Business

Canadian Taxpayers Federation looking into value of CBC properties

From the Canadian Taxpayers Federation

CBC amasses half a billion in real estate

Author: Ryan Thorpe

The Canadian Broadcasting Corporation has amassed nearly half-a-billion dollars in real estate holdings, according to documents obtained by the Canadian Taxpayers Federation.

The CBC’s real estate portfolio, comprised of 12 properties scattered across Canada, is assessed at more than $444 million. The CBC leases another 72 properties, including five in foreign countries, that it refuses to disclose costs for.

“It sure seems the CBC is spending way more on its buildings than competitors spend, but what value do taxpayers get for all these properties?” said Franco Terrazzano, CTF Federal Director. “Taxpayers have every right to question why we’re paying for all these CBC buildings in Canada and in other countries.”

Records detailing the CBC’s real estate portfolio were released in response to a written order paper question from Conservative MP Adam Chambers (Simcoe North).

CBC’s most expensive is its Toronto headquarters, which is assessed at nearly $314 million.

For context, when TorStar – the parent company that publishes the Toronto Star – was sold in 2020, the price tag for the entire newspaper chain was $52 million. And when the Calgary Herald sold its building earlier this year, it went for $17.25 million. In 2012, the Globe and Mail sold its head offices in downtown Toronto for $136 million. The National Post sold its headquarters in Toronto for $24 million in 2012.

Table: CBC-owned property, assessed municipal value

|

Location |

Value |

|

Toronto, Ont. |

$313,866,000 |

|

Vancouver, B.C. |

$99,061,000 |

|

Winnipeg, Man. |

$11,718,000 |

|

St. Johns, N.L. |

$4,439,000 |

|

Yellowknife, NWT |

$3,181,720 |

|

Fredericton, N.B. |

$2,791,000 |

|

Charlottetown, P.E.I. |

$2,631,800 |

|

Saguenay, Que. |

$2,485,939 |

|

Whitehorse, Yuk. |

$1,847,410 |

|

Winnipeg, Man. |

$1,541,000 |

|

Thunder Bay, Ont. |

$537,000 |

|

Rankin Inlet, Nun. |

$314,600 |

|

Total |

$444,414,469 |

The CBC is refusing to disclose what it spends on the 72 other properties it currently leases in Canada and abroad, citing it as “commercially sensitive information.”

Outside of Canada, the CBC leases property in London, U.K., Mumbai, India, Paris, France, and New York City and Washington, U.S.A.

In Paris, France, the CBC leases offices in “a corner building on one of the prestigious avenues leading off the Arc de Triomphe,” located in the city’s 17th Arrondissement, on the right bank of the River Seine.

In London, U.K., Canada’s public broadcaster leases office space bordering the city’s Soho district, famous for its restaurants and nightlife, located a short drive from Buckingham Palace and Hyde Park.

And in New York City, the CBC leases office space in downtown Manhattan, a short walk from Rockefeller Centre and Central Park.

It also leases multiple properties in six Canadian cities, including two in Prince Rupert, B.C. (pop. 12,300) and two in Matane, Que. (pop. 14,000).

In Montreal, the CBC leases three properties, including its French-language headquarters on Papineau Avenue. While it is now refusing to say what it costs to lease its Montreal HQ, back in 2019, the CBC disclosed it was paying $20 million per year.

“Why does the CBC need to lease these properties in far-flung countries, let alone multiple properties in smaller Canadian towns, and how much is all of this costing taxpayers?” Terrazzano said. “The CBC costs taxpayers more than $1 billion every year, so at the very least it owes Canadians full transparency.”

In 2021, the CBC took $1.2 billion from taxpayers, including $21 million in “immediate operational support” to ensure its stability during the pandemic. In late-2022, the feds gave the CBC another $42 million to help it “recover from the pandemic,” as reported by the National Post.

The CBC gave staff $28.5 million in bonuses and pay raises in 2022. There are now 949 CBC staff taking home a six-figure annual salary, with the number of employees on the sunshine list doubling since Prime Minister Justin Trudeau came to power in 2015.

Economy

Prime minister’s misleading capital gains video misses the point

From the Fraser Institute

By Jake Fuss and Alex Whalen

According to a 2021 study published by the Fraser Institute, 38.4 per cent of those who paid capital gains taxes in Canada earned less than $100,000 per year, and 18.3 per cent earned less than $50,000. Yet in his video, Prime Minister Trudeau claims that his capital gains tax hike will affect only the richest “0.13 per cent of Canadians”

This week, Prime Minister Trudeau released a video about his government’s decision to increase capital gains taxes. Unfortunately, he made several misleading claims while failing to acknowledge the harmful effects this tax increase will have on a broad swath of Canadians.

