Alberta

Alberta seeing spike in syphilis cases

Rates of syphilis in Alberta on the rise

Infectious and congenital syphilis rates have escalated across the province over the past five years, with a sharp increase in 2018.

The rapid increase in syphilis cases has spurred Alberta’s chief medical officer of health, Dr. Deena Hinshaw, to declare a provincial outbreak and encourage Albertans to get tested and protect themselves.

“We need to emphasize for all Albertans: Sexually Transmitted Infections (STIs) are a risk to anyone who is sexually active, particularly people who have new sex partners and are not using protection. I encourage anyone who is sexually active to get tested regularly. Anyone in Alberta can access STI testing and treatment for free.”

In response to the sharp rise in 2018, a provincial outbreak coordination committee composed of Alberta Health, Alberta Health Services (AHS) and other provincial health officials has been activated. Over the next three months, the committee will develop a coordinated strategy and determine concrete actions to increase STI testing, promote public awareness and reduce the overall number of syphilis cases in Alberta.

“Sexual health is an important part of overall health. We are working with community partners to remove stigma and increase awareness about STI testing services throughout Alberta. If you are sexually active, make regular STI testing part of your health routine.”

A total of 1,536 cases of infectious syphilis were reported in 2018 compared to 161 in 2014, almost a tenfold increase. The rate of infectious syphilis has not been this high in Alberta since 1948.

Congenital syphilis, which occurs when a child is born to a mother with syphilis, is a severe, disabling and life-threatening disease. While congenital syphilis cases were rare before the outbreak, there were 22 congenital syphilis cases between 2014 and 2018, one of which was stillborn.

Consistent and correct condom use is important protection against STIs such as syphilis. Like other STIs, the symptoms of syphilis may not be obvious. Health experts recommend sexually active people, regardless of gender, age or sexual orientation, get tested every three to six months if they:

- have a sexual partner with a known STI

- have a new sexual partner or multiple or anonymous sexual partners

- have previous history of an STI diagnosis

- have been sexually assaulted

Prenatal care including syphilis testing is available for all Albertans. It is critical that anyone who is pregnant seeks early prenatal care and testing for syphilis during pregnancy.

Anyone experiencing STI-related symptoms should seek testing through their local health-care provider. Call Health Link at 811, visit a STI or sexual health clinic or speak to a family doctor to find testing and treatment options.

Quick facts

- 2018 case counts for infectious syphilis by AHS zone:

- South Zone: 31 cases, an increase of 138.5 per cent compared to 2017

- Calgary Zone: 206 cases, an increase of 7.3 per cent compared to 2017

- Central Zone: 88 cases, an increase of 266.7 per cent compared to 2017

- Edmonton Zone: 977 cases, an increase of 305.4 per cent compared to 2017

- North Zone: 208 cases, an increase of 324.5 per cent compared to 2017

- For further breakdown of STI 2018 numbers, see the 2018 STI and HIV Summary Report.

- Alberta Health works with AHS and community organizations towards prevention, health promotion, outreach testing, education, harm reduction, and addressing stigma. Previous actions include:

- Grants to the Alberta Community Council on HIV to support community organizations across the province to prevent and reduce STIs, reduce harm associated with the non-medical consumption of substances and support health in their own geographic locations.

- Alberta Health has provided three one-time grants totalling a combined $2 million since 2017 to combat the rising rates of STI, including syphilis, focusing on raising awareness and education, reducing stigma and increasing testing and treatment.

- Since 2016, Alberta Health Services and Alberta Health have been working with over 100 provincial partners to develop innovative approaches to increasing access to STI services across the province.

