Alberta

Following feedback Alberta Education to release new curriculum this fall

French and science curriculums ready for classrooms

Elementary students and teachers will benefit from updated K-6 curriculums and resources in classrooms this fall.

Alberta’s government is continuing to take a balanced and measured approach to kindergarten to Grade 6 (K-6) curriculum renewal, based on advice from the Curriculum Implementation Advisory Group. All K-3 students will learn from new French First Language and Literature, French Immersion Language Arts and Literature and Science curriculums this September. School authorities will also have the option to implement new curriculum in these three subjects for grades 4 to 6 if they choose.

Alberta’s government is delivering on its commitment to provide updated curriculum with essential knowledge and skills to better prepare students for the future.

“Curriculum renewal is essential to help prepare our students for a rapidly changing labour market, which is placing an ever- increasing premium on adaptability and transferable skills. To ensure successful implementation, we are making significant investments to provide teachers with the resources they need to support students in transitioning to the new curriculum.”

In response to feedback on the original draft, changes across the three K-6 subjects have been made to address areas of concern with content load, age appropriateness and wording clarity. Subject-specific changes include:

- Strengthening French First Language and Literature content by adding spelling rules and specifying which types of texts are studied in each grade.

- Enhancing French Immersion Language Arts and Literature content to align with the principles of learning an additional language and developing students’ creative writing skills.

- Strengthening Science content to promote understanding of agricultural practices in Alberta and align with previously implemented subjects. In the new K-6 Science curriculum, students in Grade 3 will examine how layers of Earth’s surface, including the discovery and location of dinosaur fossils, hold information about the past. In Grade 6, students will examine abstractions, coding structures and the impact of computers and technology.

Alberta’s government has listened to all feedback from classroom piloting and engagement activities to make final updates to the K-6 French First Language and Literature, French Immersion Language Arts and Literature and Science curriculums. In the 2022-23 school year, 47 school boards across the province piloted the draft curriculum, including 941 teachers and 22,000 students. The updated curriculums align with top-performing jurisdictions in Canada and globally and with new curriculum previously implemented across the province. Albertans can access the final curriculum online to see what has changed.

“For this school year, we had 60 teachers from K-6 participate in the French Immersion Language Arts and Literature (FILAL) pilot. Teachers are impressed with how condensed and clearly laid out the curriculum is as well as the consideration that has been given to age-appropriate sequencing of learning outcomes. Teachers are looking forward to implementing this curriculum next school year and to receiving a list of curated Alberta Education resources to support with implementation.”

“The FCSFA appreciates the willingness to listen and the cooperation of Alberta Education. We are committed to continue this cooperation with the province to be able to offer a French First Language and Literature curriculum which meets the needs of our francophone students.”

“The CASS board of directors appreciates the ministry’s responsiveness to feedback and supports phased implementation that provides school authorities flexibility to implement new curriculum based upon local contexts.”

Supporting successful curriculum implementation

Alberta’s government is committed to ensuring the curriculum implementation process is as successful and practical as possible for elementary teachers this September. In 2023-24, approximately $47 million is being invested in teacher professional learning as well as learning and teaching resources to make sure teachers and students are equipped for the updated K-6 curriculum in classrooms.

“Professional development and timely access to resources are essential to ensure educators and the system are fully prepared to implement new curriculum. The Alberta School Boards Association looks forward to continuing to engage with our member boards, and to collaborate with the government and education partners on required supports to ensure the success of all students.”

“The Calgary Board of Education shares the government’s goal of providing a quality curriculum that prepares students for future success. Together, we are committed to ongoing effective implementation.”

As part of this investment, Alberta Education is working with the province’s four largest school authorities to develop science resources. This collaboration will ensure resources are accessible to all school authorities to support student learning and the successful implementation of new K-6 Science curriculum.

“Through our pilot process, Edmonton Catholic Schools has worked closely with Alberta Education to provide feedback to ensure quality learning experiences for all students. An updated curriculum, including Computer Science, will help students develop skills and aptitudes for the future.”

“Edmonton Public Schools is committed to creating resources and support materials that will help K-6 teachers across the province implement the new Science curriculum.”

To help teachers across the province prepare for the upcoming school year, Alberta’s government is providing a variety of supports and resources online, including:

- the final K-6 French First Language and Literature, French Immersion Language Arts and Literature and Science curriculums

- the Provincial Resource Review Guide, with guidelines for selecting learning and teaching resources aligned with the new curriculums

- bridging resources to assist with transitioning from the current curriculums to the new curriculums

- videos and support documents with an overview and orientation to the new curriculums

- tools that support teacher planning, collaborating and sharing

- information about flexible professional learning opportunities

Alberta Education will provide school authorities with additional details to facilitate planning and implementation for September. School authorities will also continue to have flexibility to select resources to support curriculum implementation in their classrooms.

Next steps for implementation, piloting and engagement

Alberta’s government is continuing to take a balanced, phased approach to K-6 curriculum renewal based on advice from the Curriculum Implementation Advisory Group.

More information on curriculum implementation, further piloting opportunities and engagement will be shared online as details become available.

Quick facts

- More than 240,000 students will be learning from the new K-3 French First Language and Literature, French Immersion Language Arts and Literature and Science curriculums during the 2023-24 school year.

- As announced in March 2022, school authorities will also implement grades 4 to 6 English Language Arts and Literature and Mathematics curriculums this fall.

