International

28-year-old Dutch woman to be killed by assisted suicide after doctors deem her autism ‘untreatable’

28-year-old Dutch woman Zoraya ter Beek (YouTube Screenshot)

From LifeSiteNews

28-year-old Zoraya ter Beek plans to die by assisted suicide over her struggles with depression and mental illness, a trend which is increasing in The Netherlands.

A 28-year-old autistic woman is scheduled to die by assisted suicide in May in The Netherlands after struggling with depression and mental illness, with her psychiatrist telling her that her condition is untreatable and will never improve.

Zoraya ter Beek, who does not suffer from any physical illness, has decided to end her life by assisted suicide after psychiatrists said they had exhausted any means of helping her deal with her mental illnesses, which includes borderline personality disorder, according to The Free Press.

Her struggles with mental illness have prevented her from being able to finish school or start a career.

READ: Canadian judge blocks imminent euthanasia death of 27-year-old autistic woman

In testimony to the nihilistic attitude adopted in the choice to end her own life on account of suffering, Ter Beek has decided that after she has been killed, her body will be cremated without a funeral and her ashes scattered in the woods.

Ter Beek’s choice to take her own life comes despite her admitted fear of death arising from the uncertainty of what happens after death.

“I’m a little afraid of dying, because it’s the ultimate unknown,” she said. “We don’t really know what’s next – or is there nothing? That’s the scary part.”

The diagnosis of autism and mental illness as “untreatable” and “unbearable” has become an increasing trend in The Netherlands, with a study published in June 2023 revealing 40 cases over a 10-year period from 2012 to 2021. In a third of those cases, those with autism or intellectual disabilities were told there was no hope of improving their lives, and so their condition was deemed “untreatable.”

READ: Autistic people in the Netherlands are being euthanized: report

Irene Tuffrey-Wijne, a palliative care physician at Britain’s Kingston University, who led the study which examined 900 cases, said, “There’s no doubt in my mind these people were suffering. But is society really OK with sending this message, that there’s no other way to help them and it’s just better to be dead?”

Tim Stainton, director of the Canadian Institute for Inclusion and Citizenship at the University of British Columbia, added, “Helping people with autism and intellectual disabilities to die is essentially eugenics.”

The scheduled killing of the 28-year-old autistic woman comes as The Netherlands continues to expand the scope of what legally qualifies for euthanasia, with a new law effective February 1 allowing the killing of terminally ill children aged 1 through 12 who are deemed to be “suffering hopelessly and unbearably.”

The law allows parents to decide to kill their child even if the child is unwilling or unable to consent.

Crime

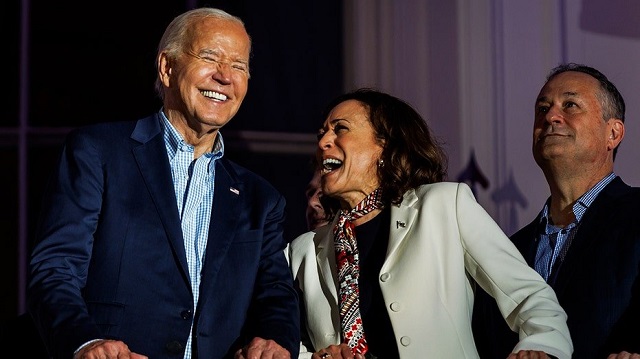

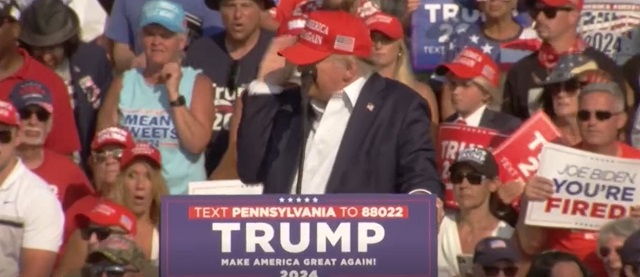

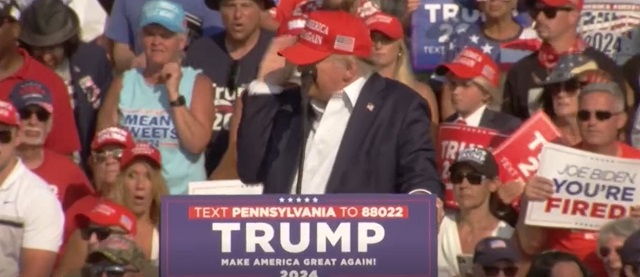

Everything you need to know about the failed assassination attempt of Donald Trump

From LifeSiteNews

By Frank Wright

Amid all the varying accounts and evidence, there is no clear picture of the attempt to kill Donald Trump, and the FBI and Secret Service have been unwilling or unable to supply answers to the questions raised by the failed assassination.

Almost two weeks have passed since the miraculous survival of Donald Trump and still the major questions raised by his attempted assassination are unanswered.

How can the United States Congress fail to determine the facts of a systematic failure of security which seems almost designed to permit an attempt on the former president’s life?

The obvious questions – how could this happen? – and why? – have equally obvious answers. The reason there are no answers is because Donald Trump is the mortal enemy of the entire political establishment of the U.S. and its subject nations.

We are ruled by a conspiracy against the obvious. The attempt to kill Donald Trump cannot be understood if we do not begin with a statement of the obvious: his political enemies want him dead.

This is a report on the official and unofficial investigations into what the FBI called “an incident” on July 13. As we shall see, the official lines of inquiry effectively exclude the obvious.

The most obvious fact of all is that everyone except the people supposed to protect him have seen this coming for a long time.

