Uncategorized

Trump team turns over written answers to Mueller’s questions

WASHINGTON — President Donald Trump has provided the special counsel with written answers to questions about his knowledge of Russian interference in the 2016 election, his lawyers said Tuesday, avoiding at least for now a potentially risky sit-down with prosecutors. It’s the first time he has directly

The step is a milestone in the negotiations between Trump’s attorneys and special counsel Robert Mueller’s team over whether and when the president might sit for an interview.

The compromise outcome, nearly a year in the making, offers some benefit to both sides. Trump at least temporarily averts the threat of an in-person interview, which his lawyers have long resisted, while Mueller secures on-the-record statements whose accuracy the president will be expected to stand by for the duration of the investigation.

The responses may also help stave off a potential subpoena fight over Trump’s testimony if Mueller deems them satisfactory. They represent the first time the president is known to have described to investigators his knowledge of key moments under scrutiny by prosecutors.

But investigators may still press for more information.

Mueller’s team months ago presented Trump’s legal team with dozens of questions they wanted to ask the president related to whether his campaign

Mueller left open the possibility that he would follow up with additional questions on obstruction, though Trump’s lawyers — who had long resisted any face-to-face interview — have been especially adamant that the Constitution shields him from having to answer any questions about actions he took as president.

Trump attorney Jay Sekulow offered no details on the current Q&A, saying merely that “the written questions submitted by the special counsel’s office … dealt with issues regarding the Russia-related topics of the inquiry. The president responded in writing.” He said the legal team would not release copies of the questions and answers or discuss any correspondence it has had with the special counsel’s office.

Another of Trump’s lawyers, Rudy Giuliani, said the lawyers continue to believe that “much of what has been asked raised serious

“It is time to bring this inquiry to a conclusion,” Giuliani said.

The president told reporters last week that he had prepared the responses himself.

Trump said in a Fox News interview that aired Sunday that he was unlikely to answer questions about obstruction, saying, “I think we’ve wasted enough time on this witch hunt and the answer is, probably, we’re finished.”

Trump joins a list of recent presidents who have submitted to questioning as part of a criminal investigation.

In 2004, President George W. Bush was interviewed by special counsel Patrick Fitzgerald’s office during an investigation into the leaked identity of a covert CIA officer. In 1998, President Bill Clinton testified before a federal grand jury in independent counsel Ken Starr’s Whitewater investigation.

“It’s very extraordinary if this were a regular case, but it’s not every day that you have an investigation that touches upon the White House,” Solomon Wisenberg, a Washington lawyer who was part of Starr’s team and conducted the grand jury questioning of Clinton, said of a prosecutor accepting written answers.

Mueller could theoretically still try to subpoena the president if he feels the answers are not satisfactory.

But Justice Department leaders, including acting Attorney General Matthew Whitaker — who now oversees the investigation and has spoken pejoratively of it in the past — would have to sign off on such a move, and it’s far from clear that they would. It’s also not clear that Mueller’s team would prevail if a subpoena fight reached the Supreme Court.

“Mueller certainly could have forced the issue and issued a subpoena, but I think he wants to present a record of having bent over backwards to be fair,” Wisenberg said.

The Supreme Court has never directly ruled on whether a president can be subpoenaed to testify in a criminal case. Clinton was subpoenaed to appear before the Whitewater grand jury, but investigators withdrew the subpoena after he agreed to appear voluntarily.

Other cases involving Presidents Richard Nixon and Clinton have presented similar issues for the justices that could be instructive now.

In 1974, for instance, the court ruled that Nixon could be ordered to turn over subpoenaed recordings, a decision that hastened his resignation. The court in 1997 said Clinton could be questioned under oath in a sexual harassment lawsuit brought by Paula Jones.

___

Follow Eric Tucker on Twitter at http://www.twitter.com/etuckerAP

Eric Tucker, The Associated Press

Alberta

Oil and gas in the global economy through 2050

From the Canadian Energy Centre

The world will continue to rely on oil and gas for decades to come, according to the International Energy Agency

Recent global conflicts, which have been partly responsible for a global spike in energy prices, have cast their shadow on energy markets around the world. Added to this uncertainty is the ongoing debate among policymakers and public institutions in various jurisdictions about the role of traditional forms of energy in the global economy.

One widely quoted study influencing the debate is the International Energy Agency’s (IEA) World Energy Outlook, the most recent edition of which, World Energy Outlook 2023 (or WEO 2023), was released recently (IEA 2023).

In this CEC Fact Sheet, we examine projections for oil and natural gas production, demand, and investment drawn from the World Energy Outlook 2023 Extended Dataset, using the IEA’s modelled scenario STEPS, or the Stated Policies Scenario. The Extended Dataset provides more detailed data at the global, regional, and country level than that found in the main report.

The IEA’s World Energy Outlook and the various scenarios

Every year the IEA releases its annual energy outlook. The report looks at recent energy supply and demand, and projects the investment outlook for oil and gas over the next three decades. The World Energy Outlook makes use of a scenario approach to examine future energy trends. WEO 2023 models three scenarios: the Net Zero Emissions by 2050 Scenario (NZE), the Announced Pledges Scenario (APS), and the Stated Policies Scenario (STEPS).

