Business

Todayville At The Home Show With Canadian Closet

Fraser Institute

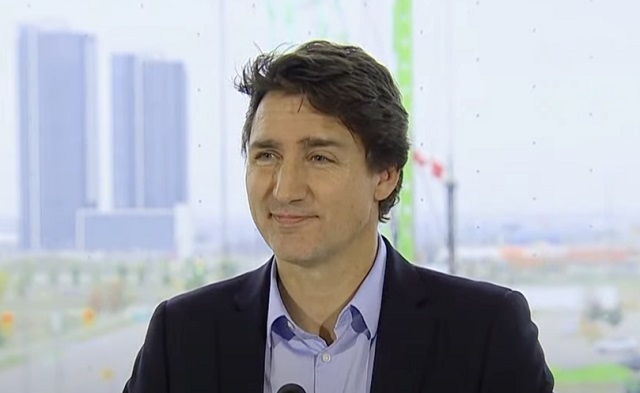

Powerful players count on corruption of ideal carbon tax

From the Fraser Institute

Prime Minister Trudeau recently whipped out the big guns of rhetoric and said the premiers of Alberta, Nova Scotia, New Brunswick, Newfoundland and Labrador, Ontario, Prince Edward Island and Saskatchewan are “misleading” Canadians and “not telling the truth” about the carbon tax. Also recently, a group of economists circulated a one-sided open letter extolling the virtues of carbon pricing.

Not to be left out, a few of us at the Fraser Institute recently debated whether the carbon tax should or could be reformed. Ross McKitrick and Elmira Aliakbari argued that while the existing carbon tax regime is badly marred by numerous greenhouse gas (GHG) regulations and mandates, is incompletely revenue-neutral, lacks uniformity across the economy and society, is set at an arbitrary price and so on, it remains repairable. “Of all the options,” they write, “it is widely acknowledged that a carbon tax allows the most flexibility and cost-effectiveness in the pursuit of society’s climate goals. The federal government has an opportunity to fix the shortcomings of its carbon tax plan and mitigate some of its associated economic costs.”

I argued, by contrast, that due to various incentives, Canada’s relevant decision-makers (politicians, regulators and big business) would all resist any reforms to the carbon tax that might bring it into the “ideal form” taught in schools of economics. To these groups, corruption of the “ideal carbon tax” is not a bug, it’s a feature.

Thus, governments face the constant allure of diverting tax revenues to favour one constituency over another. In the case of the carbon tax, Quebec is the big winner here. Atlantic Canada was also recently won by having its home heating oil exempted from carbon pricing (while out in the frosty plains, those using natural gas heating will feel the tax’s pinch).

Regulators, well, they live or die by the maintenance and growth of regulation. And when it comes to climate change, as McKitrick recently observed in a separate commentary, we’re not talking about only a few regulations. Canada has “clean fuel regulations, the oil-and-gas-sector emissions cap, the electricity sector coal phase-out, strict energy efficiency rules for new and existing buildings, new performance mandates for natural gas-fired generation plants, the regulatory blockade against liquified natural gas export facilities” and many more. All of these, he noted, are “boulders” blocking the implementation of an ideal carbon tax.

Finally, big business (such as Stellantis-LG, Volkswagen, Ford, Northvolt and others), which have been the recipients of subsidies for GHG-reducing activities, don’t want to see the driver of those subsidies (GHG regulations) repealed. And that’s only in the electric vehicle space. Governments also heavily subsidize wind and solar power businesses who get a 30 per cent investment tax credit though 2034. They also don’t want to see the underlying regulatory structures that justify the tax credit go away.

Clearly, all governments that tax GHG emissions divert some or all of the revenues raised into their general budgets, and none have removed regulations (or even reduced the rate of regulation) after implementing carbon-pricing. Yet many economists cling to the idea that carbon taxes are either fine as they are or can be reformed with modest tweaks. This is the great carbon-pricing will o’ the wisp, leading Canadian climate policy into a perilous swamp.

Author:

Business

Trudeau gov’t pledges $42 million to the CBC to promote ‘independent journalism’

From LifeSiteNews

The budget did not explain how the CBC could provide “independent journalism” if the Trudeau government is paying its bills.

Canadian taxpayers will pay $42 million in additional funding for the Canadian Broadcasting Corporation (CBC) under the Trudeau government’s newly proposed budget.

According to the Liberal’s 2024 budget, published April 16, the CBC is set to receive $42 million in increased funding for 2024-25, as the outlet continues to lose credibility with Canadians.

The increased subsides aim to ensure “Canadians across the country, including rural, remote, Indigenous, and minority language communities, have access to high-quality, independent journalism and entertainment.”

The budget did not explain how the CBC could provide “independent journalism” if the Trudeau government is paying its bills.

The $42 million to the CBC is in addition to massive media payouts which already make up roughly 70 percent of its operating budget, and total more than $1 billion annually.

The payout is also in addition to another Trudeau government announcement that saw legacy media subsidies continue for the next five years to the tune of $129 million .

That subsidies are the CBC’s largest single source of income has become a point of contention among taxpayers who see the propping up of the outlet as unnecessary.

In addition to the increased payouts for the CBC, the budget promised $58.8 million to the Department of Canadian Heritage for the Local Journalism Initiative over three years beginning in 2024-25.

Indeed, recently stories published by the CBC seems to reveal the corporation’s bias to the Trudeau government and its agenda.

Earlier this week, Dr. Jordan Peterson slammed the CBC for only interviewing pro-LGBT doctors to discuss a U.K. report on the dangers of “sex changes” for children.

While the CBC claimed “Canadian doctors who spoke to CBC disagree” with the report, Peterson accused the CBC of purposefully only speaking to doctors who opposed the research.

Similarly, in January, the CBC produced a video seemingly justifying the intentional burning of numerous churches across Canada.

While taxpayer funding of legacy media continues to increase, credibility seems to be on the decline. According to a study by Canada’s Public Health Agency, less than a third of Canadians displayed “high trust” in the federal government, with “large media organizations” as well as celebrities getting even lower scores.

-

COVID-192 days ago

COVID-192 days agoPro-freedom Canadian nurse gets two years probation for protesting COVID restrictions

-

espionage2 days ago

espionage2 days agoTrudeau’s office was warned that Chinese agents posed ‘existential threat’ to Canada: secret memo

-

Economy2 days ago

Economy2 days agoMassive deficits send debt interest charges soaring

-

Business1 day ago

Business1 day agoBusiness investment key to addressing Canada’s productivity crisis

-

International1 day ago

International1 day agoBrussels NatCon conference will continue freely after court overturns police barricade

-

Jordan Peterson1 day ago

Jordan Peterson1 day agoJordan Peterson slams CBC for only interviewing pro-LGBT doctors about UK report on child ‘sex changes’

-

Business1 day ago

Business1 day agoFederal budget fails to ‘break the glass’ on Canada’s economic growth crisis

-

Economy2 days ago

Economy2 days agoFederal budget: You can’t solve a productivity emergency with tax hikes