See no evil

The version of events presented by the bare facts is another conspiracy against the obvious. The story says a lone gunman – a 20 year old called Thomas Matthew Crooks – decided to shoot Trump one day, and no one stopped him until he had done so. According to CNN, Crooks scoped the site with a rangefinder three hours before the shooting, and was seen doing so, before returning to carry it out. A rangefinder has one use: to report the distance to a target.

Former Secret Service chief Kimberly Cheatle said a rangefinder “is not a prohibited item” when asked why Crooks was not stopped.

Crooks was filmed wandering the perimeter of the Trump rally one hour before the shooting.

NEW EXCLUSIVE video shows the shooter walking around by himself looking up at rooftops near Trump

How was he not detained?!

Especially after getting caught with a range finder?! pic.twitter.com/lOU6pnCL0C

— DC_Draino (@DC_Draino) July 17, 2024

He was photographed by Secret Service snipers and seen on the roof by them – and others – well before the shots were fired.

JUST IN: Thomas Crooks took out a rangefinder which was noticed by a sn*per before the rally before he "disappeared" and returned with a backpack.

Let me say that again: Sn*pers saw Crooks pull out a **rangefinder** to calculate the distance to the target and still didn't… pic.twitter.com/K0oztaDiqK

— Collin Rugg (@CollinRugg) July 16, 2024

‘We cannot trust the FBI’

This report will first examine the official story of a lone gunman acting alone. Cheatle refused to answer whether her agency had produced a complete timeline of Crooks’ movements leading up to the moment of Trump’s shooting.

“We cannot trust the FBI to do an open and honest investigation” said Sen. Ron Johnson, speaking to Fox News.

Johnson also mentions that local law enforcement, tasked with securing the building from which the shooting took place, were instructed to send pictures they took on the day to the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF). “What does the ATF have to do with this?” he was asked. Perhaps the FBI will explain.

Perhaps not. FBI Director Christopher Wray told Congress on July 24 that he had doubts as to whether Trump was shot at all.

Here's FBI Director Wray today testifying that "there's some question about whether or not it's a bullet or shrapnel that hit [Trump's] ear" pic.twitter.com/9WWtbkzbCz

— Aaron Rupar (@atrupar) July 24, 2024

This seems callous in the extreme, given that Corey Comperatore was killed and two other men critically injured by the shootings.

During the hearing, it was reported that two FBI agents were on record expressing regret that Trump had survived.

WOW! Wray Says There Were At Least Two Instances Where FBI Officials Expressed Disappointment That Trump Survived Assassination Attempt | The Gateway Pundit

And we are supposed to believe that Trump would-be assassin Thomas Crooks acted alone?

FBI Director Christopher Wray… pic.twitter.com/xTfBovMGbJ

— Owen Gregorian (@OwenGregorian) July 25, 2024

The FBI, which sees no evil in Crooks which can explain his actions, and whose director insists Crooks “acted alone,” may itself be connected to the shooting.

Reports have surfaced showing a phone connected to Crooks was “pinged” eight times in the vicinity of an FBI field office in 2023.

The Secret Service cannot say whether it has attempted to recreate Crooks’ movements and connections prior to the shooting. In the absence of any evidence of an official attempt to do so, this task has been undertaken by the Heritage Foundation’s Oversight Project, and reported on July 22 by independent news outlet Blaze Media:

According to Oversight investigators, a phone associated with Crooks’ work address at a nursing home in Bethel Park, Pennsylvania, traveled to the Gallery Place complex in downtown Washington, D.C., on June 26, 2023. The phone ‘pinged’ seven or eight times from that location the same day.

Gallery Place – an 11-story mixed-use building constructed over the Chinatown Metro station – is filled with retail stores and restaurants but also houses offices of the FBI on the upper floors, former FBI Special Agent Kyle Seraphin told Blaze News.

‘It is the closest [location] off-site that I’m aware of to the Washington Field Office,’ Seraphin said. ‘Agents are assigned to Washington Field, but they work out of Gallery Place.’

Former Secret Service chief Cheatle told Congress she knew how many bullet casings were found beside Crooks’ body – but refused to tell Congress. Cheatle referred Congress to the FBI for more information.

Cheatle refuses to tell Congress how many bullet casings were found on roof where shooter was. This number is of critical importance, and tells how many shots that person fired. Say only three casings were found on the roof then there was another shooter. Cover up! https://t.co/d3p3djA55O

— Terra Joy (@Terrajoypray) July 23, 2024

This is significant. At least nine – some say ten shots – were recorded on the day. A burst of three, followed by a different sounding burst of five, then perhaps another, then finally the single shot from the Secret Service sniper who killed Crooks.

The number of ejected shell casings on the roof beside Crooks would indicate how many shots came from him on that roof. Cheatle’s refusal to tell Congress is a refusal to admit what sound analysis appears to have confirmed: there was more than one shooter on the day.

The narrative of Crooks being a “lone gunman” is 100% provably false. Which means any deflection to investigating ‘security lapses’ is evidence of a cover-up

The evidence I present today comes from analyzing and then comparing the audio files from two separate video recordings,…

— Chris Martenson, PhD (@chrismartenson) July 19, 2024

Sen. Ron Johnson points out Cheatle’s refusal to tell Congress that reports claimed eight shell casings were found beside Crooks’ body.

Oversight Project Director Mike Howell warned of the obvious conflict of interest in permitting the Secret Service and the FBI to investigate themselves:

For the protection of whistleblowers and our investigation, we will not be sharing further information with the congressional task force due to the connective tissue between that entity and FBI, USSS, and other entities.

