Alberta

LIsten: Ryan Jespersen, Lynda Steele, J’Lyn Nye are joined by writer Ilan Cooley: The Untold Toll of Online Trolls

Here is a link to the Ryan Jespersen show where he, along with J’Lyn Nye, Lynda Steele and Todayville contributor Ilan Cooley discuss this topic, the impact it has on them, but more importantly, the impact it has on society as a whole.

Click here to listen to their discussion.

Ilan Cooley is an Edmonton based entrepreneur and writer. She is a an avid traveller, rescue dog mama and advocate of kindness and community.

The Untold Toll of Online Trolls

By Ilan Cooley

(Warning- language)

___________________________________________________________________________________________

The concept of mean tweets has become a late-night talk show punchline that comes with a built-in laugh track, but for some Canadian media celebrities, being on the receiving end of social media bullying is no laughing matter.

J’lyn Nye

“It is always a shock to be called a cunt and a big pig,” says award-winning broadcaster J’lyn Nye. As the co-host of a talk show on Edmonton’s 630 CHED radio, her career spans two decades. “I believe whole heartedly that we, as a society, have devolved. We don’t know how to have a respectful debate.”

Lynda Steele

Like Nye, Lynda Steele is a veteran broadcaster. She works as a talk show host at CKNW radio in Vancouver. Both women previously worked in television, and both say they have endured vicious criticism throughout their careers. They believe gender impacts the kinds of attacks they receive from the public. Comments range from criticism about hairstyle, makeup, or clothing choices, to remarks about weight.

“The hateful comments were never directed at the male on air staff, only the women,” says Steele. “We all got our share of the nastiness. The attacks were almost exclusively from other women. I can only assume they have low self-esteem and feel the need to tear other women down to feel better about themselves. Or maybe they’re mentally ill.

In talk radio, it’s the opposite. The haters are older men. I suspect they are misogynists who are incensed that a woman has a platform to offer her opinion for four hours straight every day. It makes them crazy. You try to develop a thick skin about it,” she says. “But sometimes it’s exhausting, frankly.”

Dr. Tami Bereska, a sociology professor at MacEwan University, says celebrities are often in a difficult position because they need to immerse themselves in the social media environment in order to remain popular and maintain a fan base.

“They are especially at risk,” she says. “The anonymity enabled on some social media platforms gives people the courage to say things to others that they would never say in a face-to-face interaction.”

“The worst go right to the lowest hanging fruit,” says Nye. “The cunt comments. I have male co-workers who are called “asshole,” but they don’t get the viscous vitriol the women I know get. I believe they simply can’t handle a strong, successful, opinionated woman.”

Ryan Jespersen

630 CHED host Ryan Jespersen says he is often verbally attacked by listeners, mostly online. Like Nye and Steele, it is Jespersen’s job to voice his opinion live on the air, and to discuss current affairs, and news headlines. He says he is more susceptible to negative comments working in radio than when he worked in television. He believes the catalyst is the explosion of social media. “There’s also the anonymity factor.”

Bereska says anonymity can cause people lose sight of their fundamental beliefs and values, and instead act in the same ways they see others acting in that environment. “As more people begin commenting on the same story, post, or tweet, group polarization occurs, wherein comments become more and more extreme; hateful comments become even more hateful, and critics of those comments become even more critical.”

On Twitter, user @JohnnyJesus took aim at Jespersen, saying, “You’re a no name AM radio shit for brains standing up for the most disgusting anti-Alberta government one could ever imagine. Fuck off.”

“I see moronic stuff thrown at me every single day,” says Jespersen. Without accountability for their comments, some people have turned social media platforms into the new bathroom stall smear campaigns.”

Unfortunately, some people go further than name calling. “We called the police and they took it from there,” says Jespersen. “It’s happened on two occasions. You’ve got to take that stuff seriously.”

Nye believes the people who feel the need to attack others on social media are in effect poisoning the well of society. “It’s become a cesspool for trolls and anonymous keyboard jockeys.” She says since being in radio it is the worst she’s ever seen it. “I used to get upset and react, now I realize the person sending the comment has an issue.”

Facebook user Shawn Lipon does not shy away from expressing his opinions on social media, and does not conceal his identity there. He is vocal about his disdain for Prime Minister Justin Trudeau, and hurls insults at anyone he perceives to be liberal. Lipon says his motives range from a desire to bring about change, to seeking attention, or just being bored. He finds entertainment in triggering people into a debate that “keeps them up all night.”

Lipon says he wants to put his voice into the discussion with the hopes it will bring other people around to his way of thinking. “I want to have my opinion heard publicly,” he says. “To expose incompetence in hopes of changing opinion to that of my own. I think posting is great to voice opinion and have a say. Sometimes there is nowhere else to express opinions.”

Bereska likens the social media landscape to a battlefield, and says since deviance and normality are socially constructed, what we perceive as being acceptable or unacceptable evolves and changes over time, and is affected by larger sociocultural forces.

