Economy

Key energy agencies diverge as demand and oil prices climb

DUBAI, United Arab Emirates (AP) — Leaders of the world’s most consequential energy bodies gathered for a forum Wednesday to discuss the uncertain future of oil as demand rebounds and prices climb, all while a growing roster of nations pledge to transition to cleaner forms of energy.

The forum, which included speakers from the Organization of Petroleum Exporting Countries, the International Energy Agency and the International Energy Forum, presented varying forecasts for oil demand and discussed energy security and market stability.

Yet from the outset, the wider debate on how the world should best transition away from so-called dirty fuels and other sources of carbon emissions that pollute the air played out as speakers gave their remarks.

Major oil-producing nations, like Saudi Arabia and the United Arab Emirates, have long argued that a rapid energy transition away from the fossil fuels that they continue to rely on for revenue will impact global economic growth and hurt the world’s poorest. Those backing a fast-tracked transition insist new investments in energy must go toward expanding existing wind and solar solutions and in funding innovative solutions if the world is to avoid catastrophic global warming levels. On both sides, however, there is agreement that the world is far from reaching sustainable targets as demand for energy grows.

“We are not on track. So how should policy makers respond to this dilemma? The reality is that 80% of the world’s energy needs continue to be met by fossil fuels,” said Joseph McMonigle, secretary general of the Saudi-based International Energy Forum that hosted the symposium. The IEF is the largest organization of energy ministers, with 71 member states, including the United States.

McMonigle said global energy demand has “roared back” to pre-pandemic levels, but that investments in oil and gas are not back to where they were before the COVID-19 crisis.

“Disinvestment in energy supply will not deliver a just and orderly transition and cannot be a response to the climate crisis,” he said, arguing that countries should invest in both greener forms of energy as well as fossil fuels.

The IEF has called for oil and gas investment to reach $525 billion through 2030 to ensure “market balance” despite a slowdown projected in how much demand for oil will grow. The group notes that investment in the oil and gas sector in 2021 stood at $341 billion. Without more financing, the IEF says demand could outstrip future supply within the next five to six years. They say it could also result in switching to more polluting energy sources such as wood and coal.

Others disagree. The International Energy Agency’s executive director has said the world does not need more investments in new oil, gas and coal projects.

From Paris, the IEA’s Fatih Birol did not directly address the comments made by McMonigle, but he echoed the sentiment that the energy transition must happen in an “orderly manner” so that climate targets are met and oil producing economies are seen as part of the solution.

To meet these targets, the world must reduce its consumption of fossil fuels, Birol said, before later adding: “We cannot drop oil and gas tomorrow.”

“The world will need oil and gas for several years to come. However, if we want to reach our climate targets we would need less oil and less coal and less gas than we use today in an unabated format.”

The IEA says that for the world to reach net-zero emissions by 2050, annual clean energy investment worldwide will need to more than triple by 2030 to around $4 trillion. It has also called out the energy sector as the source of around 75% of greenhouse gas emissions, a main driver in climate change.

The IEA estimates that world oil demand is set to expand by 3.2 million barrels per day this year, reaching 100.6 million barrels per day as restrictions to contain the spread of the coronavirus ease. Benchmark crude prices rose by more than 15% in January to cross the $90 per barrel threshold for the first time in more than seven years.

The rebound in demand for oil, combined with a shortfall in energy investments, rising prices and market uncertainty has led to varying energy outlook scenarios. The diverging outlooks by OPEC, the IEF, IEA and others have an impact on how governments choose to formulate their energy policies and decide on production levels as they commit to net-zero pledges.

___

Follow Aya Batrawy on Twitter at www.twitter.com/ayaelb

___

Follow AP’s climate coverage at http://apnews.com/hub/climate

Aya Batrawy, The Associated Press

Business

Maxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

From LifeSiteNews

If ‘the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.’

People’s Party of Canada leader Maxime Bernier has warned that the Liberal government’s push for World Economic Forum (WEF) “Global Tax” scheme should concern Canadians.

According to Canada’s 2024 Budget, Prime Minister Justin Trudeau is working to pass the WEF’s Global Minimum Tax Act which will mandate that multinational companies pay a minimum tax rate of 15 percent.

“Canadians should be very concerned, for several reasons,” People’s Party leader Maxime Bernier told LifeSiteNews, in response to the proposal.

“First, the WEF is a globalist institution that actively campaigns for the establishment of a world government and for the adoption of socialist, authoritarian, and reactionary anti-growth policies across the world,” he explained. “Any proposal they make is very likely not in the interest of Canadians.”