Mike Benz noted how the Oversight Project’s “parallel” investigation of the Trump assassin “already has more transparency and information than what the FBI is telling us.”

Why would anyone distrust the FBI? Here it refers to “the incident that took place today involving President Trump” and reassures Americans it has “assumed the role of the lead federal law enforcement agency” investigating this “incident.”

Updated FBI statement on the ongoing incident that took place today in Butler, Pennsylvania. https://t.co/MfwVeYs3kF pic.twitter.com/6fWqcTbA1S

— FBI (@FBI) July 14, 2024

One role the FBI will play will be that of investigating its own links to the supposed “lone gunman.” FBI Director Wray says the agency still has no idea of the motive behind the shooting.

In addition, the Department for Homeland Security (DHS) will be investigating its own failure to secure the homeland. Sen. Josh Hawley revealed that whistleblowers told him that some of Trump’s security detail were “not even Secret Service. DHS assigned unprepared and inexperienced personnel.”

🚨🚨 Whistleblowers tell me that MOST of Trump’s security detail working the event last Saturday were not even Secret Service. DHS assigned unprepared and inexperienced personnel 👇 pic.twitter.com/eo4jNmJWFT

— Josh Hawley (@HawleyMO) July 19, 2024

In place of Secret Service, Hawley’s sources claim Homeland Security Investigations agents were used instead. You can watch a video here which asks you to spot which agents might be “DEI” placements from DHS.

Can we reasonably expect DHS Secretary Alejandro Mayorkas to answer for this, or for the DHS “taking over” communications from the Secret Service to Congress?

Apparently not. On July 24, as a U.S. Senate hearing on the “Trump shooting” was announced, Hawley noted that Mayorkas would not be present to answer questions.

The Senate just announced hearings on the Trump shooting – why is Mayorkas not coming? This is a joke. He is the head of DHS.

— Josh Hawley (@HawleyMO) July 24, 2024

Conspiracy or clown show?

There are two ways to see the clear path to the assassination of Trump that Crooks was presented on the day. One – incredible incompetence. Two – a conspiracy to kill the enemy of the status quo.

The attempt to kill Trump is slipping off the news cycle. The latest news is that Kim Cheatle has refused to answer any of the most important questions around the shooting. She appears to have perjured herself before Congress whilst doing so.

She has since resigned. So far, no one has recommended she undergo enhanced interrogation to encourage her to respond to questioning.

Cheatle was even condemned by Alexandria Ocasio-Cortez, as well as Marjorie Taylor Greene – a genuinely bipartisan outrage at the “security failures” over which Cheatle had presided.

Greene asked bluntly, “Was there a stand down order? Was there a conspiracy to assassinate President Trump?”

🔥 WOW! COMPLETE FLAMETHROWER 🔥

MTG TORCHES disgraced US Secret Service Director Cheatle after forcing her to answer point-blank:

"Was there a stand-down order, Ms. Cheatle?

Was there a conspiracy to kill President Trump?!"Her response says it all.

Listen to the room GASP: pic.twitter.com/vcpmZXBnFV

— Benny Johnson (@bennyjohnson) July 22, 2024

Cheatle said the Secret Service had no audio recordings from the day of the shooting.

Cheatle was shown video of Crooks crawling on the roof before the shooting, asking to explain why he was not seen as a threat.

Rep. Krishnamoorthi plays video of a clearly visible Crooks crawling on the roof to prove he was an obvious threat contradicting answer of misleading Cheatle. That doesn't look like suspicious behavior. That's Threatening Behavior. The guy's on the roof & everybody's yelling. pic.twitter.com/dqD5OFicH8

— Steve Retired Texas Pragmatist (@SteveTexasBest) July 23, 2024

Cheatle refused to answer when asked whether Crooks was “acting alone,” referring Congress to the FBI investigation.

BIGGS: "Was Mr. Crooks acting alone?

CHEATLE: "I would have to refer you to the FBI's investigation."

BIGGS: "Was he just a lone gunman?"

CHEATLE: "I would have to refer you to the FBI's investigation for motive." pic.twitter.com/BBzwaKnj5C

— Townhall.com (@townhallcom) July 22, 2024

Following this performance, House Oversight Committee Chairman Rep. James Comer said “there will be more accountability to come” following Cheatle’s resignation. Comer’s pledge displays a confidence that few sane people will share.

The actors from the Deep State are never held to account.

More to this story?

It is unlikely in the extreme that Cheatle, Mayorkas, or any of the people who have sought to destroy Trump will ever be held accountable – unless he takes power in November.

They know this very well, and this is an obvious reason why the only good Trump is a dead Trump to the Deep State. This is a view shared by some members of Congress.

As Rep. Eli Crane asked the House Committee on Homeland Security on July 23:

After partisan attempts to bankrupt Trump, to imprison him for 750 years and countless depictions of him as a modern-day Hitler – are you surprised that a lot of Americans are like, ‘Maybe there’s more to this story’?

Cheatle’s role in the story was to briefly become it, but her appearance before Congress was a master class in refusing the mention of the obvious.

No news from Cheatle is good news – if you support the official conspiracy theory of a lone gunman, favored by an unlikely series of helpful oversights.

How fortunate was this son of a registered Libertarian? The timeline of Crooks’ movements raises even more questions than those Cheatle declined to answer.

Timeline of events

The court press of the regime which hates Trump has offered a simple timeline of the day. NBC’s “full timeline” has it like this:

5:10PM: Crooks, the shooter, identified as a person of interest.

5:30PM: Crooks spotted with rangefinder.

5:52PM: Crooks spotted on roof by Secret Service.

