Alberta

Red Deer Regional Airport expansion takes flight

Alberta’s government will provide a $7.5-million grant to expand infrastructure and services at the Red Deer Regional Airport.

An $18-million airport expansion project will include widening the runway and constructing a terminal to support new low-cost passenger services.

These improvements will help the Red Deer Regional Airport attract new passenger and cargo services and offer a wider range of travel options to area residents, increasing the region’s tourism potential. More than 100 jobs will be created during construction.

Quick facts

- Construction tenders will be issued this month. Work is schedule to begin this spring and conclude in fall 2022.

- Airport improvements include widening the main runway from 30 to 45 metres, strengthening existing taxiways and aprons, and constructing a terminal to support low-cost passenger services.

- The anticipated total cost of the airport expansion is $18 million – with $7.5 million from Alberta’s government.

- Alberta’s aviation, aerospace and logistics industries employed nearly 71,000 people in 2020. These industries contributed $7.2 billion to the province’s GDP in 2020.

- Alberta’s aviation industry has been ranked third in Canada by company size, fourth by number of companies and fourth by GDP contribution in aerospace and defence.

- Alberta’s government created the Strategic Aviation Advisory Council in 2020 to provide expert advice to government on how aviation and aerospace can increase economic development opportunities, expand markets and create jobs in the province.

- Expanding the aviation sector is a key goal of Alberta’s Recovery Plan.

- Three low-cost Alberta based-carriers – the recently created Lynx Air, along with new routes added by Swoop and Flair Airlines – are strong signs of the province’s growing aviation industry.

This investment in Alberta’s aviation industry helps the province further diversify the economy and create more jobs, growth and prosperity. The industry employed more than 71,000 people in 2020, and it continues to grow thanks in part to the Alberta Recovery Plan.

“Central Albertans need a modern, expanded airport that will serve businesses, create jobs and give travellers more choice in airline options. Alberta’s government will make this project happen through this $7.5-million Budget 2022 investment.”

“The aviation sector is a vital part of Alberta’s Recovery Plan and this project will be a great boost to the Red Deer and central Alberta economy. This airport funding will attract more investment and new opportunities for residents and businesses.”

“My optimism around economic opportunities in central Alberta is growing, thanks to this commitment to our airport. We will be able to diversify our economy while creating good-paying jobs and tourism potential.”

“Alberta is an economic powerhouse and the Red Deer airport is strategically centred in the dynamic Calgary-Edmonton corridor. This investment will position our airport to leverage its natural competitive advantages as Alberta and central Alberta prospers and grows.”

“Being able to expand on the airport’s rich history will improve economic opportunities across the region, attract investment and put people back to work. This grant shows everyone that central Alberta is a key contributor to our economic recovery.”

“Now more than ever, aviation and aviation-related businesses are actively looking for alternatives to the ever-increasing costs associated with operating out of large airports. With low lease rates, free parking and no airport improvement fees, the Red Deer Regional Airport is well-positioned for future growth.”

“This expansion will provide huge economic benefits to central Alberta. Red Deer County is appreciative of this important investment from the Alberta government and the continuing commitment to build economic prosperity.”

“The Red Deer Regional Airport is a regional amenity that supports the whole of Alberta. This investment translates to not only potential for increased passengers, revenues and regional economic development, but also opportunities to generate employment at a time when the economy and travel industry needs it most.”

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

Province to stop municipalities overcharging on utility bills

Making utility bills more affordableAlberta’s government is taking action to protect Alberta’s ratepayers by introducing legislation to lower and stabilize local access fees. Affordability is a top priority for Alberta’s government, with the cost of utilities being a large focus. By introducing legislation to help reduce the cost of utility bills, the government is continuing to follow through on its commitment to make life more affordable for Albertans. This is in addition to the new short-term measures to prevent spikes in electricity prices and will help ensure long-term affordability for Albertans’ basic household expenses.

Local access fees are functioning as a regressive municipal tax that consumers pay on their utility bills. It is unacceptable for municipalities to be raking in hundreds of millions in surplus revenue off the backs of Alberta’s ratepayers and cause their utility bills to be unpredictable costs by tying their fees to a variable rate. Calgarians paid $240 in local access fees on average in 2023, compared to the $75 on average in Edmonton, thanks to Calgary’s formula relying on a variable rate. This led to $186 million more in fees being collected by the City of Calgary than expected.