“Second, this minimum tax on multinationals is a way to insidiously build support for a global harmonized tax regime that will lower tax competition between countries, and therefore ensure that taxes can stay higher everywhere,” he continued.

“Canada reaffirms its commitment to Pillar One and will continue to work diligently to finalize a multilateral treaty and bring the new system into effect as soon as a critical mass of countries is willing,” the budget stated.

“However, in view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot continue to wait before taking action,” it continued.

The Trudeau government also announced it would be implementing “Pillar Two,” which aims to establish a global minimum corporate tax rate.

“Pillar Two of the plan is a global minimum tax regime to ensure that large multinational corporations are subject to a minimum effective tax rate of 15 per cent on their profits wherever they do business,” the Liberals explained.

“The federal government is moving ahead with legislation to implement the regime in Canada, following consultations last summer on draft legislative proposals for the new Global Minimum Tax Act,” it continued.

According to the budget, Trudeau promised to introduce the new legislation in Parliament soon.

The global tax was first proposed by Secretary-General of Amnesty International at the WEF meeting in Davos this January.

“Let’s start taxing carbon…[but] not just carbon tax,” the head of Amnesty International, Agnes Callamard, said during a panel discussion.

According to the WEF, the tax, proposed by the Organization for Economic Co-operation and Development (OECD), “imposes a minimum effective rate of 15% on corporate profits.”

Following the meeting, 140 countries, including Canada, pledged to impose the tax.

While a tax on large corporations does not necessarily sound unethical, implementing a global tax appears to be just the first step in the WEF’s globalization plan by undermining the sovereignty of nations.

While Bernier explained that multinationals should pay taxes, he argued it is the role of each country to determine what those taxes are.

“The logic of pressuring countries with low taxes to raise them is that it lessens fiscal competition and makes it then less costly and easier for countries with higher taxes to keep them high,” he said.

Bernier pointed out that competition is good since it “forces everyone to get better and more efficient.”

“In the end, we all end up paying for taxes, even those paid by multinationals, as it causes them to raise prices and transfer the cost of taxes to consumers,” he warned.

Bernier further explained that the new tax could be a first step “toward the implementation of global taxes by the United Nations or some of its agencies, with the cooperation of globalist governments like Trudeau’s willing to cede our sovereignty to these international organizations.”

“Just like ‘temporary taxes’ (like the income tax adopted during WWI) tend to become permanent, ‘minimum taxes’ tend to be raised,” he warned. “And if the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.”

Trudeau’s involvement in the WEF’s plan should not be surprising considering his current environmental goals – which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development – which include the phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum – the aforementioned group famous for its socialist “Great Reset” agenda – in which Trudeau and some of his cabinet are involved.

Business

Canada’s economy has stagnated despite Ottawa’s spin

From the Fraser Institute

By Ben Eisen, Milagros Palacios and Lawrence Schembri

Canada’s inflation-adjusted per-person annual economic growth rate (0.7 per cent) is meaningfully worse than the G7 average (1.0 per cent) over this same period. The gap with the U.S. (1.2 per cent) is even larger. Only Italy performed worse than Canada.

Growth in gross domestic product (GDP), the total value of all goods and services produced in the economy annually, is one of the most frequently cited indicators of Canada’s economic performance. Journalists, politicians and analysts often compare various measures of Canada’s total GDP growth to other countries, or to Canada’s past performance, to assess the health of the economy and living standards. However, this statistic is misleading as a measure of living standards when population growth rates vary greatly across countries or over time.

Federal Finance Minister Chrystia Freeland, for example, recently boasted that Canada had experienced the “strongest economic growth in the G7” in 2022. Although the Trudeau government often uses international comparisons on aggregate GDP growth as evidence of economic success, it’s not the first to do so. In 2015, then-prime minister Stephen Harper said Canada’s GDP growth was “head and shoulders above all our G7 partners over the long term.”

Unfortunately, such statements do more to obscure public understanding of Canada’s economic performance than enlighten it. In reality, aggregate GDP growth statistics are not driven by productivity improvements and do not reflect rising living standards. Instead, they’re primarily the result of differences in population and labour force growth. In other words, they aren’t primarily the result of Canadians becoming better at producing goods and services (i.e. productivity) and thus generating more income for their families. Instead, they primarily reflect the fact that there are simply more people working, which increases the total amount of goods and services produced but doesn’t necessarily translate into increased living standards.

Let’s look at the numbers. Canada’s annual average GDP growth (with no adjustment for population) from 2000 to 2023 was the second-highest in the G7 at 1.8 per cent, just behind the United States at 1.9 per cent. That sounds good, until you make a simple adjustment for population changes by comparing GDP per person. Then a completely different story emerges.

