Fraser Institute

Government meddling contributes to doctor exodus in Quebec

From the Fraser Institute

By Bacchus Barua and Yanick Labrie

They have not left Quebec’s health-care system but rather have opted out of the province’s publicly-financed framework to provide care to their patients privately.

Quebec’s health minister recently came under fire after reports revealed a record number of physicians left the province’s public system to practise privately. Less discussed are the reasons why physicians made this choice.

Indeed, it turns out that ill-conceived attempts to protect publicly-funded health care by the Trudeau government and successive provincial governments may have contributed to the increasing numbers of physicians opting-out.

To be clear, the 780 physicians in question account for about four per cent of physicians in the province. However, this represents a 22 per cent increase in the number of physicians leaving the public system compared to the previous year—and is part of a growing trend. More importantly, they have not left Quebec’s health-care system but rather have opted out of the province’s publicly-financed framework to provide care to their patients privately.

Why?

One reason, is because governments have forced them to do so.

Until recently, physicians in Quebec (including those who practiced in the public sector) were allowed to charge patients so-called “accessory-fees” in certain instances—for example, if the service was either not covered or insufficiently reimbursed by the government’s fee schedule.

However, the federal Canada Health Act (CHA) clearly states that “extra-billing” of this nature, when charged by physicians who also bill the public system, must result in dollar-for-dollar deductions in federal health-care transfer payments to the province. In other words, the CHA encourages provincial efforts to effectively force doctors to choose between the public and private system if any out-of-pocket expenses are involved.

And so, under financial threat by the Trudeau government, Quebec eventually clamped down on such fees charged by physicians who worked in the public system.

Consequently, physicians who relied on these payments to cover a portion of their operating costs faced an unfortunate choice—stay in the public system at the risk of financial ruin or opt-out entirely and practise exclusively in the private sector.

For many, the choice was obvious. One study found that by 2019 “an additional 69 specialist physicians opted out after the 2017 clampdown on double billing [sic] than previous trends would have predicted.” Several clinics offering endoscopy and colonoscopy services simply closed their doors. Quebecers also ended up with a less convenient health-care experience following this clamp down, as evidenced by the reduction in clinic-provided services that followed.

This attitude to extra-billing stands in stark contrast to the situation in other universal health-care countries such as Australia where consultations with specialists are usually only partially (85 per cent) covered by the universal plan. In fact, physicians (family doctors and specialists) can generally set fees above the government’s fee schedule so long as they forgo the convenience of directly billing the government (i.e. patients claim reimbursement after the fact). Notably, Australia’s health-care system costs less than Canada’s in total (including these private payments) yet delivers more rapid access to health-care services with a greater availability of medical professionals, hospital beds, and diagnostic and surgical technologies.

More generally, a recent study found 22 of 28 universal health-care countries require patients to share a portion of the cost of treatment (with generous protections for vulnerable groups). These include deductibles (an amount individuals must pay before insurance coverage kicks in), co-insurance payments (the patient pays a certain percentage of treatment cost) and copayments (the patient pays a fixed amount per treatment). Crucially, many of these countries including Australia, Germany, the Netherlands and Switzerland also have shorter wait times than we endure.

In these countries, physicians are also generally allowed to practise both in publicly-funded universal settings and private settings (a policy known as “dual practice”) rather than having their activities restricted to one setting only. In other words, Canada’s federal restrictions on cost-sharing and extra-billing (such as Quebec’s accessory fees) and provincial barriers to dual-practice place our universal system in the minority of a small cohort of countries that are not particularly known for stellar performance.

The looming threat of further reductions in federal cash transfers, under the CHA, has led to provinces such as Quebec imposing increasingly restrictive conditions on physicians in the public system. And in response, physicians—by opting-out—are indicating that they’ve had enough.

It’s ironic that the very groups intent on supposedly “protecting public health care” by forcing physicians to choose between the public and private systems have enforced policies that may very well lead to the public system’s continued demise.

