Canadian Energy Centre

Mexico leapfrogging Canada on LNG and six other global oil and gas megaprojects

By Deborah Jaremko of the Canadian Energy Centre Ltd.

Major investments in countries like the United States, Norway, Qatar and Saudi Arabia are being made to meet world demand

New major oil and gas megaprojects around the world are proceeding amid concern about underinvestment in conventional energy leading to painful supply shortages.

“The energy future must be secure and affordable, as well as sustainable,” said Daniel Yergin, vice-chairman of S&P Global, earlier this year.

“Adequate investment that avoids shortages and price spikes, and the economic hardship and social turbulence that they bring, is essential to that future.”

Even if oil and gas demand growth slows, a cumulative $4.9 trillion will be needed between 2023 and 2030 to prevent a supply shortfall, according to a report by the International Energy Forum and S&P Global Commodity Insights.

Major investments in countries like the United States, Norway, Qatar, Saudi Arabia and Mexico are being made to meet world demand.

Meanwhile, due to regulatory uncertainty and concerns over proposed policies like an emissions cap for oil and gas production, Canada’s vast resources – produced with among the world’s highest standards for environmental protection and social progress – are being left behind.

Here’s a look at just a handful of global oil and gas megaprojects, listed in rising order of development cost.

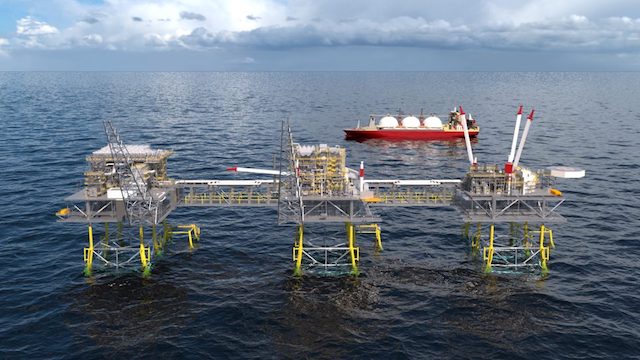

Mexico: Altamira LNG

US$1 billion

New Fortress Energy

Mexico is leapfrogging over Canada to become an LNG exporter.

While Canada’s first LNG export project is expected to start operating in 2025, Mexico’s could come online this August – less than 10 months after Mexico’s government finalized a deal with U.S.-based New Fortress Energy to make it happen.

While relatively small at 1.4 million tonnes of LNG per year (LNG Canada’s first phase will have capacity of 14 million tonnes per year), under Mexico’s agreement the Altamira site is to become an LNG hub.

New Fortress Energy is to deploy multiple same-sized floating LNG units to produce LNG from natural gas transported through TC Energy’s Sur de Texas-Tuxpan pipeline.

An existing LNG import terminal at Altamira is also expected to be converted into a 2.8-million-tonne-per-year export facility.

United States: Willow Oil Project

US$8 billion

ConocoPhillips

The U.S. government granted approval this March for the giant Willow oil project on Alaska’s North Slope to proceed.

The project, owned by ConocoPhillips, is designed to produce 180,000 barrels per day at peak and operate for 30 years. It includes a processing facility, operations centre, and three drilling sites.

The Willow leases are inside the National Petroleum Reserve – Alaska, which was established in 1923 as an emergency oil supply for the U.S. Navy. It is now administered by the U.S. Bureau of Land Management.

Willow would occupy about 385 acres (around half the area of Central Park in New York City) in the northeast portion of the 23-million-acre reserve. It is expected to deliver nearly US$9 billion in government revenue, creating about 2,500 jobs during construction and 300 long-term positions.

ConocoPhillips has yet to make a final investment decision, but is anticipating starting production in 2029, according to the Anchorage Daily News.

United States: Golden Pass LNG

US$10 billion

QatarEnergy, Exxon Mobil

Golden Pass LNG is one of four natural gas export terminals under construction on the U.S. Gulf Coast as the United States continues to build its platform as an LNG powerhouse.

With about 90 million tonnes per year of LNG export capacity today, analysts with Wood Mackenzie expect that if current momentum continues, another 190 million tonnes per year could come online by the end of this decade.

The US$10-billion Golden Pass project owned by QatarEnergy and Exxon Mobil will have three production trains with total export capacity of about 18 million tonnes of LNG per year.