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

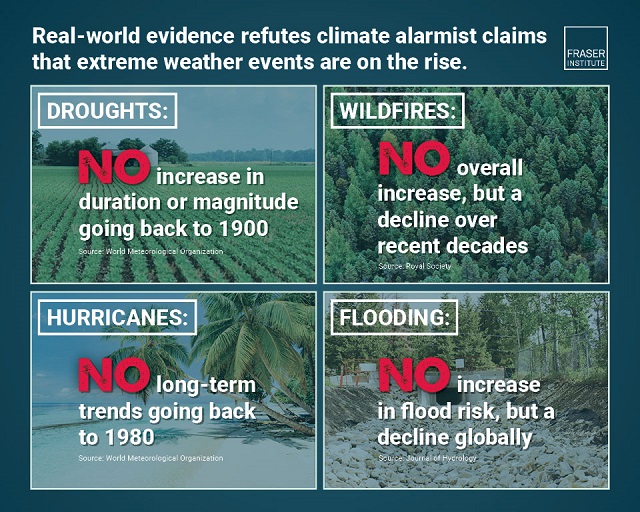

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

Province to stop municipalities overcharging on utility bills

Making utility bills more affordableAlberta’s government is taking action to protect Alberta’s ratepayers by introducing legislation to lower and stabilize local access fees. Affordability is a top priority for Alberta’s government, with the cost of utilities being a large focus. By introducing legislation to help reduce the cost of utility bills, the government is continuing to follow through on its commitment to make life more affordable for Albertans. This is in addition to the new short-term measures to prevent spikes in electricity prices and will help ensure long-term affordability for Albertans’ basic household expenses.

Local access fees are functioning as a regressive municipal tax that consumers pay on their utility bills. It is unacceptable for municipalities to be raking in hundreds of millions in surplus revenue off the backs of Alberta’s ratepayers and cause their utility bills to be unpredictable costs by tying their fees to a variable rate. Calgarians paid $240 in local access fees on average in 2023, compared to the $75 on average in Edmonton, thanks to Calgary’s formula relying on a variable rate. This led to $186 million more in fees being collected by the City of Calgary than expected.

To protect Alberta’s ratepayers, the Government of Alberta is introducing the Utilities Affordability Statutes Amendment Act, 2024. If passed, this legislation would promote long-term affordability and predictability for utility bills by prohibiting the use of variable rates when calculating municipalities’ local access fees. Variable rates are highly volatile, which results in wildly fluctuating electricity bills. When municipalities use this rate to calculate their local access fees, it results in higher bills for Albertans and less certainty in families’ budgets. These proposed changes would standardize how municipal fees are calculated across the province, and align with most municipalities’ current formulas.

If passed, the Utilities Affordability Statutes Amendment Act, 2024 would prevent municipalities from attempting to take advantage of Alberta’s ratepayers in the future. It would amend sections of the Electric Utilities Act and Gas Utilities Act to ensure that the Alberta Utilities Commission has stronger regulatory oversight on how these municipal fees are calculated and applied, ensuring Alberta ratepayer’s best interests are protected.

If passed, this legislation would also amend sections of the Alberta Utilities Commission Act, the Electric Utilities Act, Government Organizations Act and the Regulated Rate Option Stability Act to replace the terms “Regulated Rate Option”, “RRO”, and “Regulated Rate Provider” with “Rate of Last Resort” and “Rate of Last Resort Provider” as applicable. Quick facts

Related information |

-

Housing22 hours ago

Housing22 hours agoTrudeau’s 2024 budget could drive out investment as housing bubble continues

-

Business2 days ago

Business2 days agoMaxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

-

Alberta2 days ago

Alberta2 days agoAlberta moves to protect Edmonton park from Trudeau government’s ‘diversity’ plan

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCoyotes Ugly: The Sad Obsession Of Gary Bettman

-

Freedom Convoy2 days ago

Freedom Convoy2 days agoOttawa spent “excessive” $2.2 million fighting Emergencies Act challenge

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoA Coup Without Firing a Shot

-

COVID-192 days ago

COVID-192 days agoWHO Official Admits the Truth About Passports

-

Alberta1 day ago

Alberta1 day agoProvince to stop municipalities overcharging on utility bills