6:02PM: Trump takes stage.

6:12PM: Crooks fires first shots.

Even the lying press admits a 20-minute gap between Crooks being seen with a rifle on the roof and the shots fired at Trump. He had been noted as suspicious one hour before the shooting.

Sen. Chuck Grassley published video on July 23 that showed agents admitting they had identified Crooks as a danger before he was permitted to start shooting.

The man who was mentioned as “detained” is this man, who appears to be the owner of the bicycle that some accounts – such as that of the U.K.’s Daily Mail – said belonged to Crooks.

Apparently, this guy was detained guy

and HE had the bicycle..Did this guy interact at all with Yearick/Crooks/etc?

There WAS a backpack near the bicycle by the tree.

Now, we see no backpack.They thought this guy had a bomb?

Unconfirmed.

Could be a hallucination.. pic.twitter.com/ccrrgk2rkL— John Cullen 🐓 (@I_Am_JohnCullen) July 24, 2024

Pictures of the bicycle showed a bag on the handlebars and a backpack on the ground beside it.

The bag on the handlebars appears to be the bedroll of Mr. Evans, the owner of the bicycle. Media reports said the bike belonged to Crooks. Evans said he was detained – not for being the shooter. “They thought I had the bomb.”

Agents in the video released by Sen. Grassley can be heard saying they saw Crooks arrive on a bicycle, with a backpack, but then lost sight of him.

NBC’s timeline is far from “full.” It excludes these and other key events, including Crooks’ actions in preparing for the shooting, the presence of explosives in a vehicle at the site, and the eyewitness reports of at least a second shooter.

The timeline: complete?

A far more comprehensive timeline has been published here. It begins with Crooks’ preparations, which included visiting the site three times: once a week beforehand, once on the morning of the shooting – and once more to carry it out.

Crooks bought a remote transmitter to detonate explosives, planned a drone surveillance route, and set up and used “encrypted communications channels” before visiting a shooting range on July 12.

At some point he hid the weapon on site, before the “pac man” perimeter was set up.

Kim Cheatle told Congress “the rooftop was outside of the perimeter” of the Secret Service’s “responsibility.” She did not explain why.

She had previously told the media that the roof, being slightly sloped, was unsafe. Here, Rep. Pat Fallon excoriates Cheatle for this ridiculous non-explanation, saying she should “go back to guarding Doritos,” referring to her previous post as senior director of global security at PepsiCo.

The sniper who shot Crooks was positioned on a much steeper roof, of course.

Holy Crap… Rep. Fallon Just Buried Cheatle…

• Cheatle still hasn’t visited the site after 9 days

• She spoke to the agents involved 3 days after

• The Secret Service Counter Snipers were on a Sloped Roof steeper than the shooters

• He recreated the event and got killshots… pic.twitter.com/qecbTiU4uB— MJTruthUltra (@MJTruthUltra) July 22, 2024

She did explain why there were no agents on that roof. They were taken off the roof because it was too hot, and went inside the building instead, to take up positions on the second floor of the building.

This gave them clear lines of sight to Crooks, who was “jumping from roof to roof” in plain view of Secret Service positions.

More than one gunman

According to one independent analyst, “The first three shots came from a very different weapon in a different location” to that of Crooks.

The narrative of Crooks being a “lone gunman” is 100% provably false. Which means any deflection to investigating ‘security lapses’ is evidence of a cover-up

The evidence I present today comes from analyzing and then comparing the audio files from two separate video recordings,…

— Chris Martenson, PhD (@chrismartenson) July 19, 2024

Lone Shooter 100% disproven. https://t.co/Bq3NbNCzYE

— 🇺🇲Take a Stand 🇺🇲🙏 (@keepitwilder) July 19, 2024

Why should anyone believe Chris Martenson, who is just posting on X? Well, his analysis relies on a report of sound signatures which confirmed at least three shooters.

“Deep State-aligned” CNN published a report on July 14 detailing the acoustic analysis of shots fired, naming three separate weapons. That of Crooks, that of the sniper who killed him, and a third weapon.

Martenson says the shots from Shooter 1 have no echo, whilst Shooter 2’s echoes are consistent with Crooks’ position, the report of the AR-15 resounding from the flat roof.

The third sound signature is unexplained.

The sounds from that day do not support the lone gunman conspiracy theory.

This image shows the location of two recordings of the shots fired on the day, which Martenson analyses here. The image below is taken from another account, which suggests a second shooter (the heavy) was firing from a window in a building to the rear of that where Crooks – “the patsy” – was positioned.

Wherever the shots came from, this third weapon was also firing at the stage, says Martenson. He explains that the first three shots have no echo, are muffled, are further away.

Five shots follow, with echoes. Another shot, more of a snapping sound, is heard. Nine shots so far.

Later, the Secret Service sniper shoots. This would be shot number 10 – if the snapping sound is counted.

John Cullen contests Martenson’s account. He says there may have been two shooters in addition to Crooks – drawing on another eyewitness report.

"So, they got the one on the tower. On this side.

But the one on the right side, they never got.They thought there was still a shooter out there, somewhere.

So there could be, in these woods around Butler..".. Eyewitnesses pic.twitter.com/ypJFO30t22

— John Cullen 🐓 (@I_Am_JohnCullen) July 24, 2024

Cullen suggests a shooter may have been positioned in a tree, which one reporter said snipers were aiming at. Police were pictured scaling the tree after the shots with a ladder.

Does that explain this? pic.twitter.com/siEteqrcdI

— John Cullen 🐓 (@I_Am_JohnCullen) July 24, 2024

An eyewitness who says she was present at the rally says she saw “cops pull a guy out of the tree.” She said her friend saw someone shooting from the tree.

