Energy

Energy wise, how do you even describe 2024?

From the Frontier Centre for Public Policy

By Terry Etam

There still remains a full court press in North America/western Europe among certain socioeconomic classes to “just stop oil” and the like. While we as an industry in many ways remain in our foxholes, and the opponents of hydrocarbons roam freely, looking to criminalize if at all possible any positive dialogue about the value of hydrocarbons.

Huh. Look at that. It’s been ten years since I started writing about energy. Not that that particular trivia interests anyone, why would it, however it is interesting to look back at the impetus for writing and how that has changed.

Ten years ago, as I worked in a communications department for an energy infrastructure business that did not like publicity of any kind whatsoever, it began to dawn on me how dangerous were the habits that formed thereof, and how far reaching the consequences. As but one example, anti-pipeline activists were all over Washington DC like ants on a mound, pressuring the government to kill the Keystone XL pipeline. They swarmed social media and a motivated army spread the gospel like wildfire, truth be damned.

The pipeline industry looked at the energy ignoramuses and kind of just sniggered, for they knew they were right – pipelines were and are the safest and most reliable form of liquid/gas transportation, forming a global industrial backbone we can’t even imagine living without – and there seemed a largely prevailing attitude in industry that these pipeline facts were so glaringly obvious that everyone would figure it out. I still hear the chortling: “Look at those lunatics, protesting pipelines without knowing they’re standing on one that’s been there for 40 years.”

Yeah, well, the lunatics did pretty well didn’t they… Keystone XL is a distant memory, the US Mountain Valley Pipeline is years late and twice over budget, and even TMX is only now limping into service at what, about 700 times over budget and equally late… I shudder to think what kind of back room deals were cut with extremists who promised TMX would never be built and yet now stand silent. If we had a conservative prime minister at the helm now trying to complete TMX, I would bet my ears that the going wouldn’t be as protest-lite as it is now.

Ten years ago, the impetus was to fill a void in public energy knowledge because there wasn’t much of an effective voice that was doing so. If there was, there was scant evidence of any success. So that was kind of fun, going for the low hanging fruit of explaining energy nuances to a public that cared about nothing except utility bills and what it cost to fill up the family beast.

But that excitement faded as the energy industry’s inability to articulate its value was overwhelmed by the likes of Greta Thunberg, a Swedish teen that was hoisted onto the shoulders of cagey mobs, and thrust into the public consciousness as some sort of Jesus-like figure. At that point, the battlefield was completely overrun, and the oil/gas industry seemed to head underground and wait for the storm to pass. What a mistake.

There still remains a full court press in North America/western Europe among certain socioeconomic classes to “just stop oil” and the like. While we as an industry in many ways remain in our foxholes, and the opponents of hydrocarbons roam freely, looking to criminalize if at all possible any positive dialogue about the value of hydrocarbons. But. The anti-fossil fuel people are so busy working on Orwellian regulations/policies/roadmaps that they haven’t looked over their shoulders at the storm clouds brewing, the ones that hydrocarbon producers always knew would arrive.

As seven out of eight billion people on earth strive to live like the west does, the inevitable is happening: global demand for energy, in all forms, is soaring, and absolutely no one wants to take a step backwards in terms of standard of living. The world wants to add a billion air conditioners, because those things are life-transforming (see: any modern glass-cube high rise residential/commercial building, modern hospitals/seniors centers, etc), and the comfy west wants to add an estimated $250 billion per year in data centers because we can and it looks fun.

We haven’t even begun to figure out how to rewire the world for an energy transition even if we used energy consumption from 20 years ago as the starting point; today, we can’t keep up using all our resources. Every year, we set new records for solar installations, wind installations, coal consumption, oil consumption… and new natural gas infrastructure is being built around the world backed by multi-decade contracts. The fight over nuclear continues in the oddly ridiculous way it now goes, with countries within the same jurisdiction (EU, for example) shutting down nuclear facilities (Germany) on safety or environmental (?) grounds while countries right beside them add new ones. In the US, the same craziness is happening within the country; places like New York shuttering nuclear facilities while other parts of the country develop new ones.

