Business

Canada needs to get serious about securing its border

From the Macdonald Laurier Institute

By Todd Hataley for Inside Policy

US President-elect Donald Trump has made clear his intention to call out Canada on weak enforcement on migration, money laundering, and the cross-border trafficking of narcotics, especially fentanyl.

Until just very recently, Canada has remained largely silent on these issues. Security agencies, such as the Royal Canadian Mounted Police (RCMP), Ontario Provincial Police (OPP), Sûreté du Québec (SQ) and the Canada Border Services Agency (CBSA), have tried to secure the border via memorandums of understanding, framework agreements, and legislated agreements that allow them to share information and even work together.

However, resources are limited for cross-border law enforcement co-operation. CBSA remains understaffed and RCMP Integrated Border Enforcement Teams (which work with US security agencies) have limited geographic reach, leaving much of the enforcement between ports of entry left to police of jurisdiction, who already are hard pressed to provide services to the communities they serve.

The Canadian government’s apparent strategy of largely ignoring the problem is becoming more difficult to maintain. With the United States Border Patrol intercepting increasing numbers of illegal migrants crossing into that country from Canada, it’s clear the porous border is a concern. Exacerbating the situation is the recent discovery of illegal narcotic super labs in Canada – where production far outstrips the market – and Canada’s unfortunate, albeit well-deserved reputation as a haven for global money launderers.

Thanks to Trump’s 25 per cent tariff threat, the crisis is now endangering Canada’s relationship with its largest and most-important trading partner. This announcement sent all sectors of government and the private sector into a frenzy, prompting Prime Minister Justin Trudeau to fly to Florida to seek out an early audience with Trump at his Mar-a-lago resort home. Trudeau’s team spun the trip as proof that the federal government is serious about working with the US to address its border security and public safety concerns.

But with political crises piling up, it will be difficult for Trudeau to also manage the political optics of kowtowing to Trump, who is widely unpopular among Canadians. Spending extra money to appease Trump during the ongoing housing, immigration, and health care crises could make the Trudeau’s popularity nosedive even further. Adding insult to injury, Trump is essentially demanding that Canada do America’s work by stopping illicit goods and people from entering the United States: customs and border security officials generally work on the principle of stopping goods from entering their country.

Trudeau faces many practical challenges, including the need to ramp up the number of border and law enforcement agents who have the skill sets and training required to police offences such as drug production, money laundering, and the cross-border smuggling of goods and humans. Purchasing helicopters and drones to conduct surveillance will do little to aid enforcement, since most goods smuggled across the border pass through legitimate border crossings. RCMP Commissioner Mike Duheme even suggested putting RCMP cadets along the border – a challenging proposition since vast swathes of the border are either wilderness or water. Surveillance is one thing, but the act of enforcement takes skilled people with the capacity to investigate, gather evidence, and articulate that evidence into something that can be used by the courts for convictions. These concerns are not being addressed in this current frenzy to spend money on border security.

There is also good evidence that fortifying the border, or what has become known as forward deployment along the border, does nothing to stop the cross-border transit of contraband goods and people. One need only look as far as the United States-Mexico border to see the failure of forward deployment.

As authorities increase border enforcement activities, the costs of smuggling goods and people mounts for criminals. Eventually, it drives out amateurs, leaving only the professional, skilled, and well-equipped criminal groups. This, in turn, often leads to increasing levels of violence along the border, making interdiction and disruption far more difficult for law enforcement agencies.

Canada has several clear options to address Trump’s border concerns. It can increase the staffing of frontline CBSA officers, including border agents, inland enforcement units that actively investigate and remove individuals from Canada, international liaison officers, and customs processing staff. It can also create a plan for CBSA to take over enforcement between ports of entry. Currently, CBSA enforces entry into Canada at the ports of entry and the RCMP are responsible for the areas in between. Having a single agency manage the border builds capacity and expertise, avoiding inter-bureaucracy competition and confusion.

Canada can also work to better integrate law enforcement, intelligence units, and border services at all levels of government and across international boundaries. Cross-border crime operations are often planned and execute far from the border.

Some of this already takes place, as noted above, but it needs to go much deeper and be more supportive at both institutional and individual levels. This process must also include private sector stakeholders: companies such as FedEx, UPS, and Amazon, as well as freight forwarders, trucking companies, and customs brokers, are all involved in cross-border trade. Their participation as partners in reducing cross-border criminal activity is essential.

