Energy

Energy policies proposed at Republican and Democrat conventions are worlds apart

From the Daily Caller News Foundation

From the Daily Caller News Foundation

Democrats Are On A Different Planet

As Republicans and Democrats meet at the conventions and propose policies for the next four years, the contrast between Republican and Democrat energy policies could not be greater.

Republicans would speed up oil and natural gas production; eliminate mandates to purchase electric vehicles; get rid of subsidies for renewables; and end dependence on China. Democrats propose to electrify the energy supply, ridding the economy of gasoline-powered vehicles and natural-gas appliances and substituting solar and wind for legacy fuels.

Through a series of executive orders and regulations, President Joe Biden has reduced federal oil and gas leases. America has 373.1 billion barrels of technically recoverable crude oil resources, and 2,973 trillion cubic feet of technically recoverable natural gas resources — an 85-year supply. Expect the next Republican administration to encourage production and use these resources to lower energy prices at home and around the world.

A Republican president would be able to reverse Biden’s executive orders and regulations. Increasing energy production is fourth out of 20 promises in the 2024 Republican Platform, “We will DRILL, BABY, DRILL and we will become Energy Independent, and even Dominant again. The United States has more liquid gold under our feet than any other Nation, and it’s not even close. The Republican Party will harness that potential to power our future.”

A Republican administration would allow a choice in cars. The Republican Party Platform calls for cancelling the mandate for EVs.

The Biden administration is subsidizing electric vehicles through the Inflation Reduction Act. Companies are paid to manufacture these EVs and consumers get tax credits to buy them. The Environmental Protection Agency’s final tailpipe rule would require 70% of new cars sold and 25% or new trucks sold to be battery powered electric or plug-in hybrid by 2032.

The Biden administration has focused on providing wind and solar power through billions in tax credits in the Infrastructure and Jobs Act and the Inflation Reduction Act. Either directly or through access to banks and Wall Street investors, it is deciding who is suitable to receive funding for energy projects.

But government control of energy is control of people and the economy. This is one reason why the trend toward nationalization of our energy industry through government mandates, bans on the production and use of oil and natural gas and reorganization of the electric grid is so dangerous.

Under a new Republican administration, rather than slowing down pipeline approval, the Federal Energy Regulatory Commission would focus on speeding it up. The Bureau of Land Management would prioritize approving both onshore and offshore drilling permits. The Security and Exchange Commission would no longer look at climate effects of companies’ investments, and the Office of the Comptroller of the Currency would not look at the climate effects of bank loans.

Democrat energy policies increase dependence on China because China makes nearly 80% of the world’s batteries and is home to 7 out of 10 of the world’s largest solar panel manufacturers, and 7 out of 10 of the world’s largest wind turbine manufacturers. China dominates the critical minerals such as lithium and cobalt required for EVs through its own mines and by purchasing mines in Africa and Latin America.

Trade with China is not free or fair. China can produce lower-cost goods because it subsidizes labor, capital and energy. It uses forced labor from Xinjiang; gives low-interest rate loans to favored companies; and is not bound by the clean energy regulations of the West.

The next administration should use America’s domestic resources and provide tools to assist our allies and deter our adversaries.

Diana Furchtgott-Roth, former deputy assistant secretary for research and technology at the U.S. Department of Transportation, is the director of The Heritage Foundation’s Center for Energy, Climate and Environment.

Bruce Dowbiggin

Integration Or Indignation: Whose Strategy Worked Best Against Trump?

““He knows nothing; and he thinks he knows everything. That points clearly to a political career.” George Bernard Shaw

In the days immediately following Donald Trump’s rude intervention into the 2025 Canadian federal election— suggesting Canada might best choose American statehood— two schools of thought emerged.

The first and most impactful school in the short term was the fainting-goat response of Canadian’s elites. Sensing an opening in which to erode Pierre Poilievre’s massive lead in the 2024 polls over Justin Trudeau, the Laurentian elite concocted Elbows Up, a self-pity response long on hurt feelings and short on addressing the issues Trump had cited in his trashing of the Canadian nation state.

In short order they fired Trudeau into oblivion, imported career banker Mark Carney as their new leader in a sham convention and convinced Canada’s Boomers that Trump had the tanks ready to go into Saskatchewan at a moment’s notice. The Elbows Up meme— citing Gordie Howe— clinched the group pout.

(In fact, Trump has said that America is the world’s greatest market, and if those who’ve used it for free in the past [Canada] want to keep special access they need to pay tariffs to the U.S. or drop protectionist charges on dairy and more against the U.S.)

The ruse worked out better than they could have ever imagined with Trump even saying he preferred to negotiate with Carney over Poilievre. In short order the Tories were shoved aside, the NDP kneecapped and the pet media anointed Carney the genius skewing Canada away from its largest trade partner to the Eurosphere. We remain in that bubble, although the fulsome promises of Carney’s first days are now coming due.

