Business

Downtown Business Spotlight: Summit Strategies Chartered Professional Accountants

This week’s Business Spotlight shines on Summit Strategies Chartered Professional Accountants! These tax accountants and business advisors are located at 4817 48 Street. We spoke with them to learn more about their business!

What is your business?

Summit Strategies Chartered Professional Accountants.

When did your business open?

We opened in 1996.

What makes your business unique?

Our approach to integration of wealth management strategies with tax and accounting and business advisory services.

What are some products/services that you offer?

Accounting with a specialized emphasis on taxation in the agricultural sector as well as coaching business start-ups.

Why did you choose Downtown Red Deer as the location for your business?

Our business services span throughout Central Alberta and beyond but Red Deer is the epi-center and our physical location being downtown fits. The downtown environment provides a centralization of other services such as banking and legal therefore providing convenience for our clients.

What do you think makes Downtown vibrant?

A variety of services, culture and dining options are available.

We love Downtown Red Deer because… of the revitalization and the re-energizing that is occurring.

Check out Summit Strategies website to see how they can help you!

Website: https://www.summitstrategies.ca/

Freedom Convoy

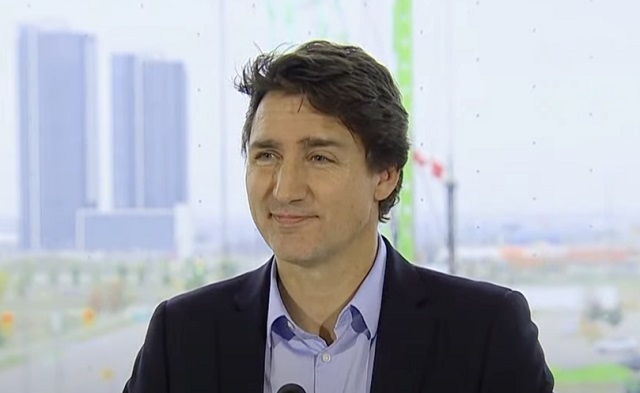

Trudeau’s use of Emergencies Act has cost taxpayers $73 million thus far

From LifeSiteNews

Expenses for the Emergencies Act, the use of which a federal court ruled ‘not justified,’ included $17.5 million for a judicial inquiry, $400,000 for charter flights and $1.3 million for hotel rooms for out-of-town RCMP officers.

The Liberal government’s use of the Emergencies Act against the 2022 Freedom Convoy has cost Canadian taxpayers over $73 million thus far.

According to newly released records obtained by Blacklock’s Reporter, Prime Minister Justin Trudeau’s enactment of the Emergencies Act, the use of which has since been ruled “not justified” by a federal court, to drive out Freedom Convoy protestors from Ottawa in 2022, cost the Department of Public Safety $73,550,568.

According to Blacklock’s Reporter, the $73 million figure was part of records released by the department at the request of Conservative MP Ziad Aboultaif, and despite its high number, is not the final account.

“With regard to enactment of the Emergencies Act in 2022, what was the cost burden for the government?” Conservative MP Ziad Aboultaif asked.

“Cost associated with fiscal year 2023-2024 are still to be determined,” the department responded.

According to the Department of Public Safety, most of the public safety expenses were attributed to local authorities in Ottawa and Windsor, Ontario.

“It should be noted additional funding allocated by the government to Ottawa and its partners as well as Windsor were not specifically as a result of the Emergencies Act invocation but meant to compensate both municipalities for the extraordinary expenses incurred during and after the protracted blockades,” the report said.

Other expenses included $17.5 million for a judicial inquiry, $400,000 for charter flights, and $1.3 million for hotel rooms for out-of-town RCMP officers.

The costs were incurred after Trudeau enacted the Act on February 14, 2022 to shut down the Freedom Convoy protest which took place in Ottawa.

The popular protest featured thousands of Canadians calling for an end to COVID mandates by camping outside Parliament in Ottawa. Measures taken under the Act included freezing the bank accounts of Canadians who donated to the protest.

At the time, the use of the Act was justified by claims that the protest was “violent,” a claim that has still gone unsubstantiated.