Nye feels we need to change the way we communicate with each other, but fears we are too far gone. She believes her bosses and managers need to stand up for employees more and adhere to the “no abuse” policy that already exists where she works. She also thinks social media outlets need to take a stronger stance enforcing their codes of conduct. “They aren’t doing a good job right now.”

Steele says the solution starts with parents. “Teach your children to be nice and respectful. Teach them about consequences.”

Jespersen encourages people to speak out. “Hold people accountable.”

Bereska suggests a solution may be possible with the efforts of both individuals and institutions. “The question is whether individuals, groups, and agents of power, such as social media companies themselves, will take a stand against trolling behaviours. Not just in words, but in actions.”

Read more on Todayville Edmonton.

Ilan Cooley is an Edmonton based entrepreneur and writer. She is a an avid traveller, rescue dog mama and advocate of kindness and community.

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

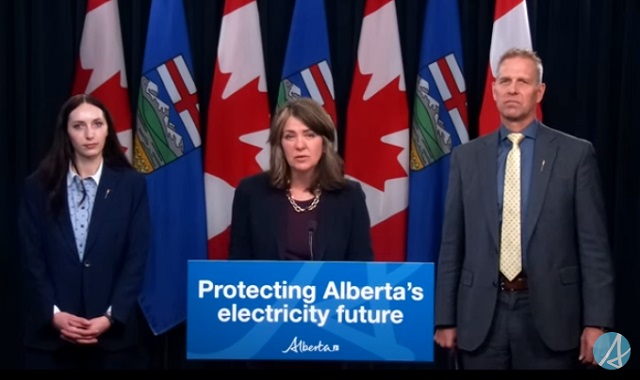

Province to stop municipalities overcharging on utility bills

Making utility bills more affordableAlberta’s government is taking action to protect Alberta’s ratepayers by introducing legislation to lower and stabilize local access fees. Affordability is a top priority for Alberta’s government, with the cost of utilities being a large focus. By introducing legislation to help reduce the cost of utility bills, the government is continuing to follow through on its commitment to make life more affordable for Albertans. This is in addition to the new short-term measures to prevent spikes in electricity prices and will help ensure long-term affordability for Albertans’ basic household expenses.

Local access fees are functioning as a regressive municipal tax that consumers pay on their utility bills. It is unacceptable for municipalities to be raking in hundreds of millions in surplus revenue off the backs of Alberta’s ratepayers and cause their utility bills to be unpredictable costs by tying their fees to a variable rate. Calgarians paid $240 in local access fees on average in 2023, compared to the $75 on average in Edmonton, thanks to Calgary’s formula relying on a variable rate. This led to $186 million more in fees being collected by the City of Calgary than expected.

To protect Alberta’s ratepayers, the Government of Alberta is introducing the Utilities Affordability Statutes Amendment Act, 2024. If passed, this legislation would promote long-term affordability and predictability for utility bills by prohibiting the use of variable rates when calculating municipalities’ local access fees. Variable rates are highly volatile, which results in wildly fluctuating electricity bills. When municipalities use this rate to calculate their local access fees, it results in higher bills for Albertans and less certainty in families’ budgets. These proposed changes would standardize how municipal fees are calculated across the province, and align with most municipalities’ current formulas.

If passed, the Utilities Affordability Statutes Amendment Act, 2024 would prevent municipalities from attempting to take advantage of Alberta’s ratepayers in the future. It would amend sections of the Electric Utilities Act and Gas Utilities Act to ensure that the Alberta Utilities Commission has stronger regulatory oversight on how these municipal fees are calculated and applied, ensuring Alberta ratepayer’s best interests are protected.

If passed, this legislation would also amend sections of the Alberta Utilities Commission Act, the Electric Utilities Act, Government Organizations Act and the Regulated Rate Option Stability Act to replace the terms “Regulated Rate Option”, “RRO”, and “Regulated Rate Provider” with “Rate of Last Resort” and “Rate of Last Resort Provider” as applicable. Quick facts

Related information |

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoDeborah Birx Gets Her Close-Up

-

Alberta2 days ago

Alberta2 days agoCoutts Three verdict: A warning to protestors who act as liaison with police

-

Alberta2 days ago

Alberta2 days agoAlberta moves to protect Edmonton park from Trudeau government’s ‘diversity’ plan

-

Business2 days ago

Business2 days agoMaxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

-

Energy2 days ago

Energy2 days agoCanada Has All the Elements to be a Winner in Global Energy — Now Let’s Do It

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoA Coup Without Firing a Shot

-

Freedom Convoy2 days ago

Freedom Convoy2 days agoOttawa spent “excessive” $2.2 million fighting Emergencies Act challenge

-

COVID-192 days ago

COVID-192 days agoWHO Official Admits the Truth About Passports