Energy

Canadian Liquified Natural Gas (LNG) is the Cleaner Fuel Alternative that Asian Markets Want and Need – CPW

Trans Mountain LNG Terminal Expansion

From EnergyNow Media

A woman in rural China gets ready to make dinner. She starts with food prep, then reaches for her fuel source to begin cooking.

Her options: likely wood or coal.

As she cooks, she is probably not aware that nearly half a million people in China who cook with wood or coal have an increased risk of major eye diseases that lead to blindness.

This was detailed in a University of Oxford study that also showed nearly half of the world’s population (that’s 3.8 billion people) is exposed to household air pollution from cooking with “dirty” solid fuels like wood or coal.

Even if she knew all this, what other choice would she have? Everyone has to prepare food for their family.

Poor air quality and its effect on human health is a significant cost to consider when using coal, but there are others as well, such as greenhouse gas emissions.

When burned for energy, coal releases carbon dioxide into the atmosphere. If you shift from thinking about the individual cooking at home to large-scale coal burning for electricity generation, the problem becomes a major environmental concern — and a significant contributing factor to climate change.

How big is the problem?

Coal power plants produce 20% of global greenhouse gas emissions, more than any other single source, says the International Energy Agency (IEA).

This issue is important to us because that woman cooking at home could be any one of us. The difference is, we have options. With energy demand continuing to grow, the IEA reports that many countries feel they have little choice but to continue generating power with coal.

Furthermore, Canada Powered by Women research (which captures the opinions of 24% of all women in Canada) shows that the vast majority (84%) personally care about tackling climate change through global greenhouse gas (GHG) emission reduction.

So, what exactly is the solution to this problem? It’s choice.

The solution for regions of the world that don’t have access to different types of energy is to provide alternatives to what they have today. One choice can, and should, be Canadian liquified natural gas (LNG).

(Assuming, that is, Canadian suppliers are supported enough by regulatory environments to produce and export this resource. More on this later…)

Many parts of the world — particularly Asia — want to replace coal with cleaner energy like LNG. Foreign markets such as Japan, Korea, Malaysia, and China are interested in turning to Canada as their source, over countries with less-than-stellar environmental and human rights records (not to mention uncertain political structures).

“We have incredible volumes of lower-carbon gas in B.C., and it represents an important new source of energy,” says Teresa Waddington, vice president, corporate relations at LNG Canada. “Canada is politically stable in an increasingly energy security-conscious world. We have good infrastructure and good systems in place to make sure that we are able to produce very, very reliably.”

It’s not just industry players who are on board with exporting our energy resources to foreign markets, either.

The majority of Canadian women we asked consider it important to supply ethical and responsibly produced oil, as well as LNG, internationally.

Canada is primed to take its cleaner energy options to the world — we just need the ability to get it to market.

Canadian LNG: The Same Energy for Half the Emissions

Markets around the world are interested in LNG over coal for good reason. It has half the emissions of coal for the same output of energy.

But in some Asian countries, coal-burning plants are being built at a lightning-fast pace because populations and manufacturers need rapid access to energy, Reuters reports.

“If we can displace current and future energy electricity generation and power generation with LNG, we’re taking a massive step forward,” Waddington says.

Beyond being a cleaner molecule, Canadian LNG is particularly attractive because it’s produced ethically and safely, thanks in part to strict industry regulations.

“We have the lowest methane emissions leakage anywhere in the globe,” Waddington notes.

And this is in part because Canada has highly stringent requirements for managing methane leakage — which can lead to greenhouse gas emissions and is a common concern about this kind of fuel.

“If you look across the spectrum of environment, social, governance (ESG), Canadian LNG is made with human rights at the forefront,” says Waddington.

With Support, Canada Can Lead the Global LNG Opportunity

Canada has the potential to pull ahead as a global leader in the production and export of clean energy to foreign markets — a move that would play an important role in reducing global emissions, facilitating a prosperous Canada economy and providing for those in need at home and abroad.

