Opinion

Female UN expert calls for ban on men in women’s sports, gets accused of ‘demeaning language’

Reem Alsalem

From LifeSiteNews

By Ordo Iuris

“Giving men so-called hormone blockers so they can compete with women – as some sports leagues do – doesn’t work”

United Nations Special Rapporteur Reem Alsalem, in a recent report, called on countries and sporting organization authorities not to allow “men who identify as women” to compete in female sports competitions.

- The U.S. representative to the UN accused Alsalem of using “degrading language” and of “bullying and gender misinformation.”

- Delegates from Great Britain, Canada, the Netherlands, France, Mexico, Colombia, and other Western countries raised similar objections.

- “Gender should be understood in its ordinary sense as biological sex,” Alsalem said during the report’s presentation, citing the agreement from the 1995 UN World Conference on Women in Beijing.

- Alsalem’s approach challenges the assumptions of Western and UN-backed gender policies, which are based on gender as a social construct unrelated to biological sex.

In her latest report to the General Assembly, the UN Special Rapporteur on Violence Against Women, Reem Alsalem, called on countries to stop allowing “men who identify as women” to compete against women and girls in sports. The U.S. representative to the UN, wearing a badge on his jacket with the colors of the LBGT and trans lobbies, accused her of using “degrading language” against trans athletes, as well as spreading “gender misinformation” and “bullying.” Delegates from Great Britain, Canada, the Netherlands, France, Mexico, Colombia, and other Western countries made similar accusations.

READ: Women’s sports are under siege by male participants, and no one seems to be stopping it

According to the report, allowing men declaring female gender into women’s competitions also leads to women and girls experiencing “extreme psychological distress,” due to physical imbalance with rivals, loss of fair competition and educational and economic opportunities, and violations of privacy (e.g., in locker rooms). Alsalem says that, in recent years, more than 600 female athletes have lost some 890 medals in more than 400 competitions, in 29 different sports, due to policies allowing men to compete against women.

“Giving men so-called hormone blockers so they can compete with women – as some sports leagues do – doesn’t work,” Alsalem said. It does not reduce men’s natural advantage, and strong hormone drugs can even harm an athlete’s health.

“Human rights language and principles must continue to be consistent with science and facts, including biological ones,” the expert argued. “Multiple studies have given evidence that athletes born males have a performance advantage in sports throughout their lives although this is most apparent after puberty.” Alsalem also mentioned the risk of injury to female athletes, which is knowingly increased when competing with biological men, whether they identify as men or women, the physical harm suffered by women against male athletes can be characterized as violence, according to the special rapporteur.

“Sex must be understood in its ordinary meaning to mean biological sex,” Alsalem said, citing a declaration from the 1995 UN World Conference on Women in Beijing. She continued by stating that “sex based on biology” has been established in the international human-rights catalog, as opposed to the concept of “gender.” According to Alsalem, the two categories should not be confused.

Julia Książek, of the Ordo Iuris Center for International Law, stated:

Reem Alsalem identified a major problem that became fully apparent at the Paris Olympics this year, when it became evident that women were no longer competing against women, but also men who ‘identify’ as women. The UN expert rightly noted in her report that athletes’ mental identification does not in any way affect their biological predisposition, which they have by being men. This type of situation is the result of lobbying in international law for the concept of ‘sex with social context’ – gender. The first event raising questions about the use of the ‘gender’ construct was the 1995 World Conference on the Rights of Women in Beijing. The debate around its final declaration stirred controversy precisely because of the definition of gender, listed in the text as ‘gender’ rather than ‘sex.’ Under pressure from a large group of UN member states, the conference chairman clearly stated that the word gender was used in the ordinary, generally accepted sense in which it appears in UN documents, recalling the non-binding declarations attached to the final declarations of UN conferences in the early 1990s. He also stressed that there was no intention to give a new meaning to the term that would differ from the generally accepted one. Reem Alsalem also noted this in her report.

The Ordo Iuris Institute has long opposed the gender lobby in sports. In 2020, the Institute’s experts prepared an analysis of a draft UN resolution, which maintained that athletes should be allowed to participate in competitions according to their subjective feelings about gender.

This article was originally published on Ordo Iuris’ English-language page. Edited and reprinted with permission.

