Business

Red Deer Chamber of Commerce reaches out to all businesses with COVID-19 resources and guidance

From Red Deer & District Chamber of Commerce

|

|

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Business

Maxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

From LifeSiteNews

If ‘the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.’

People’s Party of Canada leader Maxime Bernier has warned that the Liberal government’s push for World Economic Forum (WEF) “Global Tax” scheme should concern Canadians.

According to Canada’s 2024 Budget, Prime Minister Justin Trudeau is working to pass the WEF’s Global Minimum Tax Act which will mandate that multinational companies pay a minimum tax rate of 15 percent.

“Canadians should be very concerned, for several reasons,” People’s Party leader Maxime Bernier told LifeSiteNews, in response to the proposal.

“First, the WEF is a globalist institution that actively campaigns for the establishment of a world government and for the adoption of socialist, authoritarian, and reactionary anti-growth policies across the world,” he explained. “Any proposal they make is very likely not in the interest of Canadians.”

“Second, this minimum tax on multinationals is a way to insidiously build support for a global harmonized tax regime that will lower tax competition between countries, and therefore ensure that taxes can stay higher everywhere,” he continued.

“Canada reaffirms its commitment to Pillar One and will continue to work diligently to finalize a multilateral treaty and bring the new system into effect as soon as a critical mass of countries is willing,” the budget stated.

“However, in view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot continue to wait before taking action,” it continued.

The Trudeau government also announced it would be implementing “Pillar Two,” which aims to establish a global minimum corporate tax rate.

“Pillar Two of the plan is a global minimum tax regime to ensure that large multinational corporations are subject to a minimum effective tax rate of 15 per cent on their profits wherever they do business,” the Liberals explained.

“The federal government is moving ahead with legislation to implement the regime in Canada, following consultations last summer on draft legislative proposals for the new Global Minimum Tax Act,” it continued.

According to the budget, Trudeau promised to introduce the new legislation in Parliament soon.

The global tax was first proposed by Secretary-General of Amnesty International at the WEF meeting in Davos this January.

“Let’s start taxing carbon…[but] not just carbon tax,” the head of Amnesty International, Agnes Callamard, said during a panel discussion.

According to the WEF, the tax, proposed by the Organization for Economic Co-operation and Development (OECD), “imposes a minimum effective rate of 15% on corporate profits.”

Following the meeting, 140 countries, including Canada, pledged to impose the tax.

While a tax on large corporations does not necessarily sound unethical, implementing a global tax appears to be just the first step in the WEF’s globalization plan by undermining the sovereignty of nations.

While Bernier explained that multinationals should pay taxes, he argued it is the role of each country to determine what those taxes are.

“The logic of pressuring countries with low taxes to raise them is that it lessens fiscal competition and makes it then less costly and easier for countries with higher taxes to keep them high,” he said.

Bernier pointed out that competition is good since it “forces everyone to get better and more efficient.”

“In the end, we all end up paying for taxes, even those paid by multinationals, as it causes them to raise prices and transfer the cost of taxes to consumers,” he warned.

Bernier further explained that the new tax could be a first step “toward the implementation of global taxes by the United Nations or some of its agencies, with the cooperation of globalist governments like Trudeau’s willing to cede our sovereignty to these international organizations.”

“Just like ‘temporary taxes’ (like the income tax adopted during WWI) tend to become permanent, ‘minimum taxes’ tend to be raised,” he warned. “And if the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.”

Trudeau’s involvement in the WEF’s plan should not be surprising considering his current environmental goals – which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development – which include the phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum – the aforementioned group famous for its socialist “Great Reset” agenda – in which Trudeau and some of his cabinet are involved.

-

Brownstone Institute23 hours ago

Brownstone Institute23 hours agoDeborah Birx Gets Her Close-Up

-

Economy2 days ago

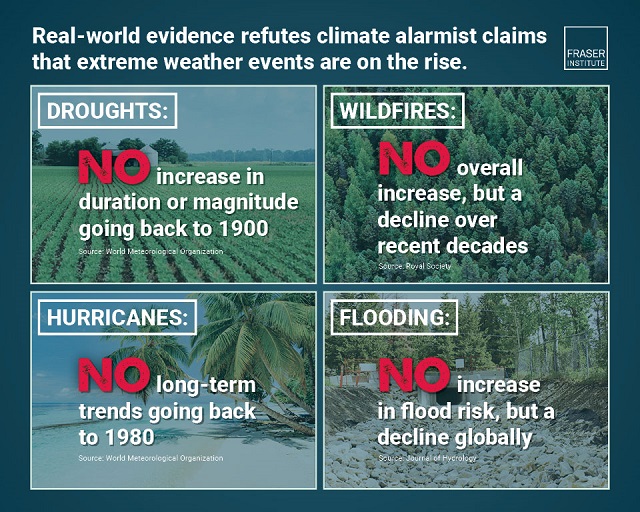

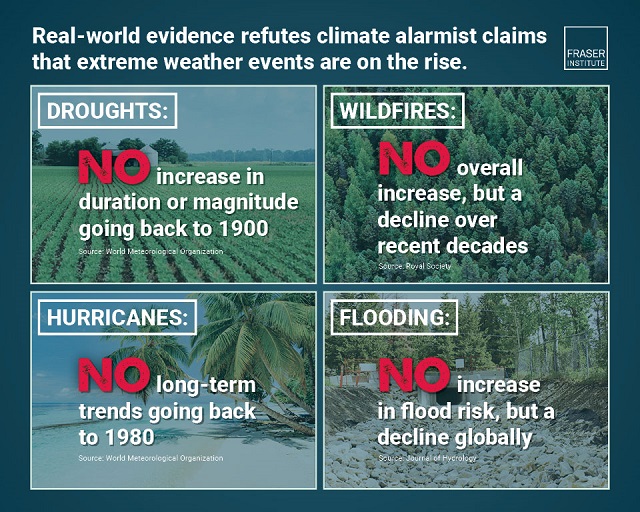

Economy2 days agoExtreme Weather and Climate Change

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWhy Are Canadian Mayors So Far Left And Out Of Touch?

-

Alberta22 hours ago

Alberta22 hours agoCoutts Three verdict: A warning to protestors who act as liaison with police

-

Justice2 days ago

Justice2 days agoOntario Court of Justice says participants must state their ‘preferred pronouns’ during introduction

-

Business2 days ago

Business2 days agoTrudeau gov’t pledges $42 million to the CBC to promote ‘independent journalism’

-

Business2 days ago

Business2 days agoCanada’s economy has stagnated despite Ottawa’s spin

-

Alberta2 days ago

Alberta2 days agoMaxime Bernier says it’s ‘astounding’ Alberta is ‘pushing’ COVID boosters, tells Danielle Smith to stop it