Opinion

Fentanyl Fiasco: The Tragic Missteps of BC’s Drug Policy

From The Opposition News Network

|

|

Unmasking the Destructive Cycle of Drug Policy in British Columbia. A Tale of Good Intentions and Dire Consequences

My fellow Canadians, it’s been a challenging time. I had initially planned to bring you the latest spectacle from the House of Commons, featuring Kristian Firth, but fate had other plans. A personal emergency struck closer to home—a fentanyl overdose in the family. This tragic event threw us headlong into the chaotic circus that is the British Columbia health system. Let me be frank: the system is a mockery. The privacy laws that supposedly protect us also shroud our crises in unnecessary mystery. When my uncle was found unconscious and rushed to the ICU, the walls of confidentiality meant we could not even ascertain his condition over the phone. They notify you of the disaster but cloak its nature in secrecy. It’s an absurdity that only adds to the anguish of families grappling with the realities of addiction.

Now, let’s address the elephant in the room: our approach to drug addiction. The authorities label it a disease, yet paradoxically offer the afflicted the choice between seeking help and remaining in their dire state. This half-hearted stance on drug addiction only perpetuates a cycle of relapse and despair. As we speak, thousands tumble through the revolving doors of our medical facilities—5,975 apparent opioid toxicity deaths this year alone, an 8% increase from 2022. Daily, we see 22 deaths and 17 hospitalizations, and yet our response remains as ineffective as ever. This issue transcends our national borders. The U.S. has openly criticized China for its role in the opioid crisis, accusing it of flooding North America with fentanyl—a drug so potent, it’s decimating communities at an unprecedented rate. Just last year, over 70,000 Americans succumbed to fentanyl overdoses. And what’s more damning? Reports from U.S. congressional committees suggest that the Chinese government might be subsidizing firms that traffic these lethal substances. Lets be clear this is a state-sponsored assault on our populace.

In response to this crisis BC NDP policymakers have championed the notion of “safe supply” programs. These initiatives distribute free hydromorphone, a potent opioid akin to heroin, with the intention of steering users away from the perils of contaminated street drugs. At first glance, this approach might seem logical, even humane. However, the grim realities paint a far different picture, one where good intentions pave the road to societal decay. Addiction specialists are sounding the alarm, and the news isn’t good. While hydromorphone is potent, it lacks the intensity to satisfy fentanyl users, leading to an unintended consequence: diversion. Users, unappeased by the drug’s effects, are selling their “safe” supply on the black market. This results in a glut of hydromorphone flooding the streets, crashing its price by up to 95% in certain areas. This collapse in street value might seem like a win for economic textbooks, but in the harsh world of drug abuse, it’s a catalyst for disaster. Cheap, readily available opioids are finding their way into the hands of an ever-younger audience, ensnaring teenagers in the grips of addiction. Far from reducing harm, these programs are inadvertently setting the stage for a new wave of drug dependency among our most vulnerable.

Programs designed to save lives are instead spinning a web of addiction that ensnares not just existing drug users but also initiates unsuspecting adolescents into a life of dependency. What’s needed isn’t more drugs, even under the guise of medical oversight, but a robust support system that addresses the root causes of addiction yet, the stark reality on the streets tells a story of systemic failure. Let’s dissect the current approach to handling addiction, a condition deeply intertwined with our societal, legal, and health systems.

Take a typical scenario—an individual battling the throes of addiction. Many of them find themselves ensnared by the law, often for crimes like theft, driven by the desperate need to sustain their habit. Yes, many addicts find themselves behind bars, where, paradoxically, they claim to clean up. Jail, devoid of freedom, ironically becomes a place of forced sobriety.

Now, consider the next step in this cycle: release. Upon their release, these individuals, now momentarily clean, are promised treatment—real help, real change. Yet, here’s the catch: this promised help is dangled like a carrot on a stick, often 30 or more days away. What happens in those 30 days? Left to their own devices, many relapse, falling back into old patterns before they ever step foot in a treatment facility.

This brings us to a critical question: why release an individual who has begun to detox in a controlled environment, only to thrust them back into the very conditions that fueled their addiction? Why not maintain custody until a treatment spot opens up? From a fiscal perspective, this dance of incarceration, release, and delayed treatment is an exercise in futility, burning through public funds without solving the core issue. Moreover, from a standpoint of basic human decency and dignity, this system is profoundly flawed. We play roulette with lives on the line, hoping against odds for a favorable outcome when we already hold a losing hand. This isn’t just ineffective; it’s cruel.

Final Thoughts

As we close the curtain on this discussion, let’s not mince words. The BC system’s approach to drug addiction treatment isn’t just flawed; it’s a catastrophic failure masquerading as mercy. Opposition leader Pierre Poilievre has hit the nail squarely on the head in his piece for the National Post. He articulates a vision where compassion and practicality intersect, not through the failed policies of perpetual maintenance, but through genuine, recovery-oriented solutions. His stance is clear: treat addiction as the profound health crisis it is, not as a criminal issue to be swept under the rug of incarceration.

