Alberta

Province announces a new High School for Blackfalds and plans for a new Middle School in Red Deer

Minister LaGrange, Minister Panda and Minister Sawhney announce provincial school capital funding at Nose Creek School in Calgary.

From the Province of Alberta

Building schools for the future

Following through on its commitment to continue building new schools, the province has announced 25 new school projects.

The Budget 2019 capital plan supports 15 new schools, including brand new high schools in Calgary, Edmonton, Leduc, Blackfalds and Langdon. Six schools are slated for replacement and four will receive modernization or additions. Together, the 25 projects will receive $397 million.

“We made a promise to Albertans that our government will continue to build new schools, and we are doing exactly that. Through our significant investment in new schools, replacements, modernizations and infrastructure upkeep, our children will continue to learn in up-to-date and safe spaces. This will result in better success in our classrooms. The future is bright for Alberta students.”

“These 25 projects confirm our government’s commitment to continue to build schools across the province. Alberta Infrastructure will continue to deliver key infrastructure projects to build prosperity for Albertans.”

Budget 2019 also includes $1.4 billion over four years to continue work on previously announced school projects across Alberta, which includes $123 million for about 250 new modular classrooms to address the most urgent needs for additional space across the province. There are more than 60 projects underway in the province. Twenty-seven are expected to be open for the 2020-21 school year, and the remaining projects are in various stages of planning and construction.

The province will also provide $527 million to school divisions for plant operations and maintenance to support the day-to-day upkeep of school facilities. Additionally, $194 million will support the capital maintenance and renewal of existing school buildings through the Infrastructure Maintenance and Renewal Program.

“I am pleased that the government chose to make this announcement here in Calgary-North East. Students and families in my community will be relieved to hear that they will be getting the new high school we have needed for a long time. I’m proud that this critical funding was included in Budget 2019, as this was one of my first and most important motivations for why I wanted to represent Calgary-North East at the legislature.”

“On behalf of our students and the Calgary Board of Education, we would like to thank Minister LaGrange and Minister Panda for this important investment in school capital. We are pleased they chose to come to Calgary to make this provincial announcement and look forward to new CBE schools that will benefit students in north Calgary and in the growing community of Auburn Bay.”

The 25 capital projects are:

| Community | School Authority | Project Type/Name |

|---|---|---|

| *Beaumont | Conseil scolaire Centre Nord (Greater North Central Francophone Education Region) | new school (K-12) |

| *Blackfalds | Wolf Creek Public Schools | new high school (9-12) |

| Buffalo Head Prairie | Fort Vermilion School Division | Blue Hills Community School addition & modernization |

| Calgary – Auburn Bay | Calgary Board of Education | new elementary school (K-4) |

| Calgary – Auburn Bay | Calgary Board of Education | new middle school (5-9) |

| Calgary – north | Calgary Board of Education | new high school (10-12) |

| Carstairs | Chinook’s Edge School Division | Carstairs Elementary School addition |

| Cochrane | Calgary Catholic School District | new elementary/junior high school (K-9) |

| Condor & Leslieville | Wild Rose School Division | David Thompson solution modernization/replacement |

| *Edmonton – south east | Edmonton Public Schools | new high school (10-12) |

| Edmonton – Windermere-Keswick | Edmonton Public Schools | new elementary/junior high (K-9) |

| *Edmonton – Heritage Valley Town Centre | Edmonton Catholic Schools | new high school (10-12) |

| Edmonton – Windermere/Keswick | Edmonton Catholic Schools | new elementary/junior high (K-9) |

| *Fort Chipewyan | Northland School Division | Athabasca Delta School modernization/replacement |

| *Grande Prairie | Peace Wapiti School Division | Harry Balfour School replacement |

| *Langdon | Rocky View Schools | new junior/senior high school (7-12) |

| *Leduc | Black Gold School Division | new high school (10-12) |

| Legal | Conseil scolaire Centre Nord(Greater North Central Francophone Education Region) | new elementary/junior high school (K-9) |

| Morinville | Greater St. Albert Catholic Schools | Morinville Community High School CTS modernization |

| Morrin | Prairie Land School Division | Morrin School replacement |

| Peace River | Conseil Scolaire du Nord-Ouest(Northwest Francophone Education Region) | École des Quatre-Vents replacement |

| *Red Deer | Red Deer Catholic Regional Schools | new middle school (6-9) |

| Smoky Lake | Aspen View Public Schools | H.A. Kostash replacement |

| *St. Albert | St. Albert Public Schools | Bellerose Composite High School addition & modernization |

| Whitecourt | Living Waters Catholic Schools | new elementary school (K-3) |

*Design funding

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

Province to stop municipalities overcharging on utility bills

Making utility bills more affordableAlberta’s government is taking action to protect Alberta’s ratepayers by introducing legislation to lower and stabilize local access fees. Affordability is a top priority for Alberta’s government, with the cost of utilities being a large focus. By introducing legislation to help reduce the cost of utility bills, the government is continuing to follow through on its commitment to make life more affordable for Albertans. This is in addition to the new short-term measures to prevent spikes in electricity prices and will help ensure long-term affordability for Albertans’ basic household expenses.