Finally, the government needs to designate laws specific to cross-border crime and include meaningful penalties as a means of deterrence.

Hyper-focusing on the border while ignoring other aspects of cross-border crime may be good political optics, but it is a bad strategy. What we really need is functional enforcement – including an integrated process extended vertically and horizontally across all sectors of border stakeholders, at and away from the border, supported by strong policy and legislation. This is the path forward to better cross-border crime enforcement.

Dr. Todd Hataley is a professor in the School of Justice and Community Development at Fleming College. A retired member of the Royal Canadian Mounted Police, he worked as an investigator in organized crime, national security, cross-border crime, and extra-territorial torture. He is a contributor to the Macdonald-Laurier Institute.

Business

The Grocery Greed Myth

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

“It’s not okay that our biggest grocery stores are making record profits while Canadians are struggling to put food on the table.” —PM Justin Trudeau, September 13, 2023.

A couple of days after the above statement, the then-prime minister and his government continued a campaign to blame rising food prices on grocery retailers.

The line Justin Trudeau delivered in September 2023, triggered a week of political theatre. It also handed his innovation minister, François-Philippe Champagne, a ready-made role: defender of the common shopper against supposed corporate greed. The grocery price problem would be fixed by Thanksgiving that year. That was two years ago. Remember the promise?

But as Ian Madsen of the Frontier Centre for Public Policy has shown, the numbers tell a different story. Canada’s major grocers have not been posting “record profits.” They have been inching forward in a highly competitive, capital-intensive sector. Madsen’s analysis of industry profit margins shows this clearly.

Take Loblaw. Its EBITDA margin (earnings before interest, taxes, depreciation, and amortization) averaged 11.2 per cent over the three years ending 2024. That is up slightly from 10 per cent pre-COVID. Empire grew from 3.9 to 7.6 per cent. Metro went from 7.6 to 9.6. These are steady trends, not windfalls. As Madsen rightly points out, margins like these often reflect consolidation, automation, and long-term investment.

Meanwhile, inflation tells its own story. From March 2020 to March 2024, Canada’s money supply rose by 36 per cent. Consumer prices climbed about 20 per cent in the same window. That disparity suggests grocers helped absorb inflationary pressure rather than drive it. The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

Yet Ottawa pressed ahead with its chosen solution: the Grocery Code of Conduct. It was crafted in the wake of pandemic disruptions and billed as a tool for fairness. In practice, it is a voluntary framework with no enforcement and no teeth. The dispute resolution process will not function until 2026. Key terms remain undefined. Suppliers are told they can expect “reasonable substantiation” for sudden changes in demand. They are not told what that means. But food inflation remains.

This ambiguity helps no one. Large suppliers will continue to settle matters privately. Small ones, facing the threat of lost shelf space, may feel forced to absorb losses quietly. As Madsen observes, the Code is unlikely to change much for those it claims to protect.

What it does serve is a narrative. It lets the government appear responsive while avoiding accountability. It shifts attention away from the structural causes of price increases: central bank expansion, regulatory overload, and federal spending. Instead of owning the crisis, the state points to a scapegoat.

This method is not new. The Trudeau government, of which Carney’s is a continuation, has always shown a tendency to favour symbolism over substance. Its approach to identity politics follows the same pattern. Policies are announced with fanfare, dissent is painted as bigotry, and inconvenient facts are set aside.

The Grocery Code fits this model. It is not a policy grounded in need or economic logic. It is a ritual. It gives the illusion of action. It casts grocers as villains. It gives the impression to the uncaring public that the government is “providing solutions,” and that “it has their backs.” It flatters the state.

Madsen’s work cuts through that illusion. It reminds us that grocery margins are modest, inflation was monetary, and the public is being sold a story.

Canadians deserve better than fables, but they keep voting for the same folks. They don’t think to think that they deserve a government that governs within its limits; a government that accept its role in the crises it helped cause, and restores the conditions for genuine economic freedom. The Grocery Code is not a step in that direction. It was always a distraction, wrapped in a moral pose.

And like most moral poses in Ottawa, it leaves the facts behind.

