Business

Canada has an energy edge, why won’t Ottawa use it?

Energy abundance, properly managed, isn’t just Canada’s strategic edge—it’s our ace in the hole while allies scramble to rearm their energy systems and competitors sprint ahead. We can keep sleepwalking through the annual ritual of self-imposed shackles, watching golden opportunities slip through our fingers, or we can finally show up as a serious player in the energy security game we’re already knee-deep in.

What the public doesn’t see behind all the climate summit fanfare is a carefully choreographed performance where capitals everywhere scramble to perfect their lines for the UN’s annual pageant. COP30 descends on Brazil in mid-November, and once again Ottawa looks primed to arrive clutching a stack of promises, desperately hoping that thunderous applause will somehow count as tangible progress in the real world.

Thanks to years of bureaucratic capture, our government keeps churning out the measures most fervently demanded by the climate lobby, and this ritual proceeds as if “net zero” were still a credible roadmap rather than a marketing slogan stretched so transparently thin it’s practically see-through. But out in the real world—away from the theatrical staging—the energy system keeps issuing updates of its own that no amount of wishful thinking can erase. The question this year cannot be what flashy new prohibition Ottawa can unveil on cue: are our leaders finally prepared to read the room? Away from the virtue-signalling theatre, countries are quietly adjusting to immovable realities: demand keeps climbing, reliability actually matters, and security trumps sermonizing—and we should be looking south to see what’s really working.

From 2005 to 2023, U.S. per-capita CO₂ emissions from energy plummeted by nearly a third. Not because of performative pledges or green grandstanding, but because coal quietly gave way to natural gas, with renewables filling in around the edges where they actually made sense. Pick almost any grid that made this pragmatic switch, and you’ll discover the same inconvenient pattern that climate absolutists prefer to ignore: fewer emissions and electricity you can actually count on when you flip the switch. Maryland serves as a clean example, where coal shrank from the backbone to a footnote as gas surged, helping keep the lights blazing when people needed them most.

Canada should pay very close attention to these uncomfortable truths. We benefit from hydro and nuclear in some regions, but what the green lobby doesn’t want to acknowledge is that our electricity demand is climbing relentlessly. Population growth alone would guarantee that outcome. Add the explosion in AI technology and it becomes utterly unavoidable, despite the silence from environmental groups. Even the cheerleaders of the new digital economy are brutally honest about this reality when pressed. The head of the world’s biggest AI chipmaker isn’t jesting when he bluntly tells the U.K. it will need gas turbines alongside nuclear and renewables to power its tech ambitions—inconvenient facts that shatter green fairy tales.

Another stubborn reality that doesn’t make it into climate summit speeches is that the International Energy Agency estimates oil and gas companies spend roughly half a trillion dollars every year just to keep output flat—a financial reality that exposes the “stranded assets” narrative as wishful thinking. Without this continual reinvestment, U.S. shale would crater within a single year. It’s rather difficult to describe that as a system drifting quietly into retirement, rather than an industrial backbone that still carries most of the load while activists pretend otherwise. If you’re Canada, that looks less like a looming problem than a golden opening that our competitors are already seizing.

Geopolitics is saying the same thing out loud, for those willing to listen beyond the climate activism echo chamber. J.P. Morgan bluntly calls this the “new energy security age,” and Europe is working frantically to end its dependence on Russian LNG—not for climate reasons, but for survival. Japan is expanding its LNG fleet, and Mexico is inking billion-dollar supply deals while climate campaigners aren’t looking. Strip away all the green branding and virtue-signalling, and you get a core calculation that energy security is nothing short of national security—and countries that get snookered by activist rhetoric into forgetting that harsh reality lose far more than bragging rights at international summits.

The Woodfibre LNG site is seen on Howe Sound in Squamish, B.C. THE CANADIAN PRESS/Darryl Dyck

Our allies have been leaning on us to quit sitting on the sidelines and deliver something concrete. And back home, even Ottawa’s mandarins are finally muttering what everyone else has known all along. For the next several years, at minimum, gas remains the most economical, rock-solid baseload option across vast stretches of the continent. Meeting that surging demand would deliver high-paying jobs, bulletproof alliances, and slash global emissions compared to the world burning more coal. Turning our backs on it means standing idle while rival producers rush to fill the void—all so we can pat ourselves on the back for warming the bench.

If this strikes you as abstract theorizing, cast your eyes toward California. A righteous crusade to shutter refineries didn’t magically eliminate the appetite for fuel—it simply exported the dirty work elsewhere, shipping out the jobs and the supply cushion that shields consumers from price shocks. The Golden State now scrambles like a panicked shopper whenever supply chains hiccup, because when push comes to shove, affordability draws the hard red line on what voters will tolerate. Meanwhile, the global landscape has shifted dramatically, with the United States now claiming the crown as top exporter of refined petroleum and LNG.

