Business

China likely to escape scot-free in persecution of two Canadians

From the MacDonald Laurier Institute

By Charles Burton

Beijing propagandists are already using recent claims to vindicate the appalling treatment of Michael Kovrig and Michael Spavor

There is a deep sadness to reports that Michael Spavor feels he was badly wronged by his fellow former political prisoner Michael Kovrig and, by extension, political officers at Canada’s embassy in Beijing and their masters in Ottawa.

Spavor reportedly wants millions in compensation from the Canadian government for its alleged complicity in his detention in his Chinese prison ordeal. If this ends up in court, Kovrig and his superiors would have an opportunity to defend themselves against these allegations, but Beijing propagandists are already using them to vindicate the appalling treatment of Kovrig and Spavor — a gross violation of international law — by a ruthless regime that arrested them to pressure Canada into releasing Chinese Communist Party figure Meng Wanzhou from house arrest in Vancouver.

While few specifics are known about Spavor’s claims, media reports depict a connection to Kovrig’s former job at Canada’s embassy in Beijing, and later with the International Crisis Group think tank, roles in which he would allegedly meet with people in China, engage them in his fluent Mandarin, and mine the conversations for nuggets of insight into China’s political or economic affairs.

Chinese authorities, of course, don’t like such activities. One expects that Kovrig and his superiors, both in government and the ICG, would have been well aware that this type of work would irritate Beijing, thus the danger of arbitrary detention on trumped-up charges was always there whenever he visited China without the protection of a diplomatic passport. And so it was.

One particularly troubling aspect of this sort of activity is the risk it presents to people who might unknowingly be sources for these information-gathering practices. Apparently Spavor and Kovrig routinely got together for drinks and sessions of good-humoured conversation. But friendships with diplomats imply that observations shared in a bar can end up the next morning in a report to Ottawa, and on to the Five Eyes. Was this possibility lost on Spavor? Was Kovrig perhaps not as forthcoming as he could have been about the full dimensions of their chats?

And there is always the possibility that China’s Ministry of State Security has access to Canadian diplomatic communications, which led them to open a file on the two.

Spavor ran a business, Paektu Cultural Exchange, that facilitated sports, cultural, tourism and business exchanges with North Korea. These pricey tours necessitated the transfer of badly-needed foreign currency into North Korea, arguably helping to enable the repressive Pyongyang regime. Perhaps more intriguing, in the course of his work Spavor developed an unlikely rapport with the third-generation Kim family dictator, Kim Jong Un, and was photographed jet-skiing and drinking cocktails with him on a private yacht. It is very plausible that China strongly disapproved of their junior proxy Korean communist dictator cavorting with non-Chinese foreign friends, hence his arrest.

Troublingly, Canadians — who were transfixed and infuriated by the two Michaels’ incarceration — have had little news about Kovrig and Spavor’s China nightmare since their sudden release in September 2021, just hours after Canada released Meng. One wonders if Ottawa really did enough to incentivize China’s Communist authorities to send them home sooner, or if there were other factors in Canada’s murky relationship with Beijing that took priority over what was perhaps downplayed behind closed doors as just another consular matter, one of many that are de facto subordinated to trade and political interests.

We may never see any Global Affairs Canada officials or former diplomats giving public evidence in a Canadian court to defend against Spavor’s accusation. To be sure, much of what goes on between Canada and China — indeed, within our own government internally — is kept from us by the secretive walls of the Security of Information Act.

Perhaps Spavor will be given a big whack of taxpayer money in an out-of-court settlement laced with ironclad nondisclosure provisions. One thing is for sure though. The Chinese authorities who so brutally persecuted him will, as usual, get off scot-free.

Charles Burton is a senior fellow at the Macdonald-Laurier Institute, non-resident senior fellow of the European Values Center for Security Policy in Prague, and former diplomat at Canada’s embassy in Beijing.

Business

Government red tape strangling Canada’s economy

From the Fraser Institute

The cost of regulation from all three levels of government to Canadian businesses totalled $38.8 billion in 2020, for a total of 731 million hours—the equivalent of nearly 375,000 fulltime jobs.

One does not have to look too deeply into recent headlines to see that Canada’s economic conditions are declining and consequently eroding the prosperity and living standards of Canadians. Between 2000 and 2023, Canada’s per-person GDP (a key indicator of living standards) has lagged far behind its peer countries. Business investment is also lagging, as are unemployment rates across the country particularly compared to the United States.