STEPS appears to be the most plausible scenario because it is based on the world’s current trajectory, rather than the other scenarios set out in the WEO 2023, including the APS and the NZE. According to the IEA:

The Stated Policies Scenario is based on current policy settings and also considers the implications of industrial policies that support clean energy supply chains as well as measures related to energy and climate. (2023, p. 79; emphasis by author)

and

STEPS looks in detail at what [governments] are actually doing to reach their targets and objectives across the energy economy. Outcomes in the STEPS reflect a detailed sector-by-sector review of the policies and measures that are actually in place or that have been announced; aspirational energy or climate targets are not automatically assumed to be met. (2023, p. 92)

Key results

The key results of STEPS, drawn from the IEA’s Extended Dataset, indicate that the oil and gas industry is not going into decline over the next decade—neither worldwide generally, nor in Canada specifically. In fact, the demand for oil and gas in emerging and developing economies under STEPS will remain robust through 2050.

Oil and natural gas production projections under STEPS

World oil production is projected to increase from 94.8 million barrels per day (mb/d) in 2022 to 97.2 mb/d in 2035, before falling slightly to 94.5 mb/d in 2050 (see Figure 1).

Source: IEA (2023b)

Canadian overall crude oil production is projected to increase from 5.8 mb/d in 2022 to 6.5 mb/d in 2035, before falling to 5.6 mb/d in 2050 (see Figure 2).

Source: IEA (2023b)

Canadian oil sands production is expected to increase from 3.6 mb/d in 2022 to 3.8 mb/d in 2035, and maintain the same production level till 2050 (see Figure 3).

Source: IEA (2023b)

World natural gas production is anticipated to increase from 4,138 billion cubic metres (bcm) in 2022 to 4,173 bcm in 2050 (see Figure 4).

Source: IEA (2023b)

Canadian natural gas production is projected to decrease from 204 bcm in 2022 to 194 bcm in 2050 (see Figure 5).

Source: IEA (2023b)

Oil demand under STEPS

World demand for oil is projected to increase from 96.5 mb/d in 2022 to 97.4 mb/d by 2050 (see Tables 1A and 1B). Demand in Africa for oil is expected to increase from 4.0 mb/d in 2022 to 7.7 mb/d in 2050. Demand for oil in the Asia-Pacific is projected to increase from 32.9 mb/d in 2022 to 35.1 mb/d in 2050. Demand for oil from emerging and developing economies is anticipated to increase from 47.9 mb/d in 2022 to 59.3 mb/d in 2050.

Source: IEA (2023b)

Source: IEA (2023b)

Natural gas demand under STEPS

World demand for natural gas is expected to increase from 4,159 billion cubic metres (bcm) in 2022 to 4,179 bcm in 2050 (see Figures 6 and 7). Demand in Africa for natural gas is projected to increase from 170 bcm in 2020 to 277 bcm in 2050. Demand in the Asia-Pacific for natural gas is anticipated to increase from 900 bcm in 2020 to 1,119 bcm in 2050.

Source: IEA (2023b)

Source: IEA (2023b)

Cumulative oil and gas investment expected to be over $21 trillion

Taking into account projected global demand, between 2023 and 2050 the cumulative global oil and gas investment (upstream, midstream, and downstream) under STEPS is expected to reach nearly U.S.$21.1 trillion (in $2022). Global oil investment alone is expected to be over U.S.$13.1 trillion and natural gas investment is predicted to be over $8.0 trillion (see Figure 8).

Between 2023 and 2050, total oil and gas investment in North America (Canada, the U.S., and Mexico) is expected to be nearly U.S.$5.6 trillion, split between oil at over $3.8 trillion and gas at nearly $1.8 trillion (see Figure 8). Oil and gas investment in the Asia Pacific, over the same period, is estimated at nearly $3.3 trillion, split between oil at over $1.4 trillion and gas at over $1.9 trillion.

Source: IEA (2023b)

Conclusion

The sector-by-sector measures that governments worldwide have put in place and the specific policy initiatives that support clean energy policy, i.e., the Stated Policies Scenario (STEPS), both show oil and gas continuing to play a major role in the global economy through 2050. Key data points on production and demand drawn from the IEA’s WEO 2023 Extended Dataset confirm this trend.

Positioning Canada as a secure and reliable oil and gas supplier can and must be part of the medium- to long-term solution to meeting the oil and gas demands of the U.S., Europe, Asia and other regions as part of a concerted move supporting energy security.

The need for stable energy, which is something that oil and natural gas provide, is critical to a global economy whose population is set to grow by another 2 billion people by 2050. Along with the increasing population comes rising incomes, and with them comes a heightened demand for oil and natural gas, particularly in many emerging and developing economies in Africa, the Asia-Pacific, and Latin America, where countries are seeing urbanization and industrialization grow rapidly.