Opinion

Landmark 2025 Study Says Near-Death Experiences Can’t Be Explained Away

The assumption that every mystery of existence can be mechanistically explained away risks distorting science into a heavily biased scientism. The article below is fascinating reading for anyone who senses that the magnificent and elusive concept of “consciousness” might not be fully comprehensible within the narrow framework of “brain-as-machine.”

If you’ve ever heard a near-death experience (NDE) story—the tunnel of light, the life review, the profound peace—you’ve probably also heard the standard scientific rebuttal.

“It’s just a brain starved of oxygen.”

“It’s a final dream caused by a flood of DMT.”

“It’s just random neurons firing as the system shuts down.”

For decades, this has been the dominant, materialistic narrative. NDEs are fascinating, the story goes, but they’re ultimately illusions—the brain’s last, desperate fireworks display before the permanent blackout.

But what if that story is wrong? What if the data we’ve been collecting for 50 years points in a completely different direction?

A powerful new paper published in October 2025 is forcing the scientific community to do a double-take. The study, “A Neuroscientific Model of Near-Death Experiences Reconsidered” by Dr. Bruce Greyson and Marieta Pehlivanova from the University of Virginia, systematically dismantles the argument that NDEs are mere brain malfunctions.

And the implications are, frankly, mind-blowing.

The Challenger: The “Comprehensive” NEPTUNE Model

Earlier in 2025, a large multinational team published a paper in Nature Reviews Neurology proposing a new, all-encompassing theory called NEPTUNE (the Neurophysiological Evolutionary Psychological Theory Understanding Near-Death Experience). It was a grand unified theory of skepticism, pulling together every conceivable brain-based explanation:

- Low oxygen/High CO₂

- Temporal lobe seizures

- Stimulation of the temporoparietal junction (TPJ) – thought to cause out-of-body illusions

- REM sleep intrusion

- Ketamine/DMT-like chemistry

- Electrical “surges” in the dying brain

Skeptics pointed to NEPTUNE as the final word. Finally, a model that explained away the mystery! But Greyson and Pehlivanova, with decades of NDE research under their belts, looked at the model and saw a house of cards. Their paper is a meticulous, point-by-point deconstruction.

The Takedown: 8 Reasons Why “Just the Brain” Isn’t Enough

Here’s how Greyson and Pehlivanova challenge the core arguments of the NEPTUNE model:

- The Oxygen Problem: If low oxygen causes NDEs, then why do studies of cardiac arrest survivors show that many who report profound NDEs had normal oxygen and CO₂ levels? And why are these experiences so lucid and structured, while true hypoxia typically causes confused, garbled, and amnesic states?

- The Seizure Mismatch: While temporal lobe epilepsy can cause odd feelings or hallucinations, they are almost always described as frightening, fragmented, and bizarre. They don’t resemble the coherent, narrative, and deeply peaceful story of a typical NDE. As one prominent epileptologist admitted, “In spite of having seen hundreds of patients with temporal lobe seizures… I have never come across that symptomatology [of NDEs] as part of a seizure” (Rodin, 1989, as cited in Greyson & Pehlivanova, 2025).

- The Out-of-Body Illusion: Stimulating the TPJ can create a sense of dissociation or the “impression” of a shadowy figure. But this is a far cry from the detailed, veridical Out-of-Body Experiences (OBEs) reported in NDEs, where people accurately describe surgical procedures, conversations, and specific details in other rooms—details they could not have perceived with their physical senses. These verified perceptions are a thorn in the side of any purely neurological model (Holden, 2009).

- The Drug Disconnect: Experiences on ketamine or DMT might share superficial similarities with NDEs, like visual patterns. But the profound, life-altering quality, the hyper-real clarity, the encounter with deceased loved ones, and the permanent personality changes are largely absent from drug-induced states.

- The REM Intrusion Red Herring: This theory suggests NDEs are like dream states intruding on wakefulness. But research shows NDE experiencers don’t have more REM intrusion than the general population. Furthermore, NDEs often occur under general anesthesia, which suppresses REM sleep.

- The “Dying Brain Surge” That Wasn’t: Recent headlines have trumpeted studies showing electrical surges in the dying brain. But Greyson and Pehlivanova point out a critical flaw: these studies were on patients whose hearts were still beating. They were not clinically dead. More importantly, none of the patients in these studies who showed these surges reported any conscious experience, let alone an NDE.

