Energy

The Real Threat to Banks Isn’t From Climate Change. It’s From Bankers.

Over the last two years, some of the world’s most powerful and influential bankers and investors have argued that climate change poses a grave threat to financial markets and that nations must switch urgently from using fossil fuels to using renewables.

In 2019, the Federal Reserve Bank of San Francisco warned that climate change could cause banks to stop lending, towns to lose tax revenue, and home values to decline. Last year, 36 pension fund managers representing $1 trillion in assets said climate change “poses a systemic threat to financial markets and the real economy.”

And upon taking office, President Joe Biden warned government agencies that climate change disasters threatened retirement funds, home prices, and the very stability of the financial system.

But a major new staff report from the New York Federal Reserve Bank throws cold water on the over-heated rhetoric coming from activist investors, bankers, and politicians. “How Bad Are Weather Disasters for Banks?” asks the title of the report by three economists. “Not very,” they answer in the first sentence of the abstract.

The reason is because “weather disasters over the last quarter century had insignificant or small effects on U.S. banks’ performance.” The study looked at FEMA-level disasters between 1995 and 2018, at county-level property damage estimates, and the impact on banking revenue.

The New York Fed’s authors only looked at how banks have dealt with disasters in the past, and what they wrote isn’t likely to be the final word on the matter. The United Nations Intergovernmental Panel on Climate Change and most other scientific bodies predict that many weather events, including hurricanes and floods, which cause the greatest financial damage, are likely to become more extreme in the future, due to climate change.

And in February, The New York Times quoted one of six United States Federal Reserve governors saying, “Financial institutions that do not put in place frameworks to measure, monitor and manage climate-related risks could face outsized losses on climate-sensitive assets caused by environmental shifts.”

But the Fed economists looked separately at the most extreme 10 percent of all disasters and found that banks impacted not only didn’t suffer, “their income increases significantly with exposure,” and that the improved financial performance of banks hit by disasters wasn’t explained by increased federal disaster (FEMA) aid.

In other words, disasters are actually good for banks, since they increase demand for loans. The larger a bank’s exposure to natural disasters, the larger its profits.

Happily, the profits made by banks are trivial compared to rising societal resilience to disasters, which can be seen by the fact that the share of GDP spent on natural disasters has actually declined over the last 30 years.

While scientists expect hurricanes to become five percent more extreme they also expect them to become 25 percent less frequent, and now, new data showglobal carbon emissions actually declined over the last decade, and thus there is no longer any serious risk of a significant rise in global temperatures.

Banking Against Growth

Biden nominee Saule Omarova said she wants to bankrupt energy companies

The real risk to banks and the global economy comes from climate policy, not climate change, particularly efforts to make energy more expensive and less reliable through the greater use of renewables, new taxes, and new regulations.

“For policymakers,” warned the three economists writing for the New York Fed, “our findings suggest that potential transition risks from climate change warrant more attention than physical disaster risks.”

While they may seem like outliers, they are far from alone in expressing their concern. The second half of the quote by the Fed governor about climate change, which was hyped by The New York Times, warned that banks “could face outsized losses” from the “transition to a low-carbon economy.” (My emphasis.)

And, now concern is growing among members of Congress about the dangers of over-relying on weather-dependent energy, with some members citing the New York Fed’s report after The Wall Street Journal editorialized about it last week .

Proof of the threat to the economy from climate policy is the worst global energy crisis in 50 years. Shareholder activists played a significant role in creating it, according to analysts at Goldman Sachs, Bloomberg, and The Financial Times, by reducing investment in oil and gas production, and causing nations to over-invest in unreliable solar and wind energies, which has driven up energy prices, and contributed significantly to inflation.

And yet a crucial Biden Administration nominee for bank regulation has openly said she would like to bankrupt firms that produce oil and gas, the two fuels whose scarcity is causing the global energy crisis. Progressive academic, Saule Omarova, nominated by Biden, said recently that “we want [oil and gas firms] to go bankrupt” and that “the way we basically get rid of these carbon financiers is we starve them of their source of capital.

Omarova is not an outlier. The Biden Administration’s Financial Stability Oversight Council (FSOC) is advocating 30 new climate regulations that should be imposed on banking. Many analysts believe the US Securities and Exchange Commission will require new regulations. The goal is to radically alter how America’s banks lend money, the energy sector, and the economy as a whole.

And former Bank of England chief, Mark Carney, co-chair of the Glasgow Financial Alliance for Net Zero, has organized $130 trillion in investment and said recently that his investors should expect to make higher, not lower, returns than the market. How? In the exact same way Omarova predicted: by bankrupting some companies, and financing other ones, through government regulations and subsidies.

