Canadian Energy Centre

Canadian renewable propane could be a fuel of the future

From the Canadian Energy Centre

‘We want to make sure we reduce emissions while keeping in mind affordability and reliability’

Four years ago, Craig Timmermans’ two Ontario radio stations became Canada’s first to go on the air from off the grid.

Faced with an $80,000 connection fee and ongoing electricity delivery costs, Timmermans opted for another solution: solar and propane.

“I did our power calculation: five staff, hot water tank, heating system, etc., right down to a coffee maker…then we need a heating source, so it made sense to go with propane,” he said.

“When I looked at all the different heating systems, I found that propane is hands down the most efficient.”

Now Timmermans is building a new home that will run exclusively on propane. He says he wanted propane appliances due to their efficiency.

Ontario radio operators KT and Craig Timmermans power their off-grid business with propane and solar. Photo supplied to the Canadian Energy Centre

“A propane cooking stove is the best cooking appliance…The heat is continuous, it’s instant. It just works so well.”

Lower environmental footprint

Propane serves many purposes in Canada, from supporting mining and oil and gas operations to fueling heating, cooling, cooking and power in remote, off-grid communities.

In these communities, propane can replace diesel with a lower environmental footprint. Propane’s carbon intensity is estimated at 72 grams of CO2 equivalent per megajoule, compared to 100 grams for diesel.

That could be slashed by more than half with a move to renewable propane, according to the Canadian Propane Association (CPA). The CPA has commissioned a new report that looks at potential pathways to producing renewable propane in Canada.

Propane storage tank. Getty Images photo

Propane storage tank. Getty Images photo

Pairing with heat pumps and hybrid energy systems

The report serves as the foundation of the CPA’s roadmap for scaling up renewable propane production in Canada.

The CPA says the fuel is ideal for pairing with electric heat pumps to provide back-up heat in low temperatures, especially in remote regions that are not near natural gas grids.

It’s also promising for hybrid systems where solar or wind provides baseload energy and renewable propane provides support when renewables are not available.

Part of propane’s appeal – renewable or otherwise – is that it’s easily liquefied and stored in pressurized cylinders, making it a versatile energy source used almost anywhere, the CPA says.

“We want to make sure we reduce emissions while keeping in mind affordability and reliability as key pillars in any energy transformation,” said CEO Shannon Watt.

“Propane goes where other fuels can’t go.”

Producing renewable propane

Today, most propane produced in Canada comes as a byproduct from natural gas processing.

Among other sources, renewable propane can be co-produced with renewable diesel and sustainable aviation fuel, made primarily from plant and vegetable oils, animal fats or used cooking oil.

Cost is the barrier to renewable propane production – about double what it takes to produce conventional propane, the CPA says.

The United States is offering incentives for renewable propane that are not available in Canada.

Through the Inflation Reduction Act, Renewable Fuel Standard and Low Carbon Fuel Standard, renewable propane producers can receive C$20 per gigajoule (or more than C$30 per GJ in California).

Through Canada’s Clean Fuel Regulations, the incentive is just over C$5 per GJ, or about C$10 per GJ in British Columbia.

“In order to attract investment the same way as the U.S. under the Inflation Reduction Act, we need to have competing measures in place,” Watt said.

“We’ve got the technology and we’ve got the feedstocks. We’ve got a lot of those big puzzle pieces that we need. Now we need the dollars to flow.”

The Ridley Island Export Terminal in Prince Rupert, B.C. ships Canadian propane to overseas markets. Photo courtesy AltaGas

The Ridley Island Export Terminal in Prince Rupert, B.C. ships Canadian propane to overseas markets. Photo courtesy AltaGas

Exporting renewable propane to the world

A large-scale renewable propane industry wouldn’t just benefit Canadians, she said.

That’s because global demand for propane is growing.

Market research firm IMARC Group projects world propane use will rise to nearly 250 million tonnes by 2032, more than one-third higher than demand last year.

The transition to cleaner energy sources is a major factor propelling growth, analysts said.

Until recently, Canada’s only propane exports went to the United States. That changed with the startup of two export terminals at Prince Rupert, B.C.

Since 2017, Canada’s propane exports outside the U.S. have grown substantially, reaching 42 per cent of total propane exports in 2023, according to the Canada Energy Regulator.

“We export more and more propane to non-U.S. locations,” Watt said.

“Now, roughly 50 per cent of Canadian propane is shipped to South Korea, Japan and Mexico, displacing higher emission intensity sources, namely coal and timber.”

Exporting renewable propane would take the benefits a step further, she said.

“That carries the conversation on about reducing global emissions and not just what’s happening in our own backyard.”

Alberta

How economic corridors could shape a stronger Canadian future

Ship containers are stacked at the Panama Canal Balboa port in Panama City, Saturday, Sept. 20, 2025. The Panama Canals is one of the most significant trade infrastructure projects ever built. CP Images photo

From the Canadian Energy Centre

Q&A with Gary Mar, CEO of the Canada West Foundation

Building a stronger Canadian economy depends as much on how we move goods as on what we produce.