The lofty rhetoric of “climate solidarity” has quietly faded into something far more practical—nations ruthlessly pursuing their own interests. Even the most progressive speechwriters now pepper their drafts with buzzwords like ‘pragmatism’ and ‘realism.’ It represents nothing short of a grudging acknowledgment that wishful thinking won’t keep the lights on when the grid starts groaning.

British Columbia, meanwhile, sits perched atop the Montney—one of the continent’s most spectacular gas reservoirs—boasting the shortest shipping lanes to Asian markets. Indigenous nations are shrewdly securing equity stakes in LNG ventures while demanding genuine partnership—a blueprint that marries reconciliation with cold, hard prosperity. Those outbound cargoes are displacing coal-fired power overseas. If your genuine goal involves slashing real-world emissions, that achievement trumps a dozen flowery Ottawa press releases.

So no, the magic formula isn’t “all of the above,” but rather “the best of the above.” It demands deploying hydro, nuclear, and renewables where they deliver maximum punch, with natural gas serving as the indispensable bridge that keeps systems humming while breakthrough technologies mature. We must construct infrastructure that performs when sidewalks turn into skating rinks and when asphalt starts melting like butter.

We’ve also absorbed some hard-earned lessons about the political theatrics that spook serious capital. At COP28 in Dubai, then–environment minister Steven Guilbeault sported a baseball cap emblazoned with “emissions.” Emissions cap—catch the clever wordplay? The joke bombed spectacularly with investors. The policy proposal fared no better; its most vocal champion is reportedly eyeing the exit door, while nearly a hundred Canadian oil and gas CEOs have now fired off two blunt open letters to the new prime minister, spelling out precisely what the cap would accomplish: driving investors to pack their bags for friendlier jurisdictions. If your economic blueprint hinges on attracting capital, avoid crafting policies that essentially scream ‘beat it.’

World leaders at COP29 in Baku, Azerbaijan.

Energy abundance, properly managed, isn’t just Canada’s strategic edge—it’s our ace in the hole while allies scramble to rearm their energy systems and competitors sprint ahead. We can keep sleepwalking through the annual ritual of self-imposed shackles, watching golden opportunities slip through our fingers, or we can finally show up as a serious player in the energy security game we’re already knee-deep in.

What would that look like at COP30? It would sound nothing like the strangely self-defeating Canadian speeches of years past, which have been heavy on confessional hand-wringing, light on genuine intent, drowning in performative self-flagellation, and starved of actual competence. If Ottawa wants to prove it has finally woken up from its ideological slumber, it should ditch the tired theatre and roll out policies that actually unleash investment instead of strangling it: streamlined approvals with firm timelines that mean something; predictable fiscal treatment that doesn’t shift with every political breeze; a clear path for Indigenous equity in major projects; and an explicit commitment to “best of the above” power and fuels. Pair that with a forthright message to allies that cuts through the usual diplomatic fog: Canada intends to supply reliable, cleaner energy to the democracies that desperately need it.

It’s not capitulating to industry to stop pretending we can wish away reality. It’s the path that lets us grow the economy, slash global emissions faster than sanctimonious lectures ever will, and strengthen the alliances that keep free countries from getting steamrolled. If we want Canada to matter in this new energy security age instead of being relegated to the sidelines, we should start acting like we mean business. COP30 is the stage. Time to scrap the old script and write one that actually works.

Alberta

Emissions Reduction Alberta offering financial boost for the next transformative drilling idea

From the Canadian Energy Centre

$35-million Alberta challenge targets next-gen drilling opportunities

‘All transformative ideas are really eligible’

Forget the old image of a straight vertical oil and gas well.

In Western Canada, engineers now steer wells for kilometres underground with remarkable precision, tapping vast energy resources from a single spot on the surface.

The sector is continually evolving as operators pursue next-generation drilling technologies that lower costs while opening new opportunities and reducing environmental impacts.

But many promising innovations never reach the market because of high development costs and limited opportunities for real-world testing, according to Emissions Reduction Alberta (ERA).

That’s why ERA is launching the Drilling Technology Challenge, which will invest up to $35 million to advance new drilling and subsurface technologies.

“The focus isn’t just on drilling, it’s about building our future economy, helping reduce emissions, creating new industries and making sure we remain a responsible leader in energy development for decades to come,” said ERA CEO Justin Riemer.

And it’s not just about oil and gas. ERA says emerging technologies can unlock new resource opportunities such as geothermal energy, deep geological CO₂ storage and critical minerals extraction.

“Alberta’s wealth comes from our natural resources, most of which are extracted through drilling and other subsurface technologies,” said Gurpreet Lail, CEO of Enserva, which represents energy service companies.

ERA funding for the challenge will range from $250,000 to $8 million per project.

Eligible technologies include advanced drilling systems, downhole tools and sensors; AI-enabled automation and optimization; low-impact rigs and fluids; geothermal and critical mineral drilling applications; and supporting infrastructure like mobile labs and simulation platforms.