Carney created the Glasgow Financial Alliance, or GFANZ, with Michael Bloomberg, and they did so under the official seal of the United Nations. “Carney said the alliance will put global finance on a trajectory that ultimately leaves high-carbon assets facing a much bleaker future,” wrote a reporter with Bloomberg. “He also said investors in such products will see the value of their holdings sink.”

What’s going on, exactly? How is it that some of the world’s most powerful bankers, and the politicians they finance, came to support policies that threaten the stability of electrical grids, energy supplies, and thus the global economy itself?

Donate to Environmental Progress

The Unseen Order

Tom Steyer, Michael Bloomberg, and George Soros

Three of the largest donors to climate change causes are billionaire financial titans Michael Bloomberg, George Soros, and Tom Steyer, all of whom have significant investments in both renewables and fossil fuels.

Soros is worth $8 billion and recently made large investments in natural gas firms (EQT) and electric vehicles (Fisker), Bloomberg has a net worth of around $70 billion and has large investments in natural gas and renewables, and much of Steyer’s wealth derives from investments in all three main fossil fuels—coal, oil, and natural gas — as well as renewables.

All three men finance climate activists and politicians, including President Biden, who then seek policies — from $500 billion for renewables and electric vehicles over the next decade to federal control over state energy systems to banking regulations to bankrupt oil and gas companies — which would benefit each of them personally.

Bloomberg gave over $100 million to Sierra Club to lobby to shut down coal plants after he had taken a large stake in its replacement, natural gas, and operates one of the largest news media companies in the world, which publishes articles and sends emails nearly every day reporting that climate change threatens the economy, and that solar panels and wind turbines are the only cost-effective solution.

Soros donates heavily to Center for American Progress, whose founder, John Podesta, was chief of staff to Bill Clinton, campaign chairman for Hillary Clinton’s presidential campaign, and who currently runs policy at the Biden White House. So too does Steyer, who funds the climate activist organization founded by New Yorker author Bill McKibben, 350.org, which reported revenues of nearly $20 million in 2018.

The most influential environmental organization among Democrats and the Biden Administration is the Natural Resources Defense Council, NRDC, which advocated for federal control of state energy markets, the $500 billion for electric cars and renewables, and international carbon markets that would be controlled by the bankers and financiers who also donate to it.

In the 1990s, NRDC helped energy trading company Enron to distribute hundreds of thousands of dollars to environmental groups. “On environmental stewardship, our experience is that you can trust Enron,” said NRDC’s Ralph Cavanagh in 1997, even though Enron executives at the time were defrauding investors of billions of dollars in an epic criminal conspiracy, which in 2001 bankrupted the company.

From 2009 to 2011, NRDC advocated for and helped write complex cap-and-trade climate legislation that would have created and allowed some of their donors to take advantage of a carbon-trading market worth upwards of $1 trillion.

NRDC created and invested $66 million of its own money in a BlackRock stock fund that invested heavily in natural gas companies, and in 2014 disclosed that it had millions invested in renewable funds.

Former NRDC head, Gina McCarthey, now heads up Biden’s climate policy team, and Biden’s top economic advisor, Brian Deese, last worked at BlackRock, and almost certainly will return at the end of the Biden Administration.

Money buys influence. In 2019, McKibben called Steyer a “climate champ” when Steyer announced he was running for president, adding that Steyer’s “just-released climate policy is damned good!” And in 2020, McKibben wrote an article called, “How Banks Could Bail Us Out of the Climate Crisis,” for The New Yorker, which repeated the claim that extreme weather created by climate change threatens financial interests, and that the way to prevent it is to divert public and private money away from reliable energy sources toward weather-dependent ones.

Forms filed to the Internal Revenue Service by Steyer’s philanthropic organization, the TomKat Charitable Trust, show that it gave McKibben’s climate activist group, 350.org, $250,000 in 2012, 2014, and 2015, and may have given money to 350.org in 2013, 2016, 2017, 2018, 2019, and 2020, as well, because 350.org thanked either Steyer’s philanthropy, TomKat Foundation, or his organization, NextGen America, in each of its annual reports since 2013.

At the same time, McKibben’s motivations are plainly spiritual. He claims that various natural disasters are caused by humans, that climate change literally threatens life on Earth, and is thus “greatest challenge humans have ever faced,” a statement so unhinged from reality, considering declining deaths from disasters, declining carbon emissions, and the total absence of any science for such a claim, that it must be considered religious.