There are many reasons for Canada’s dismal economic conditions—including layer upon layer of regulation. Indeed, Canada’s regulatory load is substantial and growing. Between 2009 and 2018, the number of regulations in Canada grew from about 66,000 to 72,000. These regulations restrict business activity, impose costs on firms and reduce economic productivity.

According to a recent “red tape” study published by the Canadian Federation of Independent Business (CFIB), the cost of regulation from all three levels of government to Canadian businesses totalled $38.8 billion in 2020, for a total of 731 million hours—the equivalent of nearly 375,000 fulltime jobs. If we apply a $16.65 per-hour cost (the federal minimum wage in Canada for 2023), $12.2 billion annually is lost to regulatory compliance.

Of course, Canada’s smallest businesses bear a disproportionately high burden of the cost, paying up to five times more for regulatory compliance per-employee than larger businesses. The smallest businesses pay $7,023 per employee annually to comply with government regulation while larger businesses pay a much lower $1,237 per employee for regulatory compliance.

And the Trudeau government has embarked on a massive regulatory spree over the last decade, enacting dozens of major regulatory initiatives including Bill C-69 (which tightens Canada’s environmental assessment process for major infrastructure projects), Bill C-48 (which restricts oil tankers off Canada’s west coast) and electric vehicle mandates (which require all new cars be electric by 2035). Other examples of government red tape include appliance standards to reduce energy consumption from household appliances, home efficiency standards to reduce household energy consumption, banning single-use plastic products, “net zero” nitrous oxide emissions regulation, “net zero” building emissions regulations, and clean electricity standards to drive net emissions of greenhouse gases in electricity production to “net zero” by 2035.

Clearly, Canada’s festooning pile of regulatory red tape is badly in need of weeding. And it can be done. For example, during a deregulatory effort in British Columbia, which appointed a minister of deregulation in 2001, there was a 37 per cent reduction in regulatory requirements in the province by 2004.

Rather with plowing ahead with an ever-growing pallet of regulations to be heaped upon Canadian businesses and citizens, government should reach for the garden shears and start reducing the most recent regulatory expansions (before they have time to do too much harm), and then scour the massive strangling forest of older regulations.

Whacking through the red tape would go a long way to help Canada’s economy out of its dismal state and back into competitive ranges with its fellow developed countries and our neighbours in the U.S.

Author:

Business

Trudeau’s environment department admits carbon tax has only reduced emissions by 1%

From LifeSiteNews

The Trudeau Liberals had first seemed to claim that the unpopular carbon tax had cut emissions by 33%, only to explain that the figure is merely a projection for 2030 and the actual reduction thus far stands at 1%.

The Liberal government has admitted that the carbon tax has only reduced greenhouse gas emissions by 1 percent following claims that the unpopular surcharge had cut emissions by 33 percent.

During a May 21 House of Commons environment committee meeting, Environment Minister Steven Guilbeault testified that the carbon tax cut greenhouse gas emissions by 33 percent, before his department backtracked to explain that the figure is a projection for the year 2030, and that the true figure sits at a mere 1 percent.

“I will be the first one to recognize it is complex,” said Guilbeault, according to information obtained by Blacklock’s Reporter.

“If you want simple answers, I am sorry. There is no simple answer when it comes to climate change or modeling,” he said, adding, “Carbon pricing works. This has never been clearer.”

“Carbon pricing alone accounts for around a third of emission reductions expected in Canada,” said Guilbeault, explaining this number was based on “complex statistical calculations.”

However, Conservative Members of Parliament (MPs) pointed out that the numbers provided by Guilbeault’s department do not add up to a 33 percent decrease in emissions, as the department had characterized.

“How many megatonnes of emissions have been directly reduced from your carbon tax since it was introduced?” Conservative MP Dan Mazier questioned.

According to Guilbeault, after the introduction of the carbon tax, emissions reduced by five megatonnes in 2018, fourteen megatonnes in 2019, seventeen megatonnes in 2020, eighteen megatonnes in 2021, and nineteen megatonnes in 2022.

However, the total tonnes of emissions reduced by the carbon tax comes to 73 million tonnes, or 2 percent, of the combined 3,597 million tonnes of emissions over the same five-year period, according to National Inventory Reports.

According to Blacklock’s, Guilbeault failed to explain how the environment department calculated a 33 percent benefit.

