Alberta

Child and Youth Advocate says Pepper Spray is used far too often in Alberta Young Offender Centres

From the office of Alberta’s Child and Youth Advocate

Child and Youth Advocate releases special report on OC spray and segregation in Alberta’s young offender centres

Alberta’s Child and Youth Advocate has completed a special report on oleoresin capsicum spray (OC spray, commonly referred to as pepper spray) and segregation in young offender centres.

The Advocate is making four recommendations related to reducing the use of OC spray and segregation as well as increasing accountability measures.

“Young people in custody often have complex needs and may present with difficult and challenging behaviours,” said Del Graff, Child and Youth Advocate. “It is imperative that the Young Offender Branch explores approaches to improve the health and well-being of young people while ensuring a safe environment for everyone. I sincerely hope the recommendations from this report will be quickly acted on to improve the circumstances for youth in custody.”

From January to March 2019, the OCYA received input from over 100 stakeholders through community conversations and one-to-one interviews. Young people, youth justice stakeholders, and community stakeholders shared their perspectives and experiences.

The purpose of this report is to provide advice to government related to improving the safety and well-being of young people in custody.

A copy of the report: “Care in Custody: A Special Report on OC Spray and Segregation in Alberta’s Young Offender Centres” is available on our website:

http://www.ocya.alberta.ca/adult/publications/ocya-reports/

The Child and Youth Advocate has the authority under the Child and Youth Advocate Act to complete special reports on issues impacting children and youth who are receiving designated government services. This is the Advocate’s fourth special report.

The Office of the Child and Youth Advocate is an independent office of the Legislature, representing the rights, interests and viewpoints of children and young people receiving designated government services.

Executive Summary

In 2016, the Young Offender Branch, Ministry of Justice and Solicitor General, changed its policy, making it easier for correctional peace officers to use OC spray on incarcerated young people. Since then, the use of OC spray in youth justice facilities has steadily increased. By inflicting pain to control behaviour, the use of OC spray can damage relationships with youth justice staff, undermine rehabilitation efforts, and further traumatize young people.

The use of segregation in young offender centres is also a concern, as it can result in physical, psychological, and developmental harm to young people. Segregation is occurring without sufficient guidelines and safeguards to protect the well-being of young people. The current use of segregation undermines the Youth Criminal Justice Act’s (YCJA) principle of rehabilitation and reintegration. If segregation must occur for safety reasons, it should be short-term and must include meaningful interactions, mental health supports, and programming.

Further, complaints and review processes at young offender centres must be transparent and strengthened so that young people can challenge decisions without facing repercussions. They have the right to be supported through those processes by a person such as an advocate. Public reporting will also help ensure accountability and promote fair treatment of young people in custody.

Increased accountability changes behaviour and choices. Under the old policy, when the tactical team had to be called to use OC spray in youth justice facilities, it was only deployed once in approximately four years. Since correctional peace officers have been able to carry and use OC spray, it has been used on young people 60 times in the last three years. In the last four weeks of finalizing this report, OC spray was used 10 times. This example is alarming and highlights the importance and timeliness of this report.

The treatment of young people in custody should uphold their human rights, in alignment with the United Nations Convention on the Rights of the Child (UNCRC).The current use of OC spray and segregation contradict the intention of the UNCRCand other United Nations rules and conventions.1 The Advocate urges the Young Offender Branch to review its policies and practices to ensure they align with the goals of its legislation and support the human rights of the young people they serve.

The Advocate is making the following four recommendations:

- OC spray should only be used in exceptional circumstances, if there is an imminent risk of serious physical harm to a young person or others.

- The Young Offender Branch should review and update their policies and standards to reduce the number of hours a young person can be segregated, ensure that they receive appropriate programming and supports, and improve conditions within segregation.

- The Young Offender Branch should develop an impartial complaints and review process for young people. An impartial multi-disciplinary committee that includes external stakeholders should hear complaints and reviews, and young people should have access to a supportive adult.

- The Young Offender Branch should monitor and publicly report all incidents of OC spray use and segregation annually.

