Business

Changing of the Tides – How One Alberta Company Is Driving Hydrokinetic Power

The energy conversation has been a polarized debate for years and continues to hit headlines. The clean energy industry is driven by forward-thinking individuals who have one common goal, transitioning from traditional energy sources to a more sustainable form of energy. Now in 2020, we have more oil than we know what to do with, an unprecedented amount of unused facilities that require cleanup, and jobs being lost daily. We exist in a time where competition drives innovation, demonstrating proof of concept is essential to drive investment and still, unable to see eye to eye for a common approach. Let me ask you this, is it problematic for us as a society to hold onto previous conceptions of clean energy projects, regardless of what type?

Jupiter Hydro was founded in September 2010 by Co-CEO Ross Sinclaire in Calgary, Alberta. Their main focus is in-stream hydrokinetic power generation. Co-Ceo Bob Knight joined the team later in their development. If you have read into hydropower in the past, you may be aware of this type of power generation. Jupiter Hydro has taken the benefits of traditional hydropower and combined their unique technology to produce a far more cost-effective and sustainable form of hydrokinetic power generation.

Like any new technology that works to produce power in a non-traditional method, Jupiter Hydro has gone through three phases over a decade that has brought them a unique opportunity in Nova Scotia’s Bay of Fundy scheduled for later in 2020. Beginning with testing their hypothesis, proving the theory of generating rotational power utilizing an Archimedes screw presented to fluid flow at an angle was tested in an irrigation channel. With promise in their theory, they move to test their methodology developed to quantify produced power was developed using a rudimentary test tank and 3D printed screws. Mounting systems were developed and fabrications were created with cost-effective materials. In 2012, testing at the University of Calgary’s test tank began to quantify torque characteristics and confirmed blade pitch and presentation characteristics. Both the horizontal orientation and longitudinal orientation of the screw were tested, giving insight into a highly effective angle for their Archimedes screw.

Open Water Testing

Crucial for any proof of concept in hydrokinetic power generation, Jupiter Hydro began their open water testing in 2013 in the Fraser River in BC. Early tests allowed discrepancies to be addressed with submerged generators and confirmed scalability for the technology for the team. Their second open water test addressed the longitudinal placement of their Archimedes screw while testing a swing arm in open water. With support from the Canadian Hydrokinetic Turbine Test Center, they had their third and fourth test at the facility to demonstrate the technology to identify flow clearances for their swing arm. They recorded nearly 50% efficiency and formed the basis of their current design for the upcoming Bay of Fundy project.

Defining In-Stream Hydrokinetics

In-stream hydrokinetics can be defined as harnessing the natural flow of water to provide rotational power. “In-stream” means that no containment or diversions are required, meaning that obstruction of the water flow is not required; be it a river, dam outflow, canal, or tidal flow. No dams or penstocks are required, and water flow is not restricted. If we consider that there are over 8500 named rivers in Canada according to the WWF, with the addition of ocean currents or any source of flowing water, the resources are huge for this technology.

Key Innovation

If we visit the pros and cons that have been put on traditional hydro, we tend to lie on the outstanding cons that have given the industry a black eye over the last decade. As mentioned previously, competition drives innovation, to which Jupiter Hydro has adapted previous technology with a new methodology to produce a new in-stream power generation. Through multiple test phases and focusing on being cost-effective, they have created patented technology to produce power utilizing the 2,000 year old Archimedes screw with a pitch of 60% of the diameter and angled at 30 degrees to the flow to produce high torque power from the in-stream flow. Traditionally, hydropower would require a permanent infrastructure and there is a risk for large scale remediation. Jupiter Hydro does not require any permanent infrastructure and thus they do not require any remediation from environmental disturbance.