Conservative MP Michael Kram pressed Guilbeault, saying, “I want to make sure I have the math correct.”

“In 2022 emissions were at 708 megatonnes and the carbon tax was responsible for reducing 19 megatonnes,” he continued. “By my math that works out to a three percent reduction.”

Associate deputy environment minister Lawrence Hanson explained that the department’s 33 percent emissions cut is a projection of the emissions cut by 2030, not a current statistic.

“It’s the distinction between how much the carbon price might have affected emissions in one year versus how much in 2030,” said Hanson. “So when you heard us talking about its responsible for one third of reductions we were talking about the 2030 number.”

This explanation was echoed by Derek Hermanutz, director general of the department’s economic analysis directorate, who said, “When we talk about one third, it’s one third of our expected reductions. That’s getting to 2030.”

“Yes, but three percent of the total emissions have been reduced as a result of carbon pricing?” Kram pressed.

“No, emissions have declined three percent in total,” assistant deputy minister John Moffet responded.

“And so only one percent of that three percent is from the carbon tax?” Kram asked.

“To date,” Moffet replied.

Prime Minister Justin Trudeau’s carbon tax, framed as a way to reduce carbon emissions, has cost Canadian households hundreds of dollars annually despite rebates.

The increased costs are only expected to rise. A recent report revealed that a carbon tax of more than $350 per tonne is needed to reach Trudeau’s net-zero goals by 2050.

Currently, Canadians living in provinces under the federal carbon pricing scheme pay $80 per tonne, but the Trudeau government has a goal of $170 per tonne by 2030.

On April 1, Trudeau increased the carbon tax by 23 percent despite seven out of 10 provincial premiers and 70 percent of Canadians pleading with him to halt his plan.

Despite appeals from politicians and Canadians alike, Trudeau remains determined to increase the carbon tax regardless of its effects on citizens’ lives.

The Trudeau government’s current environmental goals – which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development – include phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum, the globalist group behind the socialist “Great Reset” agenda in which Trudeau and some of his cabinet are involved.

-

Business21 hours ago

Business21 hours agoGovernment red tape strangling Canada’s economy

-

Agriculture1 day ago

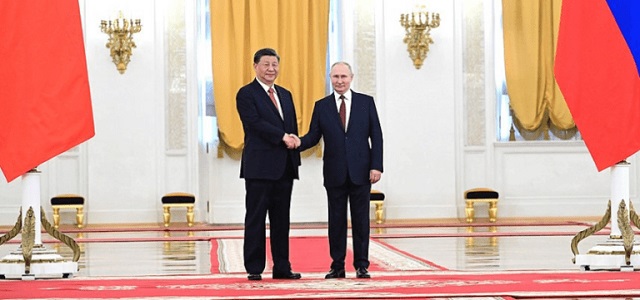

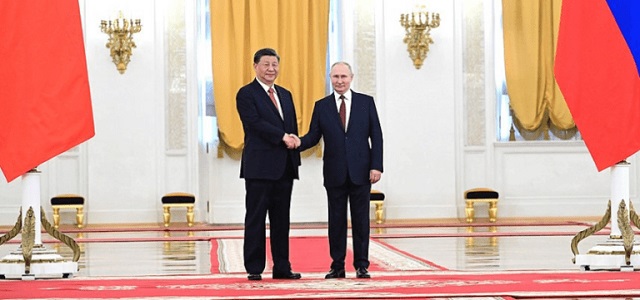

Agriculture1 day agoThe China – Russia “Grain Entente” – what is at stake for Canada and its allies?

-

International23 hours ago

International23 hours agoRep. Paul Gosar grills Biden official on government funding of underage ‘gender transitions’

-

Automotive1 day ago

Automotive1 day agoEV transition stalls despite government mandates and billion-dollar handouts

-

Business1 day ago

Business1 day agoTrudeau’s environment department admits carbon tax has only reduced emissions by 1%

-

Great Reset1 day ago

Great Reset1 day agoDr. Robert Malone reacts to Klaus Schwab’s resignation: ‘Resistance is not futile’

-

International1 day ago

International1 day agoBiden DOJ authorized FBI to use ‘deadly force’ if needed during raid of Trump’s Mar-a-Lago estate

-

Bruce Dowbiggin24 hours ago

Bruce Dowbiggin24 hours agoThe Most Dangerous Man In Canada: Emmanuel Goldstein Reborn