Right now, individuals and businesses who sell capital assets pay taxes on 50 per cent of the gain (based on their full marginal rate). Beginning on June 25, however, the Trudeau government will increase that share to 66.7 per cent for capital gains above $250,000. People with gains above that amount will again pay their full marginal rate, but now on two-thirds of the gain.

In the video, which you can view online, the prime minister claims that this tax increase will affect only the “very richest” people in Canada and will generate significant new revenue—$20 billion, according to him—to pay for social programs. But economic research and data on capital gains taxes reveal a different picture.

For starters, it simply isn’t true that capital gains taxes only affect the wealthy. Many Canadians who incur capital gains taxes, such as small business owners, may only do so once in their lifetimes.

For example, a plumber who makes $90,000 annually may choose to sell his business for $500,000 at retirement. In that year, the plumber’s income is exaggerated because it includes the capital gain rather than only his normal income. In fact, according to a 2021 study published by the Fraser Institute, 38.4 per cent of those who paid capital gains taxes in Canada earned less than $100,000 per year, and 18.3 per cent earned less than $50,000. Yet in his video, Prime Minister Trudeau claims that his capital gains tax hike will affect only the richest “0.13 per cent of Canadians” with an “average income of $1.4 million a year.”

But this is a misleading statement. Why? Because it creates a distorted view of who will pay these capital gains taxes. Many Canadians with modest annual incomes own businesses, second homes or stocks and could end up paying these higher taxes following a onetime sale where the appreciation of their asset equals at least $250,000.

Moreover, economic research finds that capital taxes remain among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. By increasing them the government will deter investment in Canada and chase away capital at a time when we badly need it. Business investment, which is crucial to boost living standards and incomes for Canadians, is collapsing in Canada. This tax hike will make a bad economic situation worse.

Finally, as noted, in the video the prime minister claims that this tax increase will generate “almost $20 billion in new revenue.” But investors do not incur capital gains taxes until they sell an asset and realize a gain. A higher capital gains tax rate gives them an incentive to hold onto their investments, perhaps until the rate is reduced after a change in government. According to economists, this “lock-in” effect can stifle economic activity. The Trudeau government likely bases its “$20 billion” number on an assumption that investors will sell their assets sooner rather than later—perhaps before June 25, to take advantage of the old inclusion rate before it disappears (although because the government has not revealed exactly how the new rate will apply that seems less likely). Of course, if revenue from the tax hike does turn out to be less than anticipated, the government will incur larger budget deficits than planned and plunge us further into debt.

Contrary to Prime Minister Trudeau’s claims, raising capital gains taxes will not improve fairness. It’s bad for investment, the economy and the living standards of Canadians.

Authors:

Business

Ottawa should end war on plastics for sake of the environment

From the Fraser Institute

Here’s the shocker: Meng shows that for 15 out of the 16 uses, plastic products incur fewer GHG emissions than their alternatives…

For example, when you swap plastic grocery bags for paper, you get 80 per cent higher GHG emissions. Substituting plastic furniture for wood—50 per cent higher GHG emissions. Substitute plastic-based carpeting with wool—80 per cent higher GHG emissions.

It’s been known for years that efforts to ban plastic products—and encourage people to use alternatives such as paper, metal or glass—can backfire. By banning plastic waste and plastic products, governments lead consumers to switch to substitutes, but those substitutes, mainly bulkier and heavier paper-based products, mean more waste to manage.

Now a new study by Fanran Meng of the University of Sheffield drives the point home—plastic substitutes are not inherently better for the environment. Meng uses comprehensive life-cycle analysis to understand how plastic substitutes increase or decrease greenhouse gas (GHG) emissions by assessing the GHG emissions of 16 uses of plastics in five major plastic-using sectors: packaging, building and construction, automotive, textiles and consumer durables. These plastics, according to Meng, account for about 90 per cent of global plastic volume.

Here’s the shocker: Meng shows that for 15 out of the 16 uses, plastic products incur fewer GHG emissions than their alternatives. Read that again. When considering 90 per cent of global plastic use, alternatives to plastic lead to greater GHG emissions than the plastic products they displace. For example, when you swap plastic grocery bags for paper, you get 80 per cent higher GHG emissions. Substituting plastic furniture for wood—50 per cent higher GHG emissions. Substitute plastic-based carpeting with wool—80 per cent higher GHG emissions.

