Energy

Trump’s 1,000 Words About Energy

From the Daily Caller News Foundation

From the Daily Caller News Foundation

As a person who spent 40 years doing policy and government affairs work in the oil and gas industry, I have always paid close attention to what presidential nominees of both parties have to say — or do not say — about energy in their acceptance speeches.

The vast majority of the time, it has been much more about what they did not say.

Many such speeches since I first started paying attention to such things in 1980 (Reagan vs. Carter) said literally nothing at all on the topic. Most other nominees limited energy-related talk to a sentence or two.

In most election years, energy and its costs are just not a top-of-mind topic for most Americans. But that has all changed now in the wake of the Biden administration’s heavy focus on inflation-causing green subsidies and the rising public awareness of the central role that mushrooming energy costs play in prices for groceries and every other aspect of their lives.

So, after being stunned by how much time former President Donald Trump dedicated to the energy subject during his acceptance speech Thursday evening in Milwaukee, I decided to plow through the transcript of that 90-minute speech to figure out just how many words he had to say on the topic. Amazingly, the number comes to right at 1,000 words. It is impossible to know for sure, but I would speculate that is the most words ever spoken about energy by any nominee in such a speech in American history.

In addition to the predictable promise to bring a return to the “Drill, baby, drill” oil and gas philosophy that characterized his first presidency, the former president spoke at length on other plans for a second one.

- He openly mocked some elements of Biden’s Green New Deal agenda, at one point noting: “They spent $9 billion on eight chargers, three of which didn’t work.” He then called Biden’s obsession with forcing electric cars on a reluctant public “a crazy electric band-aid.”

- Trump promised to end Biden’s “EV mandates” on the day he is sworn into office. Given that some of the web of EV-promoting policies implemented by the Biden administration come via regulatory actions, achieving a full pullback will be a little more time-consuming than that.

- He talked at length about plans by Chinese companies to flood the American EV market with cars either made in Mexico or shipped from China into the U.S. through Mexico, saying the United Auto Workers union “should be ashamed” for continuing to support Biden and other Democrats while this is taking place.

- He accused the Biden administration of spending “trillions of dollars” on “the green new scam. It’s a scam. And that has caused tremendous inflationary pressures in addition to the cost of energy.”

- Trump noted that: “Under the Trump administration just three and a half years ago, we were energy independent” — which is factually accurate. The US did produce much more energy than it consumed throughout his presidency, and was a net exporter of oil, natural gas and coal in many months during that time.

- Trump continued: “But soon we will actually be better than that. We will be energy dominant and supply not only ourselves, but we will supply the rest of the world.” Well, maybe not the rest of the world, but surely much of it. It is a political speech, after all, so a little hyperbole fits.

- Trump further criticized the Biden White House for reversing the hard line he took with Iran while president, saying: “I told China and other countries, ‘If you buy from Iran, we will not let you do any business in this country, and we will put tariffs on every product you do send in of 100 percent or more.’ And they said to me, ‘Well, I think that’s about it.’ They weren’t going to buy any oil. And…Iran was going to make a deal with us.”

There was much more energy-related content in his speech, but you get the gist: A second Trump presidency would start by reversing as much of the Biden Green New Deal agenda as possible and go from there.

It is safe to say no presidential nominee has ever been as focused on energy as Donald Trump is today. We will see if it pays off for him in November.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Business

Canada’s future prosperity runs through the northwest coast

Prince Rupert Port Authority CEO Shaun Stevenson. Photo courtesy Prince Rupert Port Authority

From the Canadian Energy Centre

A strategic gateway to the world

Tucked into the north coast of B.C. is the deepest natural harbour in North America and the port with the shortest travel times to Asia.

With growing capacity for exports including agricultural products, lumber, plastic pellets, propane and butane, it’s no wonder the Port of Prince Rupert often comes up as a potential new global gateway for oil from Alberta, said CEO Shaun Stevenson.

Thanks to its location and natural advantages, the port can efficiently move a wide range of commodities, he said.

That could include oil, if not for the federal tanker ban in northern B.C.’s coastal waters.

The Port of Prince Rupert on the north coast of British Columbia. Photo courtesy Prince Rupert Port Authority

“Notwithstanding the moratorium that was put in place, when you look at the attributes of the Port of Prince Rupert, there’s arguably no safer place in Canada to do it,” Stevenson said.

“I think that speaks to the need to build trust and confidence that it can be done safely, with protection of environmental risks. You can’t talk about the economic opportunity before you address safety and environmental protection.”

Safe Transit at Prince Rupert

About a 16-hour drive from Vancouver, the Port of Prince Rupert’s terminals are one to two sailing days closer to Asia than other West Coast ports.