References (as of February 11, 2024)

International Energy Agency (IEA), 2023(a), World Energy Outlook 2023 <http://tinyurl.com/4nv9xyfj>; International Energy Agency (IEA), 2023(b), World Energy Outlook 2023 Extended Dataset <http://tinyurl.com/3222553b>.

Uncategorized

Chrystia Freeland refuses to answer how much Trudeau government has collected via carbon tax

From LifeSiteNews

Deputy Prime Minister and Finance Minister Chrystia Freeland continues to claim that the revenue from the carbon tax ‘goes back to Canadians’ despite data showing otherwise.

Canadian Deputy Prime Minister and Finance Minister Chrystia Freeland has refused to reveal how much Liberals have collected via the unpopular carbon tax, which is set to go up again on April 1.

During a March 21 session in the House of Commons, Conservative Member of Parliament (MP) Marty Morantz questioned Freeland regarding how much the Liberal government has taken in through the carbon tax.

“How much has your government collected in carbon taxes?” Morantz asked.

Freeland responded by dodging the question, stating, “[This is] also an opportunity for me to point out that Manitoba families will be getting $1,200 this year.”

“Again, minister, if I could just have the number [of] how much you’ve collected in carbon taxes,” Morantz pressed.

Freeland again refused to answer, instead claiming that the “key point” is that the “price on pollution” is “revenue neutral.”

As Morantz persisted in his question, Freeland alleged that the revenue from the carbon tax is “all money that goes back to Canadians.”

However, this statement has been proven untrue as the Parliamentary Budget Officer recently revealed that the government rebates are insufficient to cover the rising costs of fuel under Trudeau’s carbon tax, causing many to wonder where their money is actually going.

According to records published in December, the carbon tax cost Canadians nearly $200 million in paperwork since Prime Minister Justin Trudeau introduced the fuel charge in 2019.

Trudeau’s carbon tax, framed as a way to reduce carbon emissions, has cost Canadian households hundreds of dollars annually despite rebates when factoring in the indirect costs associated with the measure.

The costs are only expected to rise, as a recent report revealed that a carbon tax of more than $350 per tonne is needed to reach Trudeau’s net-zero goals by 2050.

Currently, Canadians living in provinces under the federal carbon pricing scheme pay $65 per tonne, but the Trudeau government has a goal of $170 per tonne by 2030.

Additionally, Trudeau has refused to pause the carbon tax hike scheduled for April 1, despite seven out of ten provincial premiers and 70 percent of Canadians pleading with him to halt his plan.

Meanwhile, Trudeau and his cabinet continue to attend lavish retreats, with a recent Liberal retreat costing taxpayers nearly $500,000.

During a media interview following the nearly $500,000 retreat, Trudeau told Canadians struggling with the high cost of living that times are also difficult for politicians.

“Yeah, people are facing tough times, and yes, everyone is finding it difficult right now. And as leaders, MPs, parliamentarians of all types, part of our job is to be there to take it, to support it as Canadians are worried and anxious, and put out those solutions,” he said.

“So yeah, it’s not an easy time to be a politician,” Trudeau lamented.

-

Economy12 hours ago

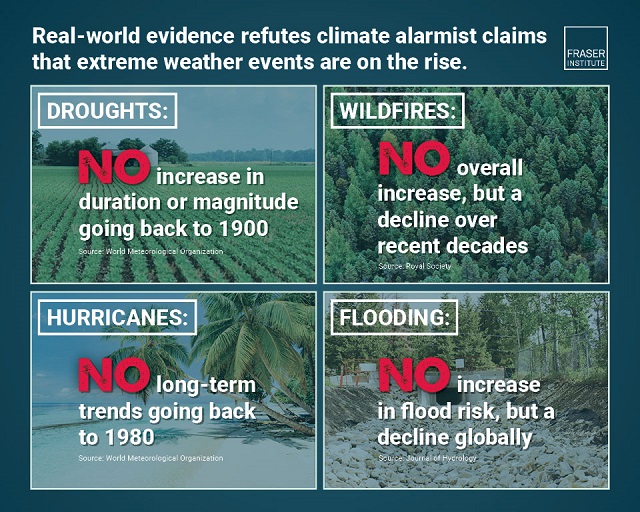

Economy12 hours agoExtreme Weather and Climate Change

-

Jordan Peterson1 day ago

Jordan Peterson1 day agoJordan Peterson slams CBC for only interviewing pro-LGBT doctors about UK report on child ‘sex changes’

-

Freedom Convoy1 day ago

Freedom Convoy1 day agoTrudeau’s use of Emergencies Act has cost taxpayers $73 million thus far

-

International10 hours ago

International10 hours agoTelegram founder tells Tucker Carlson that US intel agents tried to spy on user messages

-

Business1 day ago

Business1 day agoDoubling Down on Missing the Mark

-

COVID-192 days ago

COVID-192 days agoPro-freedom Canadian nurse gets two years probation for protesting COVID restrictions

-

Economy2 days ago

Economy2 days agoMassive deficits send debt interest charges soaring

-

Agriculture1 day ago

Agriculture1 day agoBill C-282, now in the Senate, risks holding back other economic sectors and further burdening consumers