McKibben first book about climate change, The End of Nature, explicitly expressed his spiritual views, arguing that, through capitalist industrialization, humankind had lost its connection to nature. “We can no longer imagine that we are part of something larger than ourselves,” he wrote in The End of Nature. “That is what this all boils down to.” Indeed, for William James, the belief in “an unseen order” that we must adjust ourselves to, in order to avoid future punishment, is a defining feature of religion.

Climate change is punishment for our sins against nature — that’s the basic narrative pushed by journalists, climate activists, and their banker sponsors, for 30 years. It has a supernatural element: the belief that natural disasters are getting worse, killing millions, and threatening the economy, when in reality they are getting better, killing fewer, and costing less. And it offers redemption: to avoid punishment we must align our behavior with the unseen order, namely, a new economy controlled by the U.N., bankers, and climate activists. Unfortunately, as is increasingly obvious, the unseen order is parasitical and destructive.

When Nuclear Leads, the Bankers Will Follow

Former German Chancellor Angela Merkel, French President Emanuel Macron, and U.S. Energy Secretary Jennifer Granholm

The unseen order of bankers, climate activists, and the news media is so powerful that it is difficult to imagine how it could ever be challenged.

The financial might of the climate lobby covers the wealth not only of billionaires Soros, Steyer, and Bloomberg, but also $130 trillion in investment funds, including many of the world’s largest pension funds, such as the one belonging to California public employees. The climate lobby’s political power is equally awesome, covering the entirety of the Democratic Party and a significant portion of the Republican Party, and most center-Left parties in Europe.

And all of that is sustained by cultural power, which has led many elites to view climate change as the world’s number one issue, has convinced half of all humans that climate change will make our species extinct, and has served as the apocalyptic foundation for Woke religion.

But serious cracks in the foundation are growing. The global energy crisis has revealed for many around the world the limits of unreliable renewables, with European governments having to subsidize energy to avoid public backlash, President Biden and other heads of state opening up emergency petroleum reserves, and all nations begging OPEC to produce more energy.

The blackouts and rising unreliability of electricity in California, along with the work of the pro-nuclear movement over the last 6 years, has resulted in a growing number of Democrats supporting nuclear energy. Energy Secretary Jennifer Granholm last week publicly urged California Governor Gavin Newsom not to close California’s Diablo Canyon nuclear plant, the signature nuclear plant Environmental Progress has been trying to save since 2016. Democratic support in particular for nuclear is growing.

And alternative media including Substack, podcasts, and social media platforms are increasingly providing a counterweight to the mainstream news media, exposing a huge number of issues that the media got wrong in recent years, and amplifying alternative voices.

Nowhere is the change occurring faster than in Europe, where energy shortages are affecting heating, cooking, and electricity supplies in ways that undermine the legitimacy of the banker-led climate efforts. In Britain, private energy companies have gone bankrupt, forcing the government to bail them out. For-profit energy companies, like banks, ultimately depend on taxpayers, who are also voters.

Outgoing German Chancellor Angela Merkel, who led her nation’s exit from nuclear energy, acknowledged that Germany had been defeated in its anti-nuclear energy advocacy at the European Union level, and that nuclear would finally be recognized as low-carbon.

Donate to Environmental Progress

And French president Emanuel Macron, under pressure from the political right as voters look to elections next year, gave a passionate speech in favor of nuclear energy last month, announcing $35 billion for new reactors.

As the world returns to nuclear, policymakers, media elites, and climate advocates will be increasingly confronted with the question of why consumers and taxpayers will benefit from a global carbon trading scheme and more weather-dependent renewables, particularly at a time of declining global emissions from the continuing transition from coal to natural gas, reduced deforestation, and increased reforestation.

Simply building more nuclear power plants means there is no climate change justification for weather-dependent renewables, which actually require greater use of natural gas, in order to deal with the high amount of unreliability.

Nuclear power goes with slow and patient capital. The obvious funders of a nuclear expansion in the West would be the pension funds, which need the secure return on investment that major construction and infrastructure projects provide, and which unreliable renewables, as the energy crisis shows, do not.

And though the news media is currently ignoring the New York Fed’s report, reporters will not be able to continue spreading misinformation about climate change indefinitely. Increasingly, they, and thus policymakers and the public, will be forced to confront facts inconvenient to their narrative, including that humans are adapting remarkably well to climate change, that renewables make energy unreliable and expensive, and that only nuclear can achieve sustainability goals of reduced emissions, material throughput, and land use.

As people ask, “How Bad Are Weather Disasters?”, not just for banks, but for all of us, the answer will increasingly come back, “Not very.”