Cullen also asks questions concerning the van – said to be that of Crooks – which was towed 10 miles away from outside the Trump rally – despite being reported as being “laden with explosives.”

Why did they tow the van, if it was filled with explosives?

Shouldn't they have brought in the bomb squad to disable the bombs? Pittsburgh isn't that far away.

They have bomb squads.Do we have footage of the bomb squad at work?

Why not?

How much explosive material was found? pic.twitter.com/nZKac2PE4Y— John Cullen 🐓 (@I_Am_JohnCullen) July 23, 2024

A report from CNN, however, claims Crooks had a Hyundai Sonata “with an improvised explosive device in the trunk wired to a transmitter he carried.”

Then, Crooks drove his Hyundai Sonata about an hour north, joining thousands of people from around the region who flocked to Trump’s rally in Butler, Pennsylvania. He parked the car outside the rally, with an improvised explosive device hidden in the trunk that was wired to a transmitter he carried, the official said. Then, investigators believe, he used his newly-bought ladder to scale a nearby building, and opened fire on the former president.

As investigators continue to search for a motive behind the attempted assassination, they are scrutinizing Crooks’ movements before the attack and trying to piece together a timeline of his actions leading up to it.

The New York Times reported two explosive devices in the Hyundai, along with the drone presumed to have been used by Crooks to surveil the site. According to the Times, “So far, [the FBI has] found no evidence that he was motivated by any strong partisan political beliefs or an animus against Mr. Trump.”

Yet the social media site Gab seems to have found an account made by Crooks making strong pro-immigration and pro-Biden remarks.

“While the account made very few posts on the site, the majority of them were in support of President Biden,” Gab CEO Andrew Torba claimed. “A number of posts in particular expressed support for President Biden’s COVID lockdowns, border policies and executive orders.”

Torba made the claims in a July 24 X post.

The refusal to notice the obvious is a hallmark of the agents of the empire of lies. This is a regime which obviously hates Trump, and the truth he tells about their corrupt junta and the murderous wars by which it is enriched. It is obvious that the regime has radicalized millions through its propaganda and lies to defend a dying liberal global order from democracy. The refusal to find any whisper of a motive is the refusal to acknowledge the reality in which this shooting took place.

Did the van – which resembles a vehicle pictured under the water tower – carry the explosives? Did the Hyundai? Did Crooks arrive in two vehicles and on a bicycle as well? The agents in Sen. Grassley’s video mention both the water tower and a van. This is footage we would never have seen had it not been leaked. Why?

All the information which has been useful so far has been released outside official channels. The narrative of the fact-checkers and trusted sources in the mainstream simply does not make sense.

How many shots were fired?

On July 3, the House Committee on Homeland Security met to discuss the assassination attempt.

During the hearing, the Pennsylvania State Police Commissioner Christopher Paris told Rep. Eric Swalwell that “eight casings have been recovered,” after Swallwell asked how many rounds the shooter fired.

Rep. Michael McCaul asked Commissioner Paris about the water tower. According to Paris, there were no Secret Service at or on the water tower. McCaul also mentions explosives in a car, said to be that of Crooks, which Crooks was presumably intending to detonate using a device found on his body.

Who gave the order not to position a sniper on the water tower – the “tallest structure on that site”?

“I do not know,” said Paris.

At the 3-hour, 10-minute mark, Paris confirms that a local police officer gained the roof and was confronted by Crooks, who pointed his weapon at the officer peering over the rooftop.

Paris says that Crooks began firing “a matter of seconds” after this officer came face to face with Crooks, dropping from the roof to avoid being shot himself.

“I’d like to clarify it was a matter of seconds,” says Paris, “because I think earlier it might have been minutes.” Earlier reports suggested an interval of several minutes between the officer’s encounter with Crooks and when, as Paris says, “the first shots rang out.”

Seconds after turning to face a police officer, Crooks is here said to reposition and immediately fire on Trump, narrowly missing his skull.

Hiding in plain sight

Rep. Eli Crane is a former U.S. Navy Seal sniper. On July 22, he posted a video on X from the perspective of a window on a floor occupied by Secret Service agents.

It shows a clear field of view of the roof on which Crooks took position. How could these agents not have seen Crooks?

This video was taken from one of the windows the Secret Service had access to, overlooking the entire roof.

As you can see, they had complete coverage.

Makes you wonder how on earth they allowed the shooter to access the roof, let alone crawl up it & fire several shots. pic.twitter.com/C1GTUAuPEa

— Rep. Eli Crane (@RepEliCrane) July 22, 2024

On the same day, July 22, Crooks posted a video he filmed himself from the roof on which the “supposed sniper took his shot.”

I’m on the roof of the building in Butler, PA where shots were fired in an attempt to assassinate President Trump.

As a former Navy SEAL sniper, it was clear to me that many security measures were dropped making Pres. Trump extremely vulnerable.

Many questions still remain. pic.twitter.com/p2EhBTFg1M

— Rep. Eli Crane (@RepEliCrane) July 22, 2024

Crane does not believe the official account is credible. This may echo suspicions that the shooter was not Crooks at all. [Caution – graphic image.]

“Why weren’t security team sir, on site, able to spot a 20-year-old kid with zero camouflage crawling up a white roof with an AR-15 that several rally-goers were screaming and yelling and pointing out and they noticed him – and they weren’t even there to conduct security they were there to watch the president – do you have any idea why the security teams couldn’t find that guy?” he asked.

“I do not, sir,” Paris replied.