What makes energy commentary challenging these days is that we’ve become desensitized to such insanity, we are pickled in it, and treat it as just the regular public discourse. I mean really. Look at Germany’s self inflicted damage in shutting down its nuclear plants on the grounds of safety. How much safer are Germans if Belgium builds new ones next door?

We’ve become used to the blaring theme “electrify everything” when we can clearly see, if we choose to look, that electrifying anything at all is becoming more challenging, with grid operators all over the place issuing warnings about potential energy shortages/rolling blackouts or brownouts/falling grid reliability.

AI is coming. Like a freight train. No one is prepared for it. Anyone paying attention is sounding the alarm bells: Power consumption is going to go through the roof. And that is in addition to a world that continues to set new energy usage records relentlessly, a trend that seems unstoppable and huge even before AI.

The storm clouds are there, they are growing, and no one wants to look up.

And then we need to set this insanity against a truly mind-boggling global geopolitical framework that looks like something out of Monty Python.

China is an amazing object, like a parallax, that looks completely different depending on your vantage point. By that I mean: energy transition advocates, the ones that ‘just know’ that net-zero 2050 is inevitable and simply requires more ‘policy’, point to China as a green hero, installing more solar than any other country, at breakneck pace. At the same time, the opposite camp that ‘just knows’ that net-zero 2050 has no chance due to the sheer challenge point out that China is constructing new coal-fired power plants at a rate of two per week.

Both are right. So are the people that rejoice at how solar panels have become so much cheaper due to China’s manufacturing prowess, as are the people that point out the staggering environmental footprint of building all that stuff behind a somewhat opaque curtain.

The people that herald the rise of China’s EV adoption are right, but so are the people that fear China’s control of most of the critical mineral/metal supply/processing chain.

India is a rising behemoth. The EU still thinks it runs the world. The US’ leadership is a gym full of blindfolded shouting people running at full speed. Canada thinks it is the world’s conscience, to the extent it is still thinking at all, building foreign and local policy on the notion that Canadians are the global good guys, a selfless hero running around the globe’s stages eagerly saying politically correct things while back home the wheels are coming off. Watch us impale our economy on a stick just to show the world that no one can possibly be morally superior. Russia is a vodka-soaked-yet-clever power monger with some thousand-year-old chip on its shoulder and enough bullets to fill a million Ladas. The Middle East remains the Middle East, reliably distributing both petroleum products and anger to every corner of the world…

The world’s biggest economies are so far in debt that they don’t know what to do, and we must painfully watch central bankers craft new policies and plans under the faulty pretense that they do know what they’re doing. The US is adding a trillion dollars worth of debt every hundred days, and the gurus of monetary policy are watching the economy with the wisdom and effectiveness of a time-forgotten goat-herder buying a cell phone before he’s found out what electricity is.

The future is never certain. Obviously. There will be black swans, rare events that have major global seismic repercussions. Terrorists are pretty good at destabilizing the world with a flick of the wrist, doing more damage than a tsunami, but then there are tsunamis as well. And all sorts of human hijinks that can throw a spanner in the works quite easily because we are all one step away from snapping.

There will be new wars, apparently, the peace dividend nothing but a dead deer on the side of the road. Political polarization is so severe that at any given time some substantial percent of the population believes that if their political enemy gets elected that ‘the future of the nation is at stake’. In the US two very ancient people are leading these charges, and every single American I talk to says, in a burst of frustration, “How the hell did we get here, and why are those two the only choices?”

And all of us that pay attention to energy ask the very same questions about the energy world. We watch economic powerhouses like Germany and California screw themselves into the ground with remarkable efficiency. We can see these problems arising. We listen to grid operators that warn of coming instability instead of shouting them down or tossing them out and replacing them with people that toe the line.

The energy industry is, despite all the madness, making actual strides in reducing emissions, developing new types of energy, developing carbon sequestration options, working on hydrogen programs, integrating with all sorts of green technology. It’s tough slogging, because most attempts are met with chants of “greenwash, greenwash” by people that don’t want progress, they want fossil fuels dead and gone. As their vision of a solution, they throw soup on famous paintings. The world stands in awe, like watching a naked drunk lurch across a freeway, oblivious to his surroundings.