Gary Mar, CEO of the Canada West Foundation, says economic corridors — the networks that connect producers, ports and markets — are central to the nation-building projects Canada hopes to realize.

He spoke with CEC about how these corridors work and what needs to change to make more of them a reality.

CEC: What is an economic corridor, and how does it function?

Gary Mar: An economic corridor is a major artery connecting economic actors within a larger system.

Consider the road, rail and pipeline infrastructure connecting B.C. to the rest of Western Canada. This infrastructure is an important economic corridor facilitating the movement of goods, services and people within the country, but it’s also part of the economic corridor connecting western producers and Asian markets.

Economic corridors primarily consist of physical infrastructure and often combine different modes of transportation and facilities to assist the movement of many kinds of goods.

They also include social infrastructure such as policies that facilitate the easy movement of goods like trade agreements and standardized truck weights.

The fundamental purpose of an economic corridor is to make it easier to transport goods. Ultimately, if you can’t move it, you can’t sell it. And if you can’t sell it, you can’t grow your economy.

CEC: Which resources make the strongest case for transport through economic corridors, and why?

Gary Mar: Economic corridors usually move many different types of goods.

Bulk commodities are particularly dependent on economic corridors because of the large volumes that need to be transported.

Some of Canada’s most valuable commodities include oil and gas, agricultural commodities such as wheat and canola, and minerals such as potash.

CEC: How are the benefits of an economic corridor measured?

Gary Mar: The benefits of economic corridors are often measured via trade flows.

For example, the upcoming Roberts Bank Terminal 2 in the Port of Vancouver will increase container trade capacity on Canada’s west coast by more than 30 per cent, enabling the trade of $100 billion in goods annually, primarily to Asian markets.

Corridors can also help make Canadian goods more competitive, increasing profits and market share across numerous industries. Corridors can also decrease the costs of imported goods for Canadian consumers.

For example, after the completion of the Trans Mountain Expansion in May 2024 the price differential between Western Canada Select and West Texas Intermediate narrowed by about US$8 per barrel in part due to increased competition for Canadian oil.

This boosted total industry profits by about 10 per cent, and increased corporate tax revenues to provincial and federal governments by about $3 billion in the pipeline’s first year of operation.

CEC: Where are the most successful examples of these around the world?

Gary Mar: That depends how you define success. The economic corridors transporting the highest value of goods are those used by global superpowers, such as the NAFTA highway that facilitates trade across Canada, the United States and Mexico.

The Suez and Panama canals are two of the most significant trade infrastructure projects ever built, facilitating 12 per cent and five per cent of global trade, respectively. Their success is based on their unique geography.

Canada’s Asia-Pacific Gateway, a coordinated system of ports, rail lines, roads, and border crossings, primarily in B.C., was a highly successful initiative that contributed to a 48 per cent increase in merchandise trade with Asia from $44 million in 2006 to $65 million in 2015.

China’s Belt and Road initiative to develop trade infrastructure in other countries is already transforming global trade. But the project is as much about extending Chinese influence as it is about delivering economic returns.

Piles of coal awaiting export and gantry cranes used to load and unload containers onto and from cargo ships are seen at Deltaport, in Tsawwassen, B.C., on Monday, September 9, 2024. CP Images photo

CEC: What would need to change in Canada in terms of legislation or regulation to make more economic corridors a reality?

Gary Mar: A major regulatory component of economic corridors is eliminating trade barriers.

The federal Free Trade and Labour Mobility in Canada Act is a good start, but more needs to be done at the provincial level to facilitate more internal trade.

Other barriers require coordinated regulatory action, such as harmonizing weight restrictions and road bans to streamline trucking.

By taking a systems-level perspective – convening a national forum where Canadian governments consistently engage on supply chains and trade corridors – we can identify bottlenecks and friction points in our existing transportation networks, and which investments would deliver the greatest return on investment.

Alberta

Alberta’s number of inactive wells trending downward

Aspenleaf Energy vice-president of wells Ron Weber at a clean-up site near Edmonton.

From the Canadian Energy Centre

Aspenleaf Energy brings new life to historic Alberta oil field while cleaning up the past

In Alberta’s oil patch, some companies are going beyond their obligations to clean up inactive wells.

Aspenleaf Energy operates in the historic Leduc oil field, where drilling and production peaked in the 1950s.

In the last seven years, the privately-held company has spent more than $40 million on abandonment and reclamation, which it reports is significantly more than the minimum required by the Alberta Energy Regulator (AER).

CEO Bryan Gould sees reclaiming the legacy assets as like paying down a debt.

“To me, it’s not a giant bill for us to pay to accelerate the closure and it builds our reputation with the community, which then paves the way for investment and community support for the things we need to do,” he said.

“It just makes business sense to us.”

