Economy

Why Democrats Make Energy Expensive (And Dirty)

Progressives say they care more about working people and climate change than Republicans and moderate Democrats. Why, then, do they advocate policies that make energy expensive and dirty?

|

|

Progressive Democrats including Sen. Bernie Sanders and Rep. Pramila Jayapal, the head of the House progressive caucus, have sent a letter demanding the Federal Energy Regulatory Commission (FERC) investigate whether “market manipulation” is causing natural gas prices to rise 30 percent on average for consumers over last winter, an astonishing $746 per household.

But the main reason natural gas prices are rising is because progressives have been so successful in restricting natural gas production. Sanders, Jayapal, and Rep. Alexandria Ocasio-Cortez (AOC), as individuals and as part of the Congressional Progressive Caucus, have successful fought to restrict natural gas production through fracking and to block natural gas pipelines, including the Atlantic Coast pipeline.

In 2020, Sanders celebrated efforts by progressives to cancel the Atlantic Coast pipeline. Today, New England is facing rolling blackouts and importing natural gas from Russia. “Getting [natural] gas to [progressive Senators Ed] Markey and [Elizabeth] Warren’s Massachusetts is so difficult,” reports The Wall Street Journal, “that sometimes it comes into Boston Harbor on a tanker from Russia.”

Bernie Sanders @SenSanders

Bernie Sanders @SenSandersThis is a major victory for the millions-strong climate justice movement, which fought for years to stop this pipeline. Together, we will secure clean air and good jobs building a renewable-energy economy that protects the only planet we have.  Energy companies cancel construction of Atlantic Coast PipelineDominion Energy and Duke Energy have canceled their Atlantic Coast Pipeline project, a natural gas pipeline that was to stretch hundreds of miles across West Virginia, Virginia and North Carolina, citing “legal uncertainty.”cnn.com

Energy companies cancel construction of Atlantic Coast PipelineDominion Energy and Duke Energy have canceled their Atlantic Coast Pipeline project, a natural gas pipeline that was to stretch hundreds of miles across West Virginia, Virginia and North Carolina, citing “legal uncertainty.”cnn.com

July 6th 2020

1,033 Retweets5,760 Likes

Democrats aren’t the only reason the United States isn’t producing enough natural gas to keep prices at the same low levels they’ve been at for the past decade. There is higher demand as the economy emerges from covid. There is greater demand for natural gas internationally due to a bad year for wind energy in Europe. And President Joe Biden, for his part, has resisted many progressive demands to restrict oil and gas production.

But the main reason there isn’t enough natural gas production is because of successful progressive Democratic efforts to restrict natural gas production in the United States, Europe, and other parts of the world in the name of fighting climate change, as I was one of the first to report last fall. Sanders and Jayapal talk about “market manipulation” and “profiteering” but to the extent there is any of either it’s because of inadequate supplies of natural gas and the pipelines to transport it.

Successful shareholder activism, known in the industry as “ESG” for environmental, social, and governance issues, resulted in less investment in oil and gas production, and more weather-dependent renewables, which result in higher prices everywhere they are deployed at scale. Even ESG champions including Financial Times, Goldman Sachs, and Bloomberg all now acknowledge that it was climate activist shareholder efforts that restricted oil and gas investment.

Such efforts also directly led to increasing carbon emissions. Last year saw a whopping 17 percent increase in coal-fired electricity, which resulted in a six percent increase in greenhouse gas emissions. It was the first annual increase in coal use since 2014. The reason for it was because of the scarcity and higher price of natural gas, coal’s direct replacement, not just in the U.S. but globally, since the US exports a significant quantity of natural gas.

The other reason the U.S. used more coal in 2021 is because progressive Democrats are shutting down nuclear plants. “When a nuclear plant is closed, it’s closed forever,” noted Mark Nelson of Radiant Energy Fund, an energy analytics firm, “whereas coal plants can afford to operate at relatively low levels of capacity, like just 30 to 50 percent operation, and thus wait for natural gas prices, and thus demand for coal, to rise.”

Progressives like Sanders, Jayapal, and AOC claim to care more about poor people, working people, and climate change than either Republicans or moderate Democrats, who they defeat in Democratic primary elections. Why, then, do they advocate policies that make energy expensive and dirty?