Authors:

Business

Municipal government per-person spending in Canada hit near record levels

From the Fraser Institute

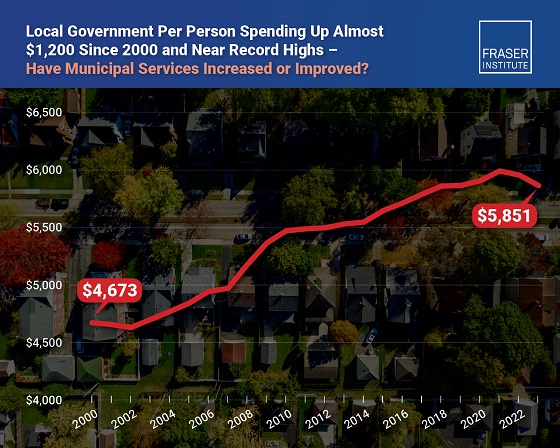

Municipal government spending in Canada hit near record levels in recent years, finds a new study by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“In light of record-high spending in municipalities across Canada, residents should consider whether or not crime, homelessness, public transit and other services have actually improved,” said Austin Thompson, senior policy analyst at the Fraser Institute and author of The Expanding Finances of Local Governments in Canada.

From 2000 to 2023, per-person spending (inflation-adjusted) increased by 25.2 per cent, reaching a record-high $5,974 per person in 2021 before declining slightly to $5,851 in 2023, the latest year of available data.

During that same period, municipal government revenue—generated from property taxes and transfers from other levels of government—increased by 33.7 per cent per person (inflation-adjusted).

And yet, among all three levels of government including federal and provincial, municipal government spending (adjusted for inflation) has actually experienced the slowest rate of growth over the last 10 years, underscoring the large spikes in spending at all government levels across Canada.

“Despite claims from municipal policymakers about their dire financial positions, Canadians should understand the true state of finances at city hall so they can decide whether they’re getting good value for their money,” said Jake Fuss, director of fiscal studies at the Fraser Institute.

The Expanding Finances of Local Governments in Canada, 1990–2023

- Canada’s local governments have experienced substantial fiscal growth in recent decades.

- Revenue and expenditure by local governments—including municipal governments, school boards, and Indigenous governments—have increased faster than population growth and inflation combined. From 1990 to 2023, real per-capita revenue rose by 32.7%, and expenditure by 30.0%.

- Local governments represent a significant component of Canada’s broader public sector. In 2023, net of inter-governmental transfers, municipal governments and school boards accounted for 18.6% of total government expenditure and 11.1% of revenue.

- Despite this growth, local governments’ share of overall government revenue and expenditure has declined over time—especially since the COVID-19 pandemic—as federal and provincial budgets have expanded even more rapidly.

- Nevertheless, between 2008 and 2023 the inflation-adjusted per-capita revenue of municipal governments in-creased by 10.1% and their expenditure by 12.4% , on average across the provinces.

- Over the same period, municipal governments recorded above-inflation increases in their combined annual operating surpluses, which contributed to an 88.1% inflation-adjusted rise in their net worth—raising important questions about the allocation of accumulated resources.

- In 2023, Ontario recorded the highest per-capita municipal revenue among the provinces ($4,156), while Alberta had the highest per-capita expenditure ($3,750). Prince Edward Island reported the lowest per-capita municipal revenue ($1,635) and expenditure ($1,186).

- Wide variation in per-capita municipal revenue and expenditure across the provinces reflects differences in the responsibilities provinces assign to municipalities, as well as possible disparities in the efficiency of service delivery—issues that warrant further scrutiny.

Click Here To Read The Full Study

armed forces

It’s not enough to just make military commitments—we must also execute them

From the Fraser Institute

By Jake Fuss and Grady Munro

To reach 2 per cent of GDP this year, the federal government is committing an additional $9.3 billion towards the military budget. Moreover, to reach 3.5 per cent of GDP by 2035, it’s estimated the government will need to raise yearly spending by an additional $50 billion—effectively doubling the annual defence budget from $62.7 billion to approximately $110 billion.

As part of this year’s NATO summit, Canada and its allies committed to increase annual military spending to reach 5 per cent of gross domestic product (GDP) by 2035. While this commitment—and the government’s recent push to meet the previous spending target of 2 per cent of GDP—are important steps in fulfilling Canada’s obligations to the alliance, there are major challenges the federal government will need to overcome to execute these plans.

Since 2014, members of the North Atlantic Treaty Organization (NATO) have committed to spend at least 2 per cent of GDP (a measure of overall economic output) on national defence. Canada had long-failed to fulfill this commitment, to the ire of our allies, until the Carney government recently announced a $9.3 billion boost to defence spending (up to a total of $62.7 billion) that will get us to 2 per cent of GDP during the 2025/26 fiscal year.

However, just as Canada reached the old target, the goal posts have now moved. As part of the 2025 NATO summit, alliance members (including Canada) committed to reach an increased spending target of 5 per cent of GDP in 10 years. The new target is made up of two components: core military spending equivalent to 3.5 per cent of GDP, and another 1.5 per cent of GDP for other defence-related spending.