- The Unexplained Core: The NEPTUNE model conveniently ignores the most challenging aspects of NDEs: verified OBEs, encounters with deceased relatives the person didn’t know had died, and the profound, lasting aftereffects like the complete loss of fear of death and a radical shift toward altruism.

- The Philosophical Bias: The authors of the NEPTUNE model explicitly state they excluded any “dualistic” theories (the idea that consciousness might be more than the brain) because it contradicts a “fundamental tenet of neuroscience.” Greyson and Pehlivanova call this out as circular reasoning: assuming the brain produces consciousness, and then ignoring any evidence that challenges that assumption.

The Bigger Picture: What Else Does the Research Show?

Greyson and Pehlivanova are not lone voices. They stand on the shoulders of a robust field of research.

- How Common Are NDEs? It’s estimated that 5-10% of the population has reported an NDE following a close brush with death. With millions of cardiac arrests and other life-threatening events worldwide each year, we are talking about a significant and recurring human experience.

- Pioneers in the Field: Dr. Greyson himself created the Greyson NDE Scale, a standardized tool to identify and measure the phenomenon. Other key figures include:

- Raymond Moody, who coined the term “Near-Death Experience” in his 1975 book Life After Life.

- Kenneth Ring, a pioneering researcher who documented the common patterns of NDEs.

- Pim van Lommel, a Dutch cardiologist whose 2001 prospective study on NDEs in cardiac arrest survivors in The Lancet was a landmark in the field.

The Takeaway: A Mystery That Refuses to Die

The Greyson and Pehlivanova paper doesn’t claim to have all the answers. But it does something crucial: it demonstrates that the old, comfortable materialistic explanations are scientifically inadequate. They fail to account for the data.

This forces a humbling and exciting conclusion: The relationship between consciousness and the brain is one of the greatest unsolved mysteries of our time. Near-death experiences, far from being simple glitches, may be our most compelling clue that there is far more to this story.

The next time someone tells you an NDE is “just the brain dying,” you can tell them the science has evolved. The conversation is no longer about if these experiences are real, but what they are telling us about the fundamental nature of mind, life, and death.

Until next time,

Christof

MILLIVITAL ACADEMY

Thanks for reading Millivital Academy!

Subscribe for free to receive new posts and support my work.

References:

1. Greyson, B., & Pehlivanova, M. (2025). A neuroscientific model of near-death experiences reconsidered. Psychology of Consciousness: Theory, Research, and Practice. Advance online publication. https://dx.doi.org/10.1037/

2. Holden, J. M. (2009). Veridical perception in near-death experiences. In J. M. Holden, B. Greyson, & D. James (Eds.), The handbook of near-death experiences: Thirty years of investigation (pp. 185–212). Praeger/ABC-CLIO.

3. Martial, C., Fritz, P., Gosseries, O., Bonhomme, V., Kondziella, D., Nelson, K., & Lejeune, N. (2025). A neuroscientific model of near-death experiences. Nature Reviews Neurology, 21(6), 297–311. https://doi.org/10.1038/

4. Moody, R. A. (1975). Life after life. Mockingbird Books.

5. Ring, K. (1980). Life at death: A scientific investigation of the near-death experience. Coward, McCann & Geoghegan.

6. van Lommel, P., van Wees, R., Meyers, V., & Elfferich, I. (2001). Near-death experience in survivors of cardiac arrest: A prospective study in the Netherlands. The Lancet, 358(9298), 2039–2045. https://doi.org/10.1016/S0140-

Focal Points

STUDY: TikTok, Instagram, and YouTube Shorts Induce Measurable “Brain Rot”

Nicolas Hulscher, MPH

Nicolas Hulscher, MPH

In 2024, “brain rot” went from an online meme to the Oxford Word of the Year.

Doomscrolling, zombie scrolling, and dopamine-driven streams of low-quality content are producing measurable cognitive impairment across an entire generation.

‘Brain rot’ is defined as “the supposed deterioration of a person’s mental or intellectual state, especially viewed as the result of overconsumption of material (now particularly online content) considered to be trivial or unchallenging.”