“All transformative ideas are really eligible for this call,” Riemer said, noting that AI-based technologies are likely to play a growing role.

“I think what we’re seeing is that the wells of the future are going to be guided by smart sensors and real-time data. You’re going to have a lot of AI-driven controls that help operators make instant decisions and avoid problems.”

Applications for the Drilling Technology Challenge close January 29, 2026.

armed forces

Global Military Industrial Complex Has Never Had It So Good, New Report Finds

From the Daily Caller News Foundation

The global war business scored record revenues in 2024 amid multiple protracted proxy conflicts across the world, according to a new industry analysis released on Monday.

The top 100 arms manufacturers in the world raked in $679 billion in revenue in 2024, up 5.9% from the year prior, according to a new Stockholm International Peace Research Institute (SIPRI) study. The figure marks the highest ever revenue for manufacturers recorded by SIPRI as the group credits major conflicts for supplying the large appetite for arms around the world.

“The rise in the total arms revenues of the Top 100 in 2024 was mostly due to overall increases in the arms revenues of companies based in Europe and the United States,” SIPRI said in their report. “There were year-on-year increases in all the geographical areas covered by the ranking apart from Asia and Oceania, which saw a slight decrease, largely as a result of a notable drop in the total arms revenues of Chinese companies.”

Notably, Chinese arms manufacturers saw a large drop in reported revenues, declining 10% from 2023 to 2024, according to SIPRI. Just off China’s shores, Japan’s arms industry saw the largest single year-over-year increase in revenue of all regions measured, jumping 40% from 2023 to 2024.

American companies dominate the top of the list, which measures individual companies’ revenue, with Lockheed Martin taking the top spot with $64,650,000,000 of arms revenue in 2024, according to the report. Raytheon Technologies, Northrop Grumman and BAE Systems follow shortly after in revenue,

The Czechoslovak Group recorded the single largest jump in year-on-year revenue from 2023 to 2024, increasing its haul by 193%, according to SIPRI. The increase is largely driven by their crucial role in supplying arms and ammunition to Ukraine.

The Pentagon contracted one of the group’s subsidiaries in August to build a new ammo plant in the U.S. to replenish artillery shell stockpiles drained by U.S. aid to Ukraine.

“In 2024 the growing demand for military equipment around the world, primarily linked to rising geopolitical tensions, accelerated the increase in total Top 100 arms revenues seen in 2023,” the report reads. “More than three quarters of companies in the Top 100 (77 companies) increased their arms revenues in 2024, with 42 reporting at least double-digit percentage growth.”

-

Alberta2 days ago

Alberta2 days agoNet Zero goal is a fundamental flaw in the Ottawa-Alberta MOU

-

Food2 days ago

Food2 days agoCanada Still Serves Up Food Dyes The FDA Has Banned

-

COVID-192 days ago

COVID-192 days agoThe dangers of mRNA vaccines explained by Dr. John Campbell

-

Artificial Intelligence1 day ago

Artificial Intelligence1 day ago‘Trouble in Toyland’ report sounds alarm on AI toys

-

Addictions2 days ago

Addictions2 days agoManitoba Is Doubling Down On A Failed Drug Policy

-

Alberta2 days ago

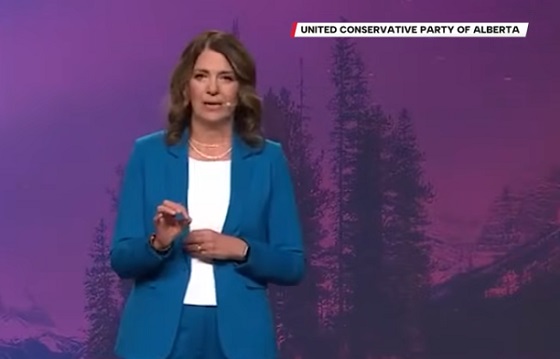

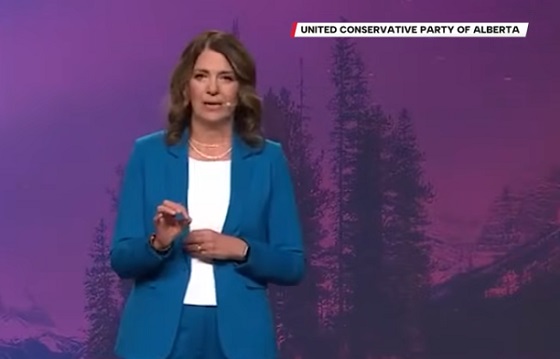

Alberta2 days agoKeynote address of Premier Danielle Smith at 2025 UCP AGM

-

COVID-192 days ago

COVID-192 days agoFDA says COVID shots ‘killed’ at least 10 children, promises new vaccine safeguards

-

Daily Caller1 day ago

Daily Caller1 day agoTom Homan Predicts Deportation Of Most Third World Migrants Over Risks From Screening Docs