The entrance to the inner harbour is wider than the length of three Canadian football fields.

The water is 35 metres deep — about the height of a 10-storey building — compared to 22 metres at Los Angeles and 16 metres at Seattle.

Shipmasters spend two hours navigating into the port with local pilot guides, compared to four hours at Vancouver and eight at Seattle.

“We’ve got wide open, very simple shipping lanes. It’s not moving through complex navigational channels into the site,” Stevenson said.

A Port on the Rise

The Prince Rupert Port Authority says it has entered a new era of expansion, strengthening Canada’s economic security.

The port estimates it anchors about $60 billion of Canada’s annual global trade today. Even without adding oil exports, Stevenson said that figure could grow to $100 billion.

“We need better access to the huge and growing Asian market,” said Heather Exner-Pirot, director of energy, natural resources and environment at the Macdonald-Laurier Institute.

“Prince Rupert seems purpose-built for that.”

Roughly $3 billion in new infrastructure is already taking shape, including the $750 million rail-to-container CANXPORT transloading complex for bulk commodities like specialty agricultural products, lumber and plastic pellets.

The Ridley Island Propane Export Terminal, Canada’s first marine propane export terminal, started shipping in May 2019. Photo courtesy AltaGas Ltd.

Canadian Propane Goes Global

A centrepiece of new development is the $1.35-billion Ridley Energy Export Facility — the port’s third propane terminal since 2019.

“Prince Rupert is already emerging as a globally significant gateway for propane exports to Asia,” Exner-Pirot said.

Thanks to shipments from Prince Rupert, Canadian propane – primarily from Alberta – has gone global, no longer confined to U.S. markets.

More than 45 per cent of Canada’s propane exports now reach destinations outside the United States, according to the Canada Energy Regulator.

“Twenty-five per cent of Japan’s propane imports come through Prince Rupert, and just shy of 15 per cent of Korea’s imports. It’s created a lift on every barrel produced in Western Canada,” Stevenson said.

“When we look at natural gas liquids, propane and butane, we think there’s an opportunity for Canada via Prince Rupert becoming the trading benchmark for the Asia-Pacific region.”

That would give Canadian production an enduring competitive advantage when serving key markets in Asia, he said.

Deep Connection to Alberta

The Port of Prince Rupert has been a key export hub for Alberta commodities for more than four decades.

Through the Alberta Heritage Savings Trust Fund, the province invested $134 million — roughly half the total cost — to build the Prince Rupert Grain Terminal, which opened in 1985.

The largest grain terminal on the West Coast, it primarily handles wheat, barley, and canola from the prairies.

Today, the connection to Alberta remains strong.

In 2022, $3.8 billion worth of Alberta exports — mainly propane, agricultural products and wood pulp — were shipped through the Port of Prince Rupert, according to the province’s Ministry of Transportation and Economic Corridors.

In 2024, Alberta awarded a $250,000 grant to the Prince Rupert Port Authority to lead discussions on expanding transportation links with the province’s Industrial Heartland region near Edmonton.

Handling Some of the World’s Biggest Vessels

The Port of Prince Rupert could safely handle oil tankers, including Very Large Crude Carriers (VLCCs), Stevenson said.

“We would have the capacity both in water depth and access and egress to the port that could handle Aframax, Suezmax and even VLCCs,” he said.

“We don’t have terminal capacity to handle oil at this point, but there’s certainly terminal capacities within the port complex that could be either expanded or diversified in their capability.”

Market Access Lessons From TMX

Like propane, Canada’s oil exports have gained traction in Asia, thanks to the expanded Trans Mountain pipeline and the Westridge Marine Terminal near Vancouver — about 1,600 kilometres south of Prince Rupert, where there is no oil tanker ban.

The Trans Mountain expansion project included the largest expansion of ocean oil spill response in Canadian history, doubling capacity of the West Coast Marine Response Corporation.

The K.J. Gardner is the largest-ever spill response vessel in Canada. Photo courtesy Western Canada Marine Response Corporation

The Canada Energy Regulator (CER) reports that Canadian oil exports to Asia more than tripled after the expanded pipeline and terminal went into service in May 2024.

As a result, the price for Canadian oil has gone up.

The gap between Western Canadian Select (WCS) and West Texas Intermediate (WTI) has narrowed to about $12 per barrel this year, compared to $19 per barrel in 2023, according to GLJ Petroleum Consultants.

Each additional dollar earned per barrel adds about $280 million in annual government royalties and tax revenues, according to economist Peter Tertzakian.

The Road Ahead

There are likely several potential sites for a new West Coast oil terminal, Stevenson said.