The lapses in security do not explain how agents with a clear view of the roof of the American Glass Research building on which Crooks was killed could not see him. Crane does not buy the story that Crooks was a lone gunman, and suggests he was not the would-be assassin at all.

At the 3-hour, 34-minute mark, Crane asks Paris whether he is aware that the “lone gunman” narrative is viewed with widespread suspicion.

“Are you aware, sir, that many Americans believe this was very likely not a lone shooter but a coordinated assassination attempt? Have you been getting those messages from people like I have?”

Paris said, “I have not, sir.”

Crane replied:

You haven’t. Well, there’s a lot of people in this room that have been getting the same messages. Why do you think that is? Why do you think that a lot of Americans are like, ‘This doesn’t add up? This doesn’t make sense, guys?’

How could this many things have gone wrong – like the things I pointed out? A 20-year-old kid got 150 yards of the [former] president of the United States with an AR-15, flew a drone to conduct sight surveillance, was spotted with a rangefinder ranging targets, then lost.

He had advanced explosive devices on him, with no military training. Nobody was placed in the most obvious spot to conduct counter-sniper operations.

I was a sniper in the SEAL Teams, Colonel. As soon as I got out of the SUV and I saw that water tower I was like, ‘That’s exactly where I’d be. Put me right there. So obvious.’

After partisan attempts to bankrupt him, imprison him for 700-50 years and countless depictions as a modern-day Hitler, are you surprised, sir, that a lot of Americans are like, ‘Maybe there’s more to this story?’

Crane finishes with reference to a November 30, 2023, article written in the Washington Post by neocon warmonger Robert Kagan, the husband of former under secretary of state Victoria Nuland. The article’s headline reads: “A Trump dictatorship is increasingly inevitable – we should stop pretending.”

“This article compares Trump to Caesar and attempts to justify the assassination of President Trump,” Crane said. “I think even though we want to dodge around it and not make this partisan, I think we all know that a lot of this has to do with the very violent rhetoric that has led up to this.”

Crane did not mention that Kagan wrote a follow-up – “The Trump dictatorship: How to stop it” – in January 2024. Kagan said that the system he champions is fighting for its survival, and that stopping Trump is a “matter of life and death.”

Kagan suggested neocon Zionist Nimrata “Nikki” Haley as the savior of the evil and its empire he has done so much to inflict on the world. His family business is war, in which others die and for which he and his murderous clique are celebrated and enriched.

Investigation

Joe Biden and DHS Secretary Alejandro Mayorkas appointed Janet Napolitano to investigate the attempted assassination of Donald Trump.

As the Oversight Project of the Heritage Foundation says, “She has a very long record of vehement anti-Trumpism.”

This is who Biden and Mayorkas picked to investigate the assassination attempt

She has a very long record of vehement anti-Trumpism that we will present to the American People soon https://t.co/Az4HQbMg3g

— Oversight Project (@OversightPR) July 23, 2024

What is more, the House of Representatives announced on July 24 that they will be off “next week” and returning on September 9.

The House just announced that it will be taking next week off and returning on September 9th

Tonight they are going to vote on a Task Force to investigate only the Secret Service

They will allegedly be investigating while "Working From Home"

They will also be gone all October pic.twitter.com/dhVwMlfvxL

— Oversight Project (@OversightPR) July 24, 2024

Trump promised to declassify the investigation should he win the election in November 2024.

Former presidential candidate Dennis Kucinich asked why the buck had seemed to stop with Kim Cheatle. Why was Mayorkas not removed, too?

What about Mayorkas? Are the steps too short? https://t.co/EiXtbfrmPl

— Dennis Kucinich (@Dennis_Kucinich) July 24, 2024

Mayorkas’ DHS had already “taken over” the briefing of Congress by July 16, replacing direct communication between the Secret Service and Congress.

According to Politico’s Congress reporter Jordain Carney, a spokesman was reported as saying, “After the Secret Service agreed to brief members of the House Oversight Committee on Tuesday, [DHS] took over communications with the Committee and has since refused to confirm a briefing time.”

Oversight’s Mike Howell saw this as a clear case of political obstruction of any “independent review” of the shooting.

Biden literally said he supported an "independent review" the other day

Now he has his political appointees obstructing? https://t.co/Xu0FEuIYzW

— Mike Howell (@MHowellTweets) July 16, 2024

Howell’s picture of the feverish domestic situation in the U.S. is also compelling, saying “years of escalating the tensions” in the U.S. shows how “this is well beyond the Secret Service and their posture.”

There simply is not the time for them to do it even if they could do it.

They do not have the investigative capabilities, institutional knowledge, political will, legal ability, nor time.

We need to get serious

— Mike Howell (@MHowellTweets) July 14, 2024

In the aftermath of the shooting, Trump supporters at the rally were filmed directly accusing the mainstream media of inciting the assassination attempt.

WATCH: In the moments after the assassination attempt on former US President Donald Trump’s life, some supporters pointed at the media.

“This is your fault!” pic.twitter.com/l5spjr2Jqz

— Rachel Parker (@Emmanuel_Rach) July 14, 2024

Moves underway to deny Trump protection

Readers may be aware that Democrat lawmakers had drafted legislation to remove Secret Service protection from former President Trump.

Rep. Thomas Massie called for those involved in this move to be barred from participating in the investigation into the attempted assassination.

No Member legislating the removal of President Trump's Secret Service protection should serve on the Task Force investigating Trump's near assassination.

These members have already displayed politicized malice, and Speaker Johnson should block their appointments. pic.twitter.com/WaU2kiY1QP

— Thomas Massie (@RepThomasMassie) July 24, 2024

Rep. Bennie Thompson is one such Democrat congressman.