The U.S. began exporting LNG in 2016 and has since built more LNG capacity than anywhere else in the world, according to the U.S. Energy Information Administration.

First LNG exports from Golden Pass are planned for 2024.

Norway: Njord Field Restart

US$29 billion

Wintershall Dea, Equinor, Neptune Energy

Norway has officially reopened a major offshore oil and gas field, with the goal to extend its life beyond 2040 and double its total production.

Nearly US$30 billion in upgrades to the Njord project’s production platform and offloading vessel started in 2016, after nearly 20 years of operations. It was originally only expected to run until 2013, but improvements in recovery technology have opened the door to accessing substantially more resources.

Production restarted in December 2022, just in time to help address Europe’s energy crisis.

“With the war in Ukraine, the export of Norwegian oil and gas to Europe has never been more important than now. Reopening Njord contributes to Norway remaining a stable supplier of gas to Europe for many years to come,” Norway’s oil and energy minister Terje Aasland said in a statement.

The project will drill 10 new wells and tie in two new subsea oil and gas fields, with the work expected to add approximately 250 million barrels of oil equivalent to the European market. Partial electrification of equipment is expected to reduce greenhouse gas emissions.

Qatar: North Field East LNG expansion

Qatar Energy, Shell, TotalEnergies, Eni, Exxon Mobil, ConocoPhillips, Sinopec

US$29 billion

The largest LNG project ever built is underway in Qatar.

State-owned QatarEnergy’s US$29 billion North Field East Expansion will increase the country’s LNG export capacity to 110 million tonnes per year, from 77 million tonnes per year today. Startup is planned in 2025.

A planned second phase of the project will further increase capacity to 126 million tonnes per year.

World LNG demand reached a record 409 million tonnes in 2022, according to data provider Revintiv. It’s expected to rise to over 700 million tonnes by 2040, according to Shell’s most recent industry outlook.

Saudi Arabia: Jafurah Gas Project

US$110 billion

Saudi Aramco

State-owned Saudi Aramco is moving ahead with development of the massive Jafurah gas project, which it says will help meet growing energy demand and provide feedstock for hydrogen production.

First gas from the $110-billion project is expected in 2025, rising to reach two billion cubic feet per day by 2030. That’s about one-third the volume of all the natural gas produced in British Columbia. Saudi Aramco produced 10.6 billion cubic feet of natural gas per day in 2022, or more than half the gas produced in Canada.

Last year the company started construction work on the gas processing facility that is the anchor of the Jafurah project. Aramco is reportedly in talkswith potential partners to back the US$110 billion development.

Russia: Vostok Oil

US$170 billion

Rosneft

Russian state-owned oil company Rosneft continues to barrel ahead with the massive Vostok oil project in the country’s arctic, which Rosneft calls the largest investment in the world.

The US$170 billion project will use the Northern Sea Route to export about 600,000 barrels per day by 2024. Production is expected to increase to two million barrels per day after the second phase. For comparison, Canada’s entire oil sands industry produces about three million barrels per day.

The main problem the energy industry faces is global underinvestment in conventional sources, Rosneft CEO Igor Sechin said earlier this year. He stressed the importance of Vostok’s oil supply for growing Asian economies.

“Vostok Oil project will provide long-term, reliable, and guaranteed energy supplies,” Sechin said.

Two new icebreaker vessels recently helped deliver 4,600 tonnes of cargo including oil pipes for the project to the arctic development sites, the Barents Observer reported.

Alberta

Canada’s advantage as the world’s demand for plastic continues to grow

From the Canadian Energy Centre

By Will Gibson

‘The demand for plastics reflects how essential they are in our lives’

From the clothes on your back to the containers for household products to the pipes and insulation in your home, plastics are interwoven into the fabric of day-to-day life for most Canadians.

And that reliance is projected to grow both in Canada and around the world in the next three decades

The Global Plastics Outlook, published by the Paris-based Organization for Economic Co-operation and Development (OECD), forecasts the use of plastics globally will nearly triple by 2060, driven by economic and population growth.

The use of plastics is projected to double in OECD countries like Canada, the United States and European nations, but the largest increases will take place in Asia and Africa.

“The demand for plastics reflects how essential they are in our lives, whether it is packaging, textiles, building materials or medical equipment,” says Christa Seaman, vice-president, plastics with the Chemical Industry Association of Canada (CIAC), which represents Canada’s plastics producers.

