Alberta

MGM, HBO, CBS, Paramount and other studios all working in Alberta right now!

Film credit attracts productions worth nearly $1B

A key part of Alberta’s Recovery Plan, the Film and Television Tax Credit is attracting major productions to the province, diversifying the economy and creating thousands of new jobs.

Since the program’s launch in January 2020, it has attracted 50 productions to Alberta with total production costs of $955 million, creating 9,000 new direct and indirect jobs in the province.

In March 2021, Alberta’s government removed the $10-million per-project cap from the Film and Television Tax Credit to make the province an even more desirable location for larger productions.

Cameras are rolling on film and television productions across Alberta, injecting hundreds of millions of dollars in investment into the economy as these productions hire local crews, actors and extras, and use local businesses.

The Film and Television Tax Credit, combined with Alberta’s competitive tax environment, affordable labour costs and breathtaking scenery, has made the province a prime choice for medium and big-budget television and film projects that have a positive impact on Alberta’s economy.

HBO is currently filming its new television series The Last of Us in Alberta. The project is the single largest television series production in Canadian history and is expected to create thousands of jobs.

“The boom in our film industry is the perfect example of Alberta’s Recovery Plan in action. Thanks to the Film and Television Tax Credit, and our recent improvements to it, we are witnessing a new billion-dollar industry take shape right before our eyes, further diversifying the economy and creating new jobs.”

Jason Kenney, Premier

“Alberta is the new Hollywood. With our stunning landscapes, our immense talent and our world-class studios, our province is being showcased on the big screen in a way that it never has before, with thousands of jobs being created in everything from carpentry to catering.”

Doug Schweitzer, Minister of Jobs, Economy and Innovation

“Film productions like The Last of Us and Ghostbusters mean thousands of new jobs for rural Albertans both on and off set. With landscapes from the Rocky Mountains to the Prairies, Alberta is becoming a global hub for film. New multimillion-dollar investments in the film industry are getting Albertans back to work and driving Alberta’s economic recovery. I look forward to seeing even more of Alberta on the big screen.”

Nate Horner, Associate Minister of Rural Economic Development

“From breathtaking landscapes to a skilled and growing workforce, Alberta has much to offer the global production community. The province’s enhanced film and television production incentive has also made it an especially attractive destination for HBO. We look forward to filming The Last of Us here, and to working with talented Alberta crews.”

Jay Roewe, senior vice-president, Production & Incentives, HBO

“Alberta’s Film and Television Tax Credit is a game-changer in terms of production volumes. It has created thousands of well-paying jobs and numerous business opportunities. High-profile projects such as The Last of Us are a major driver of jobs, Alberta businesses and training. Projects like this benefit numerous industries ranging from fabric suppliers to companies in the hospitality industry. Alberta’s spectacular landscapes are being shared globally, elevating our economic standing in the global marketplace.”

Damian Petti, president, IATSE Local 212

“We are pleased to see the Alberta government is supporting Alberta’s creative industries by their recent enhancements of our film and television tax credits and production incentives. From actors to puppeteers to stunt performers, this is fantastic news for ACTRA Alberta performers, our production community and Alberta’s economy.”

Tina Alford, branch representative, ACTRA Alberta

“Alberta’s enhanced incentive program and strong commitment to increasing investment from global studios is working to grow the creative economy and provide unparalleled opportunities for Alberta’s creative talent. On behalf of the major studios we represent, we’re thrilled that the Alberta government and industry have worked together to create jobs for thousands of skilled Albertans in front of and behind the camera, and to showcase the beauty and talent of Alberta on the global stage.”

Wendy Noss, president, MPA-Canada

“HBO is synonymous with quality and The Last of Us has long been touted as one of the most cinematic video game series ever created – a perfect marriage to Alberta’s cinematic landscapes, light and picturesque communities. We are grateful to have this tentpole series in the province developing the industry and creating hundreds of jobs for our hard-working and talented crews, as well as a great economic stimulus in communities of southern Alberta. This project, along with enhancements of the Alberta Film and Television Tax Credit, will be looked back on as cornerstone moments in a booming film production sector for years to come.”

Brock Skretting, head of advocacy, Keep Alberta Rolling

“The changes to Alberta’s Film and Television Tax credit can only be seen as a success story. Not only are we creating good high-paying jobs for Albertans, but it is also an important step in boosting Alberta’s economy at time when we need it. No matter what the business is – gas stations, lumberyard, coffee shop – movie money is being spent in Alberta.”

