Business

City Hall reopening Monday June 21 – details

City Hall reopening for payments and in-person customer service

“We are excited to be reopening City Hall for in-person payments and customer service. This long awaited reopening will enable us to reconnect with our customers in person and still support doing business with us online, where possible,” said Acting City Manager Tara Lodewyk.

Starting Monday, June 21, 2021, key customer service employees will return to City Hall with a phased reopening taking place in the coming weeks and months. With renovations that took place while the building was closed, all customer and public interactions are now provided on the main floor of City Hall.

Some additional changes include new windows and doors, improved customer service kiosks, new security controls and numerous health and safety measures that serve to protect employees and customers accessing City Hall. All renovations were focused on making necessary changes that facilitate improved customer interactions while considering the safety, health and wellness of all employees and citizens.

“As we reopen City Hall for in-person customer service, the health and safety of our citizens and employees is still top of mind. Masks are required inside the building and there will be capacity limits for the number of customers permitted inside at one time,” said Lodewyk. “We kindly ask that anybody coming to City Hall, or accessing any of our recreation or public facilities, uphold all public health restrictions as we work to keep everyone safe throughout the phased reopening.”

A full reopening and return to work for all City employees is expected to take place between June 21 and September 7, 2021. In many cases, City employees have continued to report to their workplace, in-person, based on the requirements of their position; however, with the lifting of the provincial work from home order, The City will welcome its remaining employees back into the workspace with the intention to have everybody back between now and September. This includes City Hall, the Professional Building, Civic Yards and all City owned and operated recreation and culture places and spaces.

“Covid-19 has limited us in many ways. It has taught The City to innovate, work differently and find efficiencies. As we transition back to in-person service, we ask our customers to be patient with us as we navigate the new challenges of our ever changed in-person business offerings. Our business looks different than it did when we closed City Hall more than 15 months ago, and while we are excited to be once again serving you in person, we do expect some bumps along the way,” said Lodewyk.

With changing and modified provincial restrictions continuing to be announced, The City of Red Deer will adapt and update its programs, services and offerings on an ongoing basis. This will include everything from the number of people permitted within a facility at one time, to masking requirements.

“We will continue to take our direction from the provincial government as they ease restrictions and introduce their phased relaunch strategy,” said Lodewyk. “We share the community excitement around the easing of restrictions and continue to work together with our community to uphold public health orders and preventing the spread of Covid-19.”

Starting June 21, the following payments can be made in person at City Hall:

- Utility bill payment

- Property tax payment

- Parking ticket payment

- Re-loading parking cards

- Accounts Receivable invoice payment

- Licence payment

- Special event permit payment

- Other miscellaneous fee payments

Starting July 12, the following payments and customer service will be available in-person at City Hall:

- Parking inquiries

- Licence and permit applications

- Inspections

For updates on The City’s municipal response to Covid-19, visit www.reddeer.ca/covid-19.

For more information, please contact:

Corporate Communications

The City of Red Deer

Business

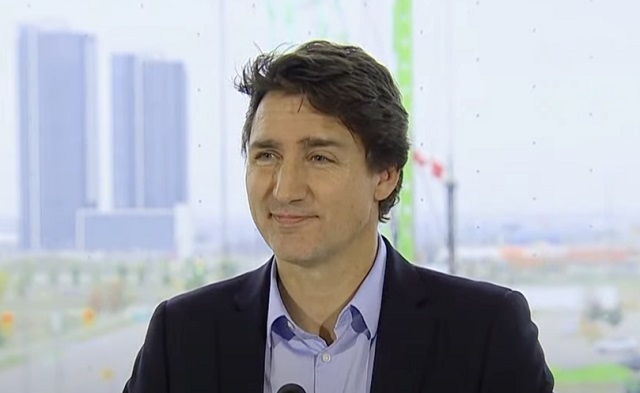

New capital gains hike won’t work as claimed but will harm the economy

From the Fraser Institute

By Alex Whalen and Jake Fuss

Capital taxes are among the most economically-damaging forms of taxation precisely because they reduce the incentive to innovate and invest.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50 per cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’ marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivises investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7 billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing—that this move only affects the wealthy—lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically-damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new start-ups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgement of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Authors:

Freedom Convoy

Trudeau’s use of Emergencies Act has cost taxpayers $73 million thus far

From LifeSiteNews

Expenses for the Emergencies Act, the use of which a federal court ruled ‘not justified,’ included $17.5 million for a judicial inquiry, $400,000 for charter flights and $1.3 million for hotel rooms for out-of-town RCMP officers.