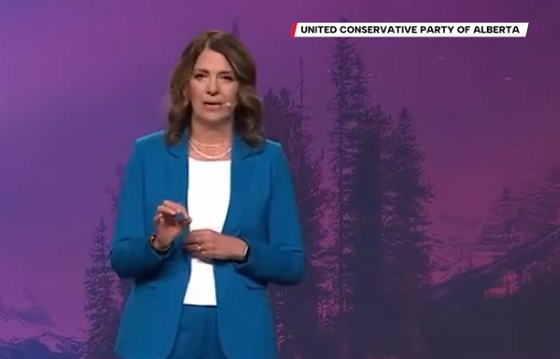

Which brings us to the second reaction. That was Alberta premier Danielle Smith bolting to Mar A Lago in the days following Trump’s comments. Her goal was to put pride aside and accept that a new world order was in play for Canada. She met with U.S. officials and, briefly, with Trump to remind them that Canada’s energy industry was integral to American prosperity and Canadian stability.

Needless to say, the fainting goats pitched a fit that not everyone was clutching pearls and rending garments in the wake of Trump’s dismissive assessment of his northern neighbours. Their solution to Trump was to join China in retaliatory tariffs— the only two nations to do so— and to boycott American products and travel. Like the ascetic monks they cut themselves off from real life. Trump has yet to get back to Carney the Magnificent

And Smith? She was a “traitor” or a “subversive” who should be keel hauled in the North Saskatchewan. For much of the intervening months she has been attacked at home in Alberta by the N-Deeps and in Ottawa by just about everyone on CBC, CTV, Global and the Globe & Mail. “How could she meet with the Cheeto?”

Nonetheless conservatives in the province moved toward a more independence within Canada. Smith articulated her demands for Alberta to prevent a referendum on whether to remain within Confederation. At the top of her list were pipelines and access to tidewater. Ergo, a no-go for BC’s squish premier David Eby who is the process of handing over his province to First Nations.

It became obvious that for all of Carney’s alleged diplomacy in Europe and Asia (is the man ever home?) he had a brewing disaster in the West with Alberta and Saskatchewan growing restless. In a striking move against the status quo, Nutrien announced it would ship its potash to tidewater via the U.S., thereby bypassing Vancouver’s strike-prone, outdated port and denying them billions.

Suddenly, Smith’s business approach began making eminent good sense if the goal is to keep Canada as one. So we saw last week’s “memorandum of understanding” between Alberta and Ottawa trading off carbon capture and carbon taxes for potential pipelines to tidewater on the B.C. coast. A little bit of something for everyone and a surrender on other things.

The most amazing feature of the Mark Carney/Danielle Smith MOU is that both politicians probably need the deal to fail. Carney can tell fossil-fuel enemy Quebec that he tried to reason with Smith, and Smith can say she tried to meet the federalists halfway. Failure suits their larger purposes. Which is for Carney to fold Canada into Euro climate insanity and Smith into a strong leverage against the pro-Canada petitioners in her province.

Soon enough, at the AFN Special Chiefs Assembly, FN Chief Cindy Woodhouse Nepinak told Carney that “Turtle Island” (the FN term for North America popularized by white hippy poet Gary Snyder) belongs to the FN people “from coast to coast to coast.” The pusillanimous Eby quickly piped up about tanker bans and the sanctity of B.C. waters etc.

Others pointed out the massive flaw in a plan to attract private interests to build a vital bitumen pipeline if the tankers it fills are not allowed to sail through the Dixon Entrance to get to Asia.

But then Eby got Nutrien’s message that his power-sharing with the indigenous might cause other provinces to bypass B.C. (imagine California telling Texas it can’t ship through its ports over moral objections to a product). He’s now saying he’s open to pipelines but not to lift the tanker ban along the coast. Whatever.

Meanwhile the kookaburras of isolation back east continue with virtue signalling on American booze— N.S. to sell off its remains stocks — while dreaming that Trump’s departure will lead to the good-old days of reliance on America’s generosity.

But Smith looks to be wining the race. B.C.’s population shrank 0.04 percent in the second quarter of 2025, the only jurisdiction in Canada to do so. Meanwhile, Alberta is heading toward five million people, with interprovincial migrants making up 21 percent of its growth.

But what did you expect from the Carney/ Eby Tantrum Tandem? They keep selling fear in place of GDP. As GBS observed, “You have learnt something. That always feels at first as if you have lost something.”

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, his new book Deal With It: The Trades That Stunned The NHL And Changed hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His 2004 book Money Players was voted sixth best on the same list, and is available via brucedowbigginbooks.ca.