Mike Dunphy, business agent, Teamsters Local 362

Quick facts

- Alberta’s Film and Television Tax Credit, launched in January 2020, offers a refundable Alberta tax credit certificate on eligible Alberta production and labour costs to corporations that produce films, television series and other eligible screen-based productions in the province.

- The Film and Television Tax Credit complements the Alberta Made Production Grant, and is part of the government’s commitment to grow Alberta’s cultural industries by 25 per cent over the next decade.

- In 2019, combined consumer spend globally for theatrical and home entertainment reached $101 billion, a 34 per cent increase since 2015.

- The film and television industry is experiencing significant growth nationally and globally.

- Global spending in the industry is projected to reach about $113 billion by 2022.

- It is expected more than $50 billion of that spending will be in North America.

- Last year, the Canadian film and television industry was valued at $3 billion and employed more than 54,000 workers.

- Every year, Alberta graduates more than 3,000 creative industry professionals from its post-secondary institutions.

- According to industry estimates, more than 3,200 Albertans are employed in the province’s motion picture and video industry.

- According to Statistics Canada data:

- Every $1 million of production activity in the screen-based production sector creates about 13 Alberta jobs.

- Every $1 million of government investment under the Film and Television Tax Credit program is expected to support about 85 Alberta jobs.

- The budget for the Film and Television Tax Credit in 2021-22 is $50 million.

Related information

Alberta

Alberta’s baby name superstar steals the show again

Olivia and Noah continue to reign as top baby names in 2023.

Olivia and Noah are once again topping the lists in Alberta, highlighting the enduring appeal of the names. Olivia maintains a record setting streak as the most popular girls name in Alberta for the 11th year in a row, while Noah remains top pick for boys’ names for a fifth consecutive year.

“Congratulations to those who welcomed a new addition to their family in 2023. Bringing a child into the world is a truly momentous occasion. Whether the name you chose was in the top 10 or one of a kind, these names are only the beginning of the endless possibilities that lie ahead for each child. I look forward to supporting this generation by ensuring Alberta remains a place where they can thrive.”

In choosing names for their new arrivals, parents appear to have found inspiration in a variety of places. Some parents may have been inspired by plants like Ivy, Rose, Juniper, Poppy, Azalea or in nature like Wren, River, Meadow and Flora.

Others may have taken a literary approach with names like Bennett, Sawyer, Juliet and Atticus or been inspired by notable names from religious texts like Eve, Noah, Mohammed and Gabriel.

As always, popular culture may have had an influence through famous musicians (Aretha, Lennon, Presley, Hendrix), athletes (Beckham, Crosby, Evander), and even fairytale princesses (Tiana, Jasmine, Aurora, Ariel, Belle).

Quick facts

- A total of 47,263 births were registered in Alberta in 2023

- Notable changes to the early 2020s lists:

- Evelyn rose to seventh place on the girls’ names list after tying for 19th place in 2022.

- Emily returned to the top 10 list for girls after taking a short break in 2021 and 2022 after a 10-year stretch in the top 10 that started in 2010.

- Violet has cracked the top 10 list for the first time in at least four decades, tying with Ava and Emily in ninth place.

- The top 10 boys’ names remain the same as last year but with a slight change in order.

- Historically, girls’ names that held the No. 1 spot for the longest consecutive time period include:

- Olivia: 11 years (2013-2023)

- Jessica: six years (1990-1995)

- Emily: five years (1998-2002)

- Historically, boys’ names that held the No. 1 spot for the longest consecutive time period include:

- Ethan: nine years (2001-2009)

- Liam: seven years (2010-2016)

- Matthew: five years (1995-1999)

- Noah: five years (2019-2023)

- Parents have up to one year to register their child’s birth. As a result, the list of 2023 baby names and birth statistics may change slightly.

Boys’ names and frequency – top 10 names 2018-23

(In brackets is the number of babies with each name)

| Place | Boy Names (2023) | Boy Names

(2022) |

Boy Names (2021) | Boy Names (2020) | Boy Names (2019) | Boy Names (2018) |

| 1 | Noah (276) | Noah (229) | Noah (274) | Noah (239) | Noah (275) | Liam (225) |

| 2 | Liam (181) | Liam (176) | Jack (220) | Oliver (229) | Liam (234) | Oliver (212) |

| 3 | Oliver (178) | Theodore (173) | Oliver (208) | Liam (206) | Oliver (225) | Noah (199) |

| 4 | Theodore (173) | Oliver (172) | Liam (198) | Benjamin (182) | Ethan (213) | Ethan (188) |

| 5 | Jack (153) | Jack (159) | Theodore (191) | William (178) | Jack (198) | Logan (182)

