Opinion

Budget 2019 – Poor wording requires 2 ex-spouses within 5 years for Home Buyers Plan

by Cory Litzenberger

This is one of those rare times I hope I am wrong in my interpretation, and look forward to being proven wrong by my professional colleagues.

On March 19, 2019 the federal government tabled its election-year budget. One of the newest and strangest provisions is the ability for people going through a separation or divorce to potentially have access to their RRSP under the Home Buyers Plan.

Now in my article and podcast entitled: “Escape Room – The NEW Small Business Tax Game – Family Edition” with respect to the Tax On Split Income (TOSI) rules, I made a tongue in cheek argument that people will be better off if they split, because then the TOSI rules won’t apply.

In keeping with the divorce theme, beginning in the year of hindsight, 2020, the federal government is giving you an incentive to split up and get your own place.

However, there are a few hoops:

On page 402 of the budget, under new paragraph 146.01(2.1)(a), at the time of your RRSP withdrawal under the Home Buyers Plan, you must make sure that:

- – the home you are buying is not the current home you are living in and you are disposing of the interest in the current home within two years; or

- – you are buying out your former spouse in your current home; and

you need to:

- be living separate and apart from your spouse or common-law partner;

- have been living separate and apart for a period of at least 90 days (markdown October 3, 2019 on the calendar),

- began living separate and apart from your spouse or common-law partner, this year, or any time in the previous 4 years (ok, you don’t have to wait for October); and…

…here is where the tabled proposed legislation gets messy.

Proposed subparagraph 146.01(2.1)(a)(ii) refers to where the individual

- wouldn’t be entitled to the home buyers plan because of living with a previous spouse in the past 4 years that isn’t the current spouse they are separating from

“(ii) in the absence of this subsection, the individual would not have a regular eligible amount because of the application of paragraph (f) of that definition in respect of a spouse or common-law partner other than the spouse referred to in clauses (i)(A) to (C), and…”

The problem with the wording of this provision, is that it is written in the affirmative by the legislators using the word “and”. This means, you must be able to answer “true” to all the tests for the entire paragraph to apply.

The way I read this, the only way to answer “true” to this subparagraph is if you have a second spouse (ie: spouse other than the spouse referred to) that you shared a home with and you split from in the past four years.

If you have a second spouse that you shared a home with in the past four years, then “paragraph (f)” in the definition of “regular eligible amount” would apply and the answer would be “true”.

If the answer is “true” you can then get access to your RRSP Home Buyers Plan.

If you don’t have a second spouse then, even though “paragraph (f)” might be met, the phrase “spouse other than the spouse referred to” would not be met, and therefore the answer would be “false”.

This would, in turn, cause the entire logic test of the provision to be “false” and so you would not be able to take out a “regular eligible amount” from your RRSP for the Home Buyers plan because you do not meet the provisions.

If my interpretation is correct then I would really be curious as to what part of the economy they are trying to stimulate.

In my opinion the legislation could be fixed with a simple edit:

“(ii) in the absence of this subsection, the individual would not have a regular eligible amount because of the application of paragraph (f) of that definition in respect of:

(A) a spouse or common-law partner; or

(B) a spouse or common-law partner other than the spouse referred to in clauses (i)(A) to (C); and…”

Cory G. Litzenberger, CPA, CMA, CFP, C.Mgr is the President & Founder of CGL Strategic Business & Tax Advisors; you can find out more about Cory’s biography at http://www.CGLtax.ca/Litzenberger-Cory.html

Energy

Canada Has All the Elements to be a Winner in Global Energy — Now Let’s Do It

Mike Rose is Chair, President and CEO of Tourmaline Oil Corp.

From EnergyNow.ca

By Mike Rose of Tourmaline Oil Corp.

There has never been a more urgent time to aggressively develop Canada’s massive resource wealth

There has never been a more urgent time to aggressively develop Canada’s massive resource wealth. An increasingly competitive world is organizing into new alliances that are threatening our traditional Western democracies.

Weaker or underperforming countries may be left behind economically and, in some cases, their sovereignty may be compromised. We cannot let either scenario happen to Canada.

Looking inward, our country has posted among the weakest economic growth of all G20 nations over the past decade — we are at real risk of delivering a materially diminished standard of living to our children and subsequent future generations.

Canada is blessed with one of the largest and most diverse natural resource endowments in the world. It’s not just oil and gas; it’s uranium, precious metals, rare earth elements, enormous renewable forests, a vast fertile agricultural land base and, of course, the single-largest freshwater reserve on the planet.

This is nothing new; Canada has been regarded as a resource-extraction economy for a long time, but over the past two decades we’ve been slowing down and finding reasons to not advance new projects. While looking ahead to an exciting new future economy is enticing, the majority of our easily accessible resource wealth remains largely untapped. Our Canadian resource sectors are the most capital-efficient, technologically advanced and environmentally responsible in the world. We’ve got the winning combination.

Canada has among the largest, lowest-cost natural gas reserves in the world — we’re already the fourth-largest producer. With consistent regulatory support, we can rapidly evolve into a leader in the growing global LNG business.