Thompson explained in the video above that the mechanism of removing Trump’s Secret Service protection relies on whether Trump “is sentenced to jail,” following his legal persecution on felony charges in a process widely criticized as lawfare. Yet as Massie points out, Thompson’s own published fact sheet calls for the removal of Trump’s protection “once he is convicted.”

Responding to the attempted assassination of Trump, Thompson’s own staffer suggested on Facebook that Crooks “should have taken shooting lessons.” Massie also notes that Thompson also “helped Secret Service delete their phone data” relating to the alleged “insurrection” on January 6.

Why should representatives who are engineering the removal of protection from Trump be involved in investigating the effective removal of protection which enabled his attempted assassination?

When reminded of the fact that Trump has just survived an attempt on his life, Thompson is asked to withdraw the legislation to remove Trump’s protective detail.

Thompson refuses to do so, saying “Trump had Secret Service protection in Butler, Pennsylvania.”

Thompson also says the secretary of the Department of Homeland Security – currently Alejandro Mayorkas – can reassign Secret Service protection once Trump has served his sentence.

He does not mention the fact that Trump did not, in fact, have a full Secret Service protective detail in Butler.

Trump to be defended by his enemies?

Massie here raises yet another question that cannot be answered by the official conspiracy theory. It is obvious that Trump is hated by members of the US political class who have worked tirelessly to destroy him. Why should people who want to throw him in prison with no protection be involved in this investigation at all?

Sen. Chuck Grassley has published a letter to Mayorkas, asking whether Mayorkas can explain why local law enforcement was sharing responsibility with Secret Service for securing the building from which Crooks shot at Trump – and why Crooks was able to fly a surveillance drone over the site.

NEW My office has obtained docs from law enforcement on July 13 assassination attempt of Pres Trump I’m writing Secret Service Acting Dir Rowe & DHS Scty Mayorkas AGAIN 2get badly needed answers/clarity pic.twitter.com/LyQMzYGCkD

— Chuck Grassley (@ChuckGrassley) July 23, 2024

Sen. Grassley also asks “whether the water tower was cleared” and whether the water tower had “any role” in the attempted assassination.

A video taken on July 13 shows a vehicle parked beneath the water tower, as the stage is prepared for Trump’s address.

2 Hours ago General Eric Tweeted @betyousomething I got a photo / video of a truck under the water tower the morning of J13. pic.twitter.com/k9zqP1RPYJ

— RyanMatta 🇺🇸 🦅 (@RyanMattaMedia) July 19, 2024

Redacted news reported three separate eyewitnesses at the rally who were interviewed – claiming shots were fired from a second location. They all indicate the water tower. At the 22-minute mark in this video you can watch them make these claims.

🔫 Eyewitnesses report seeing shots fired from a water tower in Butler, Pennsylvania, during #Trump's speech, challenging the official claim that Thomas Matthew Crooks acted alone. 😳 Is there more to the story? #ThomasMatthewCrooks #TrumpAssasinationAttempt pic.twitter.com/ChrB5xWoZU

— Redacted (@TheRedactedInc) July 18, 2024

X user Austin Ayers claims this recording is “raw 911 audio” of law enforcement responding to “shots fired towards the blue water tank, blue water tank, that side.”

There is no clear picture of the attempt to kill Donald Trump. The official agencies have been unwilling or unable to supply the answers to the questions raised by the failed assassination.

How can the Senate hope to succeed where Congress has failed? The conspiracy against the obvious did not begin with this shooting. It is the policy of the liberal global regime itself, to deny its agenda of destruction and death, while the evidence of its diabolical designs becomes impossible to ignore.

Whoever fired those shots, whoever was behind the alleged lone gunman and his apparently motiveless crime, and however he arrived to commit it, it is obvious that the number one enemy of the globalist regime was almost shot to death on live television.

Bruce Dowbiggin

Garbage In, Garbage Out: The Democrats 2024 Election Coup

Been quite a month for political plot lines, no? Since Joe Biden went full Sling Blade in his debate with Donald Trump to a near-fatal assassination attempt on Trump in Pennsylvania to the Democratic Party staging a Covid-inspired coup against Biden. And now Ms. Montreal, Kamala Harris, being retro-fitted into the Dems’ nominee against Trump while her media pals hastily erase her past.

You rarely get this much red meat from the people who run the American political system. Most of the time the public is encouraged to think that Aaron Sorkin’s version of politics on The West Wing is how it works. Earnest liberals gamely coping with venal right wingers and foreign potentates in airtight 60-minute chunks.

There have been occasional attempts to pierce the fog. Veep showed politics as Benny Hill farce, Wag The Dog showed Hollywood’s staging counter narratives. The Death of Stalin showed the totalitarian state managing leadership succession.

But thanks to mainstream news networks, American politics for the most part is shown as a horse race to the White House, one with show ponies, handicappers and media jockeys. That seems to be the way people wish to consume their constitutional republic. Show business for ugly people.

That’s likely why the naked bones of the process being shown so explicitly since June 27 has upset people. Like the making of sausage, the making of laws is a distasteful sight. Guts and tissue on a blood-stained abattoir floor are hard to un-see. The fainting-goat followers of The West Wing are upset that the man with his hand on the nuclear codes can’t zip his own fly anymore.

Gullible liberals, with their fondness for the Covid administrative state, are most upset with all this honesty. As we wrote in September of 2023 of this Gallup Poll : “It shows that from 1972-2022 that GOP trust of media has plummeted from 41 percent to under 10 percent, while independents have gone from 53 percent to under 36 percent trust. IOW, their former favourite news sources don’t jive with their everyday reality.