Business

Canada’s climate agenda hit business hard but barely cut emissions

This article supplied by Troy Media.

By Gwyn Morgan

By Gwyn Morgan

Canada is paying a steep economic price for climate policies that have delivered little real environmental progress

In 2015, the newly elected Trudeau government signed the Paris Agreement. The following year saw the imposition of the Pan-Canadian Framework on Clean Growth and Climate Change, which included more than 50 measures aimed at “reducing carbon emissions and fostering clean technology solutions.” Key among them was economy-wide carbon “pricing,” Liberal-speak for taxes.

Other measures followed, culminating last December in the 2030 Emissions Reduction Plan, targeting emissions of 40 per cent below 2005 levels by 2030 and net-zero emissions by 2050. It included $9.1 billion for retrofitting structures, subsidizing zero-emission vehicles, building charging stations and subsidizing solar panels and windmills. It also mandated the phaseout of coal-fired power generation and proposed stringent emission standards for vehicles and buildings.

Other “green initiatives” included the “on-farm climate action fund,” a nationwide reforestation initiative to plant two billion trees, the “Green and Inclusive Community Buildings Program” to promote net-zero standards in new construction, and a “Green Municipal Fund” to support municipal decarbonization. That’s a staggering list of nation-impoverishing subsidies, taxes and restrictions.

Those climate measures come at a real cost to the industry that drives the nation’s economy.

The Trudeau government cancelled the Northern Gateway oil pipeline to the northwest coast, which had been approved by the Harper government, costing sponsors hundreds of millions of dollars in preconstruction expenditures. The political and regulatory morass the Liberals created eventually led to the cancellation of all but one of the 12 LNG export proposals.

Have all those taxes and regulatory measures reduced Canada’s fossil-fuel consumption? No. As Bjorn Lomborg has reported, between the election of the Trudeau government in 2015 through 2023, fossil fuels’ share of Canada’s energy supply increased from 75 to 77 per cent.

That dismal result wasn’t for lack of trying. The Fraser Institute has found that Ottawa and the four biggest provinces have either spent or forgone a mind-numbing $158 billion to create just 68,000 “clean” jobs, increasing the “green economy” by a minuscule 0.3 percentage points to 3.6 per cent of GDP at an eye-watering cost of more than $2.3 million per job.

That’s Canada’s emissions reduction debacle. What’s the global picture? A decade after Paris, 80 per cent of the world’s energy still comes from fossil fuels. World energy demand is up 150 per cent. Canada, which produces roughly 1.5 per cent of global emissions, cannot influence that trajectory. And, as Lomborg writes: “achieving net zero emissions by 2050 would require the removal of the equivalent of the combined emissions of China and the United States in each of the next five years. This puts us in the realm of science fiction.”

Does this mean our planet will become unlivable? A U.S. Department of Energy report issued in July is grounds for optimism. It finds that “claims of increased frequency or intensity of hurricanes, tornadoes, floods and droughts are not supported by U.S. historical data.” And it goes on: “CO2-induced warming appears to be less damaging economically than commonly believed and aggressive mitigation policies could be more detrimental than beneficial.”

U.S. Secretary of Energy Chris Wright responded to the report by saying: “Climate change is real … but it is not the greatest threat facing humanity … (I)mproving the human condition depends on access to reliable, affordable energy.”

That leaves no doubt as to where our largest trading partner stands on carbon emissions. But don’t expect Prime Minister Mark Carney, who helped launch the Glasgow Financial Alliance for Net Zero (GFANZ) at COP 26 in that city in 2021 and co-chaired it until this January, to soften his stand on carbon taxes. His just-released budget imposes carbon tax increases of $80 to $170 per ton by 2030 on our already struggling industries.

Doing so increases Canadian businesses’ competitive disadvantage with our most important trading partner while doing essentially nothing to help the environment.

Gwyn Morgan is a retired business leader who has been a director of five global corporations.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta2 days ago

Alberta2 days agoThis new Canada–Alberta pipeline agreement will cost you more than you think

-

Energy2 days ago

Energy2 days agoUnceded is uncertain

-

Automotive2 days ago

Automotive2 days agoPower Struggle: Governments start quietly backing away from EV mandates

-

Business18 hours ago

Business18 hours agoCanada’s climate agenda hit business hard but barely cut emissions

-

Energy22 hours ago

Energy22 hours agoCanada following Europe’s stumble by ignoring energy reality

-

MAiD1 day ago

MAiD1 day agoFrom Exception to Routine. Why Canada’s State-Assisted Suicide Regime Demands a Human-Rights Review

-

Alberta2 days ago

Alberta2 days agoAlberta will defend law-abiding gun owners who defend themselves

-

Great Reset2 days ago

Great Reset2 days agoCanada’s MAiD (State Sanctioned Murder) Report Just Dropped