She says as countries look to meet climate and sustainability goals, demand for plastic will grow.

“Plastics in the market today demonstrate their value to our society. Plastics are used to make critical components for solar panels and wind turbines. But they also can play a role in reducing weight in transportation or in ensuring goods that are transported have less weight in their packaging or in their products.”

Canada produces about $35 billion worth of plastic resin and plastic products per year, or over five per cent of Canadian manufacturing sales, according to a 2019 report published by the federal government.

Seaman says Canadian plastic producers have competitive advantages that position them to grow as demand rises at home and abroad. In Alberta, a key opportunity is the abundant supply of natural gas used to make plastic resin.

“As industry and consumer expectations shift for production to reduce emissions, Canada, and particularly Alberta, are extremely well placed to meet increased demand thanks to its supply of low-carbon feedstock. Going forward, production with less emissions is going to be important for companies,” Seaman says.

“You can see that with Dow Chemical’s decision to spend $8.8 billion on a net zero facility in Alberta.”

While modern life would not be possible without plastics, the CIAC says there needs to be better post-use management of plastic products including advanced recycling, or a so-called “circular economy” where plastics are seen as a resource or feedstock for new products, not a waste.

Some companies have already started making significant investments to generate recyclable plastics.

For example, Inter Pipeline Ltd.’s $4.3 billion Heartland Petrochemical Complex near Edmonton started operating in 2023. It produces a recyclable plastic called polypropylene from propane, with 65 per cent lower emissions than the global average thanks to the facility’s integrated design.

Achieving a circular economy – where 90 per cent of post-consumer plastic waste is diverted or recycled – would benefit Canada’s economy, according to the CIAC.

A Deloitte study, commissioned by Environment & Climate Change Canada, estimated diverting or reusing 90 per cent of post-consumer plastic waste by 2030 will save $500 million annually while creating 42,000 direct and indirect jobs. It would also cut Canada’s annual CO2 emissions by 1.8 megatonnes.

Right now, about 85 per cent of plastics end up in Canada’s landfills. To reach the 90 per cent diversion rate, Seaman says Canada must improve its infrastructure to collect and process the plastic waste currently being landfilled.

But she also says the industry rather than municipalities need to take responsibility for recycling plastic waste.

“This concept is referred to as extended producer responsibility. Municipalities have the responsibility for managing recycling within a waste management system. Given the competing costs and priorities, they don’t have the incentive to invest into recycling infrastructure when landfill space was the most cost-effective solution for them,” she says.

“Putting that responsibility on the producers who put the products on the market makes the most sense…The industry is adapting, and we hope government policy will recognize this opportunity for Canada to meet our climate goals while growing our economy.”

Business

Decarbonization deal opens new chapter in Alberta-Japan relationship

From the Canadian Energy Centre

By Will Gibson

Agreement represents a homecoming for JAPEX, which first started work in the Alberta oil sands in 1978

A new agreement that will see Japan Petroleum Exploration Company (JAPEX) invest in decarbonization opportunities in Alberta made history while also being rooted in the past, in the eyes of Gary Mar.

JAPEX is seeking to develop projects in carbon capture and storage (CCS), hydrogen and bioenergy. It’s part of the company’s JAPEX2050 strategy toward carbon neutrality.

“This new endeavour is a great opportunity that demonstrates the world is changing but the relationships endure,” says Mar, the province’s former trade envoy to Asia and the current CEO of the Canada West Foundation.

“Alberta’s very first international office was opened in Tokyo in 1981. And we have built a tremendous soft infrastructure that includes partnerships between a dozen Alberta and Japanese universities.”

For JAPEX, the agreement represents something of a homecoming for the company that first started work in the Alberta oil sands in 1978 and operated one of the first in situ (or drilled) oil projects for nearly two decades before selling its stake in 2018.

“We are now aiming to come back to Alberta and contribute to its decarbonization,” JAPEX president of overseas business Tomomi Yamada said in a statement.

Mar says the memorandum of understanding signed this March between JAPEX and the crown corporation Invest Alberta stems from a strong relationship built over decades.

“You can’t be considered a reliable partner for a new venture if you haven’t been a reliable partner for decades in the past,” says Mar.

“Economies change and world’s needs change but strong relationships are important factor in whom you do business with.”