One good thing about the world of energy though, compared to the utter lunacy of the global political/geopolitical/sociological mess, is that we can see fairly clearly where energy is going. The crazed experiments, the building of castles to the sky, will slow to a pace that makes sense and is digestible. Global demand for oil, natural gas, and it looks like even coal will stay strong for several decades at least. Nuclear power will have a renaissance, and new technologies or battery breakthroughs will enter the scene at a rate that the world can handle. It won’t be pretty or linear or without strife, but that’s how it will be. People won’t live without cheap reliable energy.

So if you’re in the energy business, take heart – in the world of political theatre, reality is whatever you can get away with convincing the world that it is. In the world of energy, fuel is fuel, availability is availability, and we can at least count on the fact that despite all the handwringing and grandiose policy that reality can’t be evaded. It might be small comfort but at least it’s real.

Terry Etam is a columnist with the BOE Report, a leading energy industry newsletter based in Calgary. He is the author of The End of Fossil Fuel Insanity. You can watch his Policy on the Frontier session from May 5, 2022 here.

Alberta

COWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

Fr0m Energy Now

As Calgarians take a break from the incessant news of tariff threat deadlines and global economic challenges to celebrate the annual Stampede, Conservative party leader Pierre Poilievre gave them even more to celebrate.

Poilievre returned to Calgary, his hometown, to outline his plan to amplify the legitimate demands of Western Canada and not only fight for oil and gas, but also fight for the interests of farmers, for low taxes, for decentralization, a stronger military and a smaller federal government.

Speaking at the annual Conservative party BBQ at Heritage Park in Calgary (a place Poilievre often visited on school trips growing up), he was reminded of the challenges his family experienced during the years when Trudeau senior was Prime Minister and the disastrous effect of his economic policies.

“I was born in ’79,” Poilievre said. “and only a few years later, Pierre Elliott Trudeau would attack our province with the National Energy Program. There are still a few that remember it. At the same time, he hammered the entire country with money printing deficits that gave us the worst inflation and interest rates in our history. Our family actually lost our home, and we had to scrimp and save and get help from extended family in order to get our little place in Shaughnessy, which my mother still lives in.”

This very personal story resonated with many in the crowd who are now experiencing an affordability crisis that leaves families struggling and young adults unable to afford their first house or condo. Poilievre said that the experience was a powerful motivator for his entry into politics. He wasted no time in proposing a solution – build alliances with other provinces with mutual interests, and he emphasized the importance of advocating for provincial needs.

“Let’s build an alliance with British Columbians who want to ship liquefied natural gas out of the Pacific Coast to Asia, and with Saskatchewanians, Newfoundlanders and Labradorians who want to develop their oil and gas and aren’t interested in having anyone in Ottawa cap how much they can produce. Let’s build alliances with Manitobans who want to ship oil in the port of Churchill… with Quebec and other provinces that want to decentralize our country and get Ottawa out of our business so that provinces and people can make their own decisions.”

Poilievre heavily criticized the federal government’s spending and policies of the last decade, including the increase in government costs, and he highlighted the negative impact of those policies on economic stability and warned of the dangers of high inflation and debt. He advocated strongly for a free-market economy, advocating for less government intervention, where businesses compete to impress customers rather than impress politicians. He also addressed the decade-long practice of blocking and then subsidizing certain industries. Poilievre referred to a famous quote from Ronald Reagan as the modus operandi of the current federal regime.

“The Government’s view of the economy could be summed up in a few short phrases. If anything moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

The practice of blocking and then subsidizing is merely a ploy to grab power, according to Poilievre, making industry far too reliant on government control.

“By blocking you from doing something and then making you ask the government to help you do it, it makes you reliant. It puts them at the center of all power, and that is their mission…a full government takeover of our economy. There’s a core difference between an economy controlled by the government and one controlled by the free market. Businesses have to clamour to please politicians and bureaucrats. In a free market (which we favour), businesses clamour to impress customers. The idea is to put people in charge of their economic lives by letting them have free exchange of work for wages, product for payment and investment for interest.”