Alexandria Ocasio-Cortez @AOC

Alexandria Ocasio-Cortez @AOCOctober 8th 2020

81,570 Retweets648,545 Likes

Strategic Ignorance

A big part of the reason progressives make energy expensive appears to be that they just don’t know very much about energy. The fact that they are demanding that FERC investigate higher prices suggests they want to keep energy prices low. But it could also mean that their letter is just public relations cover so they are not blamed for raising energy prices.

Indeed, it would be naive to think that Sanders and other progressives didn’t realize that blocking pipelines, opposing fracking, and subsidizing renewables would make energy expensive, given that making energy expensive has been the highest goal of their main climate advisor, Bill McKibben, who subscribes to the Malthusian view that there are too many humans and we must restrict energy and development.

If renewables were cheaper than the status quo then the policies they advocate — no permitting of pipelines, restrictions on fracking, and subsidies for renewables — would not be necessary. Besides, mainstream energy experts and journalists today admit that weather-dependent renewables make electricity expensive…

Subscribe to Michael Shellenberger to read the rest.

Become a paying subscriber of Michael Shellenberger to get access to this post and other subscriber-only content.

A subscription gets you:

| Subscriber-only posts and full archive | |

| Post comments and join the community |

Business

Canada’s economy has stagnated despite Ottawa’s spin

From the Fraser Institute

By Ben Eisen, Milagros Palacios and Lawrence Schembri

Canada’s inflation-adjusted per-person annual economic growth rate (0.7 per cent) is meaningfully worse than the G7 average (1.0 per cent) over this same period. The gap with the U.S. (1.2 per cent) is even larger. Only Italy performed worse than Canada.

Growth in gross domestic product (GDP), the total value of all goods and services produced in the economy annually, is one of the most frequently cited indicators of Canada’s economic performance. Journalists, politicians and analysts often compare various measures of Canada’s total GDP growth to other countries, or to Canada’s past performance, to assess the health of the economy and living standards. However, this statistic is misleading as a measure of living standards when population growth rates vary greatly across countries or over time.

Federal Finance Minister Chrystia Freeland, for example, recently boasted that Canada had experienced the “strongest economic growth in the G7” in 2022. Although the Trudeau government often uses international comparisons on aggregate GDP growth as evidence of economic success, it’s not the first to do so. In 2015, then-prime minister Stephen Harper said Canada’s GDP growth was “head and shoulders above all our G7 partners over the long term.”

Unfortunately, such statements do more to obscure public understanding of Canada’s economic performance than enlighten it. In reality, aggregate GDP growth statistics are not driven by productivity improvements and do not reflect rising living standards. Instead, they’re primarily the result of differences in population and labour force growth. In other words, they aren’t primarily the result of Canadians becoming better at producing goods and services (i.e. productivity) and thus generating more income for their families. Instead, they primarily reflect the fact that there are simply more people working, which increases the total amount of goods and services produced but doesn’t necessarily translate into increased living standards.

Let’s look at the numbers. Canada’s annual average GDP growth (with no adjustment for population) from 2000 to 2023 was the second-highest in the G7 at 1.8 per cent, just behind the United States at 1.9 per cent. That sounds good, until you make a simple adjustment for population changes by comparing GDP per person. Then a completely different story emerges.

Canada’s inflation-adjusted per-person annual economic growth rate (0.7 per cent) is meaningfully worse than the G7 average (1.0 per cent) over this same period. The gap with the U.S. (1.2 per cent) is even larger. Only Italy performed worse than Canada.

Why the inversion of results from good to bad? Because Canada has had by far the fastest population growth rate in the G7, growing at an annualized rate of 1.1 per cent—more than twice the annual population growth rate of the G7 as a whole at 0.5 per cent. In aggregate, Canada’s population increased by 29.8 per cent during this time period compared to just 11.5 per cent in the entire G7.

Clearly, aggregate GDP growth is a poor tool for international comparisons. It’s also not a good way to assess changes in Canada’s performance over time because Canada’s rate of population growth has not been constant. Starting in 2016, sharply higher rates of immigration have led to a pronounced increase in population growth. This increase has effectively partially obscured historically weak economic growth per person over the same period.

Specifically, from 2015 to 2023, under the Trudeau government, inflation-adjusted per-person economic growth averaged just 0.3 per cent. For historical perspective, per-person economic growth was 0.8 per cent annually under Brian Mulroney, 2.4 per cent under Jean Chrétien and 2.0 per cent under Paul Martin.