In fact, videos of the protest against COVID regulations and vaccine mandates show Canadians from across the country gathering outside Parliament engaged in dancing, street hockey, and other family-friendly activities.

Indeed, the only acts of violence caught on video were carried out against the protesters after the Trudeau government directed police to end the protest. One such video showed an elderly women being trampled by a police horse.

Recently, Federal Court Justice Richard Mosley ruled that Trudeau was “not justified” in invoking the Emergencies Act.

However, the Trudeau government has doubled down on its heavy-handed response to citizen protesters, filing an appeal with the Federal Court of Appeal – a court where 10 of the 15 sitting judges were appointed by Trudeau.

Business

Red Deer District Chamber responds to Federal Budget

From the Red Deer District Chamber of Commerce

The Red Deer and District Chamber has reviewed the federal budget and despite a few bright spots,

there are no efforts to boost productivity and innovation in the country which is sorely needed for

economic growth.

Scott Robinson CEO for the Red Deer District Chamber commented, “The budget’s tagline is “Fair-

ness for every generation”; however, it is unlikely that the spending will improve conditions and continuing to increase taxes and spending will simply add to the inflation and GDP stagnation that

we are facing, as public debt reaches record highs”

Highlights include:

• Carbon tax rebates are finally being introduced for small businesses (499 or fewer employees), with approximately 600,000 firms eligible for a share of $2.5 billion. Consumers began receiving these rebates over five years ago and now small businesses will finally see the return of some of the tax dollars collected through the carbon price’s fuel charge.

• A framework for open banking will allow consumers to easily access financial data across institutions, apps, and services. Specifics will be forthcoming before the end of 2024, but this could result in business opportunities and choices for consumers.

• The targeted 3.87 million net new homes by 2031 is a step toward combatting the housing crisis experienced in Red Deer and across the country. However, our city has yet to be successful in securing funding support through the Canada Mortgage and Housing Corporation’s (CHMC) Housing Accelerator Program, despite being the 56th most populated city in the country and a vacancy rate of 0.8 percent for 2023. We are hopeful to see additional federal investment in our city and have identified recommendations to all levels of government in the Chamber’s Homelessness Task Force Report.

Areas of particular concern:

• Increasing the capital gains tax through reducing exemptions is estimated by the federal government to bring in $20 billion in additional revenue over the next five years. The Red Deer Chamber of Commerce opposes increased taxation, especially when this represents an additional tax on already taxed income. This plan will likely result in decreased investment within the country.

• Deficits of $39.8 billion are projected for 2024-2025. The government also plans to spend $54.1 billion on debt servicing, with no plans at all to decrease total public debt. This amount equates to $2 billion more than is allocated to healthcare ($52.1 billion).

• $53 billion in new spending has been identified over the next five years. This continued spending and increasing debt will negatively impact investment and will continue to increase taxes for all.

“The federal government’s 2024 budget was an opportunity to enhance economic growth and set the country on a new path, toward prosperity and investment indicated Chamber CEO Scott Robinson. “In our view the initiatives suggested by the federal government will not benefit Red Deer and district, or indeed much of the country”. The Federal Budget presented by the Government yesterday just solidify how important it is for Chambers across Canada to advocate for economic growth, innovation, and productivity policies our country needs”.

-

Alberta2 days ago

Alberta2 days agoFree Alberta Strategy backing Smith’s Provincial Priorities Act

-

Business2 days ago

Business2 days agoUS firms like BlackRock are dropping their climate obsession while Europe ramps theirs up

-

Automotive2 days ago

Automotive2 days agoBiden’s Kill Switch: The Growing Threat of Government Control of Your Car

-

COVID-191 day ago

COVID-191 day agoPro-freedom Canadian nurse gets two years probation for protesting COVID restrictions

-

espionage1 day ago

espionage1 day agoTrudeau’s office was warned that Chinese agents posed ‘existential threat’ to Canada: secret memo

-

Economy1 day ago

Economy1 day agoMassive deficits send debt interest charges soaring

-

International2 days ago

International2 days ago28-year-old Dutch woman to be killed by assisted suicide after doctors deem her autism ‘untreatable’

-

International19 hours ago

International19 hours agoBrussels NatCon conference will continue freely after court overturns police barricade