Business

Ottawa has spent nearly $18 billion settling Indigenous ‘specific claims’ since 2015

From the Fraser Institute

By Tom Flanagan

Since 2015, the federal government has paid nearly $18 billion settling an increasing number of ‘specific claims’ by First Nations, including more than $7 billion last year alone, finds a new study released today by the Fraser Institute, an independent, non-partisan Canadian public policy think tank.

“Specific claims are for past treaty breaches, and as such, their number should be finite. But instead of declining over time, the number of claims keeps growing as lucrative settlements are reached, which in turn prompts even more claims,” said Tom Flanagan, Fraser Institute senior fellow, professor emeritus of political science at the University of Calgary and author of Specific Claims—an Out-of-Control Program.

The study reveals details about “specific claims,” which began in 1974 and are filed by First Nations who claim that Canadian governments—past or present—violated the Indian Act or historic treaty agreements, such as when governments purchased reserve land for railway lines or hydro projects. Most “specific claims” date back 100 years or more. Specific claims are contrasted with comprehensive claims, which arise from the absence of a treaty.

Crucially, the number of specific claims and the value of the settlement paid out have increased dramatically since 2015.

In 2015/16, 11 ‘specific claims’ were filed with the federal government, and the total value of the settlements was $27 million (in 2024 dollars, to adjust for inflation). The number of claims increased virtually every year since so that by 2024/25, 69 ‘specific claims’ were filed, and the value of the settlements in 2024/25 was $7.061 billion. All told, from 2015/16 to 2024/25, the value of all ‘specific claims’ settlements was $17.9 billion (inflation adjusted).

“First Nations have had 50 years to study their history, looking for violations of treaty and legislation. That is more than enough time for the discovery of legitimate grievances,” Flanagan said.

“Ottawa should set a deadline for filing specific claims so that the government and First Nations leaders can focus instead on programs that would do more to improve the living standards and prosperity for both current and future Indigenous peoples.”

Specific Claims: An Out-of-Control Program

- Specific claims are based on the government’s alleged failure to abide by provisions of the Indian Act or a treaty.

- The federal government began to entertain such claims in 1974. The number and value of claims increased gradually until 2017, when both started to rise at an extraordinary rate.

- In fiscal year 2024/25, the government settled 69 claims for an astonishing total of $7.1 billion dollars.

- The evidence suggests at least two causes for this sudden acceleration. One was the new approach of Justin Trudeau’s Liberal government toward settling Indigenous claims, an approach adopted in 2015 and formalized by Minister of Justice Jodi Wilson-Raybould’s 2019 practice directive. Under the new policy, the Department of Justice was instructed to negotiate rather than litigate claims.

- Another factor was the recognition, beginning around 2017, of “cows and plows” claims based on the allegation that agricultural assistance promised in early treaties—seed grain, cattle, agricultural implements—never arrived or was of poor quality.

- The specific-claims process should be terminated. Fifty years is long enough to discover legitimate grievances.

- The government should announce a short but reasonable period, say three years, for new claims to be submitted. Claims that have already been submitted should be processed, but with more rigorous instructions to the Department of Justice for legal scrutiny.

- The government should also require more transparency about what happens to these settlements. At present, much of the revenue paid out disappears into First Nations’ “settlement trusts”, for which there is no public disclosure.

Automotive

Supreme Court Delivers Blow To California EV Mandates

From the Daily Caller News Foundation

“The Supreme Court put to rest any question about whether fuel manufacturers have a right to challenge unlawful electric vehicle mandates”

The Supreme Court sided Friday with oil companies seeking to challenge California’s electric vehicle regulations.

In a 7-2 ruling, the court allowed energy producers to continue their lawsuit challenging the Environmental Protection Agency’s decision to approve California regulations that require manufacturing more electric vehicles.

“The government generally may not target a business or industry through stringent and allegedly unlawful regulation, and then evade the resulting lawsuits by claiming that the targets of its regulation should be locked out of court as unaffected bystanders,” Justice Brett Kavanaugh wrote in the majority opinion. “In light of this Court’s precedents and the evidence before the Court of Appeals, the fuel producers established Article III standing to challenge EPA’s approval of the California regulations.”

Kavanaugh noted that “EPA has repeatedly altered its legal position on whether the Clean Air Act authorizes California regulations targeting greenhouse-gas emissions from new motor vehicles” between Presidential administrations.

“This case involves California’s 2012 request for EPA approval of new California regulations,” he wrote. “As relevant here, those regulations generally require automakers (i) to limit average greenhouse-gas emissions across their fleets of new motor vehicles sold in the State and (ii) to manufacture a certain percentage of electric vehicles as part of their vehicle fleets.”

The D.C. Circuit Court of Appeals previously rejected the challenge, finding the producers lacked standing to sue.