But that will only happen if governments offer LNG projects the support they need in the form of utility infrastructure investments and clear and fast permitting, Waddington says.

As an example, partnerships with local hydro providers to power LNG facilities is one way provincial governments can lower the carbon intensity of processing and exporting the fuel, she says.

Then of course, there’s also the potential of government incentives that inspire more investment in LNG facilities, as well as in technologies that support the production of an ever-cleaner natural gas molecule.

With technology and innovation in Canada advancing all the time, Waddington is optimistic about the opportunity ahead.

“We’re going to see Canada continue to emerge as world-leading in some of the ways that we can [reduce emissions] — as long as we keep up this momentum, supported by government.”

About Canada Powered by Women

Uniting Women Through Bold Conversations

Canada Powered by Women represents Canadian women who believe sound energy policies are vital for the continuing economic prosperity of our country. We’re driven by the unshakable belief that a better world is possible and we can make it happen… together. Visit our website HERE for more information and JOIN OUR COMMUNITY.

Energy

New Report Reveals Just How Energy Rich America Really Is

From the Daily Caller News Foundation

From the Daily Caller News Foundation

A new report by the Institute for Energy Research (IER), a nonprofit dedicated to the study of the impact of government regulation on global energy resources, finds that U.S. inventories of oil and natural gas have experienced stunning growth since 2011.

The same report, the North American Energy Inventory 2024, finds the United States also leading the world in coal resources, with total proven resources that are more than 53% bigger than China’s.

Despite years of record production levels and almost a decade of curtailed investment in the finding and development of new reserves forced by government regulation and discrimination by ESG-focused investment houses, America’s technically recoverable resource in oil grew by 15% from 2011 to 2024. Now standing at 1.66 trillion barrels, the U.S. resource is 5.6 times the proved reserves held by Saudi Arabia.

The story for natural gas is even more amazing: IER finds the technically recoverable resource for gas expanded by 47% in just 13 years, to a total of 4.03 quadrillion cubic feet. At current US consumption rates, that’s enough gas to supply the country’s needs for 130 years.

“The 2024 North American Energy Inventory makes it clear that we have ample reserves of oil, natural gas, and coal that will sustain us for generations,” Tom Pyle, President at IER, said in a release. “Technological advancements in the production process, along with our unique system of private ownership, have propelled the U.S. to global leadership in oil and natural gas production, fostering economic benefits like lower energy prices, job growth, enhanced national security, and an improved environment.”

It is key to understand here that the “technically recoverable” resource measure used in financial reporting is designed solely to create a point-in-time estimate of the amount of oil and gas in place underground that can be produced with current technology. Because technology advances in the oil and gas business every day, just as it does in society at large, this measure almost always is a vast understatement of the amount of resource that will ultimately be produced.

The Permian Basin has provided a great example of this phenomenon. Just over the past decade, the deployment of steadily advancing drilling and hydraulic fracturing technologies has enabled producers in that vast resource play to more than double expected recoveries from each new well drilled. Similar advances have been experienced in the other major shale plays throughout North America. As a result, the U.S. industry has been able to consistently raise record overall production levels of both oil and gas despite an active rig count that has fallen by over 30% since January 2023.

In its report, IER notes this aspect of the industry by pointing out that, while the technically recoverable resource for U.S. natural gas sits at an impressive 4.03 quads, the total gas resource in place underground is currently estimated at an overwhelming 65 quads. If just half of that resource in place eventually becomes recoverable thanks to advancing technology over the coming decades, that would mean the United States will enjoy more than 1,000 years of gas supply at current consumption levels. That is not a typo.

Where coal is concerned, IER finds the US is home to a world-leading 470 billion short tons of the most energy-dense fossil fuel in place. That equates to 912 years of supply at current consumption rates.

No other country on Earth can come close to rivaling the U.S. for this level of wealth in energy mineral resources, and few countries’ governments would dream of squandering them in pursuit of a political agenda driven by climate fearmongering. “And yet, many politicians, government agents, and activists seek to constrain North America’s energy potential,” Pyle says, adding, “We must resist these efforts and commit ourselves to unlocking these resources so that American families can continue to enjoy the real and meaningful benefits our energy production offers.”

