Business

Short films are becoming popular amongst ambitious realtors looking for a competitive edge to stand out in the city’s housing market.

Forget the gimmicks, fridge magnets, or free home evaluations, short films are becoming popular amongst ambitious realtors looking for a competitive edge to stand out in the city’s housing market.

A successful woman driving a Telsa pulls up and parks in the two car garage, she struts confidently through her back yard. She’s obsessed with a song by a trendy Soundcloud famous DJ, Mallrat https://www.facebook.com/lilmallrat/, from which she switches from her Model 3 electric car, to iPhone, then to her house Sonos system, seamlessly, to which she starts to dance. We’re given a cinematic tour of the smart home, from room to room has the dancer, performed by professional dancer, and successful Edmonton business woman, Larissa Kovelanko, as she rhythmically moves her body throughout the entire home. The home located at 8617 108A Street, Edmonton, Alberta, Canada.

While the beautifully shot film could be advertising any number of things – electric cars, dance classes, new religion for adults seeking meaning – it’s actually an ad for a home. The home, a brand new custom infill home built by Vrabel Homes in the core of Edmonton, near 109st, and Saskchawean drive, blocks south of Whyte Avenue. Edmonton’s bustling market place is prime location for people to shop, or hang out with friends at the local coffee shops within a short radius.

The film is the brainchild of realtor Nikita Gylander with Core Real Estate Group (corerealestategroup.ca), who sold Edmonton cinematographer Raoul Bhatt (https://www.facebook.com/raoulbhatt) his home which was built by the same builder. Nikita, the social and well connected Edmonton realtor who’s kept tight relationships with all her clients, approached Bhatt for a video, whom she was aware was in the movie business. The movie’s uniqueness shines throughout this 4min and 20second video, which we discover the three-storey house, visually and emotionally.

“The price point was much higher than what was common in the neighbourhood, because it’s a brand new home, an infill, and it has a unique layout, high end finishing’s and ability to generate an income with it’s basement suite, ideal for someone who wants a new home, but is investment savvy, ie the two bedroom legal basement suite could rent for $1800 a month, which would cover $350,000 of the mortgage. With university students at UofA just blocks away, and anyone that may enjoy flavourful foods and sips of chai at hip local indian fusion ‘coffee shop’ Remedy. So I knew the exposure [of the listing] needed to be greater than usual,” she explains.

With that in mind, Raoul suggested a short video that would appeal to her perceived prospective buyer… Nikita, an outside the box thinker, thought it would appeal to a young family looking for a quiet property in an attractive neighbourhood, or a professional that wants to be in the mix of it all. And it worked. The video has been viewed thousands of times, and the house with increasing inquiries for viewing, which was listed just last week, for the asking price at $1.1 million.

In Edmonton, real estate videos – from fanciful creations like straightforward virtual tours – are becoming more popular among realtors looking for a competitive edge in a saturated market.

According to the Edmonton Real Estate Board, there are some 3000 real estate agents working in the Edmonton and surrounding area. Forget fridge magnets. Some realtors are now doing anything to attract new clients, from throwing “wine and cheese night” open houses to branding ice cream bicycles that pedal around local fairs, this just shows how far agents are willing to go for their clients, in this case the builder of this infill.

Raoul Bhatt, After 22 years of running a software company, who initially got into film to create cinematic stories of his softwares, which have been used by NHL, Superbowl, WWE Wrestlemania, Fall Out Boy. Which also produced a short web series for Booster Juice in 2017. Has been increasingly been approached to produce docs and tv shows by national Canadian brands. Bhatt, still a CEO of his software company, has ventured into the movie business, being featured by Jetset Parking which got 1/2 million views (https://www.youtube.com/watch?v=7AtsFUKho98), and Swimco.com (https://www.swimco.com/2018/06/meet-our-swimsuitmodel-raoul-bhatt/). Early into his new career, Raoul has realized, it’s doing things differently that makes his business stand out, and storytelling through cinema compliments his other ventures.

“The typical Realestate video, they’re definitely cheesy, but the films do to job, but when you make a movie, those are never forgotten, doesn’t matter what you’re offering” says Raoul Bhatt, who advocates anything he does be like a movie.

His film isn’t just showing off the space’s amenities, they’re also meant to be aspirational. For Nikita Gylander and Vrabel Homes, he tailored this video to who he imagines is the prospective buyer, whether it’s a professor, or a young successful career woman.

“These films show what life could be like if you lived in this home,” says Bhatt. “Instead of just some beauty shots where you can turn off the video halfway through, [lifestyle films] work because people want to see the beginning, middle and the end.”

Business

Canada’s economy has stagnated despite Ottawa’s spin

From the Fraser Institute

By Ben Eisen, Milagros Palacios and Lawrence Schembri

Canada’s inflation-adjusted per-person annual economic growth rate (0.7 per cent) is meaningfully worse than the G7 average (1.0 per cent) over this same period. The gap with the U.S. (1.2 per cent) is even larger. Only Italy performed worse than Canada.