Economy

Extreme Weather and Climate Change

From the Fraser Insitute

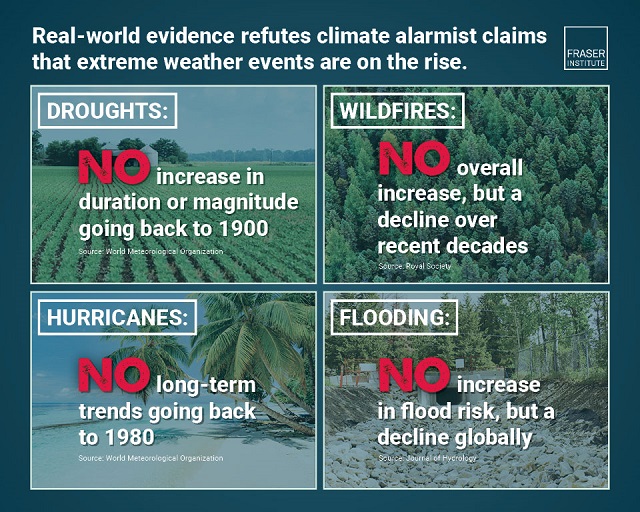

Contrary to claims by many climate activists and politicians, extreme weather events—including forest fires, droughts, floods and hurricanes—are not increasing in frequency or intensity, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Earth Day has become a time when extraordinary claims are made about extreme weather events, but before policymakers act on those extreme claims—often with harmful regulations—it’s important to study the actual evidence,” said Kenneth Green, a senior fellow with the Fraser Institute and author of Extreme Weather and Climate Change.

The study finds that global temperatures have increased moderately since 1950 but there is no evidence that extreme weather events are on the rise, including:

• Drought: Data from the World Meteorological Organization Standardized Precipitation Index showed no statistically significant trends in drought duration or magnitude—with the exception of some small regions in Africa and South America—from 1900 to 2020.

• Flooding: Research in the Journal of Hydrology in 2017, analyzing 9,213 recording stations around the world, found there were more stations exhibiting significant decreasing trends (in flood risk) than increasing trends.

• Hurricanes: Research conducted for the World Meteorological Organization in 2019 (updated in 2023) found no long-term trends in hurricanes or major hurricanes recorded globally going back to 1980.

• Forest Fires: The Royal Society in London, in 2020, found that when considering the total area burned at the global level, there is no overall increase, but rather a decline over the last decades. In Canada, data from Canada’s Wildland Fire Information System show that the number of fires and the area burned in Canada have both been declining over the past 30 years.

“The evidence is clear—many of the claims that extreme weather events are increasing are simply not empirically true,” Green said.

“Before governments impose new regulations or enact new programs, they need to study the actual data and base their actions on facts, not unsubstantiated claims.”

- Assertions are made claiming that weather extremes are increasing in frequency and severity, spurred on by humanity’s greenhouse gas emissions.

- Based on such assertions, governments are enacting ever more restrictive regulations on Canadian consumers of energy products, and especially Canada’s energy sector. These regulations impose significant costs on the Canadian economy, and can exert downward pressure on Canadian’s standard of living.

- According to the UN IPCC, evidence does suggest that some types of extreme weather have become more extreme, particularly those relating to temperature trends.

- However, many types of extreme weather show no signs of increasing and in some cases are decreasing. Drought has shown no clear increasing trend, nor has flooding. Hurricane intensity and number show no increasing trend. Globally, wildfires have shown no clear trend in increasing number or intensity, while in Canada, wildfires have actually been decreasing in number and areas consumed from the 1950s to the present.

- While media and political activists assert that the evidence for increasing harms from increasing extreme weather is iron-clad, it is anything but. In fact, it is quite limited, and of low reliability. Claims about extreme weather should not be used as the basis for committing to long-term regulatory regimes that will hurt current Canadian standards of living, and leave future generations worse off.

Author:

The Fraser Institute is an independent Canadian public policy research and educational

organization with offices in Vancouver, Calgary, Toronto, and Montreal and ties to a global

network of think-tanks in 87 countries. Its mission is to improve the quality of life for Canadians,

their families and future generations by studying, measuring and broadly communicating the

effects of government policies, entrepreneurship and choice on their well-being. To protect the

Institute’s independence, it does not accept grants from governments or contracts for research.

Visit www.fraserinstitute.org

Economy

Federal government remains intransigent on emissions cap despite dire warnings of harm

From the Fraser Institute

In the face of heavy opposition from Canada’s premiers to Prime Minister Trudeau’s carbon tax, one might have hoped that the prime minister would moderate some of his government’s extreme climate policies. But alas, on a recent swing through Alberta, he threw cold water on any hope of moderation.

