Alberta

Red Deer South MLA challenging his own government to end restrictions for all family gatherings

Article submitted by Red Deer South MLA Jason Stephan

It’s time to let families get together again.

Families are the fundamental unit of our society. As we approach Family Day, we should consider what that means.

This week, I received and delivered written requests from 28 pastors and hundreds of members of their congregations to lift restrictions so families could celebrate Family Day together.

I agree. Our mental and emotional health requires in person love and kindness. Great healing can result simply from allowing immediate family members opportunities to serve and love each other in person, in ways they agree are appropriate for their family’s circumstances, nurturing their family’s resilience, their family’s individual and collective mental and emotional health.

When I was studying our constitution in law school, I learned that Section 2 of the Canadian Charter of Rights and Freedoms says that everyone has the “fundamental freedoms” of “association” and “peaceful assembly”.

The Supreme Court of Canada said that this freedom of association allows for the “achievement of individual potential through interpersonal relationships”.

What interpersonal relationship allows for more opportunities for “achievement of our potential”, individually or collectively, than in our families?

The freedom of peaceful – that is, not violent – assembly protects the “physical gathering of people”. What physical gatherings are more important than with our own families?

Belonging to, and gathering in, our families are not mere fundamental freedoms, they are also among the highest, most important, expressions of these freedoms.

This past Christmas we saw public health “measures” disallow immediate families – other than households – from gathering, both inside and then even outside. While families are now allowed to gather outside, with freezing winter temperatures, family gatherings continue to be starved. Many of our neighbors, and ourselves, have felt isolated and alone.

We also see families continue to be severely curtailed in gathering to console each other in funerals for loved ones with miserly, artificial limits on attendance, with frustrating contradictions, disregarding the size of spaces with much greater capacities to accommodate generous physical distancing for funeral services, equaling or exceeding those imposed at Walmart. This can result in pain.

The World Health Organization (WHO) defines health as “a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity”.

The unfortunate irony is that public health measures can be unhealthy, resulting in familial disconnection, societal contention, and despair.

Government intrusions into our families’ fundamental freedoms can be very harmful. Under Section 1 of the Charter, government has the burden to justify imposing limits on these freedoms. In particular, government is required to demonstrate “proportionality” between its objectives and its limits imposed to achieve them – the cure cannot be worse than the disease.

This analysis also requires demonstration of a “rational connection” between the limit and the objective, and “minimal impairment” of no more than is necessary to accomplish the objective.

For example, while no child under 18 has died with/from COVID-19 in Alberta, many children – along with adults without serious health issues – are suffering profound economic, physical, social, mental and emotional health issues from health measures imposed upon them and their families.

If these individuals and families are at little or no risk from COVID-19, is there a rational connection to harmful health measures? Are there better opportunities for minimal impairment from less intrusive and harmful alternatives? It is healthier for our children, young adults and families to have hope for bright futures.

Government public health measures should – to the extent possible -leave families and their fundamental freedoms alone.

Societies and families are healthier and happier when they are free. A principled vision of hope is healthy, valuing freedom, requiring government to trust adults in positive ways, to govern themselves, allowing their families to carry on the activities of daily living in ways they individually deem fit appropriate to their own circumstances, in a good faith while respecting reasonable health measures and the rights of their neighbors to do the same.

Guest column from Jason Stephan, MLA for Red Deer-South

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

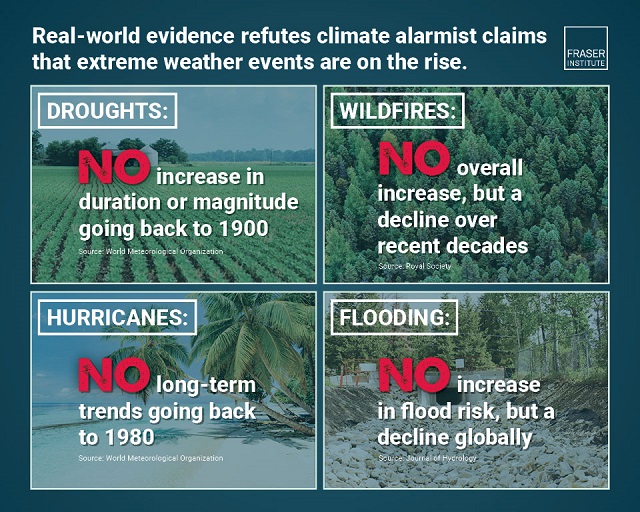

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

Province to stop municipalities overcharging on utility bills

Making utility bills more affordableAlberta’s government is taking action to protect Alberta’s ratepayers by introducing legislation to lower and stabilize local access fees. Affordability is a top priority for Alberta’s government, with the cost of utilities being a large focus. By introducing legislation to help reduce the cost of utility bills, the government is continuing to follow through on its commitment to make life more affordable for Albertans. This is in addition to the new short-term measures to prevent spikes in electricity prices and will help ensure long-term affordability for Albertans’ basic household expenses.

Local access fees are functioning as a regressive municipal tax that consumers pay on their utility bills. It is unacceptable for municipalities to be raking in hundreds of millions in surplus revenue off the backs of Alberta’s ratepayers and cause their utility bills to be unpredictable costs by tying their fees to a variable rate. Calgarians paid $240 in local access fees on average in 2023, compared to the $75 on average in Edmonton, thanks to Calgary’s formula relying on a variable rate. This led to $186 million more in fees being collected by the City of Calgary than expected.

To protect Alberta’s ratepayers, the Government of Alberta is introducing the Utilities Affordability Statutes Amendment Act, 2024. If passed, this legislation would promote long-term affordability and predictability for utility bills by prohibiting the use of variable rates when calculating municipalities’ local access fees. Variable rates are highly volatile, which results in wildly fluctuating electricity bills. When municipalities use this rate to calculate their local access fees, it results in higher bills for Albertans and less certainty in families’ budgets. These proposed changes would standardize how municipal fees are calculated across the province, and align with most municipalities’ current formulas.

If passed, the Utilities Affordability Statutes Amendment Act, 2024 would prevent municipalities from attempting to take advantage of Alberta’s ratepayers in the future. It would amend sections of the Electric Utilities Act and Gas Utilities Act to ensure that the Alberta Utilities Commission has stronger regulatory oversight on how these municipal fees are calculated and applied, ensuring Alberta ratepayer’s best interests are protected.

If passed, this legislation would also amend sections of the Alberta Utilities Commission Act, the Electric Utilities Act, Government Organizations Act and the Regulated Rate Option Stability Act to replace the terms “Regulated Rate Option”, “RRO”, and “Regulated Rate Provider” with “Rate of Last Resort” and “Rate of Last Resort Provider” as applicable. Quick facts

Related information |

-

COVID-191 day ago

COVID-191 day agoWHO Official Admits the Truth About Passports

-

Alberta1 day ago

Alberta1 day agoProvince to stop municipalities overcharging on utility bills

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoThe tale of two teachers

-

Business1 day ago

Business1 day agoMaxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

-

Alberta1 day ago

Alberta1 day agoAlberta moves to protect Edmonton park from Trudeau government’s ‘diversity’ plan

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoCoyotes Ugly: The Sad Obsession Of Gary Bettman

-

Freedom Convoy1 day ago

Freedom Convoy1 day agoOttawa spent “excessive” $2.2 million fighting Emergencies Act challenge

-

International1 day ago

International1 day agoUN attacks stay-at-home motherhood as ‘gender inequality’