Contrast this with the so-called ‘safe supply’ madness—a Band-Aid solution to a hemorrhaging societal wound. In the dystopian theatre of the Downtown Eastside, where welfare checks and drug dens operate with the efficiency of a grotesque assembly line, what we see is not healthcare, but a deathcare system. It’s a cycle of despair that offers a needle in one hand and a shot of naloxone in the other as a safety net. This isn’t treatment; it’s a perverse form of life support that keeps the heart beating but lets the soul wither.

Come next election in BC, if any provincial party is prepared to advocate for a true treatment-first approach, to shift from enabling addiction to empowering recovery, they will have my—and should have your—unwavering support. We must champion platforms that prioritize recovery, that respect human dignity, and that restore hope to the heartbroken streets of our communities.

The NDP BC government’s current model perpetuates death and decay under the guise of progressive policy. It’s a cruel joke on the citizens who need help the most. We can no longer afford to stand idly by as lives are lost to a system that confuses sustaining addiction with saving lives. Let’s rally for change, for recovery, for a future where Canadians struggling with addiction are given a real shot at redemption. This isn’t just a political imperative—it’s a moral one. The time for half-measures is over. The time for real action is now.

Become a supporter of The Opposition with Dan Knight .

For the full experience, click here to upgrade your subscription.

Opinion

Climate Murder? Media Picks Up Novel Legal Theory Suggesting Big Oil Is Homicidal

From the Daily Caller News Foundation

From the Daily Caller News Foundation

By Nick Pope

A new narrative is making its way through major media outlets about major oil corporations: climate change that they purportedly caused is taking lives, and they could be held liable for homicide.

In recent weeks, numerous outlets have run stories or opinion pieces promoting or otherwise examining the novel legal theory, which is the subject of a new paper published by the Harvard Environmental Law Review, according to a Tuesday E&E News report detailing the architects’ efforts to market their idea to prosecutors. The Boston Globe, The Guardian, Newsweek, Inside Climate News and other outlets have all recently published pieces promoting the idea that leading oil companies could or should be charged with murder for their role in climate change, which the theory’s architects claim has caused thousands of deaths in the U.S.

David Arkush, who runs Public Citizen’s climate program, and Donald Braman, a professor at George Washington University’s law school, articulated the theory in a March paper. Public Citizen is a left-of-center organization founded by failed Green Party presidential candidate Ralph Nader that, among other things, pressures American International Group (AIG) to stop providing insurance coverage for fossil fuel companies, according to its website and Influence Watch.

“Activists and journalists have called executives of major oil companies ‘mass murderers,’ lamenting that ‘millions of human beings will die so that they can have private planes and huge mansions,’ and a growing chorus of communities devastated by [fossil fuel companies’] lethal conduct have begun to demand accountability,” the authors state in their paper. “But as of this writing, no prosecutor in any jurisdiction has charged [fossil fuel companies] with any form of homicide over climate-related deaths. They should.”

The paper also suggests that the American Petroleum Institute (API), a leading trade association for the oil and gas industry, was involved in the industry’s purported attempts to obscure the effects of emissions.

“The record of the past two decades demonstrates that the industry has achieved its goal of providing affordable, reliable American energy to U.S. consumers while substantially reducing emissions and our environmental footprint,” a spokesperson for API told the Daily Caller News Foundation. “Any suggestion to the contrary is false.”

The two authors contend that energy corporations were aware of the warming that emissions from their products and operations would cause for decades, and that those companies decided to mislead the public and obscure what effects those emissions may have. A similar narrative lies at the heart of climate lawsuits that have been filed against energy companies in numerous jurisdictions across the U.S. in recent years.

Arkush wrote a Wednesday piece for Newsweek laying out his theory and referencing these climate lawsuits, opining that the fossil fuel industry’s purported “crimes may be among the, if not the, most consequential in human history.” The Boston Globe ran a similar opinion piece authored by Arkush and another official for Public Citizen on March 17.

The Guardian ran its own piece about the climate homicide theory on March 21, using the headline “Fossil fuel firms could be tried in US for homicide over climate-related deaths, experts say.” Clean Technica, a site that promotes green energy, ran a March 16 piece on the new legal theory with the headline “Climate Criminals — Prosecuting Big Oil For Environmental Crimes.”

Inside Climate News published an April 4 story on the subject, using the headline “Should Big Oil Be Tried for Homicide?” and including excerpts from interviews with the two architects of the climate homicide theory. The pair suggested that the aim is not to punish individuals or seek vengeance, but instead achieve results that would prompt companies to shift their investments away from fossil fuels, according to Inside Climate News’ story.

However, Inside Climate News did quote legal experts who expressed skepticism about the theory’s merits.

“I do not believe that a criminal prosecution on homicide charges against the major oil companies is appropriate or can be sustained,” John Coffee Jr., a professor at Columbia Law School who specializes in corporate law, told the outlet.

Nick Pope is a contributor at The Daily Caller.