With President Joe Biden and former President Donald Trump staking out polar opposite positions on this crucial question, America’s energy future is truly on the ballot this November.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Energy

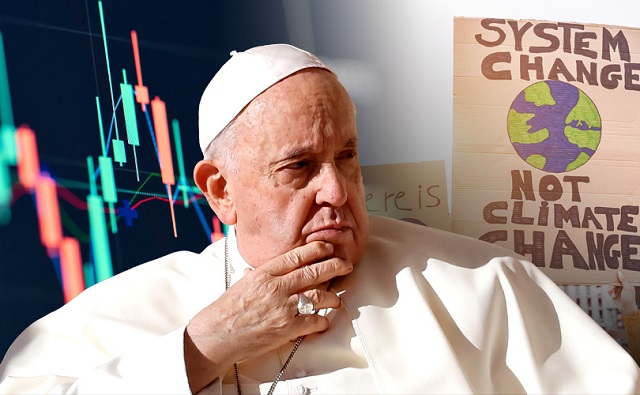

Pope Francis calls for ‘global financial charter’ at Vatican climate change conference

From LifeSiteNews

By Michael Haynes, Snr. Vatican Correspondent

Pope Francis called for a ‘new global financial charter’ by 2025 which would be centered on climate change and ‘ecological debt’ in a keynote address at the Vatican-organized ‘Climate Crisis to Climate Resilience’ conference.

Addressing a Vatican-hosted climate change conference, Pope Francis called for a “new global financial charter” by 2025 which would be centered on climate change and “ecological debt.”

“There is a need to develop a new financial architecture capable of responding to the demands of the Global South and of the island states that have been seriously affected by climate catastrophes,” said Pope Francis on Thursday, May 16.

The Pontiff’s words came towards the end of his keynote address at the conference “Climate Crisis to Climate Resilience,” organized jointly by the Vatican’s Pontifical Academy of Sciences and Pontifical Academy of Social Sciences.

JUST IN: #PopeFrancis urges @CasinaPioIV climate change conf to work for “global de-carbonization” adding: “The data emerging from this summit reveal that the specter of climate change looms over every aspect of existence, threatening water, air, food and energy systems.”… pic.twitter.com/t7cV4ne0s4

— Michael Haynes 🇻🇦 (@MLJHaynes) May 16, 2024

Outlining a three-fold action plan to respond to the “planetary crisis,” Francis told the participants that any such action must be centered around financial action.

“The restructuring and reduction of debt, together with the development of a new global financial charter by 2025, acknowledging a sort of ecological debt – we must work on this term: ecological debt – can be of great assistance in mitigating climate changes,” he said, appearing to allude to an already existing, but as yet unpublished, charter.

The Pope’s three-fold plan also highlighted his call for “policy changes” based on climate adherence and the reduction of warming, fossil fuel reliance, and carbon dioxide:

First, a universal approach and swift and decisive action is needed, capable of producing policy changes and decisions. Second, we need to reverse the curve of warming, seeking to halve the rate of warming in the short space of a quarter of a century. At the same time, we need to aim for global de-carbonization, eliminating the dependence on fossil fuels.

Third, large quantities of carbon dioxide must be removed from the atmosphere through environmental management spanning several generations.

Francis’ call for finance-related policies to implement climate change goals will have been met especially warmly by certain attendees of the Vatican’s conference. Among the numerous participants and speakers at the three-day event were ardent pro-climate change advocates California Gov. Gavin Newsom, London’s Mayor Sadiq Khan, New York Gov. Kathy Hochul, Massachusetts’s lesbian Gov. Maura Healey, along with academics and politicians from South America, Africa, Italy, and Taiwan.

