Business

A Nation Built on Sand: How Canada Squanders Its Abundance

By Garry Clement

Columnist Garry Clement, former RCMP anti–money laundering expert, argues Canada’s leaders have built prosperity on sand — leaving the nation exposed to collapse unless urgent reforms are made.

Canada is celebrated abroad as a safe, prosperous, and open society. But beneath the surface, a far more precarious reality is taking shape. The pillars of our economy — land, real estate, natural resources, and immigration — have been left vulnerable to foreign manipulation, criminal exploitation, and political negligence. The result is what can only be described as a sandcastle economy — striking at first glance, but fragile. Like the parable of the house built on sand, it is a foundation vulnerable to give way when the storm comes.

Investigative journalist Sam Cooper has long warned that foreign capital and organized crime have deeply infiltrated Canada’s real estate market. On Prince Edward Island, the Bliss and Wisdom Buddhist group quietly acquired swaths of farmland and property, raising questions about how religious fronts with Chinese connections gained such leverage in a province with limited oversight. In Saskatchewan, Chinese investors have been buying up valuable farmland, raising alarms about food sovereignty and the lack of restrictions on foreign ownership of agricultural land. Meanwhile in British Columbia, governments continue to downplay or outright ignore the extent to which transnational money laundering has fueled a housing market now completely detached from local incomes.

All of this has unfolded against a backdrop of minimal transparency, weak beneficial ownership registries, and virtually no effective enforcement. The same blind spots that allowed casinos and luxury real estate in Vancouver to become laundromats for dirty money are now being replicated nationwide.

The most urgent threat tied to these financial blind spots is fentanyl. Canada has become one of the world’s top destinations for proceeds from synthetic drug trafficking — a crisis that has devastated families from coast to coast. Chinese triads, Mexican cartels, and local gangs launder profits through casinos, shell companies, and real estate deals. Yet federal legislation continues to lag behind, leaving law enforcement outgunned. Every toxic opioid death in Canada is not only a health tragedy, but also a reminder of how organized crime is exploiting our lax financial controls. While other countries have implemented tough anti-money laundering regimes, Canada remains dangerously complacent.

That same complacency extends to national security. Canada has repeatedly delayed designating Iran’s Islamic Revolutionary Guard Corps as a terrorist organization, despite overwhelming evidence of its involvement in financing terrorism and conducting influence operations abroad. Our allies — including the United States — have acted. Canada, however, remains an outlier, seemingly unwilling to confront the risk of Iranian proxy activity operating in plain sight within our borders.

Immigration policy reveals similar weaknesses. Foreign students, particularly from India, have become central to the financial survival of colleges and universities. Yet a growing number are not here primarily to study. Instead, education visas have become a backdoor into Canada’s workforce, particularly in industries such as trucking. The tragic Humboldt Broncos bus crash in 2018 exposed gaps in training and licensing in the trucking sector. Since then, reports have continued to surface of foreign students entering the industry without adequate skills — a risk not only to public safety but to the integrity of our immigration system. Ottawa has failed to adequately regulate this pipeline, preferring instead to rely on the tuition dollars and temporary labour it generates.

Editor’s Note: Forthcoming Bureau investigations, citing U.S. government sources, question how widespread fraud and Indian transnational crime capture of Canada’s commercial trucking industry have fueled the flow of fentanyl, cocaine, and methamphetamine — turning the country into a weak link for its international allies.

The threads running through these crises are clear: willful blindness, weak laws, and short-term political expediency. Land and natural resources are being sold without regard for sovereignty. Real estate markets are distorted by laundered money. Organized crime groups funnel fentanyl profits into Canada with ease. The IRGC operates without effective restriction. And the education system is exploited as a labour channel, with little oversight. Canada is, in effect, trading away its long-term security for short-term economic gains.

Politicians, bureaucrats, and regulators too often dismiss warnings as alarmist or xenophobic, when in fact they reflect real risks to the stability of the country. A sandcastle can stand tall on the shore, admired in the moment, but everyone knows what comes next. Unless urgent steps are taken — enforcing transparency in land ownership, restricting foreign control of farmland and resources, tightening anti-money laundering measures, confronting hostile foreign actors, and restoring integrity to the education and immigration systems — collapse is inevitable.