Growth in gross domestic product (GDP), the total value of all goods and services produced in the economy annually, is one of the most frequently cited indicators of Canada’s economic performance. Journalists, politicians and analysts often compare various measures of Canada’s total GDP growth to other countries, or to Canada’s past performance, to assess the health of the economy and living standards. However, this statistic is misleading as a measure of living standards when population growth rates vary greatly across countries or over time.

Federal Finance Minister Chrystia Freeland, for example, recently boasted that Canada had experienced the “strongest economic growth in the G7” in 2022. Although the Trudeau government often uses international comparisons on aggregate GDP growth as evidence of economic success, it’s not the first to do so. In 2015, then-prime minister Stephen Harper said Canada’s GDP growth was “head and shoulders above all our G7 partners over the long term.”

Unfortunately, such statements do more to obscure public understanding of Canada’s economic performance than enlighten it. In reality, aggregate GDP growth statistics are not driven by productivity improvements and do not reflect rising living standards. Instead, they’re primarily the result of differences in population and labour force growth. In other words, they aren’t primarily the result of Canadians becoming better at producing goods and services (i.e. productivity) and thus generating more income for their families. Instead, they primarily reflect the fact that there are simply more people working, which increases the total amount of goods and services produced but doesn’t necessarily translate into increased living standards.

Let’s look at the numbers. Canada’s annual average GDP growth (with no adjustment for population) from 2000 to 2023 was the second-highest in the G7 at 1.8 per cent, just behind the United States at 1.9 per cent. That sounds good, until you make a simple adjustment for population changes by comparing GDP per person. Then a completely different story emerges.

Canada’s inflation-adjusted per-person annual economic growth rate (0.7 per cent) is meaningfully worse than the G7 average (1.0 per cent) over this same period. The gap with the U.S. (1.2 per cent) is even larger. Only Italy performed worse than Canada.

Why the inversion of results from good to bad? Because Canada has had by far the fastest population growth rate in the G7, growing at an annualized rate of 1.1 per cent—more than twice the annual population growth rate of the G7 as a whole at 0.5 per cent. In aggregate, Canada’s population increased by 29.8 per cent during this time period compared to just 11.5 per cent in the entire G7.

Clearly, aggregate GDP growth is a poor tool for international comparisons. It’s also not a good way to assess changes in Canada’s performance over time because Canada’s rate of population growth has not been constant. Starting in 2016, sharply higher rates of immigration have led to a pronounced increase in population growth. This increase has effectively partially obscured historically weak economic growth per person over the same period.

Specifically, from 2015 to 2023, under the Trudeau government, inflation-adjusted per-person economic growth averaged just 0.3 per cent. For historical perspective, per-person economic growth was 0.8 per cent annually under Brian Mulroney, 2.4 per cent under Jean Chrétien and 2.0 per cent under Paul Martin.

Due to Canada’s sharp increase in population growth in recent years, aggregate GDP growth is a misleading indicator for comparing economic growth performance across countries or time periods. Canada is not leading the G7, or doing well in historical terms, when it comes to economic growth measures that make simple adjustments for our rapidly growing population. In reality, we’ve become a growth laggard and our living standards have largely stagnated for the better part of a decade.

Authors:

Fraser Institute

Powerful players count on corruption of ideal carbon tax

From the Fraser Institute

Prime Minister Trudeau recently whipped out the big guns of rhetoric and said the premiers of Alberta, Nova Scotia, New Brunswick, Newfoundland and Labrador, Ontario, Prince Edward Island and Saskatchewan are “misleading” Canadians and “not telling the truth” about the carbon tax. Also recently, a group of economists circulated a one-sided open letter extolling the virtues of carbon pricing.

Not to be left out, a few of us at the Fraser Institute recently debated whether the carbon tax should or could be reformed. Ross McKitrick and Elmira Aliakbari argued that while the existing carbon tax regime is badly marred by numerous greenhouse gas (GHG) regulations and mandates, is incompletely revenue-neutral, lacks uniformity across the economy and society, is set at an arbitrary price and so on, it remains repairable. “Of all the options,” they write, “it is widely acknowledged that a carbon tax allows the most flexibility and cost-effectiveness in the pursuit of society’s climate goals. The federal government has an opportunity to fix the shortcomings of its carbon tax plan and mitigate some of its associated economic costs.”

I argued, by contrast, that due to various incentives, Canada’s relevant decision-makers (politicians, regulators and big business) would all resist any reforms to the carbon tax that might bring it into the “ideal form” taught in schools of economics. To these groups, corruption of the “ideal carbon tax” is not a bug, it’s a feature.