Due to Canada’s sharp increase in population growth in recent years, aggregate GDP growth is a misleading indicator for comparing economic growth performance across countries or time periods. Canada is not leading the G7, or doing well in historical terms, when it comes to economic growth measures that make simple adjustments for our rapidly growing population. In reality, we’ve become a growth laggard and our living standards have largely stagnated for the better part of a decade.

Authors:

Business

New capital gains hike won’t work as claimed but will harm the economy

From the Fraser Institute

By Alex Whalen and Jake Fuss

Capital taxes are among the most economically-damaging forms of taxation precisely because they reduce the incentive to innovate and invest.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50 per cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’ marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivises investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7 billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing—that this move only affects the wealthy—lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically-damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new start-ups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgement of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Authors:

-

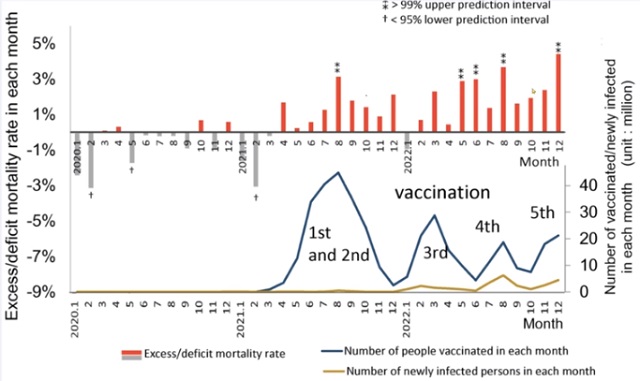

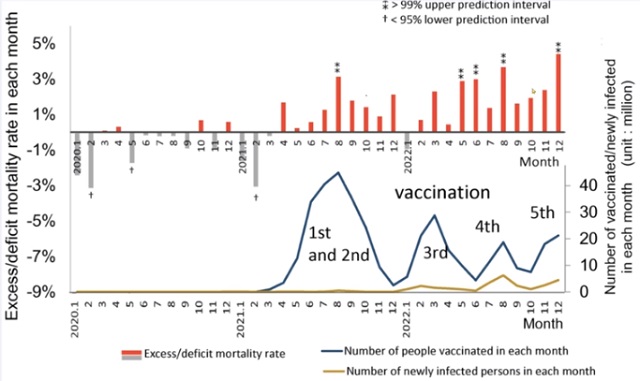

COVID-1928 mins ago

COVID-1928 mins agoCDC Quietly Admits to Covid Policy Failures

-

COVID-193 hours ago

COVID-193 hours agoJapanese study shows disturbing increase in cancer related deaths during the Covid pandemic

-

Jordan Peterson2 days ago

Jordan Peterson2 days agoJordan Peterson slams CBC for only interviewing pro-LGBT doctors about UK report on child ‘sex changes’

-

Alberta2 days ago

Alberta2 days agoDanielle Smith warns arsonists who start wildfires in Alberta that they will be held accountable

-

Freedom Convoy2 days ago

Freedom Convoy2 days agoTrudeau’s use of Emergencies Act has cost taxpayers $73 million thus far

-

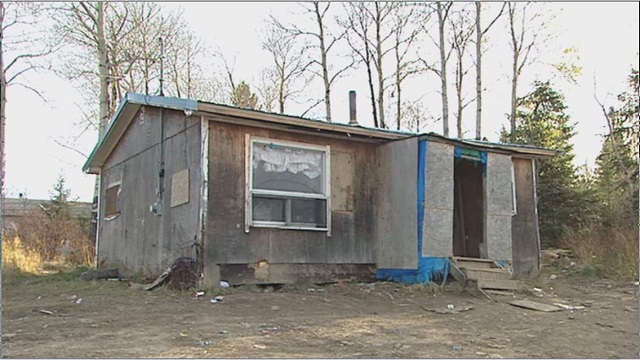

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoThe Smallwood solution

-

Agriculture2 days ago

Agriculture2 days agoBill C-282, now in the Senate, risks holding back other economic sectors and further burdening consumers

-

Addictions2 days ago

Addictions2 days agoLiberal MP blasts Trudeau-backed ‘safe supply’ drug programs, linking them to ‘chaos’ in cities