and Alberta, and one originated from the U.S.

- Four vehicles with hidden compartments

- Approximately $20,000 in various currency

Drugs and firearms located in one of EPS’ largest-ever drug seizures

“This investigation is believed to be one of the largest, if not the largest, seizure of controlled substances in EPS history,” says Staff Sergeant David Paton, with the Edmonton Drug and Gang Enforcement (EDGE) Section. “Intercepting this huge volume of extremely harmful street drugs before they wreak havoc in our city is a rewarding outcome for our investigators, who have worked tirelessly for months on this operation.”

Jesse Koble, 29, is facing 27 charges, Mitchell Steeg, 31, is charged with nine offences, and Steven Santillana, 34 is charged with two offences, for a total of 38 drug and firearms-related criminal charges.

The EPS takes a strategic approach to drug and organized crime related violence through its Guns and Gangs Strategy. This plan considers the unique factors driving serious crime in the city, identifying key focus areas that require increased and sustained effort to reduce victimization and improve community safety.

The strategy leverages EPS’ internal expertise and external partnerships with other enforcement and social agencies to strike a balance between education, suppression, intervention, and prevention. It encompasses immediate and long-term solutions that both hold those perpetrating violence accountable and lead willing individuals away from gang association.

Alberta

Alberta’s licence plate vote is down to four

|

It’s time to vote again.

After Albertans had their say in the first round, the eight original licence plate designs are down to the final four. Danielle Smith has been clear that this choice will be up to Albertans.

So now it’s your turn to help pick which designs move to the final round.

|

|

|

Don’t wait. Cast your vote now and help decide what Alberta’s new licence plate will look like.

– Your United Conservative Team

P.S. Every licence plate on the road is a rolling billboard for Alberta. Your vote helps decide what that billboard looks like. Vote here. |

Alberta

Calgary’s High Property Taxes Run Counter to the ‘Alberta Advantage’

By David Hunt and Jeff Park

Of major cities, none compare to Calgary’s nearly 50 percent property tax burden increase between censuses.

Alberta once again leads the country in taking in more new residents than it loses to other provinces and territories. But if Canadians move to Calgary seeking greater affordability, are they in for a nasty surprise?

In light of declining home values and falling household incomes amidst rising property taxes, Calgary’s overall property tax burden has skyrocketed 47 percent between the last two national censuses, according to a new study by the Aristotle Foundation for Public Policy.

Between 2016 and 2021 (the latest year of available data), Calgary’s property tax burden increased about twice as fast as second-place Saskatoon and three-and-a-half times faster than Vancouver.

The average Calgary homeowner paid $3,496 in property taxes at the last census, compared to $2,736 five years prior (using constant 2020 dollars; i.e., adjusting for inflation). By contrast, the average Edmonton homeowner paid $2,600 in 2021 compared to $2,384 in 2016 (in constant dollars). In other words, Calgary’s annual property tax bill rose three-and-a-half times more than Edmonton’s.

This is because Edmonton’s effective property tax rate remained relatively flat, while Calgary’s rose steeply. The effective rate is property tax as a share of the market value of a home. For Edmontonians, it rose from 0.56 percent to 0.62 percent—after rounding, a steady 0.6 percent across the two most recent censuses. For Calgarians? Falling home prices collided with rising taxes so that property taxes as a share of (market) home value rose from below 0.5 percent to nearly 0.7 percent.

Plug into the equation sliding household incomes, and we see that Calgary’s property tax burden ballooned nearly 50 percent between censuses.

This matters for at least three reasons. First, property tax is an essential source of revenue for municipalities across Canada. City councils set their property tax rate and the payments made by homeowners are the backbone of municipal finances.

Property taxes are also an essential source of revenue for schools. The province has historically required municipalities to directly transfer 33 percent of the total education budget via property taxes, but in the period under consideration that proportion fell (ultimately, to 28 percent).

Second, a home purchase is the largest expense most Canadians will ever make. Local taxes play a major role in how affordable life is from one city to another. When municipalities unexpectedly raise property taxes, it can push homeownership out of reach for many families. Thus, homeoowners (or prospective homeowners) naturally consider property tax rates and other local costs when choosing where to live and what home to buy.

And third, municipalities can fall into a vicious spiral if they’re not careful. When incomes decline and residential property values fall, as Calgary experienced during the period we studied, municipalities must either trim their budgets or increase property taxes. For many governments, it’s easier to raise taxes than cut spending.

But rising property tax burdens could lead to the city becoming a less desirable place to live. This could mean weaker residential property values, weaker population growth, and weaker growth in the number of residential properties. The municipality then again faces the choice of trimming budgets or raising taxes. And on and on it goes.

Cities fall into these downward spirals because they fall victim to a central planner’s bias. While $853 million for a new arena for the Calgary Flames or $11 million for Calgary Economic Development—how City Hall prefers to attract new business to Calgary—invite ribbon-cuttings, it’s the decisions about Calgary’s half a million private dwellings that really drive the city’s finances.

Yet, a virtuous spiral remains in reach. Municipalities tend to see the advantage of “affordable housing” when it’s centrally planned and taxpayer-funded but miss the easiest way to generate more affordable housing: simply charge city residents less—in taxes—for their housing.