Thus, governments face the constant allure of diverting tax revenues to favour one constituency over another. In the case of the carbon tax, Quebec is the big winner here. Atlantic Canada was also recently won by having its home heating oil exempted from carbon pricing (while out in the frosty plains, those using natural gas heating will feel the tax’s pinch).

Regulators, well, they live or die by the maintenance and growth of regulation. And when it comes to climate change, as McKitrick recently observed in a separate commentary, we’re not talking about only a few regulations. Canada has “clean fuel regulations, the oil-and-gas-sector emissions cap, the electricity sector coal phase-out, strict energy efficiency rules for new and existing buildings, new performance mandates for natural gas-fired generation plants, the regulatory blockade against liquified natural gas export facilities” and many more. All of these, he noted, are “boulders” blocking the implementation of an ideal carbon tax.

Finally, big business (such as Stellantis-LG, Volkswagen, Ford, Northvolt and others), which have been the recipients of subsidies for GHG-reducing activities, don’t want to see the driver of those subsidies (GHG regulations) repealed. And that’s only in the electric vehicle space. Governments also heavily subsidize wind and solar power businesses who get a 30 per cent investment tax credit though 2034. They also don’t want to see the underlying regulatory structures that justify the tax credit go away.

Clearly, all governments that tax GHG emissions divert some or all of the revenues raised into their general budgets, and none have removed regulations (or even reduced the rate of regulation) after implementing carbon-pricing. Yet many economists cling to the idea that carbon taxes are either fine as they are or can be reformed with modest tweaks. This is the great carbon-pricing will o’ the wisp, leading Canadian climate policy into a perilous swamp.

Author:

-

COVID-198 hours ago

COVID-198 hours agoCDC Quietly Admits to Covid Policy Failures

-

COVID-1911 hours ago

COVID-1911 hours agoJapanese study shows disturbing increase in cancer related deaths during the Covid pandemic

-

Great Reset6 hours ago

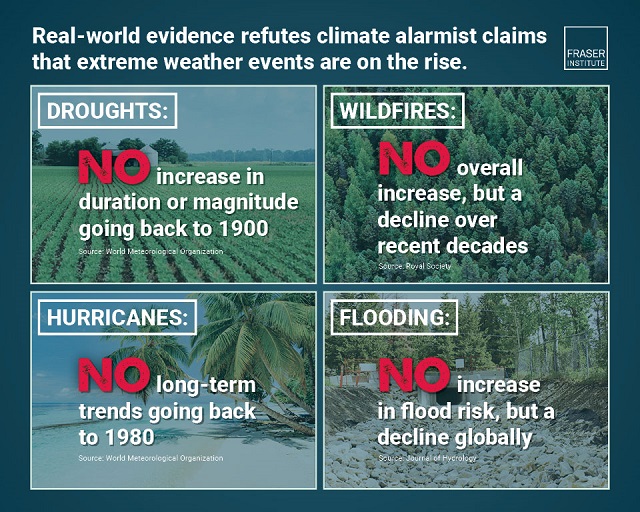

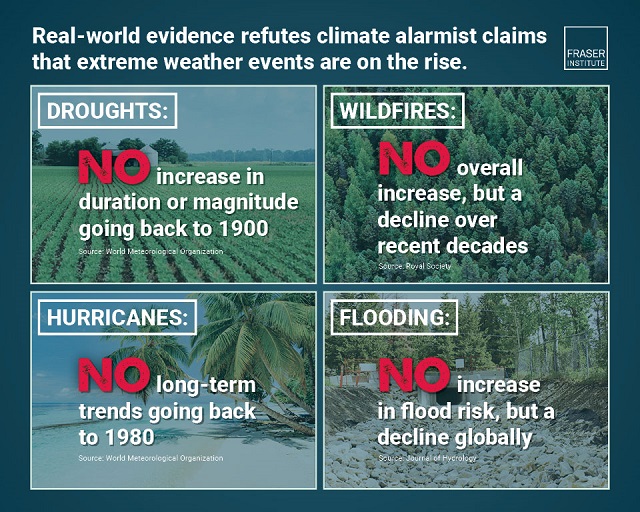

Great Reset6 hours agoClimate expert warns against extreme ‘weather porn’ from alarmists pushing ‘draconian’ policies

-

Alberta2 days ago

Alberta2 days agoDanielle Smith warns arsonists who start wildfires in Alberta that they will be held accountable

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWhy Are Canadian Mayors So Far Left And Out Of Touch?

-

National2 days ago

National2 days agoCanada’s Governor General slammed for hosting partisan event promoting Trudeau’s ‘hate speech’ bill

-

Economy1 day ago

Economy1 day agoExtreme Weather and Climate Change

-

International1 day ago

International1 day agoTelegram founder tells Tucker Carlson that US intel agents tried to spy on user messages