Economy

Raise a glass to celebrate Canadian Beer Day

The third annual day dedicated to Canadian beer and our local brewing industry – Canadian Beer Day – is today – Wednesday, October 6, 2021, with coast-to-coast celebrations at local breweries, pubs, restaurants and at home with family and loved ones. Canadian brewers, beer enthusiasts, and the hardworking Canadians connected to the production and sale of beer across the country are raising a glass to #CheersAgain on this #CDNBeerDay – recognizing the positive impact beer has on our culture, communities, lives and economy.

First started in 2019, Canadian Beer Day is dedicated to celebrating beer and the thousands of Canadians involved in the brewing, selling, delivering, serving – and enjoying – Canada’s favourite beverage loved by millions across the country. The celebration, which occurs every year on the Wednesday before Thanksgiving, recognizes and celebrates beer and breweries in Canada and the workers directly involved in beer’s supply chain – agriculture, manufacturing, transportation, and hospitality.

“Beer brings Canadians together, and it’s been a part of our country’s culture and communities for generations. The last 18 months have been a challenging time for Canadians and businesses, specifically those in hospitality and tourism, making beer’s role in bringing friends and family together more important than ever,” said Dana Miller, Interim Director, Communications and Engagement for Beer Canada.

“Whether in a small or larger group this year, we hope that Canadians will join us in safely supporting our brewers, restauranteurs, barley farmers and all those connected to beer by raising a glass of your favourite Canadian-made beer today,” Miller added.

This year, Canadian Beer Day launched an initiative to fundraise for Food Banks Canada to help fellow Canadians struggling with food insecurity, especially during COVID-19. Apparel has been sold online to beer fans across the country, and Beer Canada will match all proceeds with a donation being made shortly after October 6.

Canadian brewers directly employ over 19,000 Canadians, and approximately 149,000 jobs across Canada’s hospitality, tourism, agriculture and manufacturing sector are supported by the production and sale of beer.

Canadian Beer Day is all about celebrating the beverage Canadians love, and the positive contributions brewers make to local communities across the country throughout the year. To find out more, visit www.canadianbeerday.ca.

QUICK FACTS

· 85% of the beer consumed in Canada is made here.

· Approximately 149,000 Canadian jobs are supported by the production and sale of beer.

· Over 19,000 Canadians work in breweries across the country.

· Canada is home to over 1,200 breweries.

· Beer contributes $13.6 billion to Canada’s GDP annually.

ABOUT BEER CANADA

Beer Canada is the voice of the people who make our nation’s beers. Our members account for 90% of the beer produced in Canada. The sale of beer supports 149,000 Canadian jobs, generates $14 billion in Gross Domestic Product and $5.7 billion in government tax revenues.

Business

New capital gains hike won’t work as claimed but will harm the economy

From the Fraser Institute

By Alex Whalen and Jake Fuss

Capital taxes are among the most economically-damaging forms of taxation precisely because they reduce the incentive to innovate and invest.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50 per cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’ marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivises investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7 billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing—that this move only affects the wealthy—lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically-damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new start-ups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgement of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Authors:

Economy

Extreme Weather and Climate Change

From the Fraser Insitute

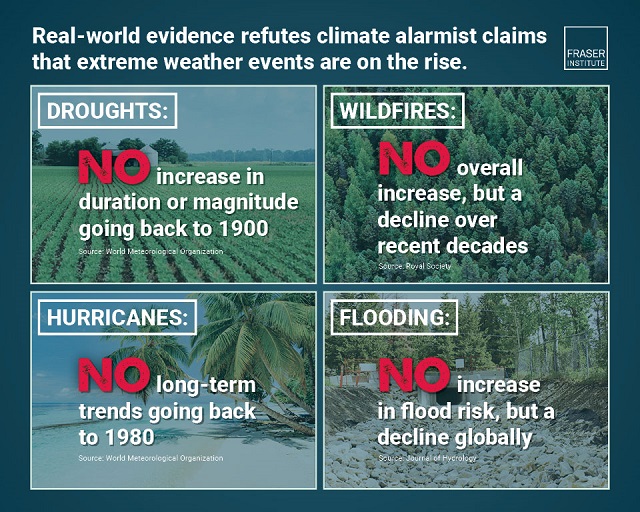

Contrary to claims by many climate activists and politicians, extreme weather events—including forest fires, droughts, floods and hurricanes—are not increasing in frequency or intensity, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Earth Day has become a time when extraordinary claims are made about extreme weather events, but before policymakers act on those extreme claims—often with harmful regulations—it’s important to study the actual evidence,” said Kenneth Green, a senior fellow with the Fraser Institute and author of Extreme Weather and Climate Change.