Alberta

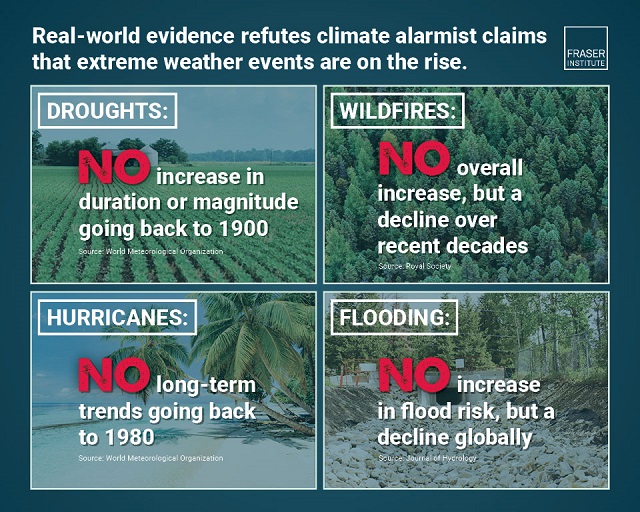

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

Province to stop municipalities overcharging on utility bills

Making utility bills more affordableAlberta’s government is taking action to protect Alberta’s ratepayers by introducing legislation to lower and stabilize local access fees. Affordability is a top priority for Alberta’s government, with the cost of utilities being a large focus. By introducing legislation to help reduce the cost of utility bills, the government is continuing to follow through on its commitment to make life more affordable for Albertans. This is in addition to the new short-term measures to prevent spikes in electricity prices and will help ensure long-term affordability for Albertans’ basic household expenses.

Local access fees are functioning as a regressive municipal tax that consumers pay on their utility bills. It is unacceptable for municipalities to be raking in hundreds of millions in surplus revenue off the backs of Alberta’s ratepayers and cause their utility bills to be unpredictable costs by tying their fees to a variable rate. Calgarians paid $240 in local access fees on average in 2023, compared to the $75 on average in Edmonton, thanks to Calgary’s formula relying on a variable rate. This led to $186 million more in fees being collected by the City of Calgary than expected.

To protect Alberta’s ratepayers, the Government of Alberta is introducing the Utilities Affordability Statutes Amendment Act, 2024. If passed, this legislation would promote long-term affordability and predictability for utility bills by prohibiting the use of variable rates when calculating municipalities’ local access fees. Variable rates are highly volatile, which results in wildly fluctuating electricity bills. When municipalities use this rate to calculate their local access fees, it results in higher bills for Albertans and less certainty in families’ budgets. These proposed changes would standardize how municipal fees are calculated across the province, and align with most municipalities’ current formulas.

If passed, the Utilities Affordability Statutes Amendment Act, 2024 would prevent municipalities from attempting to take advantage of Alberta’s ratepayers in the future. It would amend sections of the Electric Utilities Act and Gas Utilities Act to ensure that the Alberta Utilities Commission has stronger regulatory oversight on how these municipal fees are calculated and applied, ensuring Alberta ratepayer’s best interests are protected.

If passed, this legislation would also amend sections of the Alberta Utilities Commission Act, the Electric Utilities Act, Government Organizations Act and the Regulated Rate Option Stability Act to replace the terms “Regulated Rate Option”, “RRO”, and “Regulated Rate Provider” with “Rate of Last Resort” and “Rate of Last Resort Provider” as applicable. Quick facts

Related information |

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoThe tale of two teachers

-

Business1 day ago

Business1 day agoMaxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

-

Alberta1 day ago

Alberta1 day agoAlberta moves to protect Edmonton park from Trudeau government’s ‘diversity’ plan

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoCoyotes Ugly: The Sad Obsession Of Gary Bettman

-

Freedom Convoy1 day ago

Freedom Convoy1 day agoOttawa spent “excessive” $2.2 million fighting Emergencies Act challenge

-

COVID-191 day ago

COVID-191 day agoWHO Official Admits the Truth About Passports

-

Alberta23 hours ago

Alberta23 hours agoProvince to stop municipalities overcharging on utility bills

-

Energy21 hours ago

Energy21 hours agoReflections on Earth Day