Economy

Ottawa’s homebuilding plans might discourage much-needed business investment

From the Fraser Institute

In the minds of most Canadians, there’s little connection between housing affordability and productivity growth, a somewhat wonky term used mainly by economists. But in fact, the connection is very real.

To improve affordability, the Trudeau government recently announced various financing programs to encourage more investment in residential housing including $6 billion for the Canada Housing Infrastructure Fund and $15 billion for an apartment construction loan program.

Meanwhile, Carolyn Rogers, senior deputy governor of the Bank of Canada, recently said weak business investment is contributing to Canada’s weak growth in productivity (essentially the value of economic output per hour of work). Therefore, business investment to promote productivity growth and income growth for workers is also an economic priority.

But here’s the problem. There’s only so much financial capital at reasonable interest rates to go around.

Because Canada is a small open economy, it might seem that Canadian investors have unlimited access to offshore financial capital, but this is not true. Foreign lenders and investors incur foreign exchange risk when investing in Canadian-dollar denominated assets, and the risk that Canadian asset values will decline in real value. Suppliers of financial capital expect to receive higher yields on their investments for taking on more risk. Hence, investment in residential housing (which the Trudeau government wants to promote) and investment in business assets (which the Bank of Canada warns is weak) compete against each other for scarce financial capital supplied by both domestic and foreign savers.

For perspective, investment in residential housing as a share of total investment increased from 22.4 per cent in 2000 to 41.3 per cent in 2021. Over the same period, investment in two asset categories critical to improving productivity—information and communications equipment and intellectual property products including computer software—decreased from 30.3 per cent of total domestic investment in 2000 to 22.7 per cent in 2021.

What are the potential solutions?

Of course, more financial capital might be available at existing interest rates for domestic investment in residential housing and productivity-enhancing business assets if investment growth declines in other asset categories such as transportation, roads and hospitals. But these assets also contribute to improved productivity and living standards.

Regulatory and legal pressures on Canadian pension funds to invest more in Canada and less abroad would also free up domestic savings for increased investments in residential housing, machinery and equipment and intellectual property products. But this amounts to an implicit tax on Canadians with domestic pension fund holdings to subsidize other investors.

Alternatively, to increase domestic savings, governments in Canada could increase consumption taxes (e.g. sales taxes) while reducing or even eliminating capital gains taxes, which reduce the after-tax expected returns to investing in businesses, particularly riskier new and emerging domestic companies. (Although according to the recent federal budget, the Trudeau government plans to increase capital gains taxes.)

Or governments could reduce the regulatory burden on private-sector businesses, especially small and medium-sized enterprises, so financial capital and other inputs used to comply with often duplicative or excessive regulation can be used to invest in productivity-enhancing assets. And governments could eliminate restrictions on foreign investment in large parts of the Canadian economy including telecommunications, banking and transportation. By increasing competition, governments can improve productivity.

Eliminating such restrictions would also arguably increase the supply of foreign financial capital flowing into Canada to the extent that large foreign investors would prefer to manage their Canadian assets rather than take portfolio investment positions in Canadian-owned companies.

Canadians would undoubtedly benefit from increases in housing construction (and subsequently, increased affordability) and improved productivity from increased business investment. However, government subsidies to home builders, including the billions recently announced by the Trudeau government, simply move available domestic savings from one set of investments to another. The policy goal should be to increase the availability of risk-taking financial capital so the costs of capital decrease for Canadian investors.

Author:

-

Alberta2 days ago

Alberta2 days agoOfficial statement from Premier Danielle Smith and Energy Minister Brian Jean on the start-up of the Trans Mountain Pipeline

-

Economy2 days ago

Economy2 days agoToday’s federal government—massive spending growth and epic betting

-

COVID-192 days ago

COVID-192 days agoCanada’s COVID vaccine injury program has paid out just 6% of claims so far

-

Economy2 days ago

Economy2 days agoYoung Canadians are putting off having a family due to rising cost of living, survey finds

-

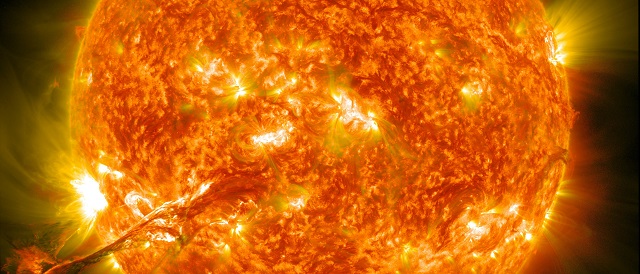

Environment1 day ago

Environment1 day agoClimate Alarmists Want To Fight The Sun. What Could Possibly Go Wrong?

-

Opinion8 hours ago

Opinion8 hours agoClimate Murder? Media Picks Up Novel Legal Theory Suggesting Big Oil Is Homicidal

-

International2 days ago

International2 days agoNYPD storms protest-occupied Columbia building, several arrested

-

Addictions18 hours ago

Addictions18 hours agoCity of Toronto asks Trudeau gov’t to decriminalize hard drugs despite policy’s failure in BC