The signs are already here: families priced out of homes, farmers squeezed out of land, fentanyl overdoses climbing, and a public losing faith in the fairness of the system. Canada prides itself on being open and inclusive. But openness without vigilance is vulnerability. Like unwise stewards, our leaders have been gifted with a land of overflowing abundance, and yet they have squandered its potential through short-sighted choices. That failure must be corrected — immediately and wisely — if the nation is to not only thrive, but survive.

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Former senior RCMP officer Garry Clement consults with corporations on anti-money laundering, contributed to the Canadian academic text Dirty Money, and wrote Canada Under Siege, and Undercover, In the Shady World of Organized Crime and the RCMP

Business

The Grocery Greed Myth

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

“It’s not okay that our biggest grocery stores are making record profits while Canadians are struggling to put food on the table.” —PM Justin Trudeau, September 13, 2023.

A couple of days after the above statement, the then-prime minister and his government continued a campaign to blame rising food prices on grocery retailers.

The line Justin Trudeau delivered in September 2023, triggered a week of political theatre. It also handed his innovation minister, François-Philippe Champagne, a ready-made role: defender of the common shopper against supposed corporate greed. The grocery price problem would be fixed by Thanksgiving that year. That was two years ago. Remember the promise?

But as Ian Madsen of the Frontier Centre for Public Policy has shown, the numbers tell a different story. Canada’s major grocers have not been posting “record profits.” They have been inching forward in a highly competitive, capital-intensive sector. Madsen’s analysis of industry profit margins shows this clearly.

Take Loblaw. Its EBITDA margin (earnings before interest, taxes, depreciation, and amortization) averaged 11.2 per cent over the three years ending 2024. That is up slightly from 10 per cent pre-COVID. Empire grew from 3.9 to 7.6 per cent. Metro went from 7.6 to 9.6. These are steady trends, not windfalls. As Madsen rightly points out, margins like these often reflect consolidation, automation, and long-term investment.

Meanwhile, inflation tells its own story. From March 2020 to March 2024, Canada’s money supply rose by 36 per cent. Consumer prices climbed about 20 per cent in the same window. That disparity suggests grocers helped absorb inflationary pressure rather than drive it. The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

Yet Ottawa pressed ahead with its chosen solution: the Grocery Code of Conduct. It was crafted in the wake of pandemic disruptions and billed as a tool for fairness. In practice, it is a voluntary framework with no enforcement and no teeth. The dispute resolution process will not function until 2026. Key terms remain undefined. Suppliers are told they can expect “reasonable substantiation” for sudden changes in demand. They are not told what that means. But food inflation remains.

This ambiguity helps no one. Large suppliers will continue to settle matters privately. Small ones, facing the threat of lost shelf space, may feel forced to absorb losses quietly. As Madsen observes, the Code is unlikely to change much for those it claims to protect.

What it does serve is a narrative. It lets the government appear responsive while avoiding accountability. It shifts attention away from the structural causes of price increases: central bank expansion, regulatory overload, and federal spending. Instead of owning the crisis, the state points to a scapegoat.

This method is not new. The Trudeau government, of which Carney’s is a continuation, has always shown a tendency to favour symbolism over substance. Its approach to identity politics follows the same pattern. Policies are announced with fanfare, dissent is painted as bigotry, and inconvenient facts are set aside.

The Grocery Code fits this model. It is not a policy grounded in need or economic logic. It is a ritual. It gives the illusion of action. It casts grocers as villains. It gives the impression to the uncaring public that the government is “providing solutions,” and that “it has their backs.” It flatters the state.

Madsen’s work cuts through that illusion. It reminds us that grocery margins are modest, inflation was monetary, and the public is being sold a story.

Canadians deserve better than fables, but they keep voting for the same folks. They don’t think to think that they deserve a government that governs within its limits; a government that accept its role in the crises it helped cause, and restores the conditions for genuine economic freedom. The Grocery Code is not a step in that direction. It was always a distraction, wrapped in a moral pose.

And like most moral poses in Ottawa, it leaves the facts behind.