“A pipeline is going to find its way to tidewater based upon the safest and most efficient route,” he said.

“The terminal part is relatively straightforward, whether it’s in Prince Rupert or somewhere else.”

Under Canada’s Marine Act, the Port of Prince Rupert’s mandate is to enable trade, Stevenson said.

“If Canada’s trade objectives include moving oil off the West Coast, we’re here to enable it, presuming that the project has a mandate,” he said.

“If we see the basis of a project like this, we would ensure that it’s done to the best possible standard.”

Alberta

Emissions Reduction Alberta offering financial boost for the next transformative drilling idea

From the Canadian Energy Centre

$35-million Alberta challenge targets next-gen drilling opportunities

‘All transformative ideas are really eligible’

Forget the old image of a straight vertical oil and gas well.

In Western Canada, engineers now steer wells for kilometres underground with remarkable precision, tapping vast energy resources from a single spot on the surface.

The sector is continually evolving as operators pursue next-generation drilling technologies that lower costs while opening new opportunities and reducing environmental impacts.

But many promising innovations never reach the market because of high development costs and limited opportunities for real-world testing, according to Emissions Reduction Alberta (ERA).

That’s why ERA is launching the Drilling Technology Challenge, which will invest up to $35 million to advance new drilling and subsurface technologies.

“The focus isn’t just on drilling, it’s about building our future economy, helping reduce emissions, creating new industries and making sure we remain a responsible leader in energy development for decades to come,” said ERA CEO Justin Riemer.

And it’s not just about oil and gas. ERA says emerging technologies can unlock new resource opportunities such as geothermal energy, deep geological CO₂ storage and critical minerals extraction.

“Alberta’s wealth comes from our natural resources, most of which are extracted through drilling and other subsurface technologies,” said Gurpreet Lail, CEO of Enserva, which represents energy service companies.

ERA funding for the challenge will range from $250,000 to $8 million per project.

Eligible technologies include advanced drilling systems, downhole tools and sensors; AI-enabled automation and optimization; low-impact rigs and fluids; geothermal and critical mineral drilling applications; and supporting infrastructure like mobile labs and simulation platforms.

“All transformative ideas are really eligible for this call,” Riemer said, noting that AI-based technologies are likely to play a growing role.

“I think what we’re seeing is that the wells of the future are going to be guided by smart sensors and real-time data. You’re going to have a lot of AI-driven controls that help operators make instant decisions and avoid problems.”

Applications for the Drilling Technology Challenge close January 29, 2026.

-

National1 day ago

National1 day agoMedia bound to pay the price for selling their freedom to (selectively) offend

-

COVID-192 days ago

COVID-192 days agoThe dangers of mRNA vaccines explained by Dr. John Campbell

-

Alberta1 day ago

Alberta1 day agoNew era of police accountability

-

Energy2 days ago

Energy2 days agoCanadians will soon be versed in massive West Coast LPG mega-project

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoSometimes An Ingrate Nation Pt. 2: The Great One Makes His Choice

-

Alberta2 days ago

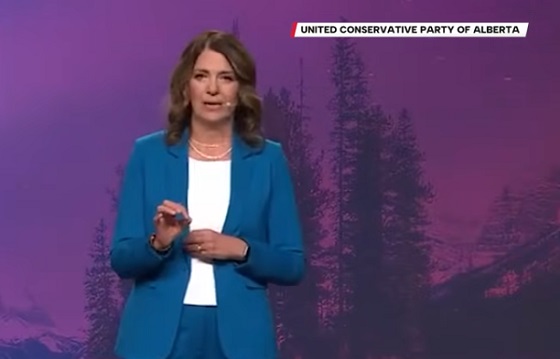

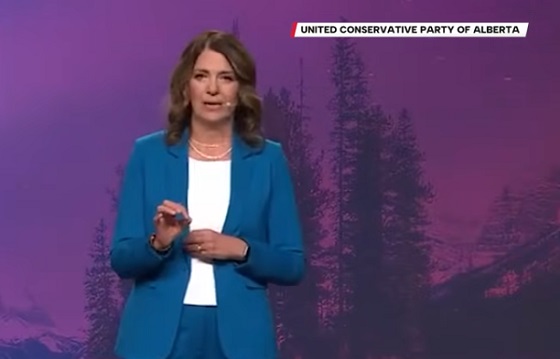

Alberta2 days agoKeynote address of Premier Danielle Smith at 2025 UCP AGM

-

Business24 hours ago

Business24 hours agoIs there a cure for Alzheimer’s Disease?

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days ago‘Trouble in Toyland’ report sounds alarm on AI toys