Economy

Federal government consistently spends beyond high spending targets

From the Fraser Institute

By Matthew Lau

Post-pandemic, the Liberals raised annual spending by nearly $100 billion versus their pre-pandemic fiscal plan.

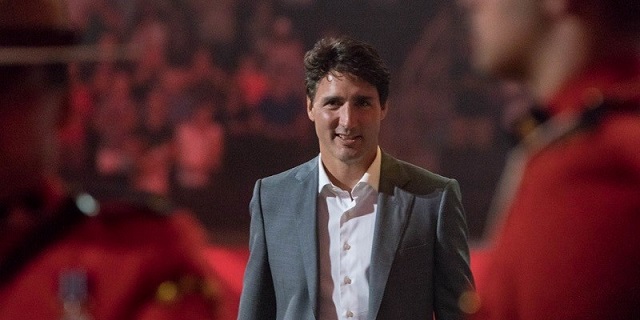

As budget season approaches, one thing is clear. If the Trudeau government is notable for planning astonishingly high levels of spending, it’s equally notable for overspending beyond its original plans. At all times—when they first took office in 2015, in the pre-pandemic years, and now—the Liberals have consistently raised their spending targets, then spent more than targeted.

Begin at the beginning. Inheriting a projected balanced budget in 2015, the Liberals proceeded to spend federal finances into deficit in the 2015-16 fiscal year (ended March 31, 2016) before presenting the first budget of their own in the spring of 2016. That budget called for $1,219 billion in program spending over the next four years. What the government actually ended up spending was $1,269 billion for the 2016-17 to 2019-20 fiscal years, blowing past their initial plan by a cumulative $50 billion.

Even worse, they set government spending on a higher trajectory—while cumulative spending in the Liberals’ first four full fiscal years in office was 4.1 per cent more than initially planned, the spending level for fiscal year 2019-20 alone was actually 11.1 per cent above the original target. So not only did the Liberals overspend their Budget 2016 fiscal plan by $50 billion over four years, they significantly weakened the fiscal outlook by permanently raising baseline spending for future years.

That federal program spending exploded to $624 billion in 2020-21 from $349 billion in 2019-20 is not surprising given the onetime expenses during the pandemic, and the $479 billion in spending in 2021-22 also included pandemic-related costs. But while some COVID spending was justifiable, much of the new spending was not. According to an analysis by Fraser Institute economists, $360 billion in pandemic-related spending, at least 25 per cent was unnecessary waste.

What about after the pandemic? In post-pandemic fiscal year 2022-23, program spending was $448 billion and debt interest expenses $35 billion, for a total of $483 billion. Compare that to what the Liberals initially planned in Budget 2018, the earliest fiscal plan to project out to 2022-23. Budget 2018, itself no model of fiscal responsibility, planned $350 billion in program spending and $33 billion in debt interest costs for a total of $383 billion (excluding a $3 billion “adjustment for risk”) in 2022-23.

So post-pandemic, the Liberals raised annual spending by nearly $100 billion versus their pre-pandemic fiscal plan. Comparing expected spending for 2023-24 with the plan in Budget 2019 shows a similar discrepancy. The 2023 Fall Economic Statement projects $450 billion in program spending and $496 billion in total spending versus $369 billion in program spending and $402 billion in total spending for 2023-24 in the Liberals’ 2019 fiscal plan (which itself contained material upward spending revisions from Budget 2018).

Speaking of the Fall Economic Statement, it also revised the spending trajectory upward from what the Liberals budgeted in the spring. In Budget 2023, the Liberals projected $2,395 billion in program spending over the next five fiscal years—or $2,630 billion including interest expenses. Because of new spending commitments and higher borrowing costs, five-year program spending is now expected to be $2,422 billion ($28 billion higher) and total spending $2,688 billion ($58 billion higher).

That’s a significant spending plan increase in only half a year. However, given the Trudeau government’s track record of missing its targets, don’t be surprised if actual spending comes in even higher than the latest forecast.

Author:

CBDC Central Bank Digital Currency

A Fed-Controlled Digital Dollar Could Mean The End Of Freedom

From the Daily Caller News Foundation

From the Daily Caller News Foundation

Central bank digital currencies (CBDC) are a threat to liberty.

Sixty-eight countries, including communist China, are exploring the possibility of issuing a CBDC. CBDCs are essentially government-sponsored cryptocurrencies pegged to the value of a national currency that allow for real-time payments.

The European Union has a digital euro CBDC pilot program, and all BRICS nations (Brazil, Russia, India, China and South Africa) are working to stand up CBDCs. China’s CBDC pilot, the largest in the world, is being used by 260 million individuals.

While faster payments are a positive for markets and economic growth, CBDCs present major risks. They would allow governments to meticulously monitor transactions made by their citizens, and CBDCs open the door for government planners to limit the types of transactions made.

Power corrupts, and no government should have that level of control. No wonder China and other authoritarian regimes around the globe are eager to implement a CBDC.