Environmental Impact

With the majority of power generating technologies, lowering the environmental impact can be one of the prominent challenges even for clean energy. If we address the main environmental concerns with hydropower, it consists of concerns of remediation of land, impacts on fish, sourcing of materials, and noise pollution. Jupiter Hydro has effectively addressed these concerns with mitigating the risk for potential investors and the societal impact of driving clean energy into the future. They have the ability to provide remote sites with dependable power without the need for extensive shore infrastructure or changes to the channel flow. The technology can provide clean power in areas historically powered by diesel generators or bio-mass. Their system in rivers can provide “base line” dispatchable power, one of the key requirements for a 100% renewable energy system.

Bay of Fundy Project

On July 3, 2019 Jupiter Hydro Inc. was granted a 2 MW demonstration permit and Power Purchase Agreement (PPA) in the Bay of Fundy by the Nova Scotia Government. This area has seen other tidal power companies like Cape Sharp Tidal and Minas Tidal and have attempted to crack into the Bay of Fundy’s 2,500-megawatt potential. The terms for Jupiter Hydro is for three sets of 5 years, totaling a 15-year project to be launched later in the year. In the image below you can see their in-stream hydrokinetic tidal platform that will be used in the 2 MW project.

Due to issues relating to the ongoing pandemic, the date of this project remains currently unknown. We look forward to future updates from Jupiter Hydro and their success in the Bay of Fundy. Nova Scotia hit a milestone last year for reaching 30% of its energy produced by renewable sources. They continue to be a key driver for this industry.

“Energy that doesn’t cost the earth”

If you would like to learn more about Jupiter Hydro, check out their website here.

For more stories, visit Todayville Calgary

(This article was originally published on May 4, 2020.)

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Business

Maxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

From LifeSiteNews

If ‘the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.’

People’s Party of Canada leader Maxime Bernier has warned that the Liberal government’s push for World Economic Forum (WEF) “Global Tax” scheme should concern Canadians.

According to Canada’s 2024 Budget, Prime Minister Justin Trudeau is working to pass the WEF’s Global Minimum Tax Act which will mandate that multinational companies pay a minimum tax rate of 15 percent.

“Canadians should be very concerned, for several reasons,” People’s Party leader Maxime Bernier told LifeSiteNews, in response to the proposal.

“First, the WEF is a globalist institution that actively campaigns for the establishment of a world government and for the adoption of socialist, authoritarian, and reactionary anti-growth policies across the world,” he explained. “Any proposal they make is very likely not in the interest of Canadians.”

“Second, this minimum tax on multinationals is a way to insidiously build support for a global harmonized tax regime that will lower tax competition between countries, and therefore ensure that taxes can stay higher everywhere,” he continued.

“Canada reaffirms its commitment to Pillar One and will continue to work diligently to finalize a multilateral treaty and bring the new system into effect as soon as a critical mass of countries is willing,” the budget stated.

“However, in view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot continue to wait before taking action,” it continued.

The Trudeau government also announced it would be implementing “Pillar Two,” which aims to establish a global minimum corporate tax rate.

“Pillar Two of the plan is a global minimum tax regime to ensure that large multinational corporations are subject to a minimum effective tax rate of 15 per cent on their profits wherever they do business,” the Liberals explained.

“The federal government is moving ahead with legislation to implement the regime in Canada, following consultations last summer on draft legislative proposals for the new Global Minimum Tax Act,” it continued.

According to the budget, Trudeau promised to introduce the new legislation in Parliament soon.

The global tax was first proposed by Secretary-General of Amnesty International at the WEF meeting in Davos this January.

“Let’s start taxing carbon…[but] not just carbon tax,” the head of Amnesty International, Agnes Callamard, said during a panel discussion.

According to the WEF, the tax, proposed by the Organization for Economic Co-operation and Development (OECD), “imposes a minimum effective rate of 15% on corporate profits.”

Following the meeting, 140 countries, including Canada, pledged to impose the tax.

While a tax on large corporations does not necessarily sound unethical, implementing a global tax appears to be just the first step in the WEF’s globalization plan by undermining the sovereignty of nations.

While Bernier explained that multinationals should pay taxes, he argued it is the role of each country to determine what those taxes are.

“The logic of pressuring countries with low taxes to raise them is that it lessens fiscal competition and makes it then less costly and easier for countries with higher taxes to keep them high,” he said.