Lucas (182) |

| 6 | Henry (146) | William (146) | William (174) | Jack (169) | William (185) | Jacob (181) |

| 7 | Lucas (140) | Benjamin (138) | Ethan (162) | Lucas (163) | Lucas (174) | William (178) |

Girls’ names and frequency – top 10 names 2018-2023

(In brackets is the number of babies with each name)

| Place | Girl Names (2023) | Girl Names

(2022) |

Girl Names (2021) | Girl Names (2020) | Girl Names (2019) | Girl Names (2018) |

| 1 | Olivia (210) | Olivia (192) | Olivia (210) | Olivia (236) | Olivia (229) | Olivia (235) |

| 2 | Amelia (145) | Sophia (152) | Charlotte (166) | Emma (184) | Charlotte (188) | Emma (230) |

| 3 | Sophia

(138) |

Emma (149) | Ava (165) | Charlotte (161) | Sophia (181) | Charlotte (175) |

| 4 | Charlotte

(135) |

Amelia (133) | Emma (164) | Ava (159) | Emma (178) | Emily (164) |

| 5 | Emma (133) | Harper (125) | Amelia (161) | Sophia (151) | Ava (161) | Ava (161) |

| 6 | Isla (120) | Charlotte (117) | Sophia (137) | Amelia (145) | Amelia (159) | Abigail (153) |

| 7 | Evelyn (114) | Ava (115) | Isla (135) | Isla (133) | Emily (150) | Harper (150) |

| 8 | Chloe (101)

Violet (101) |

Isla (101) | Abigail (120)

Chloe (120) |

Emily (127) | Abigail (141) | Sophia (146) |

| 9 | Ava (99) Emily (99) |

Lily (100) | Evelyn (119) | Lily (123) | Hannah (137) | Amelia (145) |

| 10 | Hannah (98)

Hazel (98) |

Chloe (92) | Aria (112) | Abigail (114) | Elizabeth (124) | Elizabeth (130) |

Related information

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

-

Freedom Convoy2 days ago

Freedom Convoy2 days agoOttawa spent “excessive” $2.2 million fighting Emergencies Act challenge

-

Brownstone Institute2 days ago

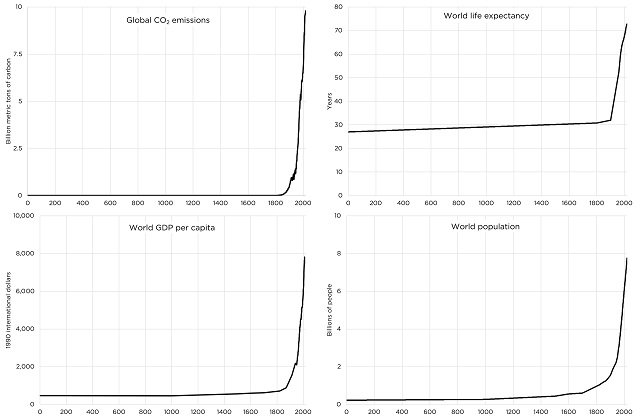

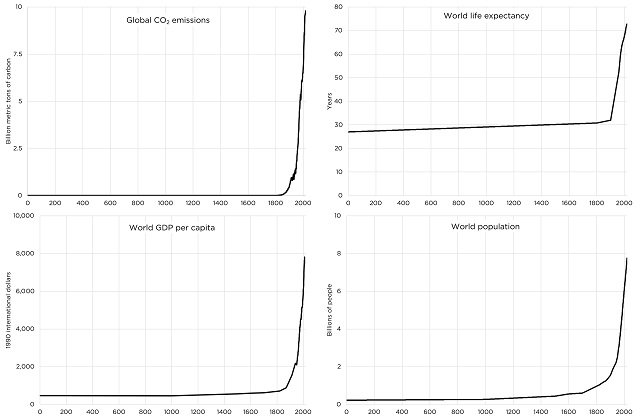

Brownstone Institute2 days agoA Coup Without Firing a Shot

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCoyotes Ugly: The Sad Obsession Of Gary Bettman

-

COVID-192 days ago

COVID-192 days agoWHO Official Admits the Truth About Passports

-

Energy2 days ago

Energy2 days agoAnti-LNG activists have decided that they now actually care for LNG investors after years of calling to divest

-

2024 City Councilor By-Election2 days ago

2024 City Councilor By-Election2 days agoRed Deer City Council by-election: Polls open today until 8 PM

-

International2 days ago

International2 days agoUN attacks stay-at-home motherhood as ‘gender inequality’

-

Energy2 days ago

Energy2 days agoReflections on Earth Day