National defence is a core function of the federal government and the Carney government deserves credit for prioritizing its NATO commitments given that past governments of different political stripes have failed to do so. Moreover, the government is ensuring that Canada remains in step with its allies in an increasingly dangerous world.

However, there are major challenges that arise once you consider how the government will execute these commitments.

First, both the announcement that Canada will reach 2 per cent of GDP in military spending this fiscal year, and the future commitment to spend up to 3.5 per cent of GDP on defence by 2035, represent major fiscal commitments that Canada’s budget cannot simply absorb in its current state.

To reach 2 per cent of GDP this year, the federal government is committing an additional $9.3 billion towards the military budget. Moreover, to reach 3.5 per cent of GDP by 2035, it’s estimated the government will need to raise yearly spending by an additional $50 billion—effectively doubling the annual defence budget from $62.7 billion to approximately $110 billion. However, based on the last official federal fiscal update, the federal government already plans to run an annual deficit this year—meaning it spends more than it collects in revenue—numbering in the tens of billions, and will continue running large deficits for the foreseeable future.

Given this poor state of finances, the government is left with three main options to fund increased military spending: raise taxes, borrow the money, or cut spending in other areas.

The first two options are non-starters. Canadian families already struggle under a tax burden that sees them spend more on taxes than on food, shelter, and clothing combined. Moreover, raising taxes inhibits economic growth and the prosperity of Canadians by reducing the incentives to work, save, invest, or start a business.

Borrowing the money to fund this new defence spending will put future generations of Canadians in a precarious situation. When governments borrow money and accumulate debt (total federal debt is expected to reach $2.3 trillion in 2025-26), the burden of this debt falls squarely on the backs of Canadians—likely in the form of higher taxes in the future. Put differently, each dollar we borrow today must be paid back by more than a dollar in higher taxes tomorrow.

This leaves cutting spending elsewhere as the best option, but one that requires the government to substantially readjusts its priorities. The federal government devotes considerable spending towards areas that are not within its core responsibilities and which shouldn’t have federal involvement in the first place. For instance, the previous government launched three major initiatives to provide national dental care, national pharmacare and national daycare, despite the fact that all three areas fall squarely under provincial jurisdiction. Instead of continuing to fund federal overreach, the Carney government should divert spending back to the core function of national defence. Further savings can be found by reducing the number of bureaucrats, eliminating corporate welfare, dropping electric vehicle subsidies, and many other mechanisms.

There is a fourth option by which the government could fund increased defence spending, which is to increase the economic growth rate within Canada and enjoy higher overall revenues. The problem is Canada has long-suffered a weak economy that will remain stagnant unless the government fundamentally changes its approach to tax and regulatory policy.

Even if the Carney government is able to successfully adjust spending priorities to account for new military funding, there are further issues that may inhibit money from being spent effectively.

It is a well-documented problem that military spending in Canada is often poorly executed. A series of reports from the auditor general in recent years have highlighted issues with the readiness of Canada’s fighter force, delays in supplying the military with necessary materials (e.g. spare parts, uniforms, or rations), as well as delays in delivering combat and non-combat ships needed to fulfill domestic and international obligations. All three of these cases represent instances in which poor planning and issues with procurement and supply chains) are preventing government funding from translating into timely and effective military outcomes.

The Carney government has recently made major commitments to increase military funding to fulfill Canada’s NATO obligations. While this is a step in the right direction, it’s not enough to simply make the commitments, the government must execute them as well.

-

MAiD9 hours ago

MAiD9 hours agoCanada’s euthanasia regime is not health care, but a death machine for the unwanted

-

Business1 day ago

Business1 day agoFederal government should finally cut Trudeau-era red tape

-

COVID-191 day ago

COVID-191 day agoOntario man launches new challenge against province’s latest attempt to ban free expression on roadside billboards

-

Business8 hours ago

Business8 hours agoOttawa Funded the China Ferry Deal—Then Pretended to Oppose It

-

Alberta1 day ago

Alberta1 day agoCanadian Oil Sands Production Expected to Reach All-time Highs this Year Despite Lower Oil Prices

-

Business1 day ago

Business1 day agoTaxpayers Federation presents Teddy Waste Awards for worst government waste

-

International1 day ago

International1 day agoPresident Xi Skips Key Summit, Adding Fuel to Ebbing Power Theories

-

armed forces7 hours ago

armed forces7 hours agoMark Carney Thinks He’s Cinderella At The Ball