- In 2023-24, approximately $47 million has been allocated for the K-6 implementation process. This includes funding for school authorities:

- $45 on a per-student basis to purchase additional curriculum resources to support implementation of new K-6 curriculum in three subject areas.

- $800 on a per-teacher basis to support professional learning.

- In addition, Alberta Education will retain funding to purchase, license and develop high-quality learning and teaching resources aligned with the new curriculum.

- Between March 2021 and February 2023, Alberta’s government provided many opportunities for Albertans to share feedback on the draft K-6 curriculum:

- More than 34,000 online surveys were completed.

- More than 1,100 attendees participated in virtual information sessions hosted by Alberta Education.

- Nearly 600 Albertans shared diverse viewpoints on each subject area at 31 virtual engagement sessions.

- Twelve partner organizations were provided $800,000 in grants to help them engage with their communities and report their unique perspectives.

- In the 2021-22 school year, about 360 teachers piloted draft K-6 Mathematics, English Language Arts and Literature, Science, Physical Education and Wellness, Social Studies and Fine Arts curriculums with about 7,800 students.

- In the 2022-23 school year, 941 teachers are piloting draft K-6 French First Language and Literature, French Immersion Language Arts and Literature and Science curriculums with 22,000 students in 47 school authorities across the province.

- The 12-member Curriculum Implementation Advisory Group had balanced representation from across the education system to help ensure the best interests of the entire education system inform the group’s advice and recommendations.

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

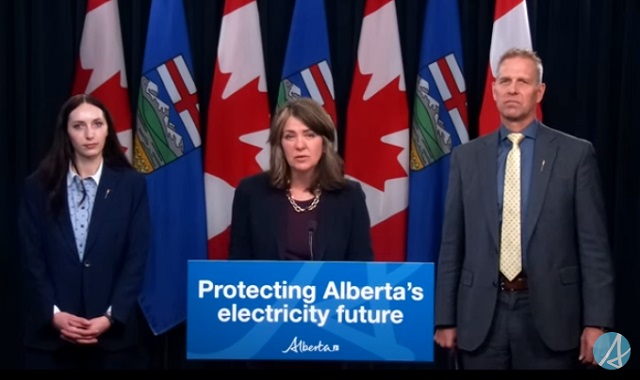

Province to stop municipalities overcharging on utility bills

Making utility bills more affordableAlberta’s government is taking action to protect Alberta’s ratepayers by introducing legislation to lower and stabilize local access fees. Affordability is a top priority for Alberta’s government, with the cost of utilities being a large focus. By introducing legislation to help reduce the cost of utility bills, the government is continuing to follow through on its commitment to make life more affordable for Albertans. This is in addition to the new short-term measures to prevent spikes in electricity prices and will help ensure long-term affordability for Albertans’ basic household expenses.

Local access fees are functioning as a regressive municipal tax that consumers pay on their utility bills. It is unacceptable for municipalities to be raking in hundreds of millions in surplus revenue off the backs of Alberta’s ratepayers and cause their utility bills to be unpredictable costs by tying their fees to a variable rate. Calgarians paid $240 in local access fees on average in 2023, compared to the $75 on average in Edmonton, thanks to Calgary’s formula relying on a variable rate. This led to $186 million more in fees being collected by the City of Calgary than expected.

To protect Alberta’s ratepayers, the Government of Alberta is introducing the Utilities Affordability Statutes Amendment Act, 2024. If passed, this legislation would promote long-term affordability and predictability for utility bills by prohibiting the use of variable rates when calculating municipalities’ local access fees. Variable rates are highly volatile, which results in wildly fluctuating electricity bills. When municipalities use this rate to calculate their local access fees, it results in higher bills for Albertans and less certainty in families’ budgets. These proposed changes would standardize how municipal fees are calculated across the province, and align with most municipalities’ current formulas.

If passed, the Utilities Affordability Statutes Amendment Act, 2024 would prevent municipalities from attempting to take advantage of Alberta’s ratepayers in the future. It would amend sections of the Electric Utilities Act and Gas Utilities Act to ensure that the Alberta Utilities Commission has stronger regulatory oversight on how these municipal fees are calculated and applied, ensuring Alberta ratepayer’s best interests are protected.

If passed, this legislation would also amend sections of the Alberta Utilities Commission Act, the Electric Utilities Act, Government Organizations Act and the Regulated Rate Option Stability Act to replace the terms “Regulated Rate Option”, “RRO”, and “Regulated Rate Provider” with “Rate of Last Resort” and “Rate of Last Resort Provider” as applicable. Quick facts

Related information |

-

Alberta2 days ago

Alberta2 days agoCoutts Three verdict: A warning to protestors who act as liaison with police

-

Alberta2 days ago

Alberta2 days agoAlberta moves to protect Edmonton park from Trudeau government’s ‘diversity’ plan

-

Business2 days ago

Business2 days agoMaxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

-

Energy2 days ago

Energy2 days agoCanada Has All the Elements to be a Winner in Global Energy — Now Let’s Do It

-

Freedom Convoy2 days ago

Freedom Convoy2 days agoOttawa spent “excessive” $2.2 million fighting Emergencies Act challenge

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoA Coup Without Firing a Shot

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCoyotes Ugly: The Sad Obsession Of Gary Bettman

-

COVID-192 days ago

COVID-192 days agoWHO Official Admits the Truth About Passports