Economy

Oil prices fall under pressure as global supply surges

This article supplied by Troy Media.

OPEC output, weak demand and global politics are flooding the market. Experts warn an oil supply glut could hit by 2026

Global oil markets are bracing for a long-term downturn, driven by rising supply, softening demand and mounting economic headwinds.

Brent crude closed Friday at US$66.68 per barrel, down 76 cents or 1.1 per cent. West Texas Intermediate dropped 89 cents to US$62.68, a 1.4

per cent decline. While markets initially hoped an interest rate cut by the U.S. Federal Reserve might boost consumption, oversupply concerns have taken the wheel.

The International Energy Agency now projects a market surplus of 3.3 million barrels per day (bpd) by 2026 if current policies remain in place. Global supply is expected to rise by 2.7 million bpd in 2025 and another 2.1 million in 2026, while demand will grow by just 700,000 bpd annually.

The U.S. Energy Information Administration echoes the concern. Its latest ShortTerm Energy Outlook forecasts global petroleum and other liquid fuels production to average 105.5 million bpd in 2025, climbing to 106.6 million bpd in 2026. Consumption will lag at 103.8 million and 105.1 million bpd, respectively.

Adding to the unease, U.S. distillate stockpiles—diesel, jet fuel and other products held in storage— unexpectedly rose by four million barrels,

suggesting that more fuel is going unused and demand is starting to stall.

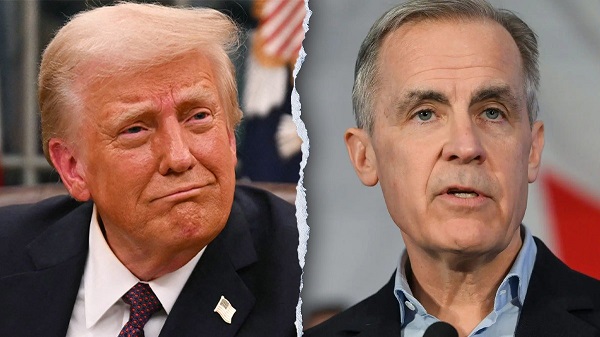

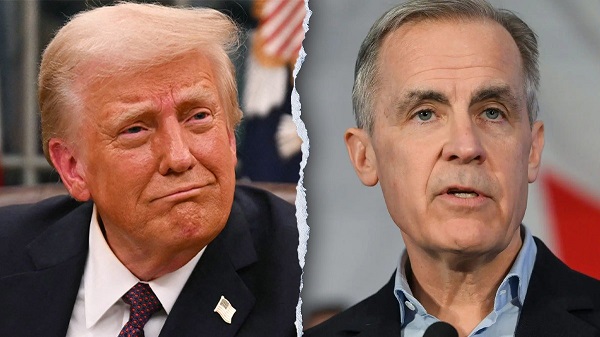

Beyond market fundamentals, some of the bearish pressure is also political. OPEC, the Organization of the Petroleum Exporting Countries, is increasing production—partly shielded by U.S. President Donald Trump’s push for lower domestic fuel prices, a priority that influences how much pressure Washington applies to oil-producing nations.

The White House has made clear it wants energy affordability, giving oil producers the political cover to keep pumping without fear of retaliation.

Geopolitical dynamics are compounding the supply picture. A recent thaw in U.S.–China relations reduced the likelihood of secondary sanctions over Chinese imports of Russian crude. Trump and Chinese President Xi Jinping are expected to meet at the upcoming Asia-Pacific Economic Cooperation summit at the end of October.

Markets took comfort in Trump’s silence on Chinese oil purchases, seeing it as a signal that confrontation is off the table, at least for now.

India continues to buy Russian oil, and the European Union’s latest sanctions package lacks the strength to provoke a firmer U.S. response. Together, these factors are helping keep Russian barrels in global circulation.

Elsewhere, Iraq appears close to resuming crude exports from its Kurdistan region to Turkey, adding yet another stream of supply to an already saturated market.

On top of all this, the upcoming refinery turnaround season—a routine drop in crude demand as refineries shut down for maintenance—will temporarily reduce consumption even further.