Alberta’s established CCS infrastructure has already attracted new investment, including Air Products’ $1.6-billion net zero hydrogen complex and Dow Chemicals’ $8.8-billion net zero petrochemical complex.

Mar sees JAPEX’s deal with Invest Alberta opening a whole new market of potential carbon neutral investors in the Pacific Rim.

“When other countries who are partners in the Trans-Pacific Partnership (TPP) see JAPEX invest in this decarbonization opportunities and net zero projects in Alberta, it will send a very clear signal to others in the TPP about the potential,” Mar says.

“This deal may come from the decades-long relationship between Alberta and Japan but can also serve as a signpost for decades to come.”

-

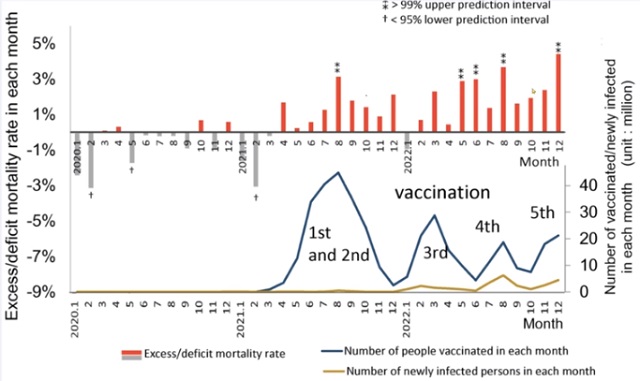

COVID-1917 hours ago

COVID-1917 hours agoCDC Quietly Admits to Covid Policy Failures

-

Brownstone Institute7 hours ago

Brownstone Institute7 hours agoDeborah Birx Gets Her Close-Up

-

COVID-1920 hours ago

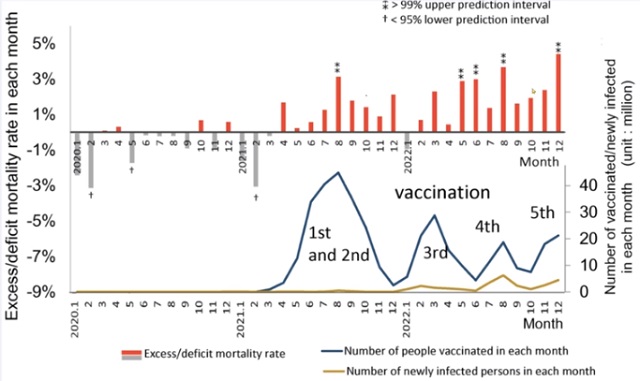

COVID-1920 hours agoJapanese study shows disturbing increase in cancer related deaths during the Covid pandemic

-

Great Reset15 hours ago

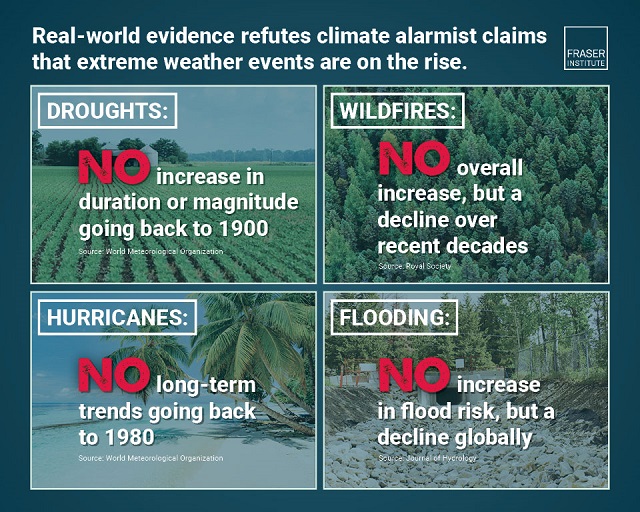

Great Reset15 hours agoClimate expert warns against extreme ‘weather porn’ from alarmists pushing ‘draconian’ policies

-

Economy2 days ago

Economy2 days agoExtreme Weather and Climate Change

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWhy Are Canadian Mayors So Far Left And Out Of Touch?

-

International2 days ago

International2 days agoTelegram founder tells Tucker Carlson that US intel agents tried to spy on user messages

-

Business2 days ago

Business2 days agoNew capital gains hike won’t work as claimed but will harm the economy