This country produces among the lowest-emission natural gas in the world and technology adaptation is widening the gap. A 10 bcf/day Canadian LNG industry targeted to displace coal-fired electrical generation in Asia would offset the vast majority of emissions from the entire domestic oil and gas industry. Contemplating a cap on the Canadian natural gas industry is actually damaging to the global environment, as growing demand will be met by jurisdictions with higher associated emissions.

As developed economies look at electrification to accelerate emissions reduction, nuclear power is becoming increasingly attractive. Canada is already one of the largest uranium producers in the world and has long possessed one of the most efficient and safest reactor designs. This is an advantage we created for ourselves several decades ago; it’s time to harvest this opportunity.

The rare earth elements required for a growing solar industry and battery requirements associated with electrification are abundant in certain regions in Canada — for example, a large new mining opportunity is emerging in Ontario. We should make that happen. One of the great outcomes of accelerating our multi-sector resource opportunity is that the economic benefits will be enjoyed across the country; all Canadians will share in it.

The Canadian agricultural industry has been long regarded as a world leader in efficiency, yield and technical innovation. Global food security and affordability are rapidly emerging issues, and Canada has a role to play here, as well. Not only could we make it more attractive for Canadian producers to grow output and explore novel new transportation corridors to feed more of the world, we have a large, well-established, globally competitive fertilizer industry.

There are many more future resource wealth opportunities we could be capitalizing on. The list is as long as the imagination of our well-educated and entrepreneurial resource sector workforce.

Enormous amounts of capital are required for these projects, and that global capital is most certainly available. These pools of capital will flow into Canada if we demonstrate a willingness to consistently support the Canadian resource sector at provincial and federal government levels.

Accelerating domestic multi-sector resource development provides solutions to many of the problems currently facing Canada. We’ll be playing to strengths that we have established and evolved over many decades. We are the most efficient and technologically advanced in the full spectrum of resource development. Adoption and innovative adaptation of the continuous march of technology advancements will only make us better.

To paraphrase: We can take advantage of what’s between our ears to do an even better job of developing what’s beneath our feet.

Mike Rose is Chair, President and CEO of Tourmaline Oil Corp.

In an ongoing monthly series presented by the Calgary Herald and Financial Post, Canadian business leaders share their thoughts on the country’s economic challenges and opportunities.

Alberta

Coutts Three verdict: A warning to protestors who act as liaison with police

From the Frontier Centre for Public Policy

By Ray McGinnis

During the trial numbers of RCMP officers conceded that the Coutts Three were helpful in their interactions with the law. As well, there didn’t seem to be any truth to the suggestion that Van Huigenbos, Van Herk and Janzen were leaders of the protest.

Twelve jurors have found the Coutts Three guilty of mischief over $5,000 at a courthouse in Lethbridge, Alberta. Marco Van Huigenbois, Alex Van Herk and George Janzen will appear again in court on July 22 for sentencing.

Van Huigenbois, Van Herk and Janzen were each protesting at the Coutts Blockade in 2022. A blockade of Alberta Highway 4 began on January 29, 2022, blocking traffic, on and off, on Alberta Highway 4 near the Coutts-Sweetgrass Canada-USA border crossing. The protests were in support of the Freedom Convoy protests in Ottawa.

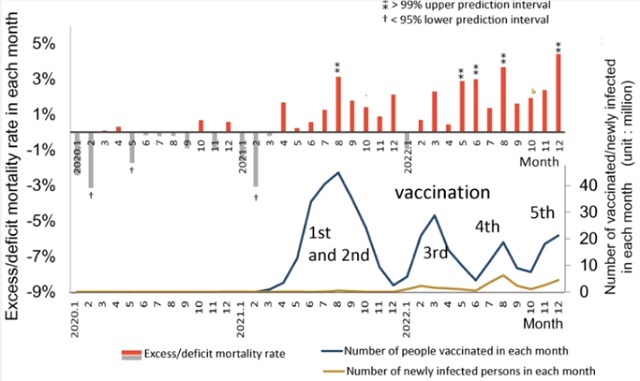

Protests began due to the vaccine mandates for truckers entering Canada, and lockdowns that bankrupted 120,000 small businesses. Government edicts were purportedly for “public health” to stop the spread of the C-19 virus. Yet the CDC’s Dr. Rachel Wallensky admitted on CNN in August 2021 the vaccine did not prevent infection or stop transmission.

By February 2022, a US court forced Pfizer to release its “Cumulative Analysis of Post-Authorization Adverse Event Reports” revealing the company knew by the end of February, 2021, that 1,223 people had a “case outcome” of “fatal” as a result of taking the companies’ vaccine.

On the day of February 14, 2022, the three men spoke to Coutts protesters after a cache of weapons had been displayed by the RCMP. These were in connection with the arrest of the Coutts Four. Van Huigenbos and others persuaded the protesters to leave Coutts, which they did by February 15, 2022.