Our experts noticed that ‘brain rot’ gained new prominence this year as a term used to capture concerns about the impact of consuming excessive amounts of low-quality online content, especially on social media. The term increased in usage frequency by 230% between 2023 and 2024.

The first recorded use of ‘brain rot’ was found in 1854 in Henry David Thoreau’s book Walden, which reports his experiences of living a simple lifestyle in the natural world. As part of his conclusions, Thoreau criticizes society’s tendency to devalue complex ideas, or those that can be interpreted in multiple ways, in favour of simple ones, and sees this as indicative of a general decline in mental and intellectual effort: “While England endeavours to cure the potato rot, will not any endeavour to cure the brain-rot – which prevails so much more widely and fatally?”

Now, a peer-reviewed paper titled, Demystifying the New Dilemma of Brain Rot in the Digital Era: A Review, confirms that brain rot is real: the digital environment is chemically, cognitively, and psychologically degrading the developing human brain. And the damage is measurable.

According to the study, brain rot isn’t a meme. It’s a documented state of cognitive atrophy, driven by overstimulation, dopamine feedback loops, and nonstop exposure to low-quality digital content.

The authors conducted a rapid review, systematically analyzing 381 studies, filtering to 35 high-quality papers published between 2023–2024. Here’s what they found:

The Core Mechanism: Overstimulation + Dopamine Feedback Loops

The review shows that young people now average 6.5 hours per day online — primarily on algorithm-driven platforms like TikTok, Instagram Reels, YouTube Shorts, and endless-scroll feeds engineered for split-second novelty.

Most of the content involves rapid, low-information stimuli: ultrashort videos, memes, reaction clips, and trivial entertainment fragments that provide novelty without cognitive substance.

These platforms deliver rapid bursts of artificially rewarding stimuli, creating a cycle of:

- Constant cognitive overstimulation

The brain never enters a “rest” mode or deeper thought state.

- Weakening of working memory

Information is consumed too quickly to be consolidated.

- Fragmented attention networks

Short-form content trains the mind to expect constant novelty.

- Difficulty processing long or complex information

Deep reading and sustained focus become neurologically harder.

- Mental fatigue & reduced executive function

Chronic overstimulation taxes the prefrontal cortex — the center of planning, reasoning, and self-regulation.

The study describes this as a shift from healthy, top-down cognitive control to bottom-up, dopamine-seeking impulsivity.

Doomscrolling: Chronic Exposure to Negative, Threatening, or Grotesque Content

Many people casually use the term, but the study provides a precise functional definition:

Doomscrolling = the compulsive consumption of emotionally negative or threat-based content.

Doomscrolling produces:

- Persistent anxiety and hypervigilance

The brain remains locked in a threat-detection mode. - Rumination loops

Negative information gets replayed mentally. - Physiological stress responses

Chronic cortisol elevation impairs cognition. - Reduced memory formation

Stress disrupts hippocampal consolidation. - Attentional fragmentation

The brain becomes primed for scanning, not focusing.

According to the review, doomscrolling directly impairs working memory, emotional regulation, and sustained attention, accelerating cognitive wear-and-tear.

Zombie Scrolling: The Dissociative “Mindless Drift” That Damages Cognition

Doomscrolling is emotionally intense. Zombie scrolling is emotionally empty.

Zombie scrolling = passive, intentionless, dissociative swiping through content with no goal, awareness, or engagement.

Zombie scrolling is associated with:

- Dissociation

The mind drifts, reducing present-moment awareness. - Working-memory depletion

Mindless consumption offers no cognitive stimulation. - Reduced attentional control

The brain becomes conditioned to effortless, low-value input. - Emotional numbing & detachment

Pleasure/reward pathways become desensitized. - Diminished cognitive engagement

The brain stops initiating deeper thought patterns.

The review notes that zombie scrolling may be even more insidious because users don’t feel stressed, so they underestimate the damage — yet the cognitive decline accumulates quietly over time.

Preclinical Dementia Signatures Are Appearing in Younger Generations

A striking findings of the review is that digital-era cognitive decline now mirrors several early dementia–like neurobiological patterns. Across neuroimaging and behavioral studies, excessive digital exposure is linked to reduced hippocampal engagement, producing shallow, fragmented memory formation rather than durable consolidation.