Aspenleaf, which says it has decommissioned two-thirds of its inactive wells in the Leduc area, isn’t alone in going beyond the requirements.

Producers in Alberta exceeded the AER’s minimum closure spend in both years of available data since the program was introduced in 2022.

That year, the industry-wide closure spend requirement was set at $422 million, but producers spent more than $696 million, according to the AER.

In 2023, companies spent nearly $770 million against a requirement of $700 million.

Alberta’s number of inactive wells is trending downward. The AER’s most recent report shows about 76,000 inactive wells in the province, down from roughly 92,000 in 2021.

In the Leduc field, new development techniques will make future cleanup easier and less costly, Gould said.

That’s because horizontal drilling allows several wells, each up to seven kilometres long, to originate from the same surface site.

“Historically, Leduc would have been developed with many, many sites with single vertical wells,” Gould said.

“This is why the remediation going back is so cumbersome. If you looked at it today, all that would have been centralized in one pad.

“Going forward, the environmental footprint is dramatically reduced compared to what it was.”

During and immediately after a well abandonment for Aspenleaf Energy near Edmonton. Photos for the Canadian Energy Centre

Gould said horizontal drilling and hydraulic fracturing give the field better economics, extending the life of a mature asset.

“We can drill more wells, we can recover more oil and we can pay higher royalties and higher taxes to the province,” he said.

Aspenleaf has also drilled about 3,700 test holes to assess how much soil needs cleanup. The company plans a pilot project to demonstrate a method that would reduce the amount of digging and landfilling of old underground materials while ensuring the land is productive and viable for use.

Crew at work on a well abandonment for Aspenleaf Energy near Edmonton. Photo for the Canadian Energy Centre

“We did a lot of sampling, and for the most part what we can show is what was buried in the ground by previous operators historically has not moved anywhere over 70 years and has had no impact to waterways and topography with lush forestry and productive agriculture thriving directly above and adjacent to those sampled areas,” he said.

At current rates of about 15,000 barrels per day, Aspenleaf sees a long runway of future production for the next decade or longer.

Revitalizing the historic field while cleaning up legacy assets is key to the company’s strategy.

“We believe we can extract more of the resource, which belongs to the people of Alberta,” Gould said.

“We make money for our investors, and the people of the province are much further ahead.”

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoRichmond Mayor Warns Property Owners That The Cowichan Case Puts Their Titles At Risk

-

Alberta2 days ago

Alberta2 days agoHow economic corridors could shape a stronger Canadian future

-

Daily Caller2 days ago

Daily Caller2 days agoProtesters Storm Elite Climate Summit In Chaotic Scene

-

Daily Caller1 day ago

Daily Caller1 day agoLaura Ingraham’s Viral Clash With Trump Prompts Her To Tell Real Reasons China Sends Students To US

-

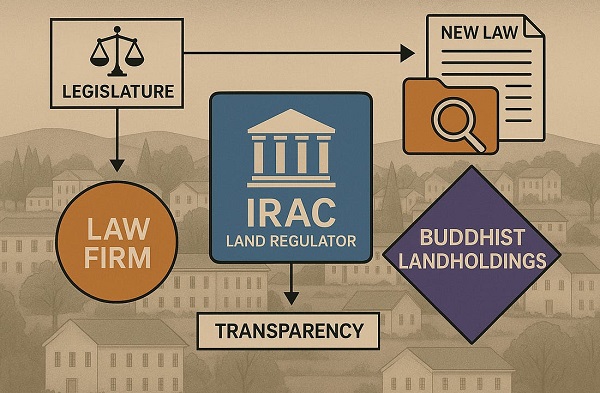

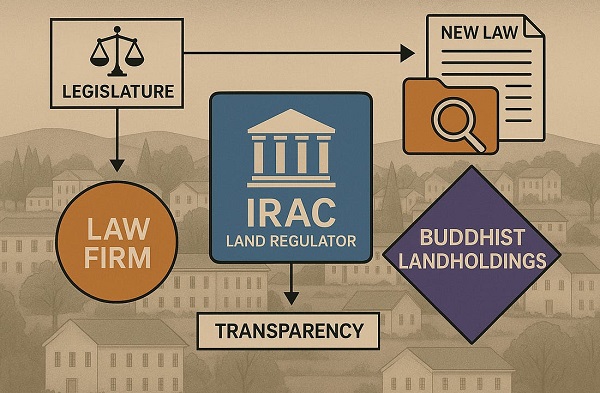

Business22 hours ago

Business22 hours agoP.E.I. Moves to Open IRAC Files, Forcing Land Regulator to Publish Reports After The Bureau’s Investigation

-

Alberta2 days ago

Alberta2 days agoWhen Teachers Say Your Child Has Nowhere Else to Go

-

Energy22 hours ago

Energy22 hours agoCanada’s oilpatch shows strength amid global oil shakeup

-

Automotive2 days ago

Automotive2 days agoThe high price of green virtue