Local access fees are functioning as a regressive municipal tax that consumers pay on their utility bills. It is unacceptable for municipalities to be raking in hundreds of millions in surplus revenue off the backs of Alberta’s ratepayers and cause their utility bills to be unpredictable costs by tying their fees to a variable rate. Calgarians paid $240 in local access fees on average in 2023, compared to the $75 on average in Edmonton, thanks to Calgary’s formula relying on a variable rate. This led to $186 million more in fees being collected by the City of Calgary than expected.

To protect Alberta’s ratepayers, the Government of Alberta is introducing the Utilities Affordability Statutes Amendment Act, 2024. If passed, this legislation would promote long-term affordability and predictability for utility bills by prohibiting the use of variable rates when calculating municipalities’ local access fees. Variable rates are highly volatile, which results in wildly fluctuating electricity bills. When municipalities use this rate to calculate their local access fees, it results in higher bills for Albertans and less certainty in families’ budgets. These proposed changes would standardize how municipal fees are calculated across the province, and align with most municipalities’ current formulas.

If passed, the Utilities Affordability Statutes Amendment Act, 2024 would prevent municipalities from attempting to take advantage of Alberta’s ratepayers in the future. It would amend sections of the Electric Utilities Act and Gas Utilities Act to ensure that the Alberta Utilities Commission has stronger regulatory oversight on how these municipal fees are calculated and applied, ensuring Alberta ratepayer’s best interests are protected.

If passed, this legislation would also amend sections of the Alberta Utilities Commission Act, the Electric Utilities Act, Government Organizations Act and the Regulated Rate Option Stability Act to replace the terms “Regulated Rate Option”, “RRO”, and “Regulated Rate Provider” with “Rate of Last Resort” and “Rate of Last Resort Provider” as applicable. Quick facts

Related information |

-

Brownstone Institute22 hours ago

Brownstone Institute22 hours agoDeborah Birx Gets Her Close-Up

-

Economy2 days ago

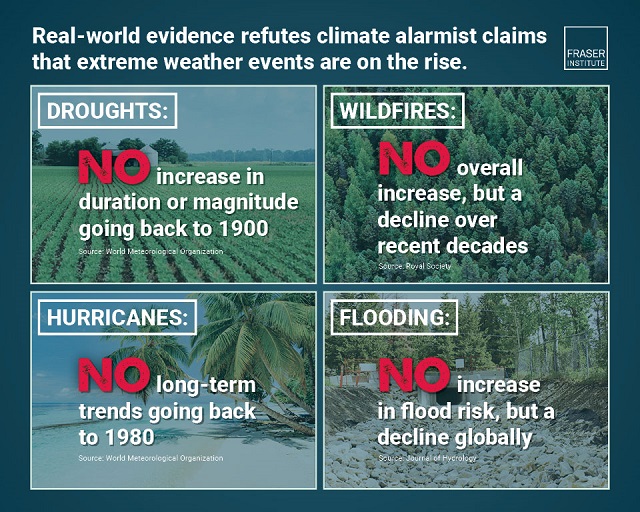

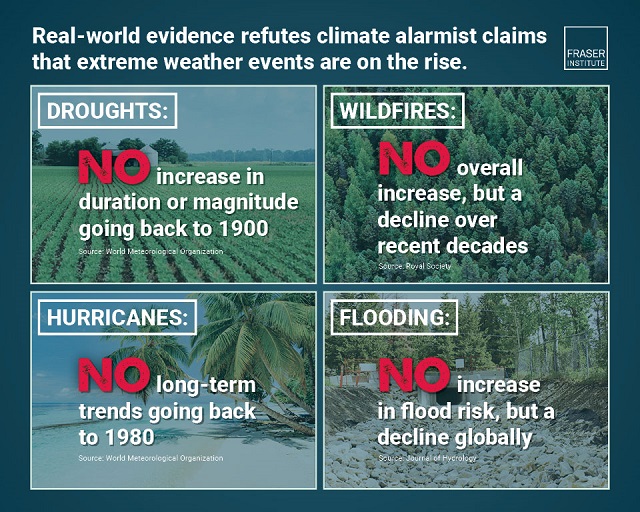

Economy2 days agoExtreme Weather and Climate Change

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWhy Are Canadian Mayors So Far Left And Out Of Touch?

-

International2 days ago

International2 days agoTelegram founder tells Tucker Carlson that US intel agents tried to spy on user messages

-

Alberta21 hours ago

Alberta21 hours agoCoutts Three verdict: A warning to protestors who act as liaison with police

-

Business2 days ago

Business2 days agoTrudeau gov’t pledges $42 million to the CBC to promote ‘independent journalism’

-

Justice2 days ago

Justice2 days agoOntario Court of Justice says participants must state their ‘preferred pronouns’ during introduction

-

Business2 days ago

Business2 days agoCanada’s economy has stagnated despite Ottawa’s spin