In short, all the major levers are pulling in the same direction: lower prices.

And while that may seem like good news for consumers, the ripple effects are far more serious. Canadians may welcome cheaper gas in the near term, but the implications go far beyond the pump.

A prolonged downturn could hit investment in Alberta’s oil sands, Newfoundland and Labrador’s offshore sector, and Saskatchewan’s oil-producing regions—each of them key drivers of provincial revenue and the Canadian economy. Lower prices mean reduced royalties, which fund everything from health care to infrastructure.

Non-renewable resource revenues—primarily from oil and gas—remain a significant source of income for these provinces. In Alberta, they are forecast to account for roughly 21.5 per cent of total government revenue in 2025–26. In Newfoundland and Labrador, oil royalties alone are projected to contribute about 15 per cent of the province’s revenue. Even in Saskatchewan, where potash and uranium also play a role, oil and gas revenues make up a substantial share of the 12.8 per cent of income tied to non-renewable resources.

These figures underscore just how exposed provincial finances remain to global oil price movements.

That pullback in investment could also slow hiring and capital spending, with ripple effects across energy-dependent regions. Pension funds and institutional investors with heavy exposure to oil and gas may feel the sting as well.

At the national level, the consequences could be far-reaching. Canada’s oil and gas extraction sector alone accounts for about 3.2 per cent of GDP, according to the Canadian Association of Petroleum Producers. Broader estimates that include investment, supply chains and related industries place the sector’s total contribution at around 6.4 per cent, based on previous Canadian Energy Centre analysis.

Lower crude prices tend to weaken the Canadian dollar, slow investment in big projects, and cut into export earnings. That can drag down GDP growth, shrink government revenues, and affect job markets even outside the oil patch.

In a country where energy exports still drive much of the economy, a prolonged slump could have wide-reaching fiscal and economic consequences.

Investors, governments and energy workers alike should brace for impact—the oil market isn’t just cooling, it’s being flooded.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

Economy

Reconciliation means clearing the way for Indigenous leadership

From the Resource Works team.

On Truth and Reconciliation Day, Canadians are asked to honour residential school survivors and to support the families and communities who must live with that history.

It also calls for action, not mere commemoration. The Truth and Reconciliation Commission called for structural change in Canada, and that means clearing the way for Indigenous leadership across this country.

Economic reconciliation is a practical journey that shifts decision-making and ownership towards First Nations and Indigenous people more generally.

Throughout B.C., First Nations are already practicing what that looks like. The Osoyoos Indian Band has built a diverse economy in tourism, wine, and recreation that has sustained steady jobs and revenue.

“I think all Native leadership need to get the economic development focus going on and make the economy the number one issue. It’s the economy that looks after everything,” Chief Clarence Louie has said. That sense of mission, along with assets like Nk’Mip Cellars and Spirit Ridge, has helped to turn Osoyoos into a B.C. success story.

On the coast, the Haisla Nation is leading in innovation in the LNG sector. In 2024, the Cedar LNG facility was granted a positive final investment decision, along with the Haisla’s majority ownership of the $4 billion project.

“Today is about changing the course of history for my Nation and Indigenous peoples,” said Haisla Chief Councillor Crystal Smith during the long approval process. By seeing the project through, Haisla ownership has created the means to fund language, health care, and opportunity for generations that had found all of that out of reach.

In the Lower Mainland, the Squamish Nation’s Sen̓áḵw development is one of the biggest projects in the Vancouver real estate market, and will become an asset for decades to come.

“This project is not just about buildings, it’s about bringing the Squamish People back to the land, making our presence felt once again in the heart of our ancestral territory, and creating long term wealth for the Squamish Nation,” said Council Chairperson Khelsilem.

The Squamish recently restructured the partnership so Squamish holds half of phases one and two and all of phases three and four, while welcoming OPTrust to a 50 percent stake in the early phases. Indigenous leadership is not just transforming the rural resource economy, but the urban one as well.

Chief Ian Campbell of the Squamish Nation, former chair of the Indigenous Partnerships Success Showcase event in Vancouver, has said that economic reconciliation is essential to the future of Canada.