Canada’s inflation-adjusted per-person annual economic growth rate (0.7 per cent) is meaningfully worse than the G7 average (1.0 per cent) over this same period. The gap with the U.S. (1.2 per cent) is even larger. Only Italy performed worse than Canada.

Why the inversion of results from good to bad? Because Canada has had by far the fastest population growth rate in the G7, growing at an annualized rate of 1.1 per cent—more than twice the annual population growth rate of the G7 as a whole at 0.5 per cent. In aggregate, Canada’s population increased by 29.8 per cent during this time period compared to just 11.5 per cent in the entire G7.

Clearly, aggregate GDP growth is a poor tool for international comparisons. It’s also not a good way to assess changes in Canada’s performance over time because Canada’s rate of population growth has not been constant. Starting in 2016, sharply higher rates of immigration have led to a pronounced increase in population growth. This increase has effectively partially obscured historically weak economic growth per person over the same period.

Specifically, from 2015 to 2023, under the Trudeau government, inflation-adjusted per-person economic growth averaged just 0.3 per cent. For historical perspective, per-person economic growth was 0.8 per cent annually under Brian Mulroney, 2.4 per cent under Jean Chrétien and 2.0 per cent under Paul Martin.

Due to Canada’s sharp increase in population growth in recent years, aggregate GDP growth is a misleading indicator for comparing economic growth performance across countries or time periods. Canada is not leading the G7, or doing well in historical terms, when it comes to economic growth measures that make simple adjustments for our rapidly growing population. In reality, we’ve become a growth laggard and our living standards have largely stagnated for the better part of a decade.

Authors:

-

Brownstone Institute23 hours ago

Brownstone Institute23 hours agoDeborah Birx Gets Her Close-Up

-

Economy2 days ago

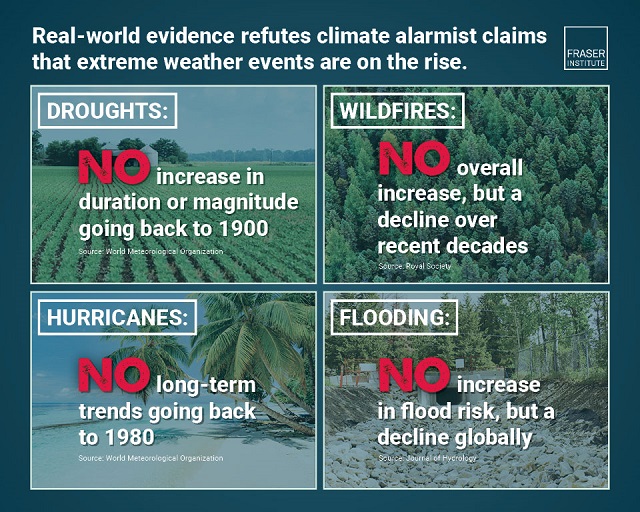

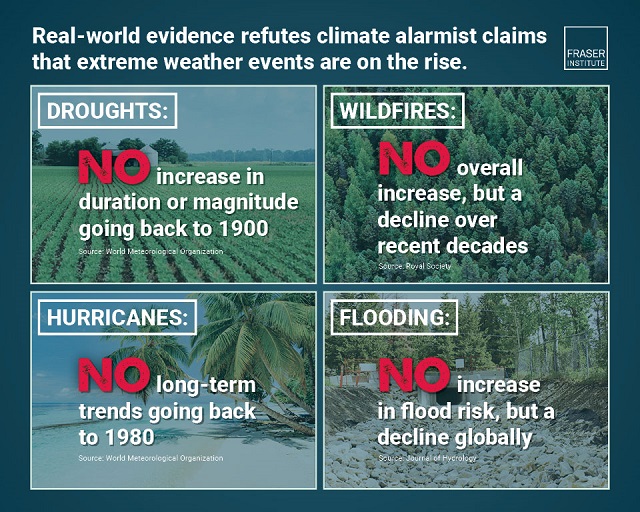

Economy2 days agoExtreme Weather and Climate Change

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWhy Are Canadian Mayors So Far Left And Out Of Touch?

-

International2 days ago

International2 days agoTelegram founder tells Tucker Carlson that US intel agents tried to spy on user messages

-

Alberta22 hours ago

Alberta22 hours agoCoutts Three verdict: A warning to protestors who act as liaison with police

-

Business2 days ago

Business2 days agoTrudeau gov’t pledges $42 million to the CBC to promote ‘independent journalism’

-

Justice2 days ago

Justice2 days agoOntario Court of Justice says participants must state their ‘preferred pronouns’ during introduction

-

Business2 days ago

Business2 days agoCanada’s economy has stagnated despite Ottawa’s spin