At the same time, prefrontal cortex function—which governs planning, inhibition, and decision-making—shows measurable degradation under chronic multitasking and rapid-fire media input.

This constant overstimulation imposes a chronic cognitive load on the neocortex, creating patterns consistent with accelerated cognitive aging. Notably, several longitudinal findings suggest an elevated lifetime risk of cognitive decline, indicating these effects may not be transient. These changes are well-documented through fMRI and controlled studies included in the review, demonstrating that preclinical neurodegenerative signatures are already emerging in younger populations.

Brain Rot: A Real Neurocognitive Syndrome

The study shows a clear, repeatable pattern: excessive digital exposure to low-quality content degrades working memory, sustained attention, executive function, problem-solving, and emotional regulation. Constant notifications and rapid content switching impair information holding and focus, while overstimulation weakens planning, self-control, and cognitive flexibility.

Both doomscrolling’s emotional overload and zombie scrolling’s emotional emptiness destabilize the central nervous system, producing a more rigid, impulsive, and cognitively inefficient brain. Adolescents exhibit the most severe deficits, underscoring the risk of long-term impact.

The evidence confirms brain rot is a real, emerging early, accelerating quickly, and consuming a generation.

This is one of the core reasons why cognitive disability is now a public health concern in the United States. Cognitive impairment is skyrocketing with no end in sight:

|

Widespread cognitive decline before adulthood may soon become the norm as AI-generated “brain rot” content begins to drastically proliferate.

Epidemiologist and Foundation Administrator, McCullough Foundation

Support our mission: mcculloughfnd.org

Please consider following both the McCullough Foundation and my personal account on X (formerly Twitter) for further content.

FOCAL POINTS (Courageous Discourse) is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

-

Health23 hours ago

Health23 hours agoTens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

-

Opinion18 hours ago

Opinion18 hours agoLandmark 2025 Study Says Near-Death Experiences Can’t Be Explained Away

-

Business2 days ago

Business2 days agoI Was Hired To Root Out Bias At NIH. The Nation’s Health Research Agency Is Still Sick

-

Carbon Tax1 day ago

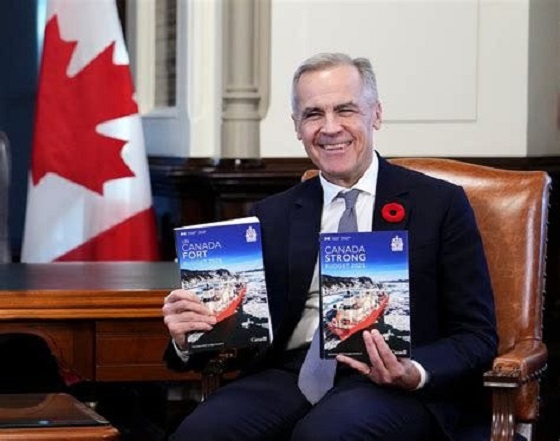

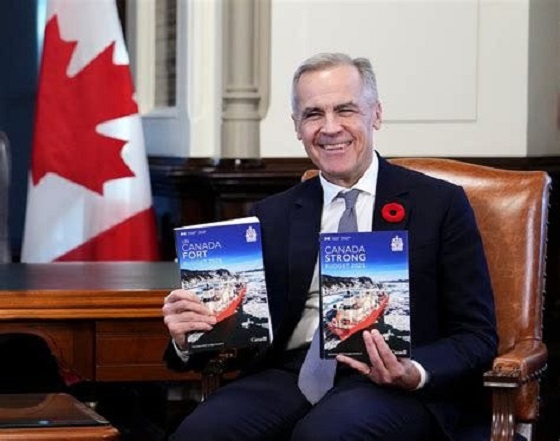

Carbon Tax1 day agoCarney fails to undo Trudeau’s devastating energy policies

-

Business24 hours ago

Business24 hours agoBudget 2025: Ottawa Fakes a Pivot and Still Spends Like Trudeau

-

International1 day ago

International1 day agoCanada’s lost decade in foreign policy

-

armed forces1 day ago

armed forces1 day agoCanada At Risk Of Losing Control Of Its Northern Territories

-

Business2 days ago

Business2 days agoLarge-scale energy investments remain a pipe dream