Poilievre also said he plans to oppose any ban on gas-powered vehicles, saying, “You should be in the driver’s seat and have the freedom to decide.” This is in reference to the Trudeau-era plan to ban the sale of gas-powered cars by 2035, which the Carney government has said they have no intention to change, even though automakers are indicating that the targets cannot be met. He also intends to oppose the Industrial Carbon tax, Bill C-69 the Impact Assessment Act, Bill C-48 the Oil tanker ban, the proposed emissions cap which will cap energy production, as well as the single-use plastics ban and Bill C-11, also known as the Online Streaming Act and the proposed “Online Harms Act,” also known as Bill C-63. Poilievre closed with rallying thoughts that had a distinctive Western flavour.

“Fighting for these values is never easy. Change, as we’ve seen, is not easy. Nothing worth doing is easy… Making Alberta was hard. Making Canada, the country we love, was even harder. But we don’t back down, and we don’t run away. When things get hard, we dust ourselves off, we get back in the saddle, and we gallop forward to the fight.”

Cowboy up, Mr. Poilievre.

Maureen McCall is an energy professional who writes on issues affecting the energy industry.

Alberta

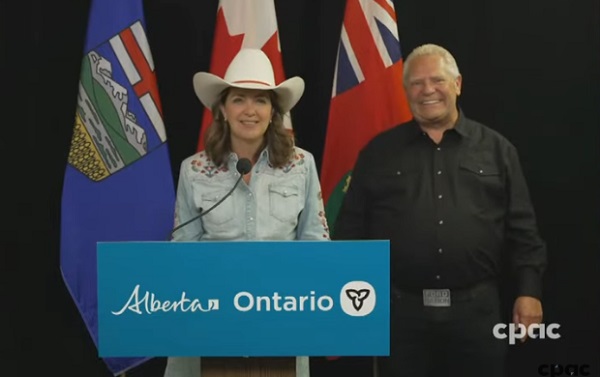

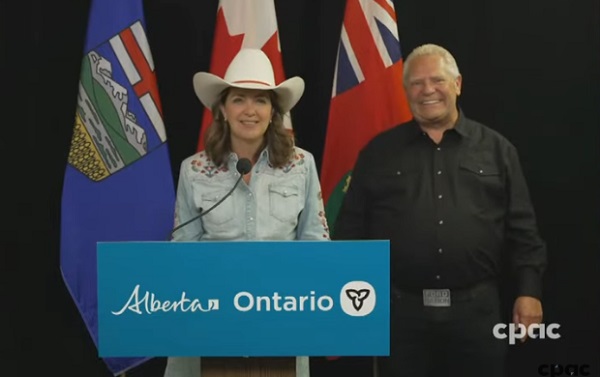

Alberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

Alberta-Ontario MOUs fuel more pipelines and trade

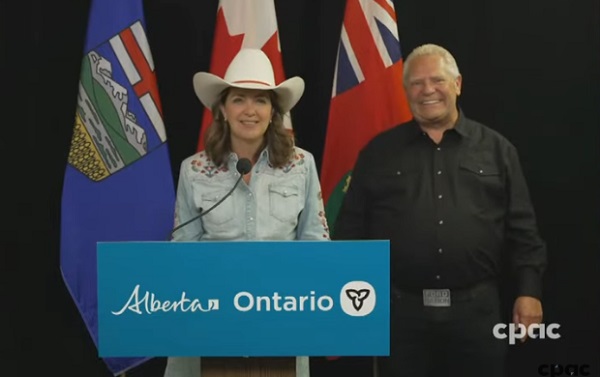

Alberta Premier Danielle Smith and Ontario Premier Doug Ford have signed two memorandums of understanding (MOUs) during Premier Ford’s visit to the Calgary Stampede, outlining their commitment to strengthen interprovincial trade, drive major infrastructure development, and grow Canada’s global competitiveness by building new pipelines, rail lines and other energy and trade infrastructure.