During the trial numbers of RCMP officers conceded that the Coutts Three were helpful in their interactions with the law. As well, there didn’t seem to be any truth to the suggestion that Van Huigenbos, Van Herk and Janzen were leaders of the protest.

RCMP officer Greg Tulloch testified that there were a number of “factions” within the larger protest group. These factions had strong disagreements about how to proceed with the protest. The Crown contended the Coutts Three were the leaders of the protest.

During his testimony, Tulloch recalled how Van Huigenbos and Janzen assisted him in getting past the “vehicle blockade to enter Coutts at a time during the protest when access to Coutts from the north via the AB-4 highway was blocked.” Tulloch also testified that Janzen and Van Huigenbos helped with handling RCMP negotiations with the protesters. Tulloch gave credit to these two “being able to help move vehicles at times to open lanes on the AB-4 highway to facilitate the flow of traffic in both directions.”

During cross examination by George Janzen’s lawyer, Alan Honner, Tulloch stated that he noticed two of the defendants assisting RCMP with reopening the highway in both directions. Honner said in summary, “[Marco Van Huigenbos and George Janzen] didn’t close the road, they opened it.”

Mark Wielgosz, an RCMP officer for over twenty years, worked as a liaison between law enforcement and protesters at the Coutts blockade. Taking the stand, he concurred that there was sharp disagreement among the Coutts protesters and the path forward with their demonstration. Rebel News video clips “submitted by both the Crown and defence teams captured these disagreements as demonstrators congregated in the Smuggler’s Saloon, a location where many of the protesters met to discuss and debate their demonstration.” Wielgosz made several attempts to name the leaders of the protest in his role as a RCMP liaison with the protesters, but was unsuccessful.”

However, the Crown maintained that the protest unlawfully obstructed people’s access to property on Highway 4.

Canada’s Criminal Code defines mischief as follows in Section 430:

Every one commits mischief who willfully

(a) destroys or damages property;

(b) renders property dangerous, useless, inoperative or ineffective;

(c) obstructs, interrupts or interferes with the lawful use, enjoyment or operation of property; or

(d) obstructs, interrupts or interferes with any person in the lawful use, enjoyment or operation of property.

Robert Kraychik reported that “RCMP Superintendent Gordon Corbett…cried (no comment on the sincerity of this emoting) while testifying about a female RCMP officer that was startled by the movement of a tractor with a large blade during the Coutts blockade/protest.” This was the climax of the trial. A tractor moving some distance away from an officer in rural Alberta, with blades. The shock of it all.

No evidence was presented in the trial that Van Huigenbos, Van Herk and Janzen destroyed or damaged property. Officers testified they couldn’t identify who the protest leaders were. They testified the defendants assisted with opening traffic lanes, and winding down the protest.

By volunteering to liaise with the RCMP, the Crown depicted the Coutts Three as the protest leaders. Who will choose to volunteer at any future peaceful, non-violent, protest to act as a liaison with the policing authorities? Knowing of the verdict handed down on April 16, 2024, in Lethbridge?

Ray McGinnis is a Senior Fellow with the Frontier Centre for Public Policy. His forthcoming book is Unjustified: The Emergencies Act and the Inquiry that Got It Wrong.

-

Economy2 days ago

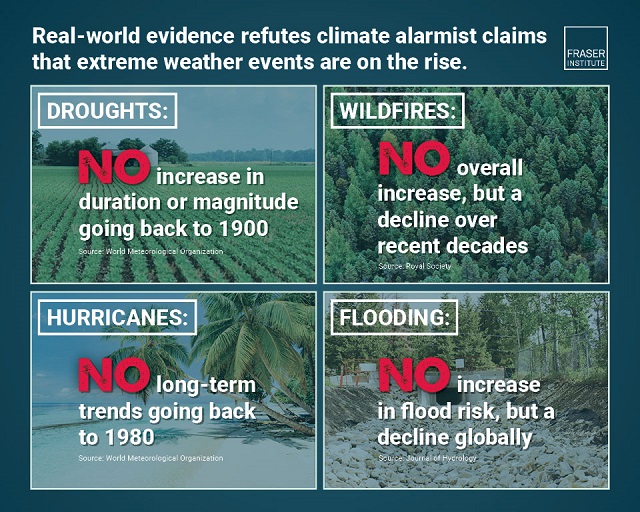

Economy2 days agoExtreme Weather and Climate Change

-

International2 days ago

International2 days agoTelegram founder tells Tucker Carlson that US intel agents tried to spy on user messages

-

Crime1 day ago

Crime1 day agoCanadian receives one-year jail sentence, lifetime firearms ban for setting church on fire

-

International1 day ago

International1 day agoGerman parliament passes law allowing minors to change their legal gender once a year

-

Business2 days ago

Business2 days agoNew capital gains hike won’t work as claimed but will harm the economy

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWhy Are Canadian Mayors So Far Left And Out Of Touch?

-

Business2 days ago

Business2 days agoCanada’s economy has stagnated despite Ottawa’s spin

-

Opinion1 day ago

Opinion1 day agoTransgender ideology has enabled people to ‘identify’ as amputees