When asked in a meeting with a who’s who of Alberta’s energy sector if he might drop the forthcoming cap on greenhouse gas emissions specific to the oil and gas industry, Trudeau reportedly replied “not a chance.” That’s a shame, because it was an opportunity for Canada (and Alberta) to dodge another bullet aimed at its economic heart, and an opportunity to reduce some of the rancor between the West and Ottawa.

And in fact, there are many good reasons to drop the GHG cap.

In a recent report, the Conference Board of Canada estimated oil and gas production cuts due to the cap would lead to a permanent decline in Canada’s real GDP of between 0.9 per cent (the report’s most likely outcome) to 1.6 per cent (its least likely outcome) relative to the baseline in 2030. Which means a loss of $22.8 billion to $40.4 billion in 2012 dollars. In Alberta, real GDP by between 3.8 per cent and 6.7 per cent (or $16.3 billion to $28.5 billion). These are devastating impacts, hand-waved away by the prime minister.

Moreover, the report estimates total employment declines nationally by between 82,000 and 151,000 in 2030. A large part of this unemployment will land in Alberta where the report estimates total employment in the province would decline by between 54,000 and 91,500 jobs. And between 2030 and 2040, employment in Alberta will be between 66,300 and 102,600 lower per year (on average). Again, these are huge economic damages disregarded by the prime minister.

Lastly, as shown in a 2023 study published by the Fraser Institute, even if the proposed cap achieved the emissions reductions government predicts, the reduction would equal four-tenths of one per cent of global emissions, a reduction unlikely to have any impact on the climate in any detectable manner, and hence, to offer only equally undetectable environmental, health or safety benefits.

The Conference Board report, and other studies of the likely high costs and non-existent climate benefits of the pending cap on oil and gas emissions, would offer cover for the prime minister if he backed away from what’s clearly an ill-considered climate policy poised to wreak massive economic harms to Canada, particularly in the West. Apparently, however, he’s unwilling to acknowledge reality and change course.

Author:

-

Business2 days ago

Business2 days agoBusiness investment key to addressing Canada’s productivity crisis

-

International2 days ago

International2 days agoBrussels NatCon conference will continue freely after court overturns police barricade

-

Jordan Peterson2 days ago

Jordan Peterson2 days agoJordan Peterson slams CBC for only interviewing pro-LGBT doctors about UK report on child ‘sex changes’

-

Business2 days ago

Business2 days agoFederal budget fails to ‘break the glass’ on Canada’s economic growth crisis

-

Alberta1 day ago

Alberta1 day agoDanielle Smith warns arsonists who start wildfires in Alberta that they will be held accountable

-

Economy2 days ago

Economy2 days agoFederal government remains intransigent on emissions cap despite dire warnings of harm

-

Addictions2 days ago

Addictions2 days agoLiberal MP blasts Trudeau-backed ‘safe supply’ drug programs, linking them to ‘chaos’ in cities

-

Frontier Centre for Public Policy2 days ago

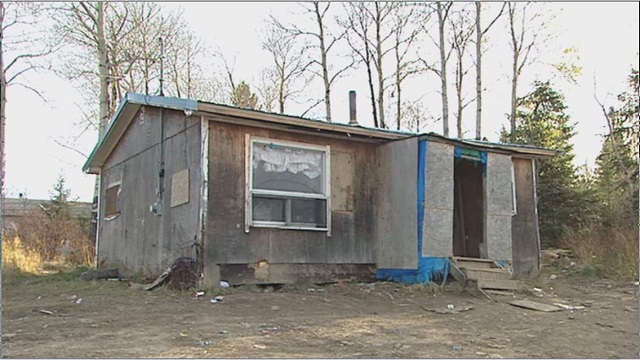

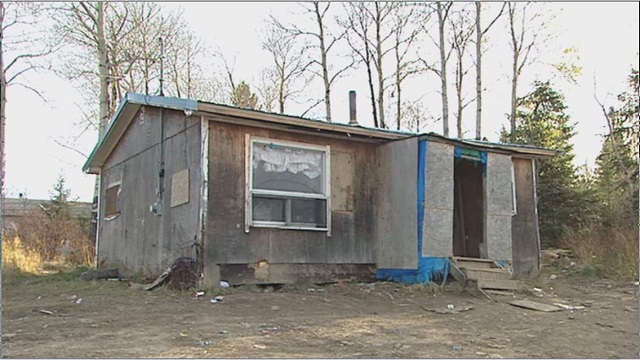

Frontier Centre for Public Policy2 days agoThe Smallwood solution