“To move forward and reframe that complex dynamic, and put the lens on economic reconciliation, to me, is the path forward to create mutual benefits and values that benefit all Canadians, which includes Indigenous people,” said Campbell.

For governments and industry, there is a duty to align policy, permitting, and capital flows with Indigenous-led priorities. Beyond benefits agreements, reconciliation requires listening both early and attentively, and ensuring cooperation every step of the way.

The Bank of Canada itself has noted that “tremendous untapped potential exists”, but only when private firms and public agencies commit to economic reconciliation.

Listening also means resisting the temptation to cast Indigenous peoples as either monolithic supporters or opponents of development. Figures like Ellis Ross, former Chief Councillor of the Haisla, and his successor Crystal Smith have challenged these narratives, pointing instead to Haisla and neighbouring Nations’ experience with real jobs, careers, and community services tied to LNG and related infrastructure.

The Haisla message is straightforward: the path to revitalized language and culture runs through sustained opportunity and self-determination.

Truth and Reconciliation Day is a reminder that the past matters, and this is evident in the inequities of the present and in the possibilities now being realized by Nations that are reclaiming jurisdiction and building enterprises on their own terms.

Our task is to ensure public policy and corporate practice do not get in the way. On September 30, we remember, and then on October 1 and every day after, we have work to do.

Alberta

Taxpayers: Alberta must scrap its industrial carbon tax

-

Carney praises carbon taxes on world stage

-

Alberta must block Carney’s industrial carbon tax

The Canadian Taxpayers Federation is calling on the government of Alberta to completely scrap its provincial industrial carbon tax.

“It’s baffling that Alberta is still clinging to its industrial carbon tax even though Saskatchewan has declared itself to be a carbon tax-free zone,” said Kris Sims, CTF Alberta Director. “Prime Minister Mark Carney is cooking up his new industrial carbon tax in Ottawa and Alberta needs to fight that head on.

“Alberta having its own industrial carbon tax invites Carney to barge through our door with his punishing industrial carbon tax.”

On Sept. 16, the Alberta government announced some changes to Alberta’s industrial carbon tax, but the tax remains in effect.

On Friday night at the Global Progress Action Summitt held in London, England, Carney praised carbon taxes while speaking onstage with British Prime Minister Keir Starmer.

“The direct carbon tax which had become a divisive issue, it was a textbook good policy, but a divisive issue,” Carney said.

During the federal election, Carney promised to remove the more visible consumer carbon tax and change it into a bigger hidden industrial carbon tax. He also announced plans to create “border adjustment mechanisms” on imports from countries that do not have national carbon taxes, also known as carbon tax tariffs.

“Carney’s ‘textbook good policy’ comments about carbon taxes shows his government is still cooking up a new industrial carbon tax and it’s also planning on imposing carbon tax tariffs,” Sims said. “Alberta should stand with Saskatchewan and obliterate all carbon taxes in our province, otherwise we are opening the door for Ottawa to keep kicking us.”

-

Energy1 day ago

Energy1 day agoOttawa must eliminate harmful regulations to spur private investment in pipelines

-

espionage2 days ago

espionage2 days agoStarmer Faces Questions Over Suppressed China Spy Case, Echoing Trudeau’s Beijing Scandals

-

Business1 day ago

Business1 day agoLabour disputes loom large over Canadian economy

-

Energy21 hours ago

Energy21 hours agoBC NDP Premier Opposing a New Oil Pipeline to Tidewater

-

Business1 day ago

Business1 day agoDaily Caller EXCLUSIVE: Chinese Gov’t-Tied Network Training Illegal Immigrants To Drive Big Rigs In US

-

Crime4 hours ago

Crime4 hours agoThe Bureau Exclusive: Chinese–Mexican Syndicate Shipping Methods Exposed — Vancouver as a Global Meth Hub

-

Crime3 hours ago

Crime3 hours agoCanadian Sovereignty at Stake: Stunning Testimony at Security Hearing in Ottawa from Sam Cooper

-

Business21 hours ago

Business21 hours agoCarney’s Bungling of the Tariff Issue Requires a Reset in Canada’s Approach to Trump