A few substitutions were GHG neutral, such as swapping plastic drinking cups and milk containers with paper alternatives. But overall, in the 13 uses where a plastic product has lower emissions than its non-plastic alternatives, the GHG emission impact is between 10 per cent and 90 per cent lower than the next-best alternatives.

Meng concludes that “Across most applications, simply switching from plastics to currently available non-plastic alternatives is not a viable solution for reducing GHG emissions. Therefore, care should be taken when formulating policies or interventions to reduce plastic demand that they result in the removal of the plastics from use rather than a switch to an alternative material” adding that “applying material substitution strategies to plastics never really makes sense.” Instead, Meng suggests that policies encouraging re-use of plastic products would more effectively reduce GHG emissions associated with plastics, which, globally, are responsible for 4.5 per cent of global emissions.

The Meng study should drive the last nail into the coffin of the war on plastics. This study shows that encouraging substitutes for plastic—a key element of the Trudeau government’s climate plan—will lead to higher GHG emissions than sticking with plastics, making it more difficult to achieve the government’s goal of making Canada a “net-zero” emitter of GHG by 2050.

Clearly, the Trudeau government should end its misguided campaign against plastic products, “single use” or otherwise. According to the evidence, plastic bans and substitution policies not only deprive Canadians of products they value (and in many cases, products that protect human health), they are bad for the environment and bad for the climate. The government should encourage Canadians to reuse their plastic products rather than replace them.

Author:

-

espionage21 hours ago

espionage21 hours agoThe Scientists Who Came in From the Cold: Canada’s National Microbiology Laboratory Scandal, Part I

-

Economy2 days ago

Economy2 days agoCanadians experiencing second-longest and third steepest decline in living standards in last 40 years

-

National20 hours ago

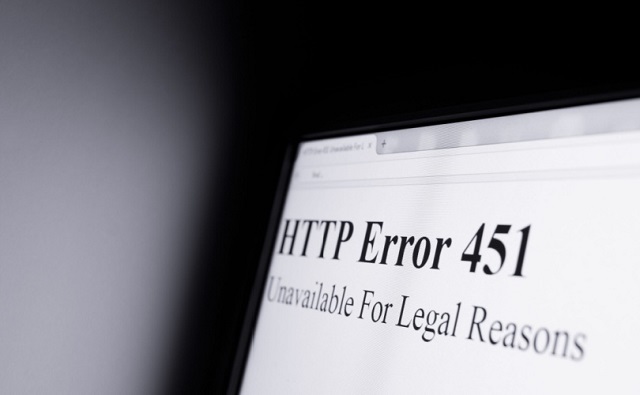

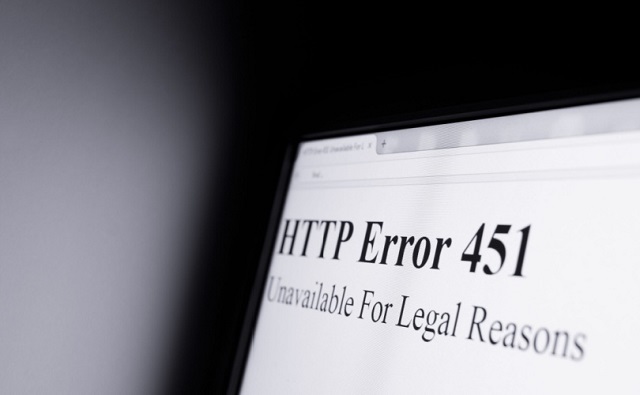

National20 hours agoTrudeau’s internet censorship Bill C-11 will not be implemented until late 2025

-

Great Reset2 days ago

Great Reset2 days agoBiden Administration Eager to Sign WHO Pandemic Treaty

-

Energy2 days ago

Energy2 days agoNew Report Reveals Just How Energy Rich America Really Is

-

Opinion2 days ago

Opinion2 days agoOrdinary working Canadians are not buying into transgender identity politics

-

Economy2 days ago

Economy2 days agoFeds spend $3 million to fly 182 politicians and bureaucrats to climate conference

-

Automotive2 days ago

Automotive2 days agoBiden’s Climate Agenda Is Running Headfirst Into A Wall Of His Own Making