The Liberal government’s use of the Emergencies Act against the 2022 Freedom Convoy has cost Canadian taxpayers over $73 million thus far.

According to newly released records obtained by Blacklock’s Reporter, Prime Minister Justin Trudeau’s enactment of the Emergencies Act, the use of which has since been ruled “not justified” by a federal court, to drive out Freedom Convoy protestors from Ottawa in 2022, cost the Department of Public Safety $73,550,568.

According to Blacklock’s Reporter, the $73 million figure was part of records released by the department at the request of Conservative MP Ziad Aboultaif, and despite its high number, is not the final account.

“With regard to enactment of the Emergencies Act in 2022, what was the cost burden for the government?” Conservative MP Ziad Aboultaif asked.

“Cost associated with fiscal year 2023-2024 are still to be determined,” the department responded.

According to the Department of Public Safety, most of the public safety expenses were attributed to local authorities in Ottawa and Windsor, Ontario.

“It should be noted additional funding allocated by the government to Ottawa and its partners as well as Windsor were not specifically as a result of the Emergencies Act invocation but meant to compensate both municipalities for the extraordinary expenses incurred during and after the protracted blockades,” the report said.

Other expenses included $17.5 million for a judicial inquiry, $400,000 for charter flights, and $1.3 million for hotel rooms for out-of-town RCMP officers.

The costs were incurred after Trudeau enacted the Act on February 14, 2022 to shut down the Freedom Convoy protest which took place in Ottawa.

The popular protest featured thousands of Canadians calling for an end to COVID mandates by camping outside Parliament in Ottawa. Measures taken under the Act included freezing the bank accounts of Canadians who donated to the protest.

At the time, the use of the Act was justified by claims that the protest was “violent,” a claim that has still gone unsubstantiated.

In fact, videos of the protest against COVID regulations and vaccine mandates show Canadians from across the country gathering outside Parliament engaged in dancing, street hockey, and other family-friendly activities.

Indeed, the only acts of violence caught on video were carried out against the protesters after the Trudeau government directed police to end the protest. One such video showed an elderly women being trampled by a police horse.

Recently, Federal Court Justice Richard Mosley ruled that Trudeau was “not justified” in invoking the Emergencies Act.

However, the Trudeau government has doubled down on its heavy-handed response to citizen protesters, filing an appeal with the Federal Court of Appeal – a court where 10 of the 15 sitting judges were appointed by Trudeau.

-

COVID-191 day ago

COVID-191 day agoPro-freedom Canadian nurse gets two years probation for protesting COVID restrictions

-

espionage1 day ago

espionage1 day agoTrudeau’s office was warned that Chinese agents posed ‘existential threat’ to Canada: secret memo

-

Economy1 day ago

Economy1 day agoMassive deficits send debt interest charges soaring

-

Business1 day ago

Business1 day agoBusiness investment key to addressing Canada’s productivity crisis

-

International2 days ago

International2 days ago28-year-old Dutch woman to be killed by assisted suicide after doctors deem her autism ‘untreatable’

-

International1 day ago

International1 day agoBrussels NatCon conference will continue freely after court overturns police barricade

-

MacDonald Laurier Institute2 days ago

MacDonald Laurier Institute2 days agoThe Governor General deserves better, but we deserve impartiality

-

Jordan Peterson22 hours ago

Jordan Peterson22 hours agoJordan Peterson slams CBC for only interviewing pro-LGBT doctors about UK report on child ‘sex changes’