Bernier pointed out that competition is good since it “forces everyone to get better and more efficient.”

“In the end, we all end up paying for taxes, even those paid by multinationals, as it causes them to raise prices and transfer the cost of taxes to consumers,” he warned.

Bernier further explained that the new tax could be a first step “toward the implementation of global taxes by the United Nations or some of its agencies, with the cooperation of globalist governments like Trudeau’s willing to cede our sovereignty to these international organizations.”

“Just like ‘temporary taxes’ (like the income tax adopted during WWI) tend to become permanent, ‘minimum taxes’ tend to be raised,” he warned. “And if the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.”

Trudeau’s involvement in the WEF’s plan should not be surprising considering his current environmental goals – which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development – which include the phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum – the aforementioned group famous for its socialist “Great Reset” agenda – in which Trudeau and some of his cabinet are involved.

-

Brownstone Institute23 hours ago

Brownstone Institute23 hours agoDeborah Birx Gets Her Close-Up

-

Economy2 days ago

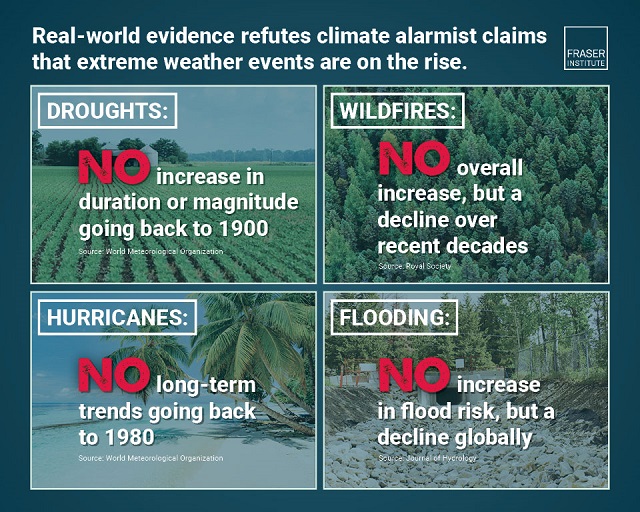

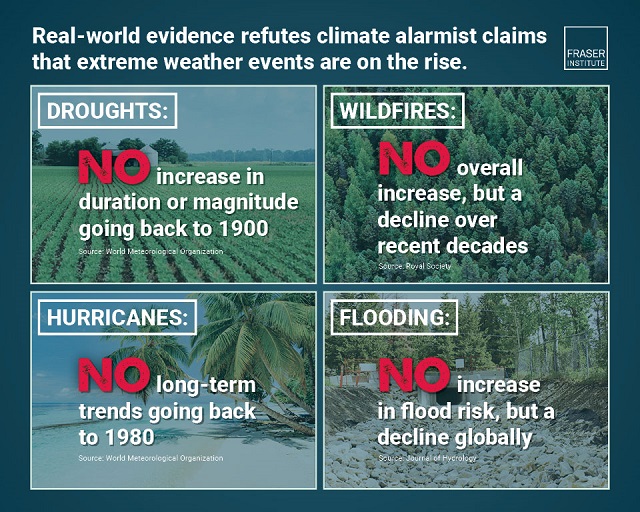

Economy2 days agoExtreme Weather and Climate Change

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWhy Are Canadian Mayors So Far Left And Out Of Touch?

-

Alberta22 hours ago

Alberta22 hours agoCoutts Three verdict: A warning to protestors who act as liaison with police

-

Business2 days ago

Business2 days agoTrudeau gov’t pledges $42 million to the CBC to promote ‘independent journalism’

-

Justice2 days ago

Justice2 days agoOntario Court of Justice says participants must state their ‘preferred pronouns’ during introduction

-

Business2 days ago

Business2 days agoCanada’s economy has stagnated despite Ottawa’s spin

-

Business2 days ago

Business2 days agoNew capital gains hike won’t work as claimed but will harm the economy