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

Business

Tax filing announcement shows consultation was a sham

The Canadian Taxpayers Federation is criticizing Prime Minister Mark Carney for announcing that the government is expanding automatic tax filing within hours of the government’s consultation ending.

“There’s no way government bureaucrats pulled an all-nighter reading through thousands of submissions and survey responses before sending Carney out to make an announcement on automatic tax filing the next morning,” said Franco Terrazzano, CTF Federal Director. “Asking Canadians for their opinion and then ignoring them isn’t a good look for Carney, it makes it look like the government is holding sham consultations.”

The government of Canada announced consultations on automatic tax filing so Canadians could give the government “broad input through an online questionnaire.”

The government’s consultation ended on Thursday, Oct. 9, 2025.

Hours after the consultation ended, Carney today announced the government would expand automatic tax filing.

The CRA is already one of the largest arms of the federal government with 52,499 bureaucrats.

The CRA added 13,015 employees since 2016 – a 33 per cent increase. For comparison, America’s Internal Revenue Service has 90,516 bureaucrats. The CRA has one bureaucrat for every 800 Canadians. The IRS has one bureaucrat for every 3,800 Americans.

“The CRA can barely answer the phone, so Carney shouldn’t be giving those bureaucrats more busy work to do,” Terrazzano said. “The CRA is a bloated mess, and Carney should be cutting the cost of bureaucracy not scheming up ways to give the bureaucracy more power over taxpayers.”

The CRA only answered about 36 per cent of the 53.5 million calls it received between March 2016 and March 2017, according to a 2017 Auditor General report. When Canadians were able to get the CRA on the phone, call centre agents gave inaccurate information about 30 per cent of the time.

“The CRA acting as both tax collector and tax filer is a serious conflict of interest,” Terrazzano said. “Trusting the taxman to do your tax return is like trusting your dog to protect your burger.

“Carney should stop the CRA power grab and instead cut taxes and simplify the tax code.”

-

Alberta2 days ago

Alberta2 days agoFact, fiction, and the pipeline that’s paying Canada’s rent

-

Business1 day ago

Business1 day agoTrump Warns Beijing Of ‘Countermeasures’ As China Tightens Grip On Critical Resources

-

Business20 hours ago

Business20 hours agoCarney government plans to muddy the fiscal waters in upcoming budget

-

International1 day ago

International1 day agoTrump gets an honourable mention: Nobel winner dedicates peace prize to Trump

-

International2 days ago

International2 days agoTrump-brokered Gaza peace agreement enters first phase

-

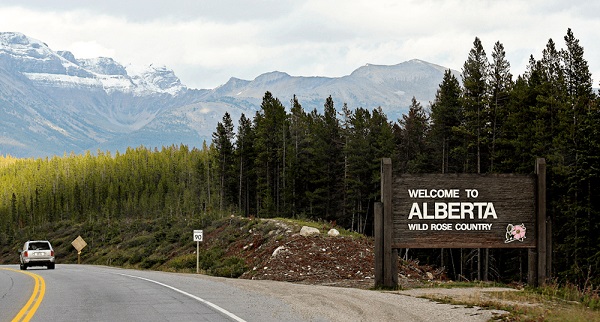

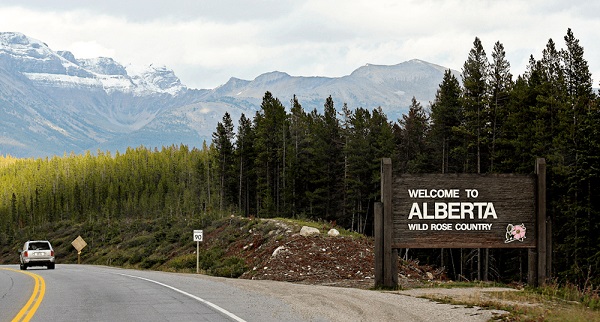

Alberta2 days ago

Alberta2 days agoAlberta Is Where Canadians Go When They Want To Build A Better Life

-

Crime1 day ago

Crime1 day agoCanada’s safety minister says he has not met with any members of damaged or destroyed churches

-

COVID-191 day ago

COVID-191 day agoTamara Lich says she has no ‘remorse,’ no reason to apologize for leading Freedom Convoy