To protect Alberta’s ratepayers, the Government of Alberta is introducing the Utilities Affordability Statutes Amendment Act, 2024. If passed, this legislation would promote long-term affordability and predictability for utility bills by prohibiting the use of variable rates when calculating municipalities’ local access fees. Variable rates are highly volatile, which results in wildly fluctuating electricity bills. When municipalities use this rate to calculate their local access fees, it results in higher bills for Albertans and less certainty in families’ budgets. These proposed changes would standardize how municipal fees are calculated across the province, and align with most municipalities’ current formulas.

If passed, the Utilities Affordability Statutes Amendment Act, 2024 would prevent municipalities from attempting to take advantage of Alberta’s ratepayers in the future. It would amend sections of the Electric Utilities Act and Gas Utilities Act to ensure that the Alberta Utilities Commission has stronger regulatory oversight on how these municipal fees are calculated and applied, ensuring Alberta ratepayer’s best interests are protected.

If passed, this legislation would also amend sections of the Alberta Utilities Commission Act, the Electric Utilities Act, Government Organizations Act and the Regulated Rate Option Stability Act to replace the terms “Regulated Rate Option”, “RRO”, and “Regulated Rate Provider” with “Rate of Last Resort” and “Rate of Last Resort Provider” as applicable. Quick facts

Related information |

-

Brownstone Institute22 hours ago

Brownstone Institute22 hours agoDeborah Birx Gets Her Close-Up

-

Economy2 days ago

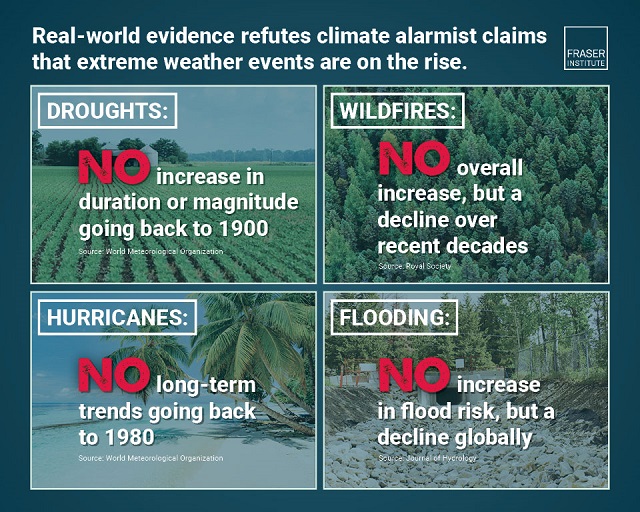

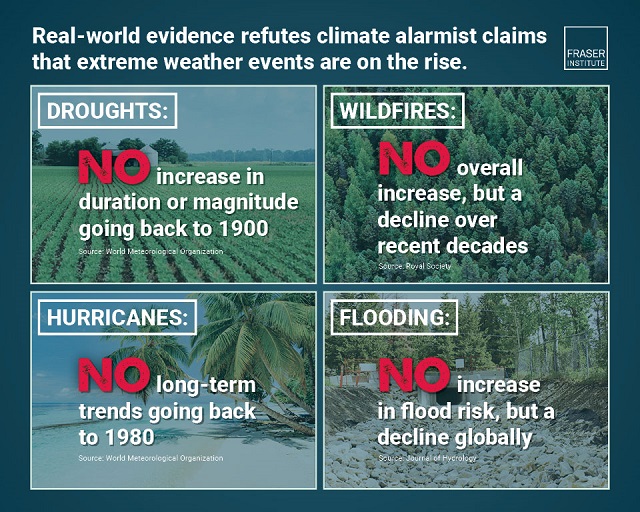

Economy2 days agoExtreme Weather and Climate Change

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWhy Are Canadian Mayors So Far Left And Out Of Touch?

-

International2 days ago

International2 days agoTelegram founder tells Tucker Carlson that US intel agents tried to spy on user messages

-

Alberta21 hours ago

Alberta21 hours agoCoutts Three verdict: A warning to protestors who act as liaison with police

-

Business2 days ago

Business2 days agoTrudeau gov’t pledges $42 million to the CBC to promote ‘independent journalism’

-

Justice2 days ago

Justice2 days agoOntario Court of Justice says participants must state their ‘preferred pronouns’ during introduction

-

Business2 days ago

Business2 days agoCanada’s economy has stagnated despite Ottawa’s spin