“The Supreme Court put to rest any question about whether fuel manufacturers have a right to challenge unlawful electric vehicle mandates,” American Fuel & Petrochemical Manufacturers (AFPM) President and CEO Chet Thompson said in a statement.

“California’s EV mandates are unlawful and bad for our country,” he said. “Congress did not give California special authority to regulate greenhouse gases, mandate electric vehicles or ban new gas car sales—all of which the state has attempted to do through its intentional misreading of statute.”

Business

Senator wants to torpedo Canada’s oil and gas industry

From the Fraser Institute

Recently, without much fanfare, Senator Rosa Galvez re-pitched a piece of legislation that died on the vine when former prime minister Justin Trudeau prorogued Parliament in January. Her “Climate-Aligned Finance Act” (CAFA), which would basically bring a form of BDS (Boycott, Divestment, and Sanctions) to Canada’s oil and gas sector, would much better be left in its current legislative oblivion.

CAFA would essentially treat Canada’s oil and gas sector like an enemy of the state—a state, in Senator Galvez’ view, where all values are subordinate to greenhouse gas emission control. Think I’m kidding? Per CAFA, alignment with national climate commitments means that everyone engaged in federal investment in “emission intensive activities [read, the entire oil and gas sector] must give precedence to that duty over all other duties and obligations of office, and, for that purpose, ensuring the entity is in alignment with climate commitments is deemed to be a superseding matter of public interest.”

In plain English, CAFA would require anyone involved in federal financing (or federally-regulated financing) of the oil and gas sector to divest their Canadian federal investments in the oil and gas sector. And the government would sanction those who argue against it.

There’s another disturbing component to CAFA—in short, it stacks investment decision-making boards. CAFA requires at least one board member of every federally-regulated financial institution to have “climate expertise.” How is “climate expertise” defined? CAFA says it includes people with experience in climate science, social science, Indgineuous “ways of knowing,” and people who have “acute lived experience related to the physical or economic damages of climate change.” (Stacking advisory boards like this, by the way, is a great way to build public distrust in governmental advisory boards, which, in our post-COVID world, is probably not all that high. Might want to rethink this, senator.)

Clearly, Senator Galvez’ CAFA is draconian public policy dressed up in drab finance-speak camouflage. But here’s what it would do. By making federal investment off-limits to oil and gas companies, it would quickly put negative pressure on investment from both national and international investors, effectively starving the sector for capital. After all, if a company’s activities are anathema to its own federal regulators or investment organs, and are statutorily prohibited from even verbally defending such investments, who in their right minds would want to invest?

And that is the BDS of CAFA. In so many words, it calls on the Canadian federal government to boycott, divest from, and sanction Canada’s oil and gas sector—which powers our country, produces a huge share of our exports, and employs people from coast to coast. Senator Galvez would like to see her Climate-Aligned Finance Act (CAFA) resurrected by the Carney government, whose energy policy to-date has been less than crystal clear. But for the sake of Canadians, it should stay dead.

-

Daily Caller1 day ago

Daily Caller1 day agoUnanimous Supreme Court Ruling Inspires Hope For Future Energy Project Permitting

-

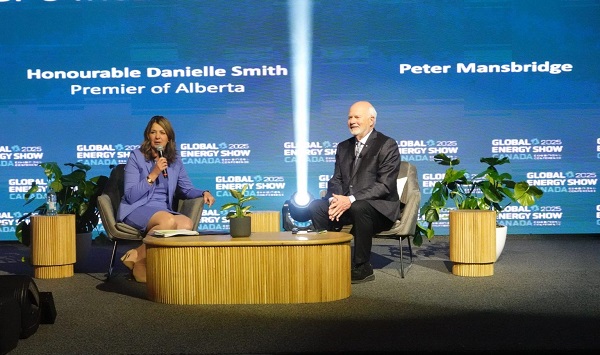

Alberta2 days ago

Alberta2 days agoUnified message for Ottawa: Premier Danielle Smith and Premier Scott Moe call for change to federal policies

-

espionage23 hours ago

espionage23 hours agoFBI Buried ‘Warning’ Intel on CCP Plot to Elect Biden Using TikTok, Fake IDs, CCP Sympathizers and PRC Students—Grassley Probes Withdrawal

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoJordan Peterson reveals DEI ‘expert’ serving as his ‘re-education coach’ for opposing LGBT agenda

-

Agriculture23 hours ago

Agriculture23 hours agoUnstung Heroes: Canada’s Honey Bees are not Disappearing – They’re Thriving

-

espionage1 day ago

espionage1 day agoFrom Sidewinder to P.E.I.: Are Canada’s Political Elites Benefiting from Beijing’s Real Estate Reach?

-

International2 days ago

International2 days agoJudiciary explores accountability options over Biden decline ‘coverup’

-

Economy2 days ago

Economy2 days agoOttawa’s muddy energy policy leaves more questions than answers