Governments that issue CBDCs could prohibit the sale or purchase of certain goods or services and more easily freeze and seize assets. But that would never happen in the U.S, right? Don’t be so certain.

Take a look at recent events in our neighbor to the north. The government of Canada shut down bank accounts and froze assets of Canadian citizens protesting the COVID-19 vaccination in Ottawa during the winter of 2022. With a CBDC, authoritarian actions of this kind would be even easier to execute.

To make matters worse, the issuance of a CBDC by the Federal Reserve, the U.S.’s central bank, has the potential to undermine the existing banking system. The exact ramifications of what a CBDC would mean to the banking sector are unclear, but such a development could position the Fed to offer banking services directly to American businesses and citizens, undercutting the community banks, credit unions, and other financial institutions that currently serve main street effectively.

The Fed needs to stay out of the banking business – it’s having a hard enough time achieving its core mission of getting inflation under control. A CBDC would open the door for the Fed to compete with the private sector, undercutting economic growth, innovation, and financial access in the process.

Fed Chair Jerome Powell has testified before Congress that America’s central bank would not issue a CBDC without express approval from Congress, but the Fed has studied CBDCs extensively.

For consumers who want the ability to make real-time payments internationally, CBDCs are not the answer. Stablecoins offer a commonsense private sector solution to this market demand.

Stablecoins are a type of cryptocurrency pegged to the value of a certain asset, such as the U.S. dollar. If Congress gets its act together and creates a regulatory framework for stablecoins, many banks, cryptocurrency firms, and other innovative private sector entities would issue dollar-pegged stablecoins. These financial instruments would allow for instantaneous cross-border payments for market participants who find that service of value.

Stablecoins are the free market response to CBDCs. They offer the benefits associated with the technology without the privacy risk, and they would likely enhance, not disrupt, the existing banking sector.

Representatives Patrick McHenry (R-N.C.) and French Hill (R-Ark.) have done yeoman’s work advancing quality, commonsense stablecoin legislation in the House of Representatives, and the Senate needs to move forward on this issue.

Inaction by Congress will force innovators overseas and put the U.S. at a competitive disadvantage. It would also help the Fed boost the case for a CBDC that will undermine liberty and open the door to government oppression.

Tommy Tuberville is a Republican from Alabama serving in the United States Senate. He is a member of the Senate Agriculture Committee, which plays a key role in overseeing emerging digital assets markets.

Business

Taxpayers criticize Trudeau and Ford for Honda deal

From the Canadian Taxpayers Federation

Author: Jay Goldberg

The Canadian Taxpayers Federation is criticizing the Trudeau and Ford governments to for giving $5 billion to the Honda Motor Company.

“The Trudeau and Ford governments are giving billions to yet another multinational corporation and leaving middle-class Canadians to pay for it,” said Jay Goldberg, CTF Ontario Director. “Prime Minister Justin Trudeau is sending small businesses bigger a bill with his capital gains tax hike and now he’s handing out billions more in corporate welfare to a huge multinational.

“This announcement is fundamentally unfair to taxpayers.”

The Trudeau government is giving Honda $2.5 billion. The Ford government announced an additional $2.5 billion subsidies for Honda.

The federal and provincial governments claim this new deal will create 1,000 new jobs, according to media reports. Even if that’s true, the handout will cost taxpayers $5 million per job. And according to Globe and Mail investigation, the government doesn’t even have a proper process in place to track whether promised jobs are actually created.

The Parliamentary Budget Officer has also called into question the government’s claims when it made similar multi-billion-dollar handouts to other multinational corporations.

“The break-even timeline for the $28.2 billion in production subsidies announced for Stellantis-LGES and Volkswagen is estimated to be 20 years, significantly longer than the government’s estimate of a payback within five years for Volkswagen,” wrote the Parliamentary Budget Officer said.

“If politicians want to grow the economy, they should cut taxes and red tape and cancel the corporate welfare,” said Franco Terrazzano, CTF Federal Director. “Just days ago, Trudeau said he wants the rich to pay more, so he should make rich multinational corporations pay for their own factories.”

-

Automotive1 day ago

Automotive1 day agoThe EV ‘Bloodbath’ Arrives Early

-

CBDC Central Bank Digital Currency1 day ago

CBDC Central Bank Digital Currency1 day agoA Fed-Controlled Digital Dollar Could Mean The End Of Freedom

-

Business2 days ago

Business2 days agoHonda deal latest episode of corporate welfare in Ontario

-

Frontier Centre for Public Policy22 hours ago

Frontier Centre for Public Policy22 hours agoHow much do today’s immigrants help Canada?

-

espionage2 days ago

espionage2 days agoOne in five mail-in voters admitted to committing voter fraud during 2020 election: Rasmussen poll

-

Brownstone Institute1 day ago

Brownstone Institute1 day agoThe Numbers Favour Our Side

-

Fraser Institute1 hour ago

Fraser Institute1 hour agoFederal government’s fiscal record—one for the history books

-

Alberta1 hour ago

Alberta1 hour agoPrincipal at Calgary Elementary School charged with possession of child pornography