The study finds that global temperatures have increased moderately since 1950 but there is no evidence that extreme weather events are on the rise, including:

• Drought: Data from the World Meteorological Organization Standardized Precipitation Index showed no statistically significant trends in drought duration or magnitude—with the exception of some small regions in Africa and South America—from 1900 to 2020.

• Flooding: Research in the Journal of Hydrology in 2017, analyzing 9,213 recording stations around the world, found there were more stations exhibiting significant decreasing trends (in flood risk) than increasing trends.

• Hurricanes: Research conducted for the World Meteorological Organization in 2019 (updated in 2023) found no long-term trends in hurricanes or major hurricanes recorded globally going back to 1980.

• Forest Fires: The Royal Society in London, in 2020, found that when considering the total area burned at the global level, there is no overall increase, but rather a decline over the last decades. In Canada, data from Canada’s Wildland Fire Information System show that the number of fires and the area burned in Canada have both been declining over the past 30 years.

“The evidence is clear—many of the claims that extreme weather events are increasing are simply not empirically true,” Green said.

“Before governments impose new regulations or enact new programs, they need to study the actual data and base their actions on facts, not unsubstantiated claims.”

- Assertions are made claiming that weather extremes are increasing in frequency and severity, spurred on by humanity’s greenhouse gas emissions.

- Based on such assertions, governments are enacting ever more restrictive regulations on Canadian consumers of energy products, and especially Canada’s energy sector. These regulations impose significant costs on the Canadian economy, and can exert downward pressure on Canadian’s standard of living.

- According to the UN IPCC, evidence does suggest that some types of extreme weather have become more extreme, particularly those relating to temperature trends.

- However, many types of extreme weather show no signs of increasing and in some cases are decreasing. Drought has shown no clear increasing trend, nor has flooding. Hurricane intensity and number show no increasing trend. Globally, wildfires have shown no clear trend in increasing number or intensity, while in Canada, wildfires have actually been decreasing in number and areas consumed from the 1950s to the present.

- While media and political activists assert that the evidence for increasing harms from increasing extreme weather is iron-clad, it is anything but. In fact, it is quite limited, and of low reliability. Claims about extreme weather should not be used as the basis for committing to long-term regulatory regimes that will hurt current Canadian standards of living, and leave future generations worse off.

Author:

The Fraser Institute is an independent Canadian public policy research and educational

organization with offices in Vancouver, Calgary, Toronto, and Montreal and ties to a global

network of think-tanks in 87 countries. Its mission is to improve the quality of life for Canadians,

their families and future generations by studying, measuring and broadly communicating the

effects of government policies, entrepreneurship and choice on their well-being. To protect the

Institute’s independence, it does not accept grants from governments or contracts for research.

Visit www.fraserinstitute.org

-

espionage2 days ago

espionage2 days agoTrudeau’s office was warned that Chinese agents posed ‘existential threat’ to Canada: secret memo

-

COVID-192 days ago

COVID-192 days agoPro-freedom Canadian nurse gets two years probation for protesting COVID restrictions

-

Economy2 days ago

Economy2 days agoMassive deficits send debt interest charges soaring

-

International1 day ago

International1 day agoBrussels NatCon conference will continue freely after court overturns police barricade

-

Business1 day ago

Business1 day agoBusiness investment key to addressing Canada’s productivity crisis

-

MacDonald Laurier Institute2 days ago

MacDonald Laurier Institute2 days agoThe Governor General deserves better, but we deserve impartiality

-

International2 days ago

International2 days ago28-year-old Dutch woman to be killed by assisted suicide after doctors deem her autism ‘untreatable’

-

Jordan Peterson23 hours ago

Jordan Peterson23 hours agoJordan Peterson slams CBC for only interviewing pro-LGBT doctors about UK report on child ‘sex changes’