But Democrats in the poll have vaulted from 64 percent to 76 percent in trust of media. Why? One reason probably lies with being told the narratives that please them. That give them comfort. These consumers allow legacy media’s fact checkers to sort out what they should know from “disinformation” without getting their hands dirty with the original story.” IOW, give me The West Wing.

The previous occasion when political machinations were so stark was the Western cultural upheavals of 1967-74, when assassinations, race riots, civil disobedience and blatant political chicanery poisoned the culture. Faced with insurrection and Charles Manson’s flower-power insanity, the powers of the time abandoned politesse for bare-knuckled reality. Martin Luther King and Robert Kennedy were dispatched to another realm, LBJ was told to go back to his Texas farm, and sources inside the FBI apparatus stabbed Richard Nixon after the greatest presidential win in U.S. history.

There was little subtlety. Chicago mayor Richard Daley saw to that in Grant Park. CBS reporter Dan Rather was gut punched on camera at the DNC convention for getting too close, and VP Spiro Agnew was canned in favour of the genial Gerald Ford, friend of the donor class and Warren Report booster. He and Jimmy Carter smoothed the anxieties of the urban middle class that went from protest to pacified. Martin Sheen über alles.

By the 1980s Ronald Reagan was crushing the Soviets, and Aaron Sorkin began his soothing epistles to the sanctity of the political process. Ted Turner’s birth of CNN cable news in the ‘80s codified the game. Guard rails were erected to keep news in its place. The true power brokers like donors and PACs were grated anonymity. Anyone defying the rules of the DC Media party— hello, Rush Limbaugh— was sent to the gulag of right-wing radio.

The emergence of brash NYC hotelier Donald Trump was first seen as fodder for the cable-news showbiz narrative. He’d be the sideshow carny to distract zombie voters from the coronation of Hillary Clinton. MSNBC’s Joe Scarborough thought he was money, constantly pimping for Trump on his morning show. What a laff riot he’d be.

Then Donald got too close to the untouchables. He discovered there were probably 50 million votes just lying there waiting for someone to pick up. Certainly not the bespoke DEMs. Or the Bush Republicans with their pals in the armaments and pharmaceutical lobbies. It was free money, and when has Don Trump ever left money on the table?

From the instant he started talking about borders, foreign wars and the Swamp he had a target posted on him. Because there is no treachery like class treachery the Swamp sought to destroy him in 2016. Chuck “Schemer” Schumer confirmed it: “Let me tell you: You take on the intelligence community — they have six ways from Sunday at getting back at you.”

WASHINGTON, DC – MAY 12: Sen. Charles Schumer (D-NY) holds a news conference following meetings between Republican presidential candidate Donald Trump and GOP congressional leadership at the U.S. Capitol May 12, 2016 in Washington, DC. The Senate Democrats pointed to policies they say that Trump and Republicans in Congress agree on and said they were both operating from the same textbook. (Photo by Chip Somodevilla/Getty Images)

When he punked Hillary in the voting they employed the FBI, CIA and Barack Obama’s machine in a coup attempt predicated on Russia. While it was a struggle, they managed to keep the real story from their MSNBC/ NYT devotees, who to this day, still recite the Russiagate tropes. To them it was a West Wing plot line in which their liberal friends would persevere.

For all that the game was in still peril. Then came Covid. The Left and Neo-Con Trump haters were able to orchestrate a quasi-election in 2020, replete with historic voting totals and hastily-assembled regulations— hello vote harvesting, unsupervised drop boxes— never seen before.

Aging longtime DEM loyalist Joe Biden “a blowhard senator, a bad guy, a fabulist, corrupt, and a preternatural liar who didn’t hold a single consistent principle in his career” was appointed as place holder till the Obamas and Nancy Pelosi could orchestrate a new Barack in 2024. It almost worked, until Biden’s debate meltdown against Trump advanced the agenda and threatened the donors.

As the world watched in amazement it was out with Joe and in with Kamala. They don’t care who knows. Between now and the election in November expect more Black Swan events to unsettle the public and advance the globalist agenda.

During that time, never forget that confusion and chaos are the calling cards of the Far Left. Far from being a problem, the head-spinning reinvention of normal is their goal. Don’t believe legacy media, they’re happy for this.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, he’s a regular contributor to Sirius XM Canada Talks Ch. 167. His new book Deal With It: The Trades That Stunned The NHL And Changed hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His 2004 book Money Players was voted sixth best on the same list, and is available via brucedowbigginbooks.ca.

-

National1 day ago

National1 day agoLiberals offer no response as Conservative MP calls Trudeau a ‘liar’ for an hour straight

-

COVID-191 day ago

COVID-191 day agoLeaked documents: German gov’t lied about shots preventing COVID, knew lockdowns did more harm than good

-

Economy1 day ago

Economy1 day agoKamala Harris’ Energy Policy Catalog Is Full Of Whoppers

-

International1 day ago

International1 day agoSwitzerland’s new portable suicide ‘pod’ set to claim its first life ‘soon’

-

Business1 day ago

Business1 day agoFederal government seems committed to killing investment in Canada

-

International20 hours ago

International20 hours agoHouse Passes Bipartisan Resolution Establishing Trump Assassination Attempt Task Force

-

Crime9 hours ago

Crime9 hours agoEverything you need to know about the failed assassination attempt of Donald Trump

-

Alberta1 day ago

Alberta1 day ago‘Fireworks’ As Defence Opens Case In Coutts Two Trial