Newsom and Khan – both of whom have implemented sweeping and highly controversial measures in the name of climate change – spoke respectively on “The Gold Standard – Climate Leadership in the Golden State” and “Governance in the Age of Climate Change.” Khan also wrote in the U.K.’s The Tablet that he joins his voice to that of Francis “to support climate resilience efforts and advocate for climate justice.”

Green finance for the future

While no further details were given about the charter Pope Francis referred to, in recent years increased attention has been paid to coordinating climate policies with finance, performing “debt for nature swaps” in line with the World Economic Forum’s policies, and addressing “ecological debt” itself, which is a term itself employed regularly by Francis.

Last October 4, Francis published a second part to his 2015 environmental encyclical letter Laudato Si’ in the form of the Apostolic Exhortation Laudate Deum, in which he issued stark calls for “obligatory” measures across the globe to address the issue of “climate change.”

READ: Pope Francis calls for obligatory global ‘climate change’ policies in new document ‘Laudate Deum’

“It is no longer possible to doubt the human – ‘anthropic’ – origin of climate change,” wrote the Pontiff, before later calling for mandatory alignment with “green” policies:

If there is sincere interest in making COP28 a historic event that honors and ennobles us as human beings, then one can only hope for binding forms of energy transition that meet three conditions: that they be efficient, obligatory and readily monitored.

Francis’ oft-repeated lines on the subject have repeatedly born similarities to the sentiments expressed by key globalist and founder of the World Economic Forum (WEF) Klaus Schwab, whose proposed anti-Catholic “Great Reset” is underpinned by a focus on a “green” financial agenda, as he mentions the “withdrawal of fossil-fuel subsidies” and a new financial system based on “investments” which advance “equality and sustainability” and the building of a “‘green’ urban infrastructure.”

Indeed, the world of finance is one of the sectors that is most devoted to implementing “climate change” policies, such as those outlined by the Paris Agreement – the pro-abortion climate agreement to which the Vatican joined in 2022.

A lesser-known third aim of the Paris Agreement pertains directly to the financial element of the document, ensuring that the future of global finance is directly connected to the various climate change efforts laid out in the Paris Agreement. It reads:

Making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.

This aim provides the basis for international governments to link provision of finance to the implementation of the “green” agenda of the Paris Agreement. The almost unknown Network of Central Banks and Supervisors for Greening the Financial System (NGFS) was born at the Paris “One Planet Summit” in December 2017, with the purpose of transforming the global economy in alignment with “green” climate change policies.

READ: Secretive international banking group may enforce Great Reset ‘green’ agenda on world

Already, it numbers 138 members, with an additional 21 observer organizations, including national and international banks such as the “Bank of Canada; Bank of England; Banque de France; Dubai Financial Services Authority; European Central Bank; Japan FSA; People’s Bank of China; Swiss National Bank; U.S. Federal Reserve.”

Such policies are regularly at the forefront of international finance meetings as well. One such example was last year, when French President Emmanuel Macron called for a “public finance shock” based around climate issues and global finance. His address was given to international leaders at the 2023 Summit for a New Global Financial Pact, held in Paris.

-

Crime1 day ago

Crime1 day agoThe US Canadian border: Greatest number of terrorist watch list individuals being apprehended at northern border

-

COVID-192 days ago

COVID-192 days agoNIH Quietly Altered Definition For Gain-Of-Function Research On Its Website, Former Fauci Aide Confirms

-

Economy15 hours ago

Economy15 hours agoCanadians experiencing second-longest and third steepest decline in living standards in last 40 years

-

Energy2 days ago

Energy2 days agoPope Francis calls for ‘global financial charter’ at Vatican climate change conference

-

Great Reset16 hours ago

Great Reset16 hours agoBiden Administration Eager to Sign WHO Pandemic Treaty

-

Opinion19 hours ago

Opinion19 hours agoOrdinary working Canadians are not buying into transgender identity politics

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoJerry Came to See The Babies. And They Walked Out On Him

-

Energy18 hours ago

Energy18 hours agoNew Report Reveals Just How Energy Rich America Really Is