When you reduce property taxes, you make housing more affordable to more people and make the city a more desirable place to live. This could mean stronger residential property values, stronger population growth, and stronger growth in the number of residential properties. Then, the municipality again faces a choice of making the city even more attractive by increasing services or further cutting taxes. And on and on it goes.

The economy is not a series of levers in the mayor’s office; it’s all of the million individual decisions that all of us, collectively, make. Calgary city council should reduce property taxes and leave more money for people to make the big decisions in life.

Jeff Park is a visiting fellow with the Aristotle Foundation for Public Policy and father of four who left Calgary for better affordability. David Hunt is the research director at the Calgary-based Aristotle Foundation for Public Policy. They are co-authors of the new study, Taxing our way to unaffordable housing: A brief comparison of municipal property taxes.

-

Automotive2 days ago

Automotive2 days agoParliament Forces Liberals to Release Stellantis Contracts After $15-Billion Gamble Blows Up In Taxpayer Faces

-

National2 days ago

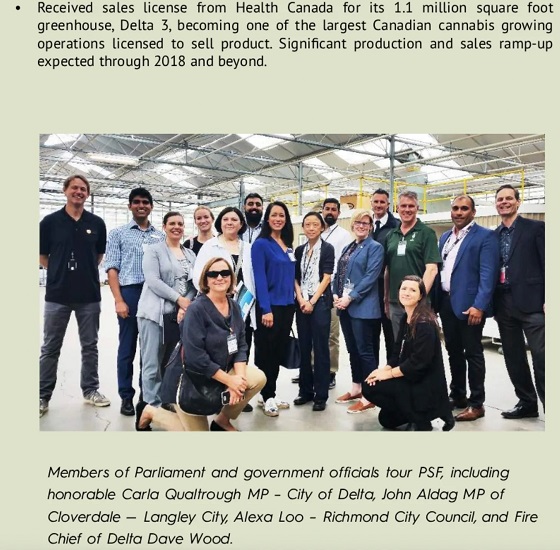

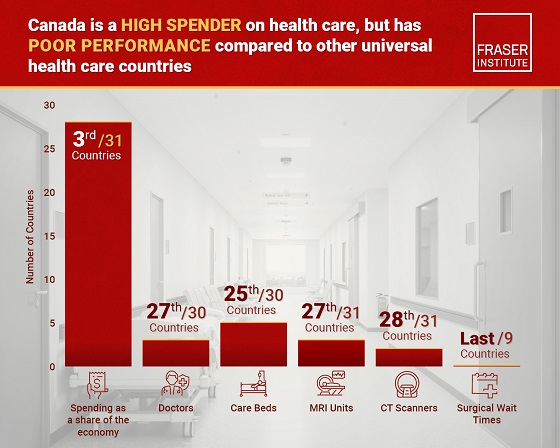

National2 days agoPolitically Connected Canadian Weed Sellers Push Back in B.C. Court, Seek Distance from Convicted Heroin Trafficker

-

Alberta2 days ago

Alberta2 days agoPetition threatens independent school funding in Alberta

-

Courageous Discourse2 days ago

Courageous Discourse2 days agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears

-

Business2 days ago

Business2 days agoQuebecers want feds to focus on illegal gun smuggling not gun confiscation

-

Business2 days ago

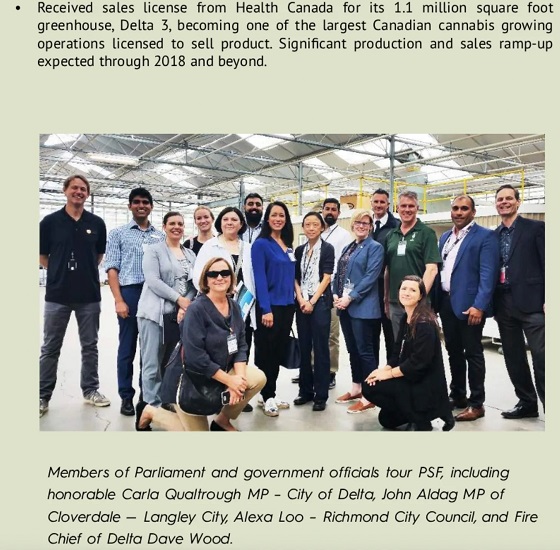

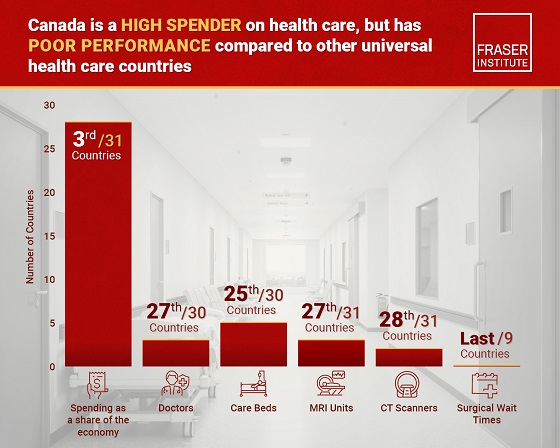

Business2 days agoCanada has fewer doctors, hospital beds, MRI machines—and longer wait times—than most other countries with universal health care

-

MAiD1 day ago

MAiD1 day agoDisabled Canadians increasingly under pressure to opt for euthanasia during routine doctor visits

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoWho tries to silence free speech? Apparently who ever is in power.