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

Business

Tax filing announcement shows consultation was a sham

The Canadian Taxpayers Federation is criticizing Prime Minister Mark Carney for announcing that the government is expanding automatic tax filing within hours of the government’s consultation ending.

“There’s no way government bureaucrats pulled an all-nighter reading through thousands of submissions and survey responses before sending Carney out to make an announcement on automatic tax filing the next morning,” said Franco Terrazzano, CTF Federal Director. “Asking Canadians for their opinion and then ignoring them isn’t a good look for Carney, it makes it look like the government is holding sham consultations.”

The government of Canada announced consultations on automatic tax filing so Canadians could give the government “broad input through an online questionnaire.”

The government’s consultation ended on Thursday, Oct. 9, 2025.

Hours after the consultation ended, Carney today announced the government would expand automatic tax filing.

The CRA is already one of the largest arms of the federal government with 52,499 bureaucrats.

The CRA added 13,015 employees since 2016 – a 33 per cent increase. For comparison, America’s Internal Revenue Service has 90,516 bureaucrats. The CRA has one bureaucrat for every 800 Canadians. The IRS has one bureaucrat for every 3,800 Americans.

“The CRA can barely answer the phone, so Carney shouldn’t be giving those bureaucrats more busy work to do,” Terrazzano said. “The CRA is a bloated mess, and Carney should be cutting the cost of bureaucracy not scheming up ways to give the bureaucracy more power over taxpayers.”

The CRA only answered about 36 per cent of the 53.5 million calls it received between March 2016 and March 2017, according to a 2017 Auditor General report. When Canadians were able to get the CRA on the phone, call centre agents gave inaccurate information about 30 per cent of the time.

“The CRA acting as both tax collector and tax filer is a serious conflict of interest,” Terrazzano said. “Trusting the taxman to do your tax return is like trusting your dog to protect your burger.

“Carney should stop the CRA power grab and instead cut taxes and simplify the tax code.”

-

Alberta2 days ago

Alberta2 days agoFact, fiction, and the pipeline that’s paying Canada’s rent

-

Business24 hours ago

Business24 hours agoCarney government plans to muddy the fiscal waters in upcoming budget

-

Business1 day ago

Business1 day agoTrump Warns Beijing Of ‘Countermeasures’ As China Tightens Grip On Critical Resources

-

International1 day ago

International1 day agoTrump gets an honourable mention: Nobel winner dedicates peace prize to Trump

-

International2 days ago

International2 days agoTrump-brokered Gaza peace agreement enters first phase

-

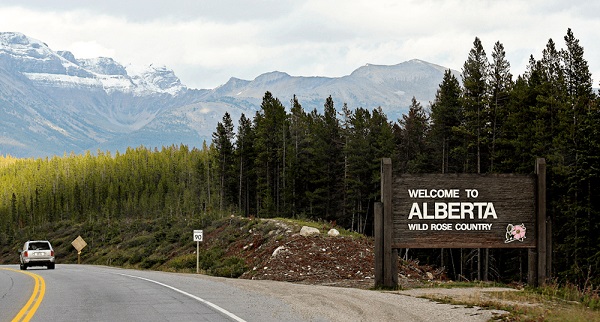

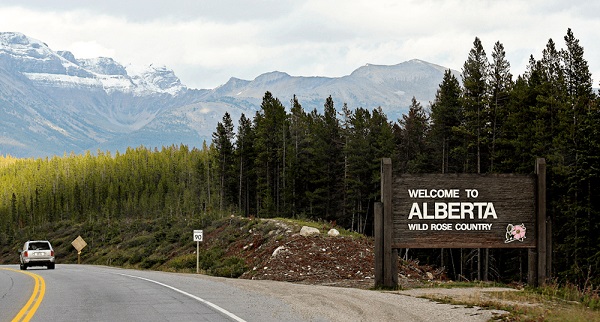

Alberta2 days ago

Alberta2 days agoAlberta Is Where Canadians Go When They Want To Build A Better Life

-

Crime1 day ago

Crime1 day agoCanada’s safety minister says he has not met with any members of damaged or destroyed churches

-

COVID-191 day ago

COVID-191 day agoTamara Lich says she has no ‘remorse,’ no reason to apologize for leading Freedom Convoy