The two provinces agree on the need for the federal government to address the underlying conditions that have harmed the energy industry in Canada. This includes significantly amending or repealing the Impact Assessment Act, as well as repealing the Oil Tanker Moratorium Act, Clean Electricity Regulations, the Oil and Gas Sector Greenhouse Gas Emissions Cap, and all other federal initiatives that discriminately impact the energy sector, as well as sectors such as mining and manufacturing. Taking action will ensure Alberta and Ontario can attract the investment and project partners needed to get shovels in the ground, grow industries and create jobs.

The first MOU focuses on developing strategic trade corridors and energy infrastructure to connect Alberta and Ontario’s oil, gas and critical minerals to global markets. This includes support for new oil and gas pipeline projects, enhanced rail and port infrastructure at sites in James Bay and southern Ontario, as well as end-to-end supply chain development for refining and processing of Alberta’s energy exports. The two provinces will also collaborate on nuclear energy development to help meet growing electricity demands while ensuring reliable and affordable power.

The second MOU outlines Alberta’s commitment to explore prioritizing made-in-Canada vehicle purchases for its government fleet. It also includes a joint commitment to reduce barriers and improve the interprovincial trade of liquor products.

“Alberta and Ontario are joining forces to get shovels in the ground and resources to market. These MOUs are about building pipelines and boosting trade that connects Canadian energy and products to the world, while advocating for the right conditions to get it done. Government must get out of the way, partner with industry and support the projects this country needs to grow. I look forward to working with Premier Doug Ford to unleash the full potential of our economy and build the future that people across Alberta and across the country have been waiting far too long for.”

“In the face of President Trump’s tariffs and ongoing economic uncertainty, Canadians need to work together to build the infrastructure that will diversify our trading partners and end our dependence on the United States. By building pipelines, rail lines and the energy and trade infrastructure that connects our country, we will build a more competitive, more resilient and more self-reliant economy and country. Together, we are building the infrastructure we need to protect Canada, our workers, businesses and communities. Let’s build Canada.”

These agreements build on Alberta and Ontario’s shared commitment to free enterprise, economic growth and nation-building. The provinces will continue engaging with Indigenous partners, industry and other governments to move key projects forward.

“Never before has it been more important for Canada to unite on developing energy infrastructure. Alberta’s oil, natural gas, and know-how will allow Canada to be an energy superpower and that will make all Canadians more prosperous. To do so, we need to continue these important energy infrastructure discussions and have more agreements like this one with Ontario.”

“These MOUs with Ontario build on the work Alberta has already done with Saskatchewan, Manitoba, Northwest Territories and the Port of Prince Rupert. We’re proving that by working together, we can get pipelines built, open new rail and port routes, and break down the barriers that hold back opportunities in Canada.”

“Canada’s economy has an opportunity to become stronger thanks to leadership and steps taken by provincial governments like Alberta and Ontario. Removing interprovincial trade barriers, increasing labour mobility and attracting investment are absolutely crucial to Canada’s future economic prosperity.”

Together, Alberta and Ontario are demonstrating the shared benefits and opportunities that result from collaborative partnerships, and what it takes to keep Canada competitive in a changing world.

Quick facts

- Steering committees with Alberta and Ontario government officials will be struck to facilitate work and cooperation under the agreements.

- Alberta and Ontario will work collaboratively to launch a preliminary joint feasibility study in 2025 to help move private sector led investments in rail, pipeline(s) and port(s) projects forward.

- These latest agreements follow an earlier MOU Premiers Danielle Smith and Doug Ford signed on June 1, 2025, to open up trade between the provinces and advance shared priorities within the Canadian federation.

Related information

-

Daily Caller2 days ago

Daily Caller2 days agoTrump’s One Big Beautiful Bill Resets The Energy Policy Playing Field

-

Alberta9 hours ago

Alberta9 hours agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Immigration

-

Business2 days ago

Business2 days agoThe Digital Services Tax Q&A: “It was going to be complicated and messy”

-

International2 days ago

International2 days agoElon Musk forms America Party after split with Trump

-

Disaster2 days ago

Disaster2 days agoTexas flood kills 43 including children at Christian camp

-

Alberta9 hours ago

Alberta9 hours agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

COVID-1912 hours ago

COVID-1912 hours agoFDA requires new warning on mRNA COVID shots due to heart damage in young men